The right of an employee to compensation is based on either an express or implied contract. Whether the employment contract is express or implied, it need not be formalized in order for the terms of employment to begin. Once employment has begun, the employment contract represents the right of the employee to be paid the wages agreed upon for services he or she has performed and the right of an employer to receive the services for which the wages have been paid.

Hawaii Complaint for Recovery of Unpaid Wages

Description

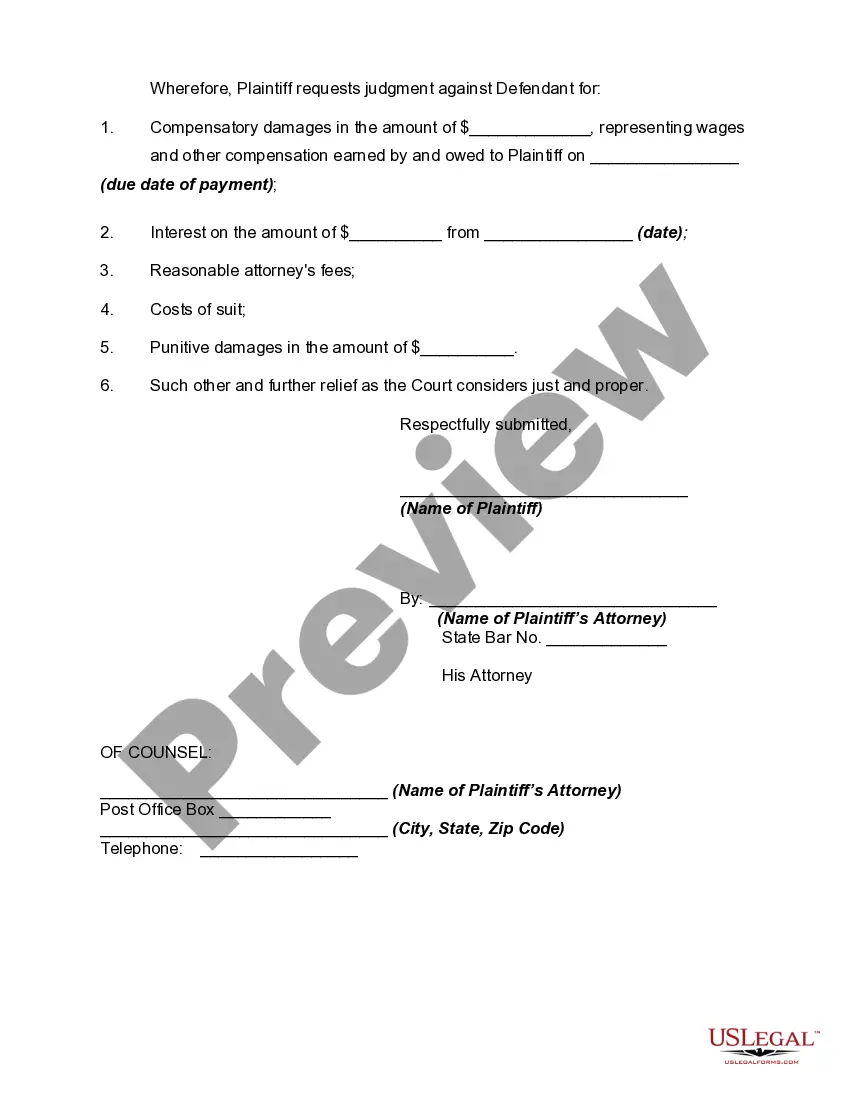

How to fill out Complaint For Recovery Of Unpaid Wages?

Finding the right legal record format could be a battle. Obviously, there are a variety of web templates available on the net, but how will you find the legal kind you want? Utilize the US Legal Forms web site. The support provides 1000s of web templates, for example the Hawaii Complaint for Recovery of Unpaid Wages, that you can use for organization and personal demands. All of the varieties are inspected by pros and meet state and federal demands.

When you are already listed, log in in your profile and click on the Down load option to get the Hawaii Complaint for Recovery of Unpaid Wages. Make use of your profile to search from the legal varieties you might have ordered in the past. Visit the My Forms tab of your respective profile and get yet another copy of your record you want.

When you are a new end user of US Legal Forms, listed here are simple directions that you can comply with:

- Very first, be sure you have chosen the correct kind for your area/state. You are able to look over the form while using Review option and look at the form explanation to make certain it will be the best for you.

- If the kind fails to meet your needs, use the Seach discipline to obtain the right kind.

- When you are certain the form would work, click on the Purchase now option to get the kind.

- Opt for the rates program you want and enter the essential info. Make your profile and purchase the transaction making use of your PayPal profile or charge card.

- Select the submit structure and download the legal record format in your product.

- Complete, change and print and sign the received Hawaii Complaint for Recovery of Unpaid Wages.

US Legal Forms is the largest local library of legal varieties that you can see a variety of record web templates. Utilize the service to download skillfully-manufactured documents that comply with status demands.

Form popularity

FAQ

Section 388-2(b), HRS, requires the employer to pay the employee all wages earned within seven days after the end of each pay period.

Hawaii Announcement Relating to 2023 Unemployment Tax Rates and Wage Base. Schedule F will be in effect in Hawaii for 2023, with rates ranging from 1.2% to 4.0% for positive reserve ratio employers and from 4.4% to 6.2% for negative reserve ratio employers.

Submitting a Pre-Complaint Questionnaire is the first step in filing a discrimination complaint with the Hawai'i Civil Rights Commission (HCRC). After reviewing your Pre-Complaint Questionnaire, we will contact you for an intake interview and, where appropriate, provide assistance in filing a formal complaint.

File A Complaint Online ? Use the Online Complaint Form. Submit your complaint online. Fax/Mail/Email ? Complete the HIOSH Complaint Form, or Send a Letter Describing Your Complaint. ... Telephone ? Call the HIOSH complaint line at (808) 586-9092. ... In Person.

Hawaii state unemployment insurance (SUI) The 2023 tax rates range from 1.7% to 6.2% on the first $56,700 in wages paid to each employee in a calendar year. If you're a new employer (congratulations!), you pay a flat rate of 4%.

Hawaii Labor Laws Guide Hawaii Labor Laws FAQHawaii minimum wage$10.10Hawaii overtime1.5 times the regular wage for any time worked over 40 hours/week ($15.75 for minimum wage workers)Hawaii breaks30-minute meal breaks for every 7.5 hours worked a day

Unemployment insurance, formerly known as ?state unemployment tax? or ?SUTA?, is a Hawaii State-run program that collects a tax from employers to provide unemployment benefits to residents when appropriate.

We are able to resolve most cases administratively. If appropriate, the Department of Labor may litigate and/or recommend criminal prosecution. Employers who have willfully violated the law may be subject to criminal penalties, including fines and imprisonment.

In Hawaii, your weekly benefit amount is equal to 1/21 of the highest quarter wages in your base period with a maximum limit of $648 for claims filed in 2020. The total amount of benefits payable during the benefit year is 26 times your weekly benefit amount.

A complaint must be filed in writing and signed. An appointment is not needed to file, however individuals may contact the Wage Standards Division on Oahu or the nearest district office, either by phone, mail, or in person at the phone numbers and locations listed under ?Contact? for information.