Hawaii UCC-1 for Personal Credit

Description

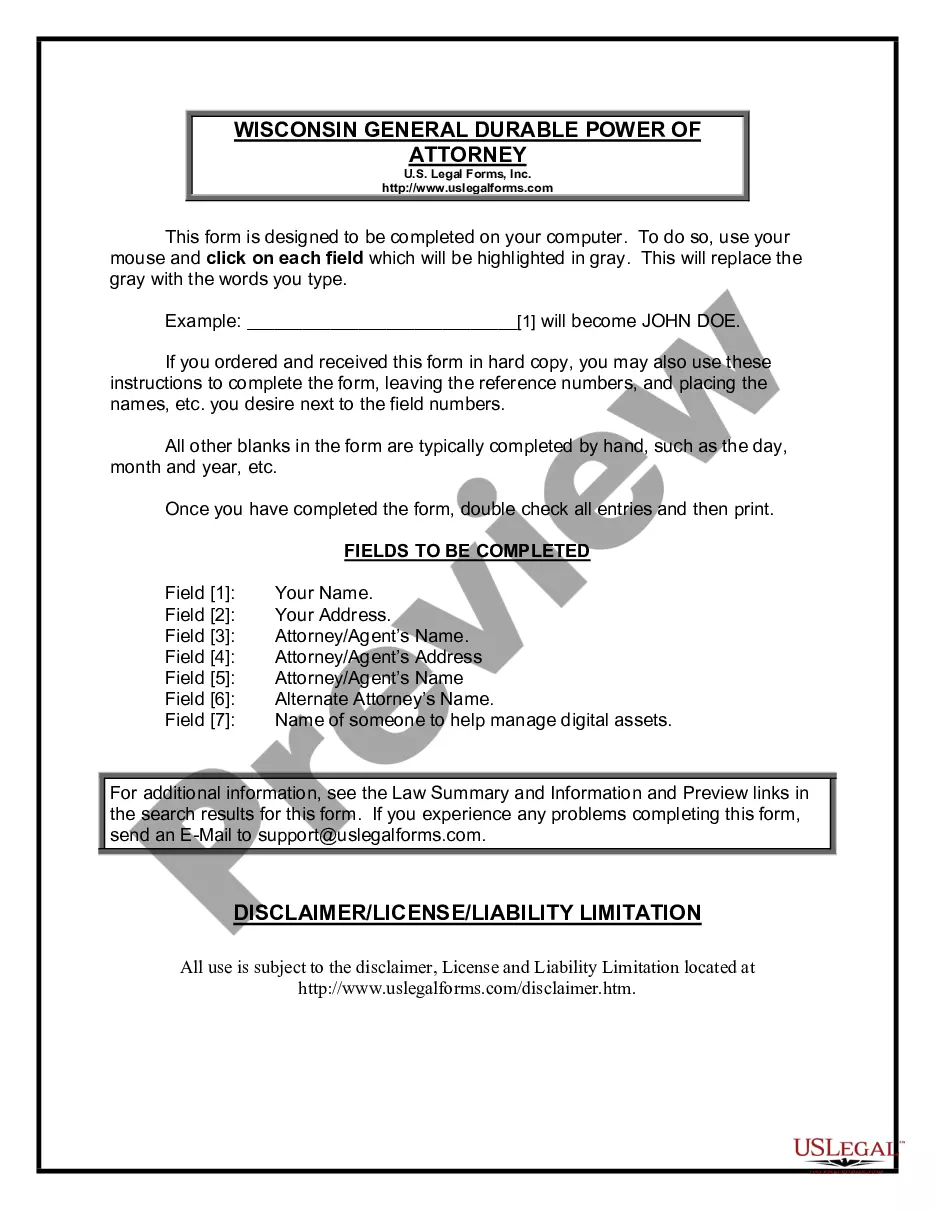

How to fill out UCC-1 For Personal Credit?

If you need to extensive, procure, or generate legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the website's user-friendly and practical search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Hawaii UCC-1 for Personal Credit in just a few clicks.

Step 5. Complete the purchase. You can use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Hawaii UCC-1 for Personal Credit.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to find the Hawaii UCC-1 for Personal Credit.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Yes, the UCC does apply to personal property, including items owned by individuals. By filing a Hawaii UCC-1 for Personal Credit, you can secure your interest in personal assets such as vehicles, equipment, or other tangible items. This legal filing helps ensure that you have a claim to the specified collateral in case the debtor defaults on their obligations.

Yes, you can file a Hawaii UCC-1 for Personal Credit against an individual if the individual is the debtor in a secured transaction. This process allows you to assert a security interest in the individual’s personal property. It is crucial to include the correct personal details to ensure that your UCC-1 filing is valid and enforceable.

To file a Hawaii UCC-1 for Personal Credit, you need to provide specific details about the debtor and the secured party. Typically, you should include the name and address of the debtor, a description of the collateral, and any necessary filing fees. Ensuring accurate and complete information helps maintain the validity of your filing and protects your interests.

A Hawaii UCC-1 for Personal Credit can affect your credit status, but it does not directly lower your credit score. Instead, it informs lenders that you have obligations that may limit your borrowing capacity. This can affect your ability to obtain new credit and the terms of loans offered to you. Being proactive in managing these filings can enhance your financial standing.

On a credit report, UCC stands for Uniform Commercial Code, indicating that a lender has a secured interest in your assets. This notation is particularly important if you've used personal or business property as collateral. If you see UCC entries, it's vital to consider their impact on your creditworthiness. For clarity, reviewing these entries with a trusted platform like uslegalforms can be beneficial.

A Hawaii UCC-1 for Personal Credit does not directly appear on your personal credit report. However, it can influence your creditworthiness because it indicates that a creditor has a claim on your assets. As a result, lenders might perceive you as a higher risk. It's essential to understand how these filings work when seeking loans.

Filling out a UCC-1 form involves several steps. First, you will enter the debtor's name and address, followed by the secured party's information. Then, describe the collateral being secured in precise terms. Finally, review all the details for accuracy before submitting your Hawaii UCC-1 for Personal Credit with the appropriate filing office.

To fill out a UCC-1 form properly, start by gathering essential information about the debtor and secured party, including names and addresses. Next, you will provide a description of the collateral being secured. Make sure all details are accurate, as mistakes can delay the filing process for your Hawaii UCC-1 for Personal Credit.

To file your Hawaii UCC-1 for Personal Credit, you will typically submit your statement to the Department of Commerce and Consumer Affairs in Hawaii. This process ensures that your financing statement is officially recorded, which provides legal notice to interested parties. You can file online, by mail, or in person, depending on your preference. Using the ulegalforms platform simplifies this process, guiding you through the necessary steps and helping you avoid common mistakes.