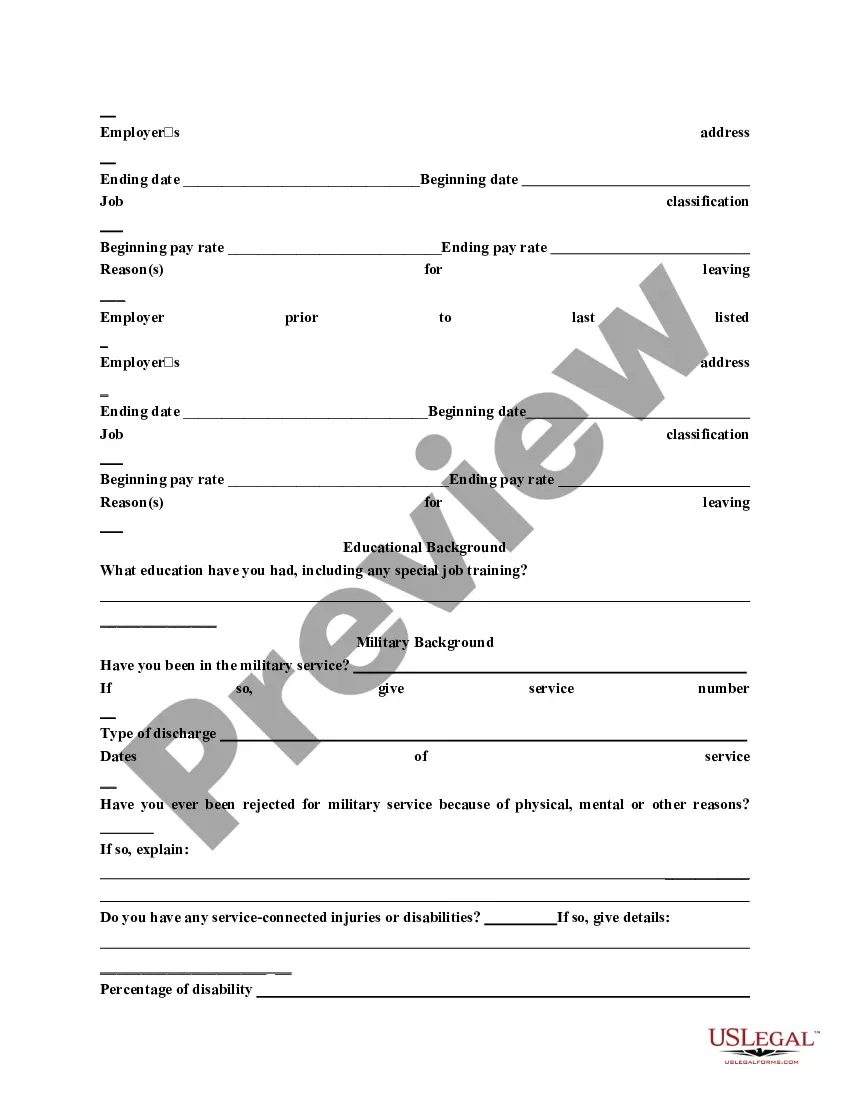

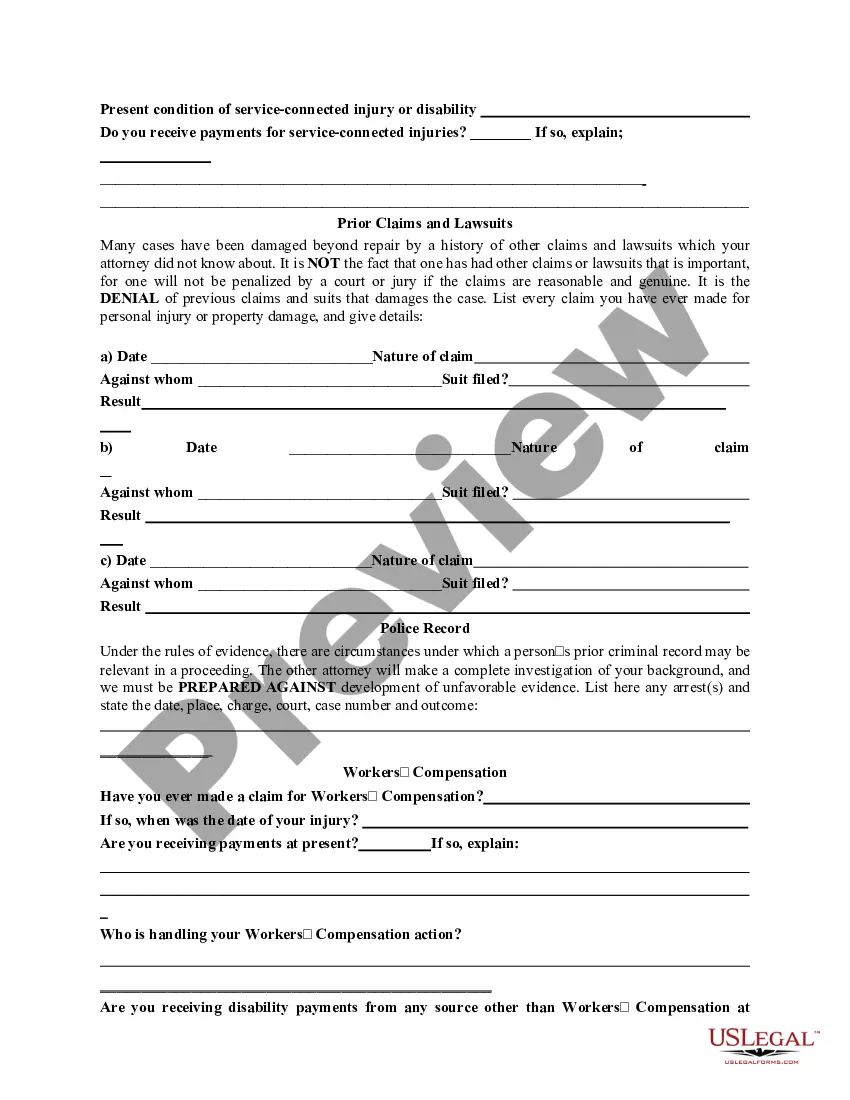

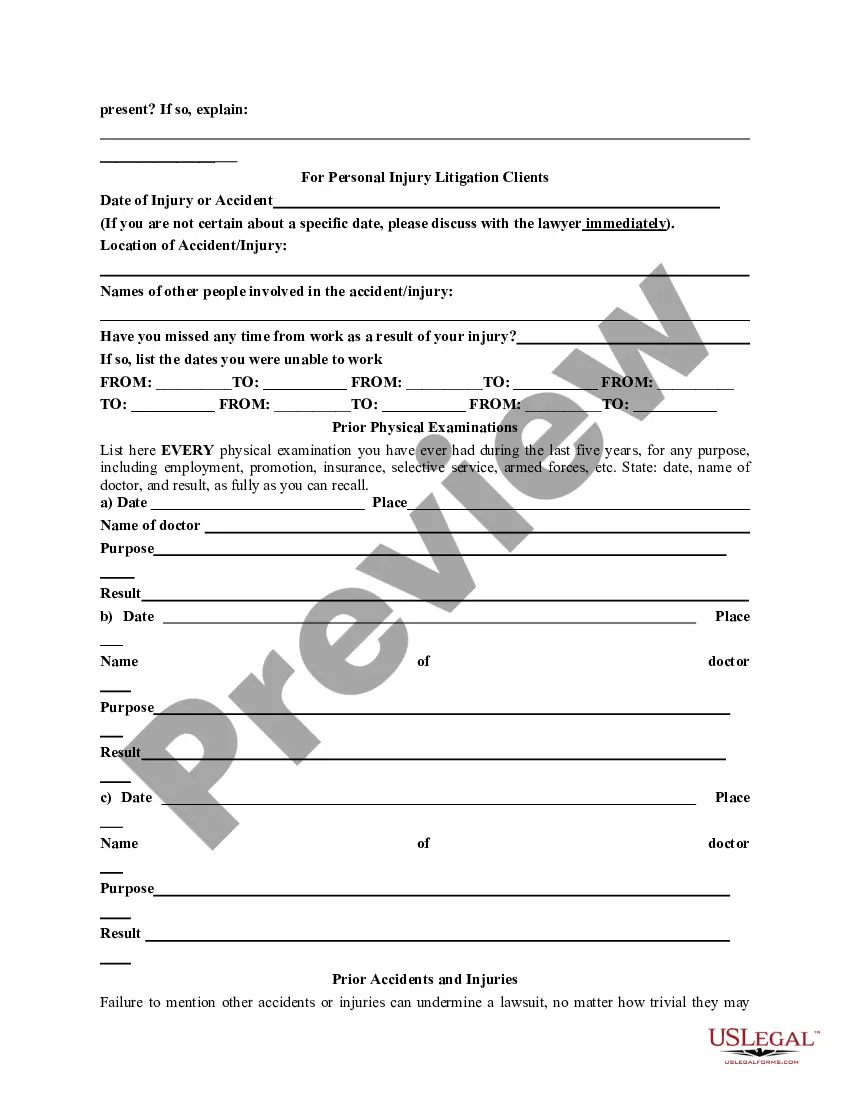

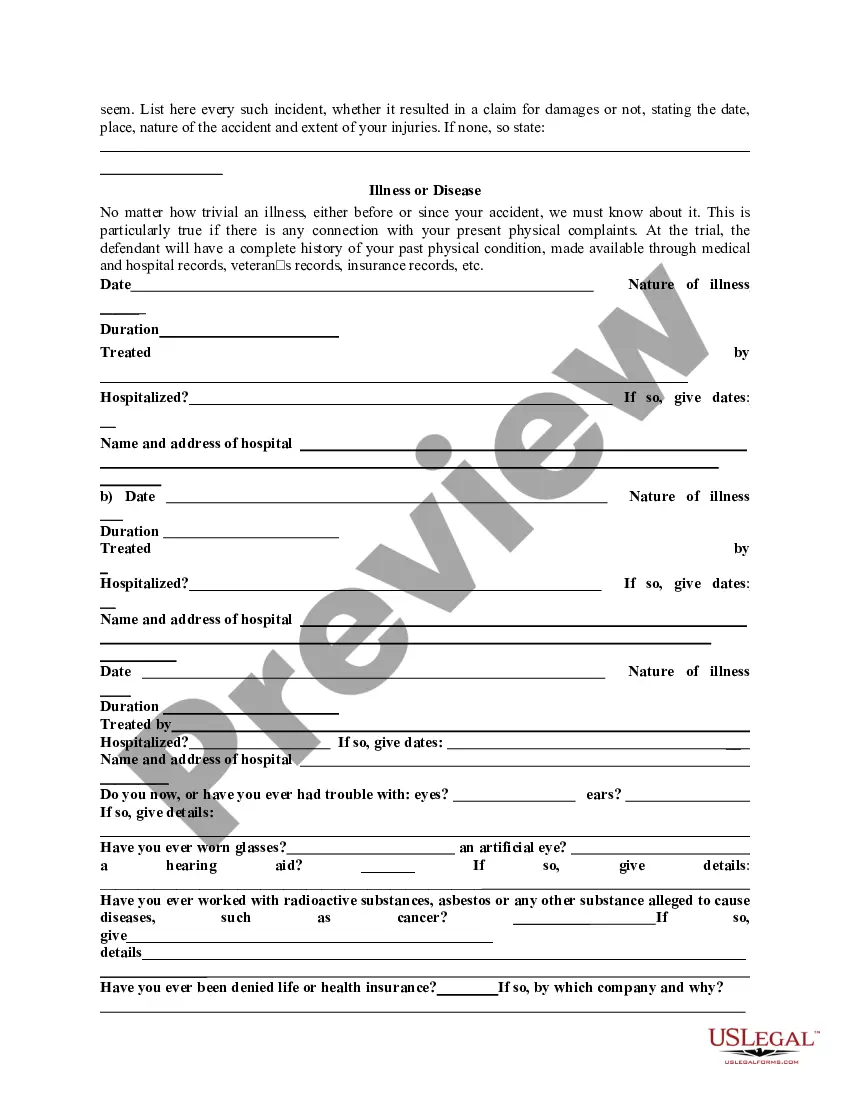

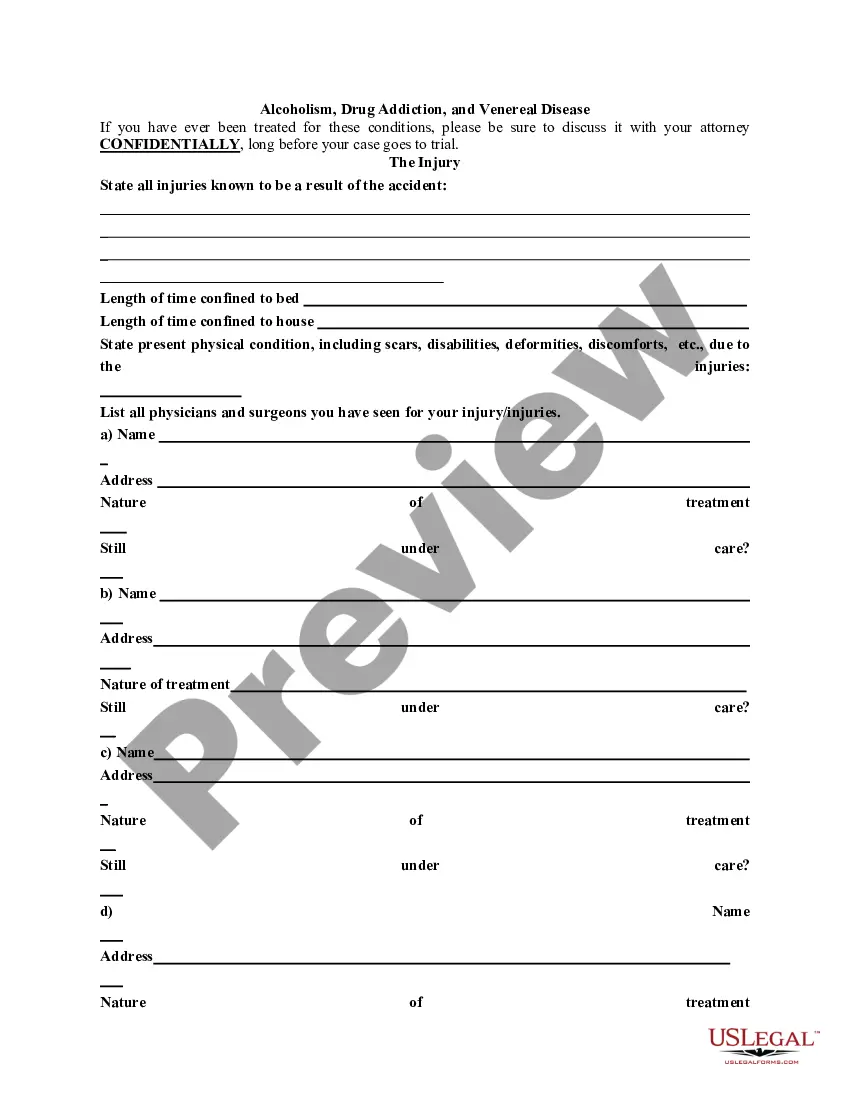

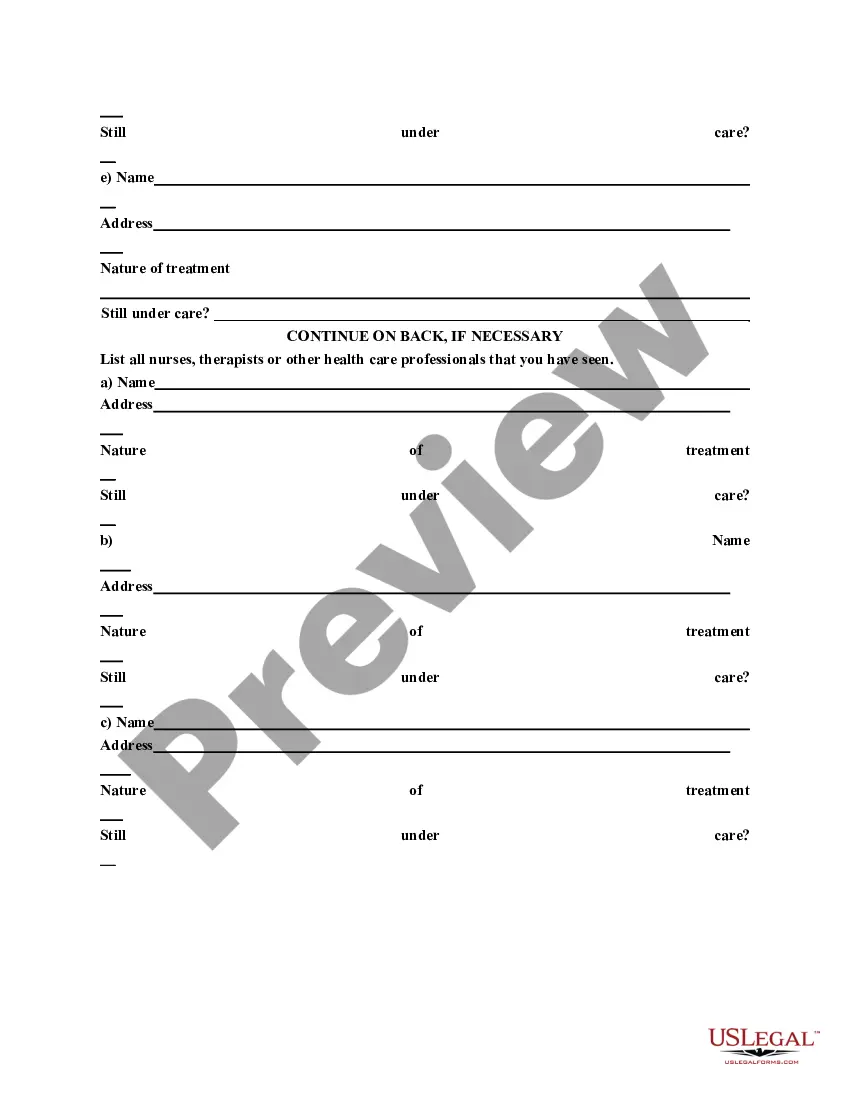

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Hawaii General Information Questionnaire

Description

How to fill out General Information Questionnaire?

If you want to thorough, acquire, or create valid document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the website's simple and convenient search to find the documents you need. Various templates for commercial and personal purposes are categorized by classifications and states, or keywords. Use US Legal Forms to obtain the Hawaii General Information Questionnaire with just a few clicks.

If you are currently a US Legal Forms member, sign in to your account and click the Download button to retrieve the Hawaii General Information Questionnaire. You can also access forms you previously downloaded from the My documents section of your account.

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form's content. Don’t forget to read the description. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template. Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and enter your details to register for an account. Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Hawaii General Information Questionnaire.

Avoid altering or deleting any HTML tags. Only synonymize plain text outside of the HTML tags.

- Every legal document template you purchase is yours permanently.

- You have access to every form you downloaded in your account.

- Click the My documents section and select a form to print or download again.

- Complete and download, and print the Hawaii General Information Questionnaire with US Legal Forms.

- There are numerous professional and state-specific forms available for your business or personal requirements.

- Take advantage of the resources US Legal Forms provides.

Form popularity

FAQ

What is Hawaii's sales tax rate? Hawaii does not have a sales tax; instead, we have the GET, which is assessed on all business activities. The tax rate is 0.15% for Insurance Commission, 0.5% for Wholesaling, Manufacturing, Producing, Wholesale Services, and Use Tax on Imports For Resale, and 4% for all others.

Interest is calculated at 2/3 of 1% per month or part of a month, on unpaid taxes and penalties beginning with the first calendar day after the date prescribed for payment, whether or not the first calendar day falls on a Saturday, Sunday or legal holiday.

While technically Hawaii does not have a sales tax, there is a 4 percent general excise tax (GET). On top of the state tax rate, there may be one or more local taxes, as well as one or more special district taxes, each of which can range between 0 percent and . 5 percent.

The periodic returns (Form G-45) are used to report gross income, exemptions, and taxes due on business activities periodically. They must be filed throughout the year at specified intervals.

Hawaii GE Tax Forms Due Dates. All G45 forms are due on the 20th day of the month following the ending of the tax period. For example, if you had to file for the six months ending on June 30th, your GE Tax Form G-45 would be due on July 20th. Form G-49 is due 4 months after the end of the fiscal year.

The GET is 4% throughout all of Hawaii with a county surcharge of 0.25% on the Big Island, but the state allows a business to charge their customers a maximum of 4.4386% to help recoup some of their total GET. Our general excise tax will be going up as of January 1, 2020.

Form G-49 is a summary of your activity for the entire year. This return must be filed in addition to Periodic General Excise/Use Tax Return (Form G-45). Form G-49 is used by the taxpayer to reconcile their account for the entire year.

Hawaii does not have a sales tax; instead, we have the GET, which is assessed on all business activities. The tax rate is 0.15% for Insurance Commission, 0.5% for Wholesaling, Manufacturing, Producing, Wholesale Services, and Use Tax on Imports For Resale, and 4% for all others.

You need to get a General Excise Tax permit in Hawaii if you meet economic or physical presence nexus requirements. General Excise Tax is different than sales tax in that sales tax is a tax on customers, while General Excise Tax is a tax on businesses.

The GET is a privilege tax imposed on business activity in the State of Hawaii. The tax is imposed on the gross income received by the person en- gaging in the business activity. The GET applies to nearly every form of business activity.