Hawaii Assignment of Property in Attached Schedule

Description

How to fill out Assignment Of Property In Attached Schedule?

Are you presently in a condition where you need documentation for both business and personal reasons almost every day.

There are numerous legal document templates available online, but finding forms you can trust isn't easy.

US Legal Forms offers thousands of form templates, including the Hawaii Assignment of Property in Attached Schedule, which are designed to meet state and federal regulations.

Once you find the correct form, click on Acquire now.

Select the pricing plan you want, fill in the required details to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your version. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Hawaii Assignment of Property in Attached Schedule anytime, if needed. Simply click on the needed form to download or print the template. Use US Legal Forms, the most extensive collection of legal documents, to save time and avoid errors. The service provides properly crafted legal document templates for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Hawaii Assignment of Property in Attached Schedule template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and verify it is for the right city/region.

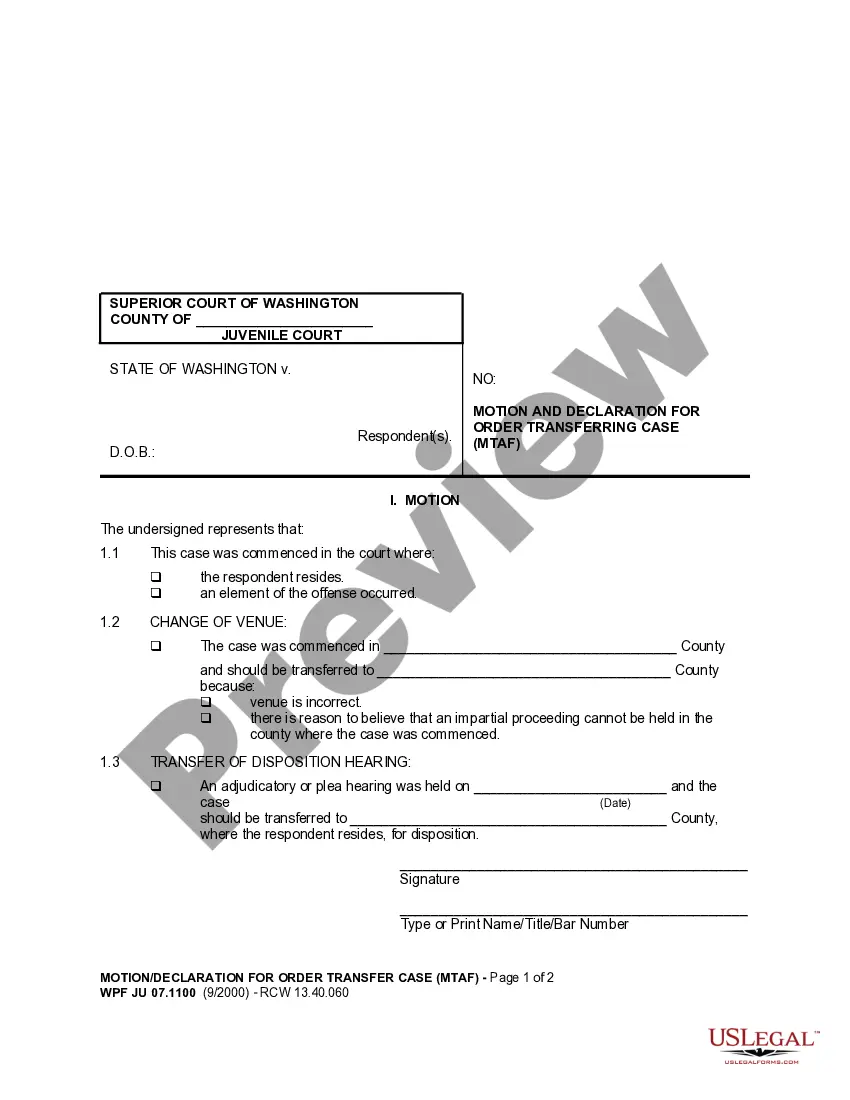

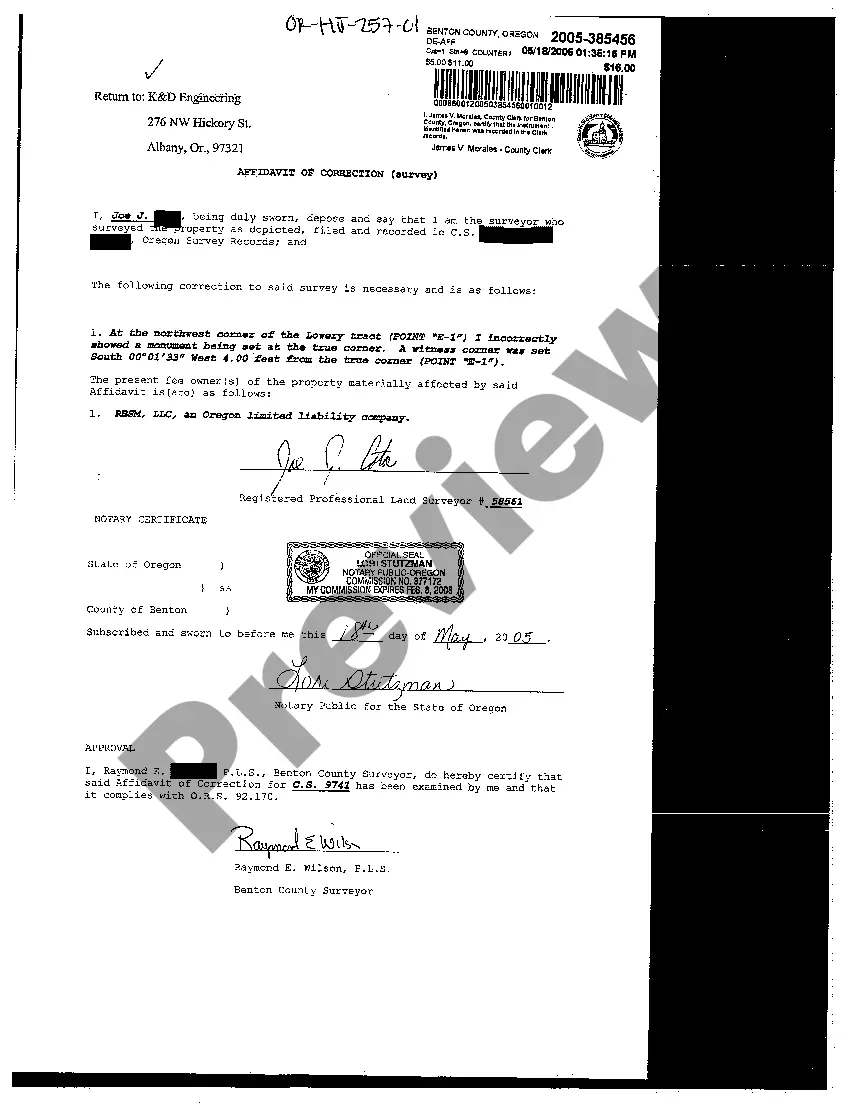

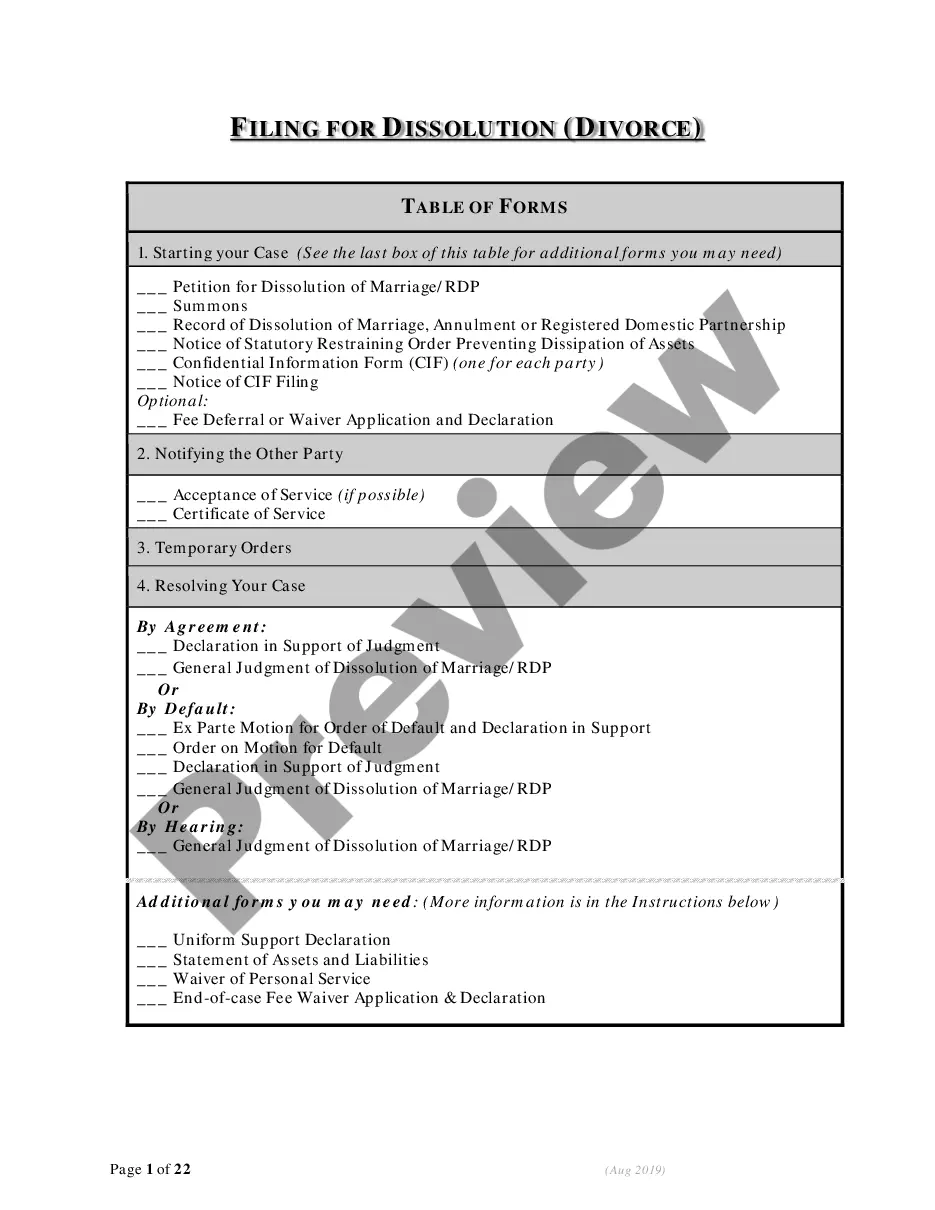

- Use the Preview button to check the document.

- Review the description to ensure that you have chosen the correct form.

- If the form isn’t what you’re looking for, utilize the Lookup area to find the document that suits your needs and criteria.

Form popularity

FAQ

To obtain a copy of your house deed, you can request it through your local County Clerk's Office in Hawaii. Providing identification and property details may be necessary. Additionally, exploring online platforms like USLegalForms can simplify the process while ensuring that your Hawaii Assignment of Property in Attached Schedule remains up to date.

In Hawaii, the real property tax rates can vary by county, and they typically range from about 0.25% to 1.25% of the property's assessed value. Knowing the tax implications is vital for property owners, as it can influence financial decisions related to your Hawaii Assignment of Property in Attached Schedule. For tailored information, check your local county tax office.

Transferring ownership of property in Hawaii involves preparing and recording a deed that identifies the new owner. It is essential to follow state regulations and ensure that all required forms are properly completed. By utilizing resources like USLegalForms, you can easily navigate the complexities involved in the Hawaii Assignment of Property in Attached Schedule.

To receive a copy of your house deed in Hawaii, visit your local County Clerk's Office or access the county's website. It requires providing relevant information about the property, including its legal description or parcel number. Ensuring you have your Hawaii Assignment of Property in Attached Schedule is beneficial to streamline this process.

In Hawaii, deeds are typically recorded at the Office of the County Clerk in the county where the property is situated. Recording a deed is crucial for establishing legal ownership and protecting your interests in the property. You can also complete this process online in some cases, helping you manage your Hawaii Assignment of Property in Attached Schedule effectively.

Form N 288A is a specific document used in Hawaii for the purpose of transferring titles and establishing ownership rights. This form often relates to property transactions, and understanding it can assist you in the context of the Hawaii Assignment of Property in Attached Schedule. You can find this form on the Hawaii Department of Taxation's website, ensuring smooth processing.

To obtain a copy of a deed in Hawaii, you can visit the Office of the County Clerk in the respective county where the property is located. They provide access to public records, including property deeds. Additionally, you can request copies online through the official state or county websites. This is essential when understanding your Hawaii Assignment of Property in Attached Schedule.

You can file the G-49 form at the Hawaii Department of Taxation, which can be done online or through traditional mail. Ensure that you include all required attachments, such as those pertaining to the Hawaii Assignment of Property in Attached Schedule. This structured submission helps maintain transparency and adherence to state requirements.

After taxes, earning $100,000 a year in Hawaii can result in a significantly lower take-home amount, often around $70,000 to $75,000, depending on your deductions and tax liabilities. This means that understanding your tax obligations is crucial. Tools like the Hawaii Assignment of Property in Attached Schedule aid in breaking down your finances, helping you plan better.

The difference between G-45 and G-49 lies in their intended purposes; G-45 is for reporting general excise taxes, while G-49 caters to corporate income taxation. Knowing which form to use is vital for maintaining compliance. As you navigate these requirements, the Hawaii Assignment of Property in Attached Schedule can help clarify how each taxes may affect your property revenues.