Hawaii General Release of all Claims by an Individual

Description

How to fill out General Release Of All Claims By An Individual?

You have the ability to spend hours online trying to locate the valid document format that complies with the federal and state requirements you need.

US Legal Forms offers thousands of valid templates that have been vetted by experts.

You can easily download or create the Hawaii General Release of all Claims by an Individual through this service.

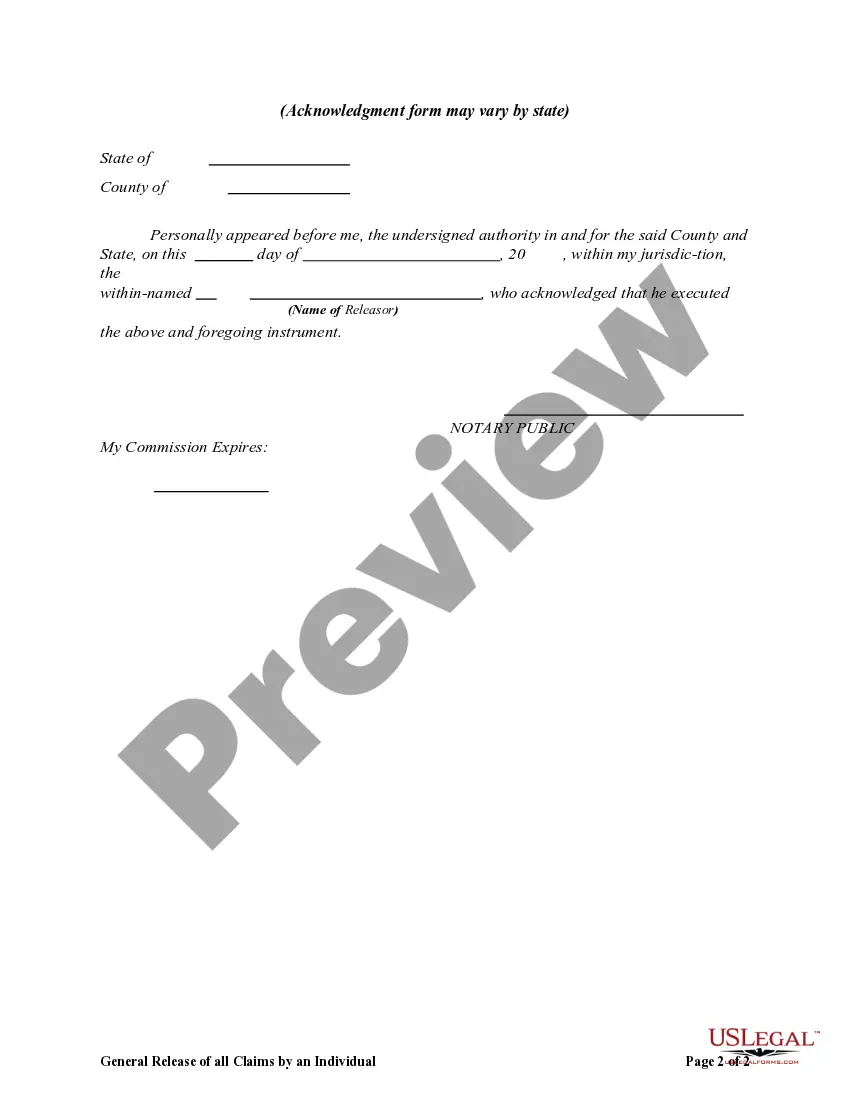

If available, use the Preview option to review the document format as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Obtain option.

- After that, you may complete, modify, print, or sign the Hawaii General Release of all Claims by an Individual.

- Every valid document template you download remains yours indefinitely.

- To obtain an additional copy of any downloaded form, go to the My documents section and select the relevant option.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct format for the state/city of your preference.

- Review the form details to guarantee you have chosen the appropriate form.

Form popularity

FAQ

The Hawaii form N-15, which is for non-resident income tax returns, should be mailed to the Department of Taxation in Hawaii. It's important to double-check the latest mailing address, as it can change. Ensure that you file this form correctly to avoid any legal implications that might affect documents like a Hawaii General Release of all Claims by an Individual.

A general excise (GE) license in Hawaii is required for any business operating in the state that sells goods or services. This license allows businesses to collect GE tax from customers. Obtaining this license is essential to avoiding fines and ensures compliance with local laws. This typically ties back to legal releases, such as a Hawaii General Release of all Claims by an Individual.

The G45 form is used for filing your periodic general excise tax returns, while the G49 form is an annual summary of your excise tax activity. Essentially, G45 is for ongoing submissions, while G49 wraps up your yearly obligations. Understanding the difference is crucial in managing your business finances and may relate indirectly to legal documents like a Hawaii General Release of all Claims by an Individual.

In Hawaii, filing for general excise tax can be done on a monthly, quarterly, or annual basis depending on your business’s gross income. Businesses earning under a certain threshold may qualify for annual filing. Ensure you stay on schedule to maintain compliance with tax obligations, which can be pivotal in scenarios involving a Hawaii General Release of all Claims by an Individual.

The 1099-G form in Hawaii reports any government payments made to you during the year, such as unemployment benefits or tax refunds. This form helps to ensure accurate reporting of income on your tax returns. If you receive a 1099-G, be sure to include this information when completing forms related to a Hawaii General Release of all Claims by an Individual.

The general excise (GE) tax rate in Hawaii is typically set at 4% for most businesses. Some counties in Hawaii impose an additional surcharge, which can raise the total rate to 4.5% or more. It's important to consider these rates when filing your taxes to avoid potential issues or penalties. Understand how they relate to your business operations, particularly if you use a Hawaii General Release of all Claims by an Individual.

The Hawaii tax G-49 form is a general excise tax (GET) annual return. It provides a summary of your general excise tax activities for the year. If you engage in business in Hawaii, you need to file this form to account for the taxes collected from your customers. Properly completing this form ensures compliance with Hawaii tax laws, which may relate to a Hawaii General Release of all Claims by an Individual.

The Romeo and Juliet law in Hawaii seeks to prevent severe penalties for young individuals engaged in consensual relationships where there is a slight age difference. This law is designed to protect minors from harsh prosecution due to the specifics of their situation. Knowing this can benefit those involved in such cases to navigate legal complexities. If you find yourself in a situation that requires legal clarity, a Hawaii General Release of all Claims by an Individual can be an effective way to settle matters amicably.

Hawaii Revised Statutes 671-3 addresses the release of claims related to personal injury and wrongful death actions. This statute outlines the legal framework for individuals to execute a general release of claims against another party. Understanding this statute is crucial, especially if you are involved in personal injury litigation. A Hawaii General Release of all Claims by an Individual can streamline the process and provide clarity in such legal matters.

Unauthorized possession of confidential personal information in Hawaii refers to the illegal acquisition or use of personal data without consent. This may include details like Social Security numbers, bank information, or other sensitive data. Violating privacy laws can lead to serious consequences and legal actions. To safeguard your interests, a Hawaii General Release of all Claims by an Individual can be useful in resolving disputes related to personal information breaches.