Under the Fair Credit Reporting Act, a consumer reporting agency, on request by and proper identification of the consumer, must clearly and accurately disclose to the consumer:

the nature and substance of certain information in its files on the consumer;

the sources of most of that information;

the recipients of any consumer report on the consumer furnished for employment purposes within the two-year period preceding the request, and for any other purpose within the one-year period preceding the request;

the dates, original payees, and amounts of any checks on which is based any adverse characterization of the consumer, included in the file at the time of the disclosure; and

a record of all inquiries received by the agency during the one-year period preceding the request that identified the consumer in connection with a credit or insurance transaction that was not initiated by the consumer.

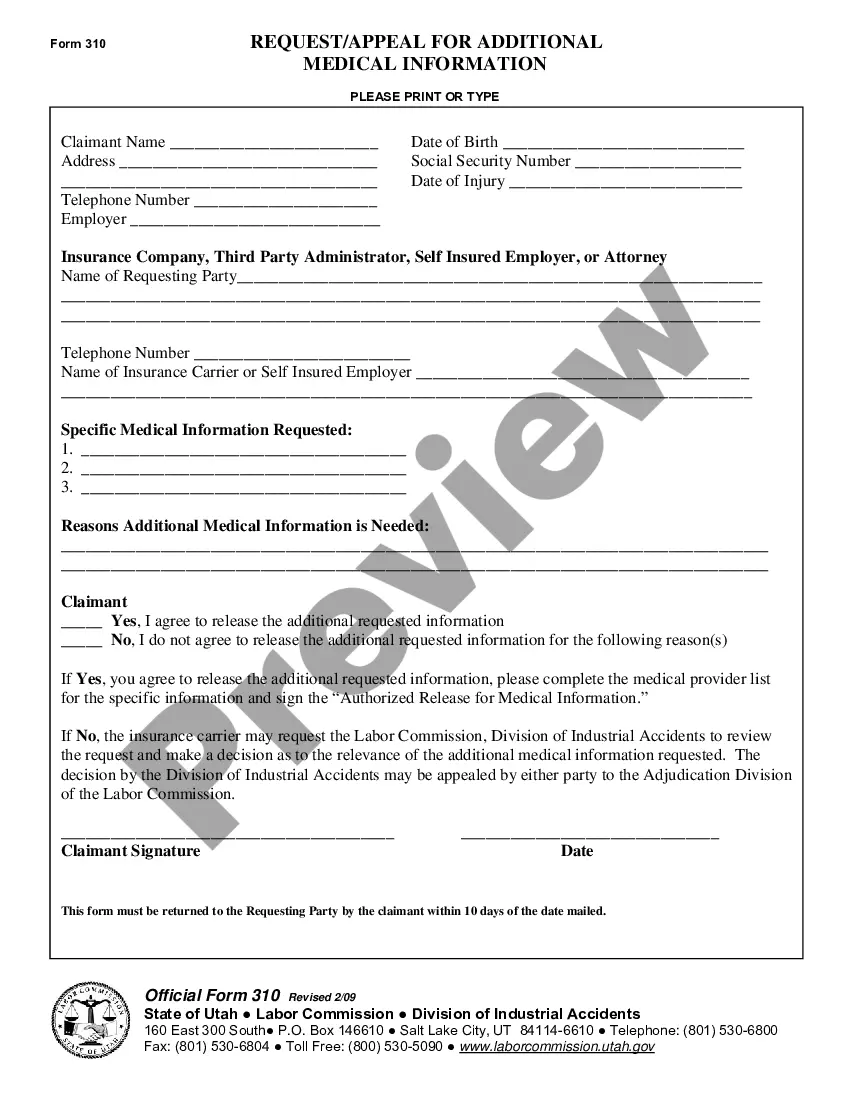

Hawaii Request for Disclosure as to Nature and Scope of Investigative Consumer Report

Description

How to fill out Request For Disclosure As To Nature And Scope Of Investigative Consumer Report?

If you wish to full, acquire, or print out legal record web templates, use US Legal Forms, the most important assortment of legal kinds, that can be found on the Internet. Take advantage of the site`s simple and easy convenient look for to obtain the files you want. Numerous web templates for enterprise and person reasons are sorted by categories and claims, or keywords. Use US Legal Forms to obtain the Hawaii Request for Disclosure as to Nature and Scope of Investigative Consumer Report in just a couple of mouse clicks.

In case you are already a US Legal Forms consumer, log in to the account and click the Acquire key to get the Hawaii Request for Disclosure as to Nature and Scope of Investigative Consumer Report. You can even gain access to kinds you formerly delivered electronically inside the My Forms tab of the account.

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for your appropriate city/country.

- Step 2. Utilize the Review method to check out the form`s information. Do not forget about to learn the information.

- Step 3. In case you are not happy together with the form, use the Lookup field at the top of the display screen to find other versions of your legal form template.

- Step 4. Upon having located the form you want, select the Acquire now key. Select the rates plan you favor and add your qualifications to sign up on an account.

- Step 5. Procedure the purchase. You may use your Мisa or Ьastercard or PayPal account to complete the purchase.

- Step 6. Pick the file format of your legal form and acquire it in your gadget.

- Step 7. Full, edit and print out or signal the Hawaii Request for Disclosure as to Nature and Scope of Investigative Consumer Report.

Every legal record template you get is your own property permanently. You may have acces to every single form you delivered electronically with your acccount. Click the My Forms section and select a form to print out or acquire once more.

Compete and acquire, and print out the Hawaii Request for Disclosure as to Nature and Scope of Investigative Consumer Report with US Legal Forms. There are millions of professional and condition-distinct kinds you can utilize for the enterprise or person demands.

Form popularity

FAQ

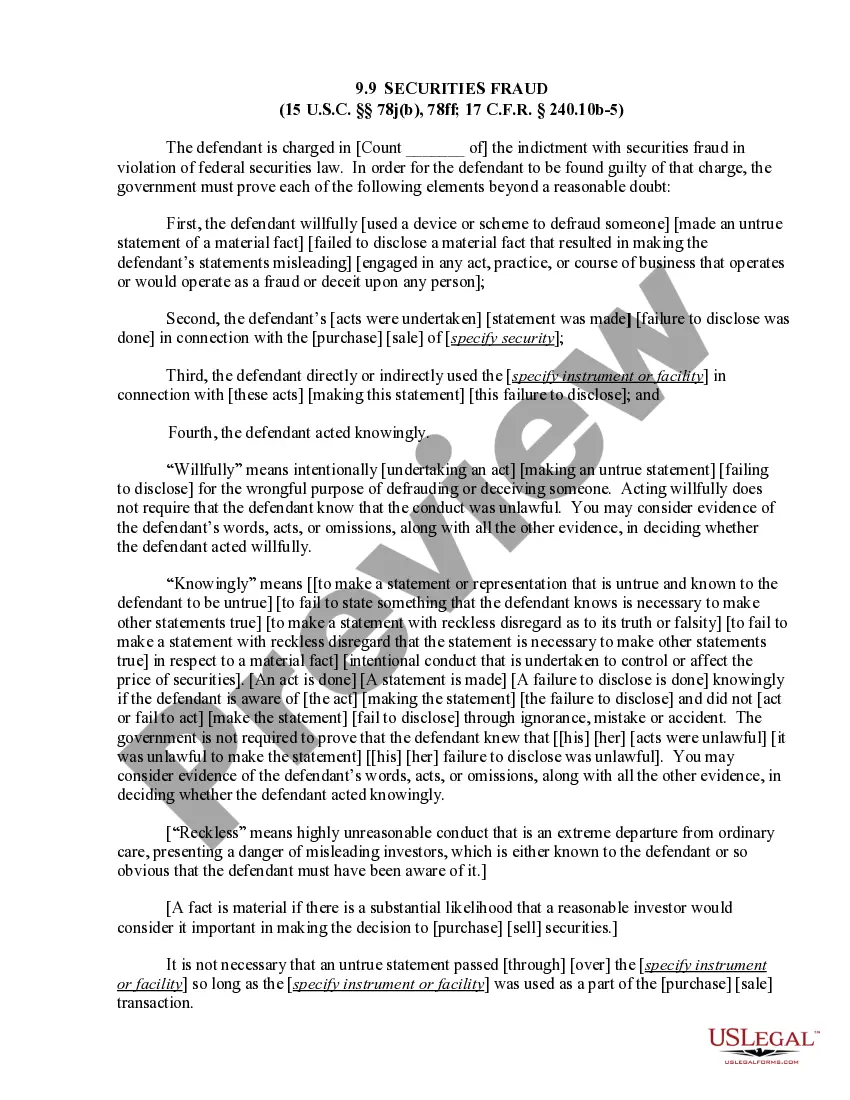

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

Investigative Reports These obligations include giving written notice that you may request or have requested an investigative consumer report, and giving a statement that the person has a right to request additional disclosures and a summary of the scope and substance of the report.

As a rule of thumb, the distinction between the two types of investigations can be thought of as simply verifying the specific facts about education, employment or other information the applicant has provided to the employer ("consumer report") versus obtaining more general character or personal information through ...

The FCRA requires any prospective user of a consumer report, for example, a lender, insurer, landlord, or employer, among others, to have a legally permissible purpose to obtain a report.

The Fair Credit Reporting Act (FCRA) governs how credit bureaus can collect and share information about individual consumers. Businesses check credit reports for many purposes, such as deciding whether to make a loan or sell insurance to a consumer. Employers may check them, too.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

Background checks and consumer reports are the same. The reason is that background checks are considered consumer reports under the Fair Credit Reporting Act (FCRA). Simply put, the term ?Consumer report? is just another, less common way to refer to a background check.

Consumer Financial Protection Bureau.