Hawaii Agreement with Health Care Worker as an Independent Contractor

Description

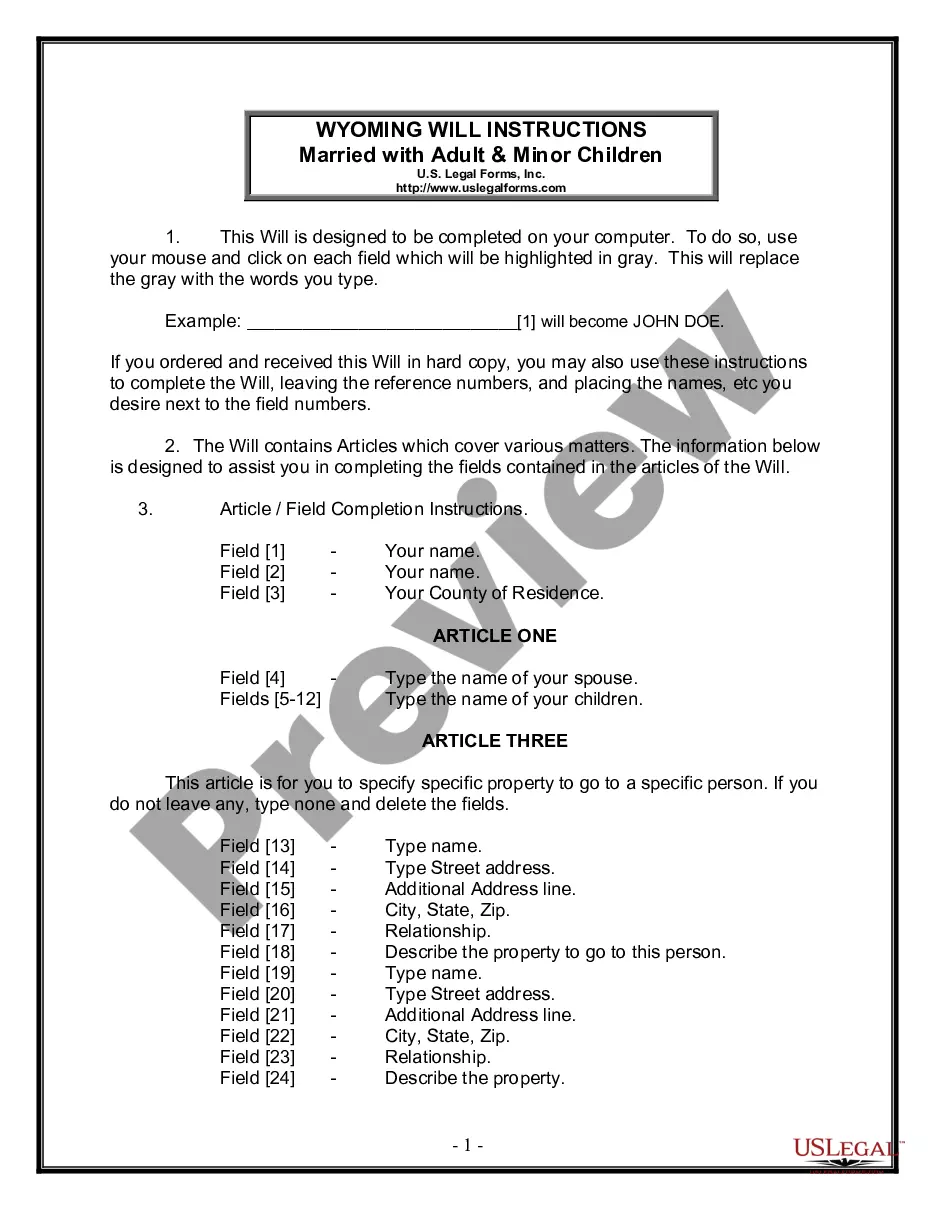

How to fill out Agreement With Health Care Worker As An Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal document templates that you can download or print.

By using the website, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Hawaii Agreement with Health Care Worker as an Independent Contractor in moments.

If you have a monthly subscription already, Log In to download the Hawaii Agreement with Health Care Worker as an Independent Contractor from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously obtained documents from the My documents tab in your account.

Complete the transaction. Use your credit card or PayPal account to finish the payment.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Hawaii Agreement with Health Care Worker as an Independent Contractor. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you need.

- Ensure you select the correct form for your area/county.

- Click the Review button to examine the content of the form.

- Check the form details to confirm you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- When satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your information to register for the account.

Form popularity

FAQ

The 1.5 medical rule in Hawaii pertains to the amount of time a health care worker can spend on patient care versus administrative duties. Essentially, this rule helps ensure that patient care remains the primary focus for health care professionals. Understanding this regulation is vital when forming a Hawaii Agreement with Health Care Worker as an Independent Contractor, as it impacts your contractual obligations. To stay compliant, consult resources like uslegalforms for detailed explanations and guidance.

Filling out an independent contractor agreement requires a clear understanding of your obligations and rights. Start by including the basic details such as your name, address, and the scope of work you will perform under the Hawaii Agreement with Health Care Worker as an Independent Contractor. Be sure to specify payment terms, deadlines, and any other relevant conditions. Platforms like uslegalforms provide templates to guide you through the process seamlessly.

As an independent contractor in Hawaii, you typically need to complete a W-9 form for tax purposes. Additionally, you may need to fill out a Hawaii Agreement with Health Care Worker as an Independent Contractor to outline the terms of your work. It's essential to ensure that you have the correct documentation to comply with state regulations and tax requirements. You can easily access these forms through platforms like uslegalforms to streamline the process.

Generally, a 1099 worker does not qualify for employer-sponsored health insurance, as they are considered independent contractors. However, negotiations can occur to provide certain benefits based on the agreement. It’s important to address this upfront in your Hawaii Agreement with Health Care Worker as an Independent Contractor to ensure both parties have clear expectations.

To set up an independent contractor agreement, start by clearly outlining the scope of work, payment terms, and deadlines for delivery. Make sure to include any required health insurance details if relevant. Using a reliable platform like uslegalforms can simplify the process, ensuring that your Hawaii Agreement with Health Care Worker as an Independent Contractor covers all necessary legal bases.

Independent contractors can obtain health insurance on the individual market, through insurance exchanges, or by joining professional organizations that offer group insurance. Researching options that fit their specific needs is crucial. Furthermore, it's beneficial to document any agreements regarding health coverage in a Hawaii Agreement with Health Care Worker as an Independent Contractor.

Independent contractors can request health insurance or other benefits during negotiations. However, it is not common for employers to provide these benefits, as contractors maintain their status as separate entities. Creating a Hawaii Agreement with Health Care Worker as an Independent Contractor can clarify any potential benefits that may be extended.

Typically, independent contractors do not receive company benefits such as health insurance or retirement plans. They operate their own businesses, and they are responsible for their own healthcare coverage. However, you can negotiate specific benefits, including health insurance, as part of a Hawaii Agreement with Health Care Worker as an Independent Contractor.

Yes, a company can offer health insurance to a non-employee, including independent contractors through a Hawaii Agreement with Health Care Worker as an Independent Contractor. However, it is essential to understand the legal implications and tax responsibilities involved. Consulting with a legal expert can help ensure the agreement aligns with your business needs.

No, you cannot legally work as an independent contractor without valid work authorization. Doing so could lead to serious legal consequences. If you are interested in a Hawaii Agreement with Health Care Worker as an Independent Contractor, ensure your work authorization is in place before engaging in any labor.