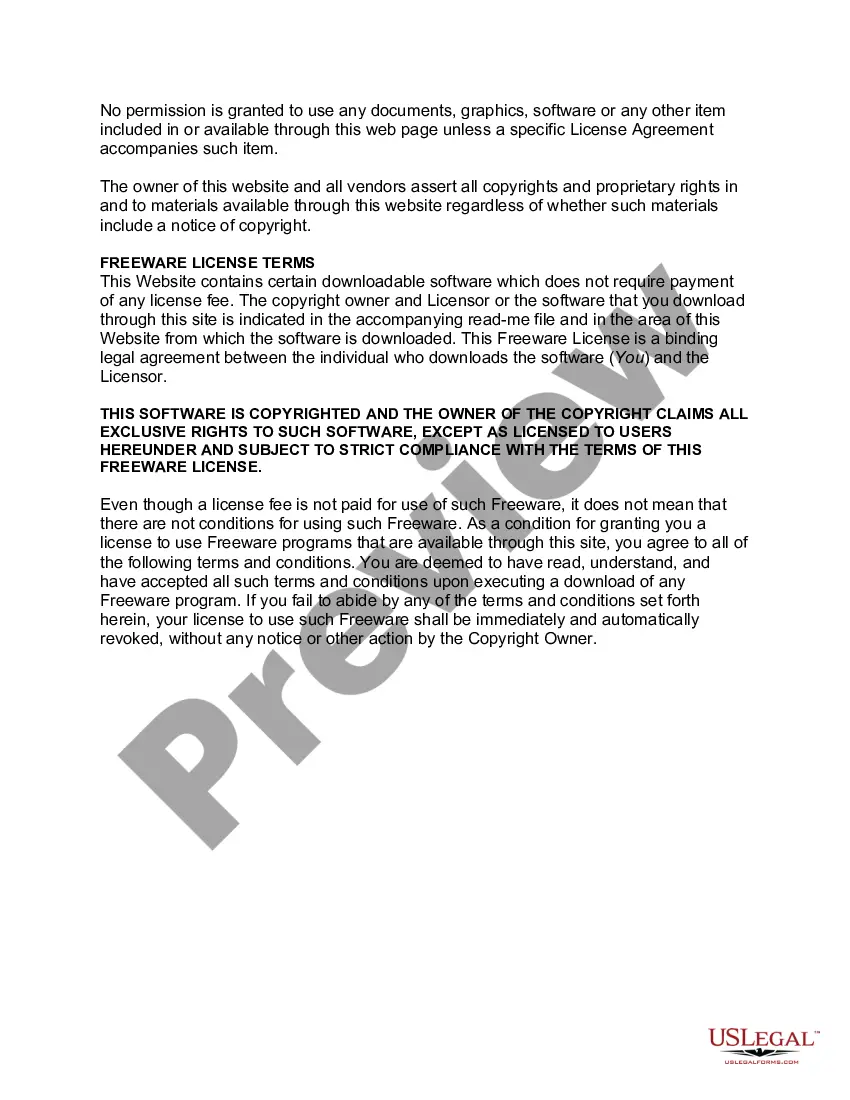

Hawaii Clickable Software License Notice

Description

How to fill out Clickable Software License Notice?

If you wish to sum up, obtain, or print official document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the site’s straightforward and user-friendly search to locate the documents you require.

A diverse range of templates for business and personal purposes are organized by categories and states or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You may use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the Hawaii Clickable Software License Notice in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Hawaii Clickable Software License Notice.

- You can also retrieve forms you previously acquired in the My documents tab of your account.

- If this is your first experience using US Legal Forms, adhere to the instructions below.

- Step 1. Ensure you have chosen the form for the correct area/state.

- Step 2. Utilize the Preview option to browse through the form’s content. Don’t forget to review the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variants of the legal form template.

Form popularity

FAQ

G45 and G49 serve different purposes in Hawaiian tax filings. G45 is used as a general excise tax return, while G49 pertains to the tax information for partnerships or S-corporations. Understanding these differences is crucial for accurate reporting. With the help of Hawaii Clickable Software License Notice, you can easily determine the right forms for your needs.

You can amend a previously filed tax return by filling out Form N-101A. This form details the specific changes you're claiming. After preparing the amendment, mail it to the relevant tax office. Using Hawaii Clickable Software License Notice simplifies form completion, helping avoid mistakes.

To file an amended Hawaii tax return, begin by obtaining Form N-101A. Fill out the necessary sections, indicating what changes you are making. After completing the form, mail it to the appropriate address. For a smoother experience, consider using Hawaii Clickable Software License Notice for guidance through the amendment process.

You should mail Hawaii form G-49 to the Department of Taxation, often to their specific processing center. Always double-check the mailing address since it may vary based on your location or the type of return you are filing. If you utilize the Hawaii Clickable Software License Notice, it can provide accurate mailing instructions to ensure timely processing.

Yes, you can file your Hawaii state tax returns online, except for amended returns. Numerous platforms offer the capability to e-file, simplifying the process. When you use Hawaii Clickable Software License Notice, you benefit from an intuitive interface designed to help you navigate through all requirements effectively.

Currently, Hawaii does not allow electronic filing of amended returns. You must complete the paper form and submit it by mail. This may seem inconvenient, but using tools like the Hawaii Clickable Software License Notice can assist in preparing your paperwork correctly before mailing.

Yes, there can be penalties for filing an amended return if you owe taxes. However, if you are simply correcting a mistake, the penalties may be minimal. It's important to file promptly to reduce any potential penalties. Using Hawaii Clickable Software License Notice can help you ensure accuracy and avoid penalties.

To file an amended Hawaii state tax return, you must use Form N-101A. This form allows you to make necessary changes to your tax information. Remember to clearly indicate the changes you are making. If you utilize Hawaii Clickable Software License Notice, the process becomes more straightforward, guiding you every step of the way.

To close your Tax Act account, log into your account and follow the provided instructions to initiate the closure request. If you encounter issues, reach out to Tax Act customer support for assistance. Be aware that closing this account will not affect any obligations related to your Hawaii Clickable Software License Notice.

To close your Hawaii withholding account, you should send a request to the Hawaii Department of Taxation. Include essential details such as your account number and reason for closure. By doing this, you can ensure that you remain compliant and can effectively manage any future needs related to your Hawaii Clickable Software License Notice.