Hawaii Notice of Default on Promissory Note Installment

Description

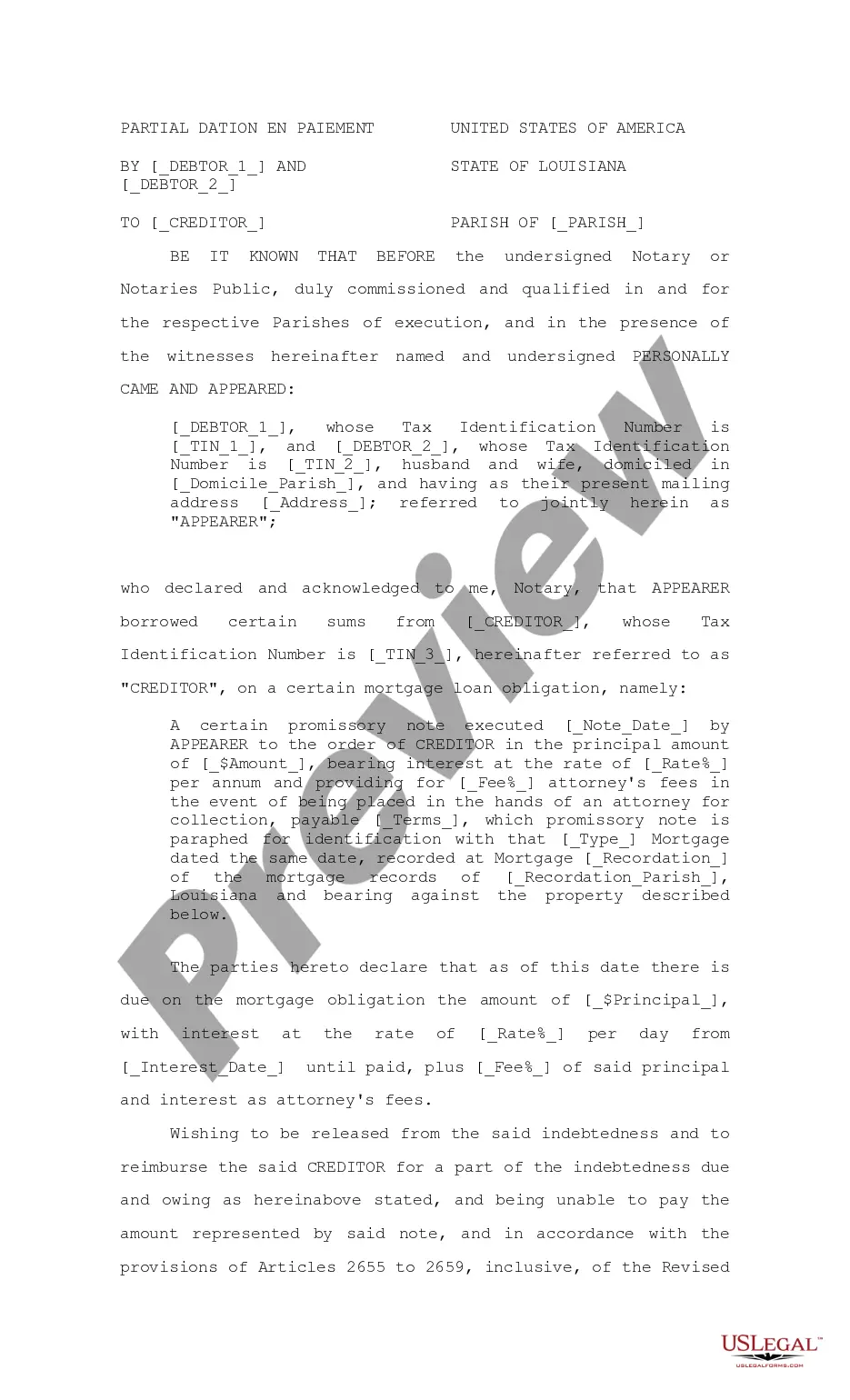

How to fill out Notice Of Default On Promissory Note Installment?

If you wish to acquire, obtain, or print authentic document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Employ the website's straightforward and user-friendly search to find the documents you require.

Numerous templates for commercial and individual purposes are categorized by types and regions, or keywords.

Step 4. Once you have identified the form you need, click the Get now button. Choose your preferred payment method and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to get the Hawaii Notice of Default on Promissory Note Installment with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download option to retrieve the Hawaii Notice of Default on Promissory Note Installment.

- Additionally, you can access forms you've previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Be sure to check the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

To legally enforce a promissory note, you must first review the terms outlined in the document. If the borrower defaults on the payment, you can issue a Hawaii Notice of Default on Promissory Note Installment, which formally notifies them of their delinquency. After this, if the borrower fails to remedy the situation, you may pursue legal action through the courts. Utilizing platforms like USLegalForms can provide you with the necessary templates and guidance to ensure you follow the correct legal procedures.

Defaulting on a promissory note can lead to serious consequences. Typically, the lender may initiate collection efforts, or even pursue legal action to recover the owed amount. In relation to Hawaii, a Hawaii Notice of Default on Promissory Note Installment can formally document the default and the next steps involved. Understanding your rights and responsibilities is crucial, and platforms like USLegalForms can guide you through the necessary actions you can take.

If someone defaults on a promissory note, the first step is to review the terms outlined in the agreement. It is important to reach out to the borrower to discuss the situation, as they may have valid reasons for their default. Additionally, if the issue is unresolved, you might need to explore legal options, which could include filing a Hawaii Notice of Default on Promissory Note Installment. Utilizing resources like USLegalForms can help you navigate this process effectively.

A notice of default can be delivered in several ways, with certified mail being one of the most common and effective methods. This delivery option provides legal proof that the borrower received the notice. Additionally, you might consider using electronic delivery methods where permitted, but always check if such methods align with the processes outlined in the Hawaii Notice of Default on Promissory Note Installment.

Writing a default notice involves presenting the necessary information in a structured format. Start with your contact information, followed by the borrower's details, and state the purpose of the letter. Highlight specifics such as the amount overdue and the date of the missed payment, mentioning that this notice is based on the Hawaii Notice of Default on Promissory Note Installment.

When writing a notice of default letter, begin by addressing the borrower directly and including the relevant details of the promissory note. Clearly outline the specific payment that is overdue and any applicable fees or penalties. Utilize a clear and professional tone, and refer to the Hawaii Notice of Default on Promissory Note Installment to ensure compliance with state regulations.

Sending a notice of default requires careful consideration of method and delivery. You can choose certified mail to ensure proof of receipt or hand delivery for immediate acknowledgment. Always keep a copy of the notice for your records and consider using the US Legal Forms platform for templates that comply with Hawaii law.

To issue a default notice for the Hawaii Notice of Default on Promissory Note Installment, start by reviewing the terms of the promissory note. Ensure you clearly state the borrower’s missed payments and specify the total amount due. Create a documented notice that adheres to both state and federal regulations for proper delivery.

When someone defaults on a promissory note, your first step should be to review the terms of the agreement and assess the situation. Open communication with the borrower may result in a workout option or a repayment plan. Moreover, consulting resources that discuss the Hawaii Notice of Default on Promissory Note Installment can offer valuable insights into your legal rights and options.

Upon receiving a default notice, you must take immediate action to address the missed payments outlined in the document. Ignoring this notice can lead to serious implications, including foreclosure proceedings if applicable. The Hawaii Notice of Default on Promissory Note Installment serves to inform you of your liabilities, so understanding it is key for any borrower.