Hawaii Vendor Evaluation

Description

How to fill out Vendor Evaluation?

Selecting the most suitable approved document format can be a challenge.

Certainly, there are numerous templates available online, but how can you find the official document you require.

Utilize the US Legal Forms site.

If you are a new user of US Legal Forms, here are simple steps to follow: First, ensure you have chosen the correct document for your city/state. You may preview the form using the Review button and read the form description to confirm it’s suitable for you.

- The service offers thousands of templates, including the Hawaii Vendor Evaluation, suitable for both business and personal needs.

- All forms are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Hawaii Vendor Evaluation.

- Use your account to search for the legal forms you have previously acquired.

- Visit the My documents tab of your account to obtain another copy of the required document.

Form popularity

FAQ

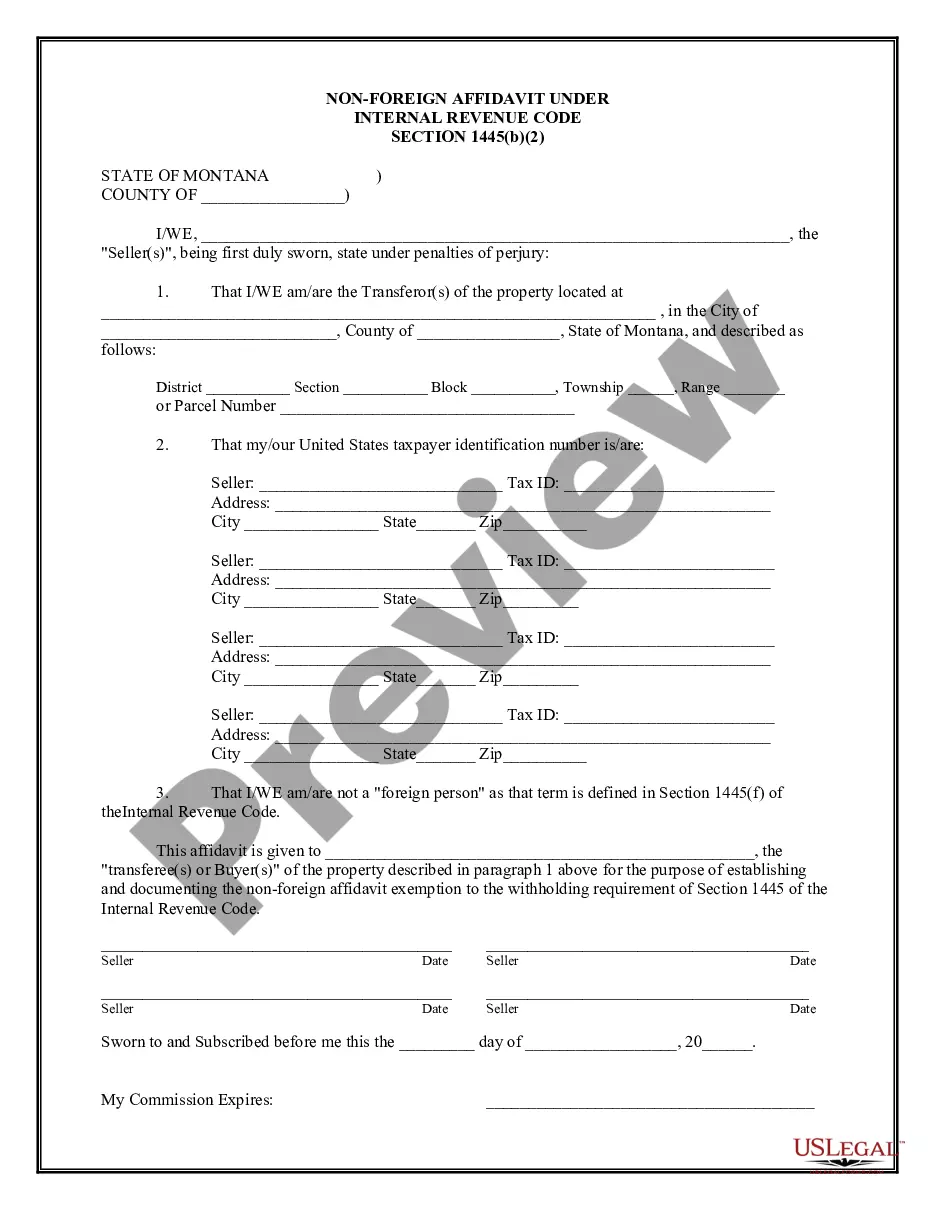

To obtain a vendor's license in Hawaii, start by visiting your local office of the Department of Commerce and Consumer Affairs. Complete the required application and provide the necessary identification, such as a Social Security number or tax identification number. Ensuring adherence to the Hawaii Vendor Evaluation process can facilitate this application, as it highlights essential compliance criteria. Additionally, if you need assistance, consider using services like USLegalForms, which provide resources for navigating vendor licensing.

To obtain a Hawaii tax clearance certificate, you need to file the necessary forms with the Hawaii Department of Taxation. Incorporating a Hawaii Vendor Evaluation is helpful, as it guides you through the process and outlines the required documents. Once completed, you submit your application and await approval, ensuring you have all your tax matters in order.

A business license is a general requirement for all businesses operating in Hawaii, while a vendor's license specifically allows you to sell goods and services. The Harvard Vendor Evaluation highlights these distinctions, making it clear which license applies to your operation. Understanding these differences is crucial for legal compliance and successful business management.

Yes, you need a license to sell in Hawaii. This requirement applies to most businesses, whether you are selling products or services. A Hawaii Vendor Evaluation can help you understand specific licensing requirements and ensure you meet all local regulations. To operate legally, it's vital to complete your licensing paperwork properly.

HCE compliance refers to adhering to the requirements set by the Hawaii Compliance Express program. This compliance ensures that vendors fulfill their obligations related to various state laws, including taxes and permits. For a thorough Hawaii Vendor Evaluation, being HCE compliant is essential to avoid potential legal issues. UsLegalForms offers solutions that can help you achieve and maintain compliance.

Hawaii's noise law regulates unnecessary sounds that can disturb the peace. These laws vary by location and often include specific decibel limits during designated hours. Business owners should be aware of these regulations during their Hawaii Vendor Evaluation to ensure they meet local standards. Utilizing services from UsLegalForms can assist you in obtaining the necessary information and forms to remain compliant.

HCE stands for Hawaii Compliance Express, a program that streamlines the process for vendors to demonstrate compliance with various state requirements. HCE simplifies the evaluation process, allowing businesses to efficiently meet regulatory standards. For effective Hawaii Vendor Evaluation, understanding HCE can enhance your compliance management. Consider using UsLegalForms to obtain necessary documentation.

The gross excise tax in Hawaii is a tax imposed on businesses for the privilege of doing business in the state. This tax applies to the total revenue generated, before any deductibles or exemptions. Understanding this tax is crucial for anyone involved in Hawaii Vendor Evaluation, as it affects overall business costs and profitability. Resources like UsLegalForms can help you navigate the complexities of this tax.

To obtain a Hawaii tax clearance certificate, first ensure that all your state taxes are current. You can apply for the certificate through the Hawaii Department of Taxation either online or by submitting a physical application. Having this certificate is vital for various business transactions and can play a key role in your Hawaii Vendor Evaluation process.

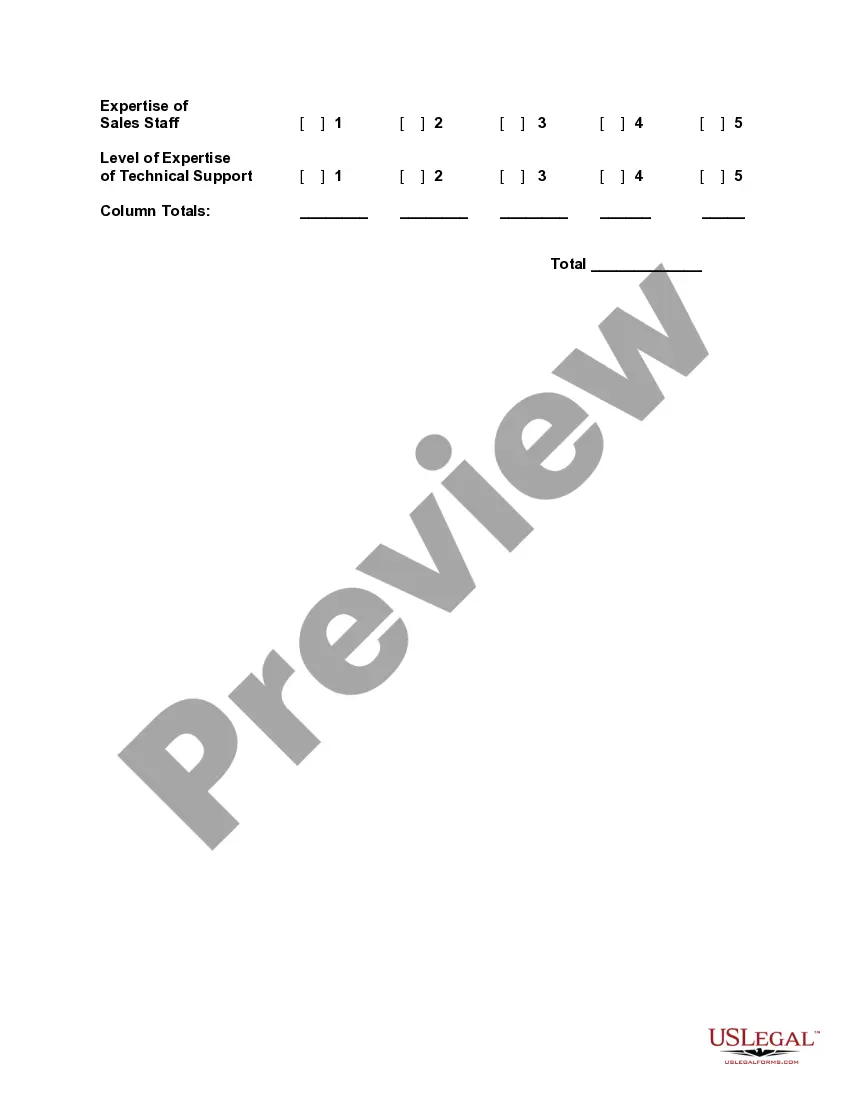

To perform vendor evaluation effectively, start by setting clear and detailed criteria aligned with your business objectives. Gather relevant information about potential vendors through questionnaires, interviews, and performance metrics. Once you have the data, analyze it, compare vendor offerings, and make an informed choice that enhances your Hawaii Vendor Evaluation process.