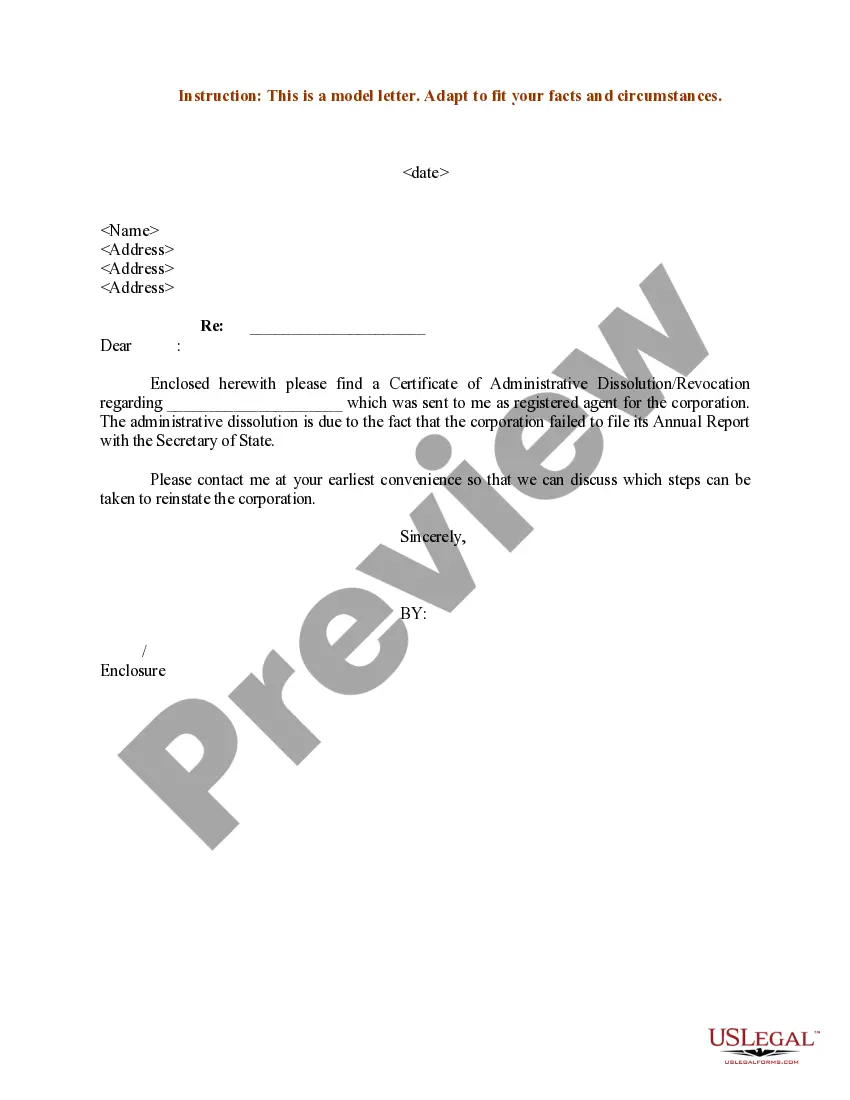

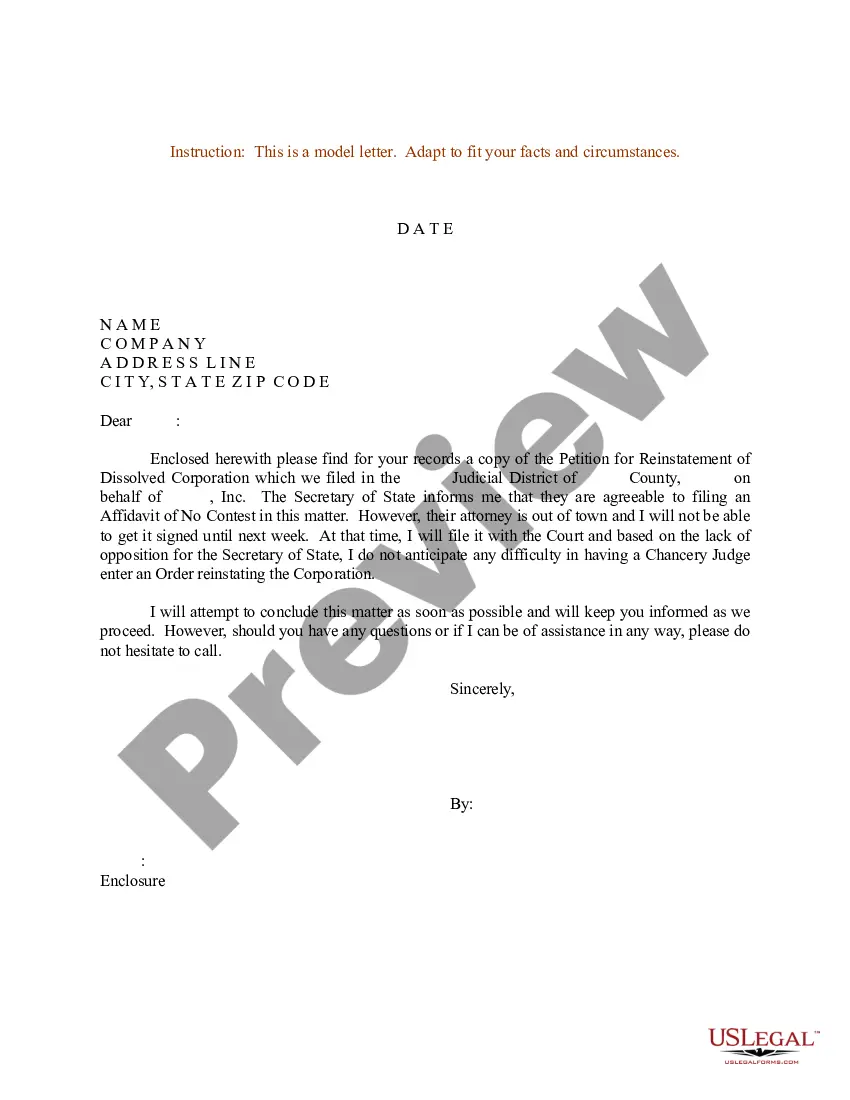

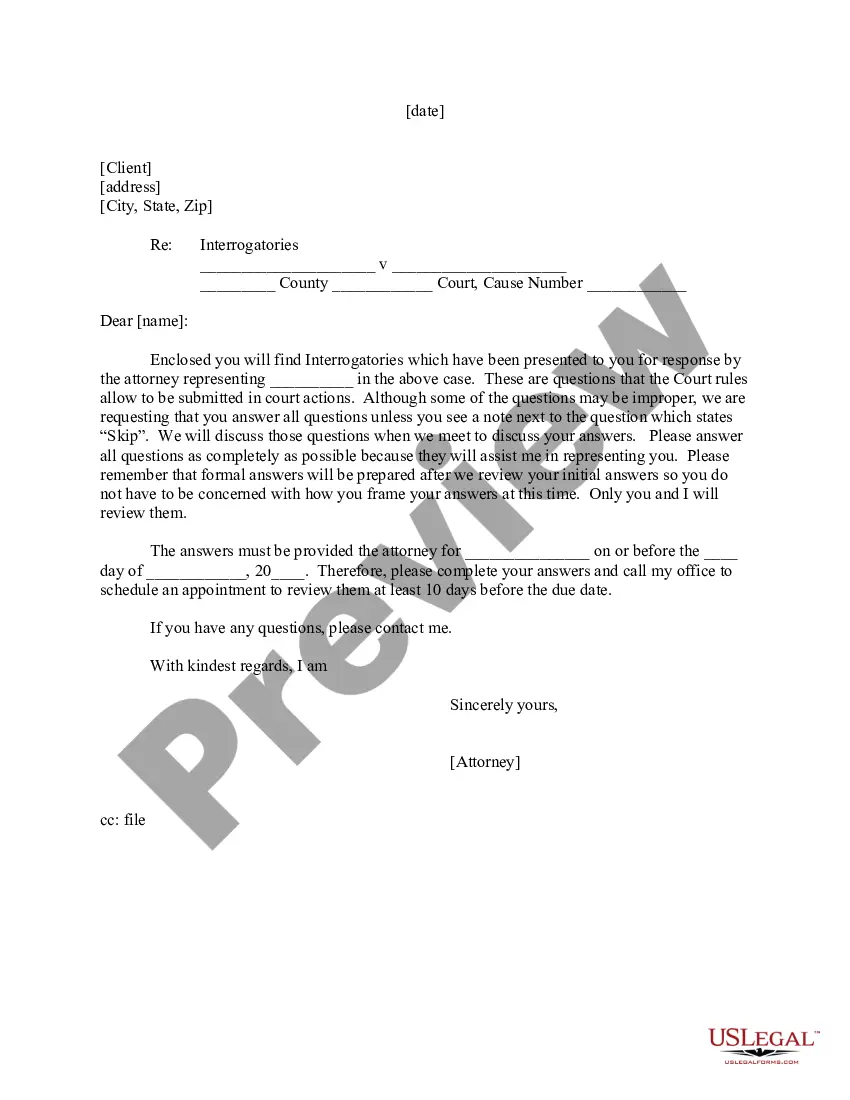

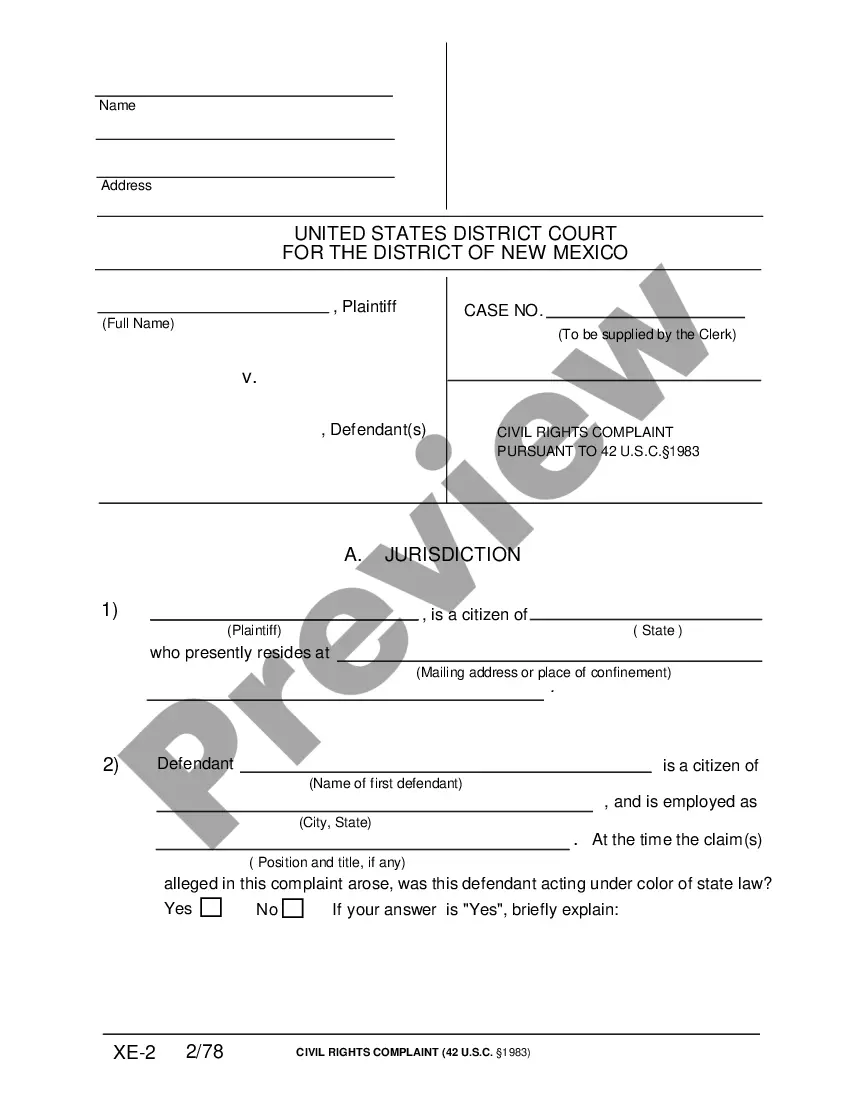

Hawaii Sample Letter for Dissolution and Liquidation

Description

How to fill out Sample Letter For Dissolution And Liquidation?

US Legal Forms - among the biggest libraries of legitimate kinds in the United States - gives a variety of legitimate record themes you are able to obtain or printing. Using the website, you may get a large number of kinds for company and personal purposes, categorized by types, says, or keywords and phrases.You can find the most recent types of kinds like the Hawaii Sample Letter for Dissolution and Liquidation within minutes.

If you already have a monthly subscription, log in and obtain Hawaii Sample Letter for Dissolution and Liquidation in the US Legal Forms local library. The Obtain button will show up on every form you look at. You have access to all formerly delivered electronically kinds within the My Forms tab of your bank account.

If you wish to use US Legal Forms the very first time, listed below are straightforward guidelines to help you get started off:

- Be sure you have picked the right form for your personal city/region. Select the Review button to examine the form`s content material. See the form outline to ensure that you have chosen the proper form.

- If the form does not satisfy your demands, use the Look for field towards the top of the screen to discover the one that does.

- Should you be happy with the form, verify your choice by simply clicking the Purchase now button. Then, pick the costs prepare you want and supply your references to register for the bank account.

- Approach the financial transaction. Make use of your charge card or PayPal bank account to complete the financial transaction.

- Pick the file format and obtain the form on your own device.

- Make alterations. Fill out, edit and printing and signal the delivered electronically Hawaii Sample Letter for Dissolution and Liquidation.

Every format you included in your account lacks an expiry date and is also yours eternally. So, in order to obtain or printing another version, just visit the My Forms section and click on in the form you require.

Obtain access to the Hawaii Sample Letter for Dissolution and Liquidation with US Legal Forms, one of the most substantial local library of legitimate record themes. Use a large number of skilled and status-certain themes that satisfy your small business or personal demands and demands.

Form popularity

FAQ

As required by law, a nonprofit organization that is ceasing existence is required to transfer all remaining assets to another tax-exempt organization or to the government. It is unlawful to give any property away to individuals ? including board members, volunteers, staff, or beneficiaries.

Although the content will vary, certain elements should be included in every letter of dissolution. These include: The name of the recipient and the name of the person sending the letter. The purpose of the letter, including the relationship to be terminated and the date of termination, stated in the first paragraph.

This intent to dissolve should include the following information: A detailed description of the claim. Information regarding the claim, the amount of the claim, and whether it is admitted to or not. A mailing address where any claims can be sent. A deadline: This must be at least 120 days after the written notice date.

In cases where approval by the members is not required and the number of directors in office is less than a quorum, the board resolution to dissolve can be approved by unanimous written consent of the directors then in office or by the affirmative vote of a majority of directors then in office at a meeting held with ...

Although state laws differ, here are some general steps to dissolving your nonprofit organization. Board approval and plan of dissolution. ... Approval from the state Attorney General. ... Dissolving the business entity. ... Notify the IRS. ... Asset distribution. ... Additional steps and considerations.

If my corporation is no longer in business, how do I take it off record with the Department? If a corporation is no longer in business, it can be dissolved by filing the Articles of Dissolution (Form DC-13) with the department. A corporation is dissolved upon the effective date of its articles of dissolution.

You'll need to file articles of dissolution for your nonprofit, but before doing so you must send the Attorney General (AG) a written notice of your nonprofit's intention to dissolve. The notice must include a copy or summary of your plan of dissolution.