Hawaii Assignment and Transfer of Stock

Description

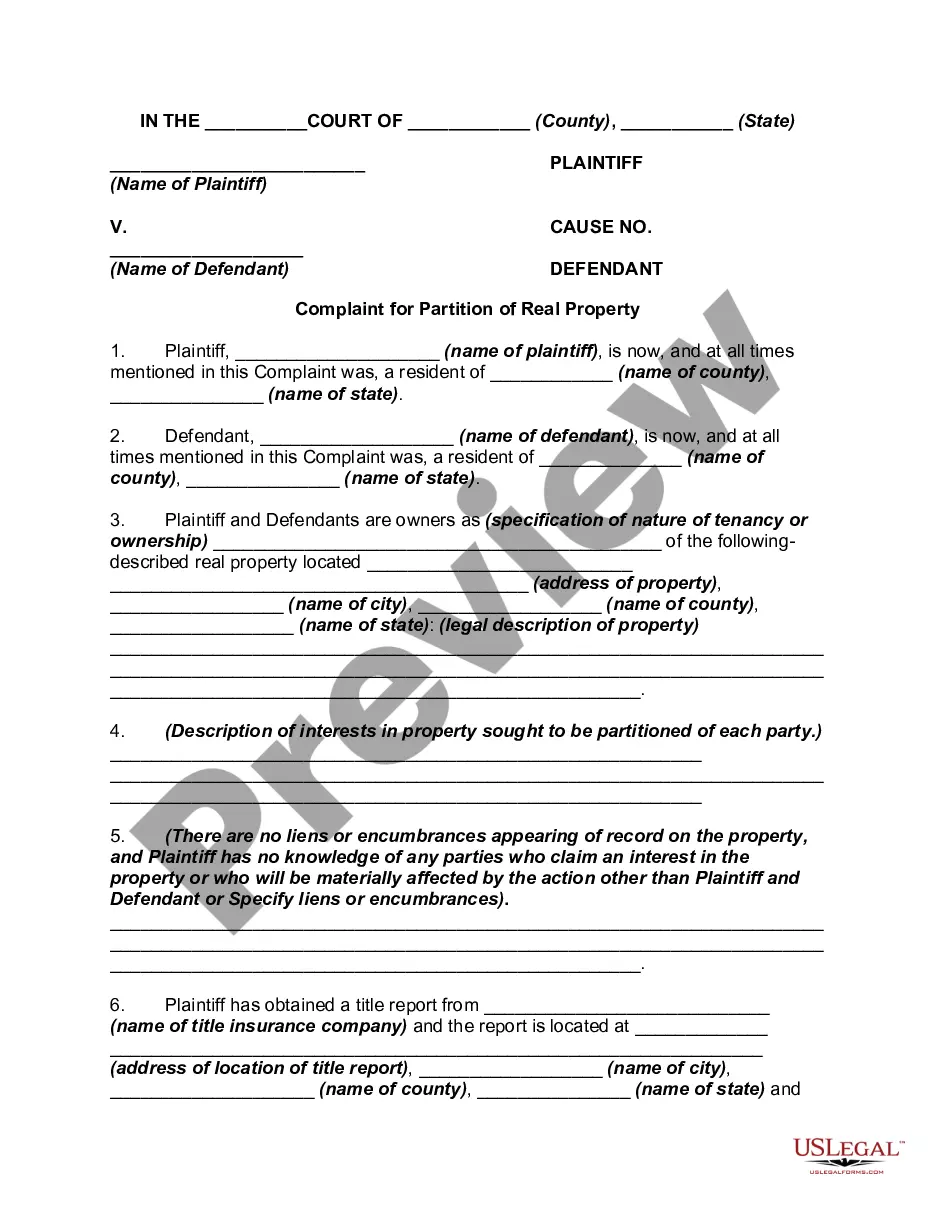

How to fill out Assignment And Transfer Of Stock?

US Legal Forms - one of the most extensive repositories of legal templates in the nation - provides a range of legal document formats that you can obtain or print. By using the website, you can find thousands of forms for commercial and personal purposes, organized by categories, states, or keywords.

You will find the most recent forms available, such as the Hawaii Assignment and Transfer of Stock, in just a few minutes.

If you already possess a membership, Log In and obtain the Hawaii Assignment and Transfer of Stock from the US Legal Forms library. The Download button will be visible on every document you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Choose the format and download the form to your device. Edit the document. Complete, modify, print, and sign the downloaded Hawaii Assignment and Transfer of Stock. Each template you add to your account does not expire and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Hawaii Assignment and Transfer of Stock with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your commercial or personal requirements and expectations.

- If you want to use US Legal Forms for the first time, here are straightforward instructions to help you get started.

- Ensure you have selected the correct form for your specific city/state. Click the Preview button to review the form’s content.

- Read the form description to confirm that you have chosen the right form.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

In the context of leasing, assignment and transfer pertain to different legal actions regarding lease rights. Assignment involves the lease-holder assigning their rights and responsibilities to a new tenant, effectively stepping out while allowing another to take their place. A transfer, however, can imply a broader scope where rights may shift without necessarily passing all obligations. Clarity on these definitions can aid your understanding of Hawaii Assignment and Transfer of Stock agreements, especially for business stakeholders.

Intellectual Property (IP) rights can be either assigned or transferred, but these actions signify different legal implications. An assignment involves moving IP rights to another entity, where the assignor relinquishes all ownership rights. In contrast, a transfer may involve a temporary sharing of rights without relinquishing ownership. When dealing with Hawaii Assignment and Transfer of Stock, having clarity on these terms is vital, as the implications can impact stock ownership rights significantly.

While both assignment and transfer relate to shifting rights and obligations, they feature distinct meanings. An assignment usually involves the delegation of rights and duties to another party, while a transfer represents a full passage of ownership. Grasping these concepts is essential in the context of Hawaii Assignment and Transfer of Stock, as accurate terminology prevents misunderstandings and legal complications.

Hawaii Revised Statutes 574 5 addresses the responsibilities and rights associated with assignments and transfers involving property interests. This statute outlines critical conditions under which such processes must occur and ensures proper legal compliance. For anyone engaging in the Hawaii Assignment and Transfer of Stock, consulting this statute provides necessary guidance and protects against potential disputes.

The terms assignment and transfer often confuse many individuals, but they refer to unique processes. An assignment typically allows one party to pass its rights and obligations to another party, while a transfer involves a complete conveyance of rights or property ownership. Understanding these differences is crucial, especially in relation to the Hawaii Assignment and Transfer of Stock, where precise language matters in legal documents.

In Hawaii, the conveyance tax on a lease applies if the rental term is longer than one year and the lease involves a significant financial consideration. The tax is typically calculated based on the rental amount and the duration of the lease. If you are engaged in a Hawaii Assignment and Transfer of Stock related to leased properties, it's crucial to consider this tax in your overall financial planning. To find more information and helpful forms, visit UsLegalForms.

To mail your Hawaii Form N-15, send it to the appropriate address listed on the form's instructions or the Hawaii Department of Taxation site. Make sure the form is filled out correctly to avoid delays. If you are dealing with stock transfers and taxes like the Hawaii Assignment and Transfer of Stock, ensure all documentation is prepared meticulously.

The TAT tax in Hawaii is typically the responsibility of property owners who rent out their properties. They usually include the tax amount in rental fees charged to guests. To manage your finances effectively while engaging with the Hawaii Assignment and Transfer of Stock, being aware of these tax liabilities is beneficial.

In most cases, the seller is responsible for paying the conveyance tax in Hawaii, but this obligation can be negotiated. It is essential for both parties to clarify responsibilities in the sales contract. Understanding these obligations could greatly simplify matters during the Hawaii Assignment and Transfer of Stock process.

The TAT, or transient accommodations tax, is imposed on income generated from Hawaii's short-term rentals and accommodations. The tax benefits the state by funding tourism and related services. If you're looking to understand how this affects your Hawaii Assignment and Transfer of Stock, thorough research is essential.