Hawaii General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

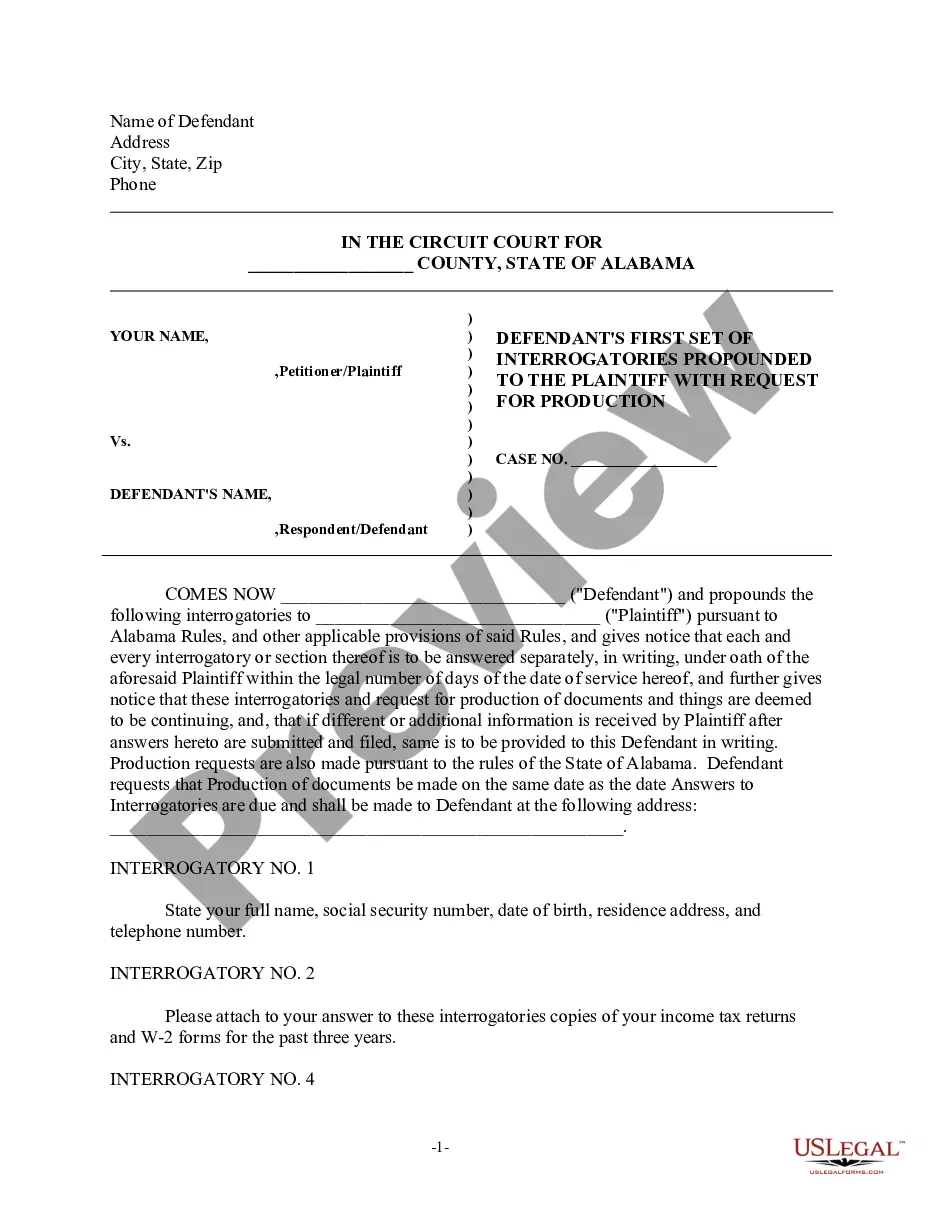

How to fill out General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

Are you presently within a location where you require documents for either professional or personal purposes nearly every day.

There are numerous lawful document templates available online, but finding forms you can rely on is not simple.

US Legal Forms offers a vast array of template forms, such as the Hawaii General Form of Factoring Agreement - Assignment of Accounts Receivable, which are designed to comply with federal and state regulations.

Once you locate the appropriate form, click Purchase now.

Choose the pricing plan you prefer, provide the necessary information to create your account, and pay for the order using PayPal or a credit card. Select a suitable document format and download your copy. You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the Hawaii General Form of Factoring Agreement - Assignment of Accounts Receivable at any time if necessary. Just navigate through the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal templates, to save time and prevent mistakes. The service provides professionally created legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Hawaii General Form of Factoring Agreement - Assignment of Accounts Receivable template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Obtain the template you require and ensure it is for the correct city/county.

- Use the Review option to assess the document.

- Check the description to ensure you have selected the correct form.

- If the document is not the one you seek, utilize the Search field to find the form that suits your needs and criteria.

Form popularity

FAQ

The assignment of accounts receivable refers to the transfer of rights to collect payment on your invoices to another party, typically a factor. This legal arrangement enables businesses to convert their outstanding invoices into immediate capital. By adopting a Hawaii General Form of Factoring Agreement - Assignment of Accounts Receivable, you can ensure a smooth transition and maintain clarity in your financial operations.

Factoring involves selling your receivables to a third party, while assignment of accounts receivable means transferring the right to collect the payment without the sale of the receivables. In a Hawaii General Form of Factoring Agreement - Assignment of Accounts Receivable, you effectively sell the receivables, allowing the factoring company to manage collections and take on the risk.

A General Excise (GE) tax license is required for individuals or businesses engaging in any retail sales, services, or contracting within Hawaii. If you provide goods or services in the state, you must secure this license to operate lawfully. Having a GE tax license is crucial when you are entering a Hawaii General Form of Factoring Agreement - Assignment of Accounts Receivable, as it helps ensure your business remains compliant with state tax regulations.

The G49 form, which is a General Excise Tax return, must be filed with the Hawaii Department of Taxation. You can submit it online through their tax system or mail a paper copy to the designated address. Ensuring that you file the G49 correctly is essential, especially if you engage in a Hawaii General Form of Factoring Agreement - Assignment of Accounts Receivable, as it can impact your overall tax compliance.

In Hawaii, you cannot deduct the general excise tax from your taxable income on your state tax return. Instead, this tax is typically included in the prices of goods and services. However, it is important to understand how this tax affects your overall finances, especially if you are entering into a Hawaii General Form of Factoring Agreement - Assignment of Accounts Receivable. For detailed insights, consider consulting a tax professional to navigate these nuances effectively.

In the context of factoring, a Notice of Assignment is an essential document that announces the transfer of accounts receivable from a seller to a factor. This aligns with the terms outlined in a Hawaii General Form of Factoring Agreement - Assignment of Accounts Receivable. A NoA notifies the debtor that payments should now be made to the factor instead of the original seller. This critical step helps to facilitate smoother transactions and clarifies payment expectations.

You can obtain a Notice of Assignment through your financial institution or legal counsel when engaging in transactions like factoring. Platforms such as UsLegalForms offer templates and resources tailored for creating a Notice of Assignment as part of a Hawaii General Form of Factoring Agreement - Assignment of Accounts Receivable. Using such resources simplifies the process and ensures compliance with legal requirements. Easily download templates and customize them to fit your needs.

In accounting, NoA stands for Notice of Assignment. It is a legal document that signifies the assignment of receivables to a third party, typically a factor in a Hawaii General Form of Factoring Agreement - Assignment of Accounts Receivable. This document formalizes the relationship between the parties and helps safeguard the rights of the factor. Proper issuance of a NoA ensures clarity on who owns the receivable and who is to collect it.

In finance, a Notice of Assignment (NoA) serves as communication to inform a debtor about the transfer of their debt obligations. This is often part of a larger transaction like the Hawaii General Form of Factoring Agreement - Assignment of Accounts Receivable. By issuing a NoA, the factor ensures that debtors recognize the new party responsible for collecting payments. Understanding NoA is crucial for businesses engaged in accounts receivable financing.