Hawaii Demand Bond

Description

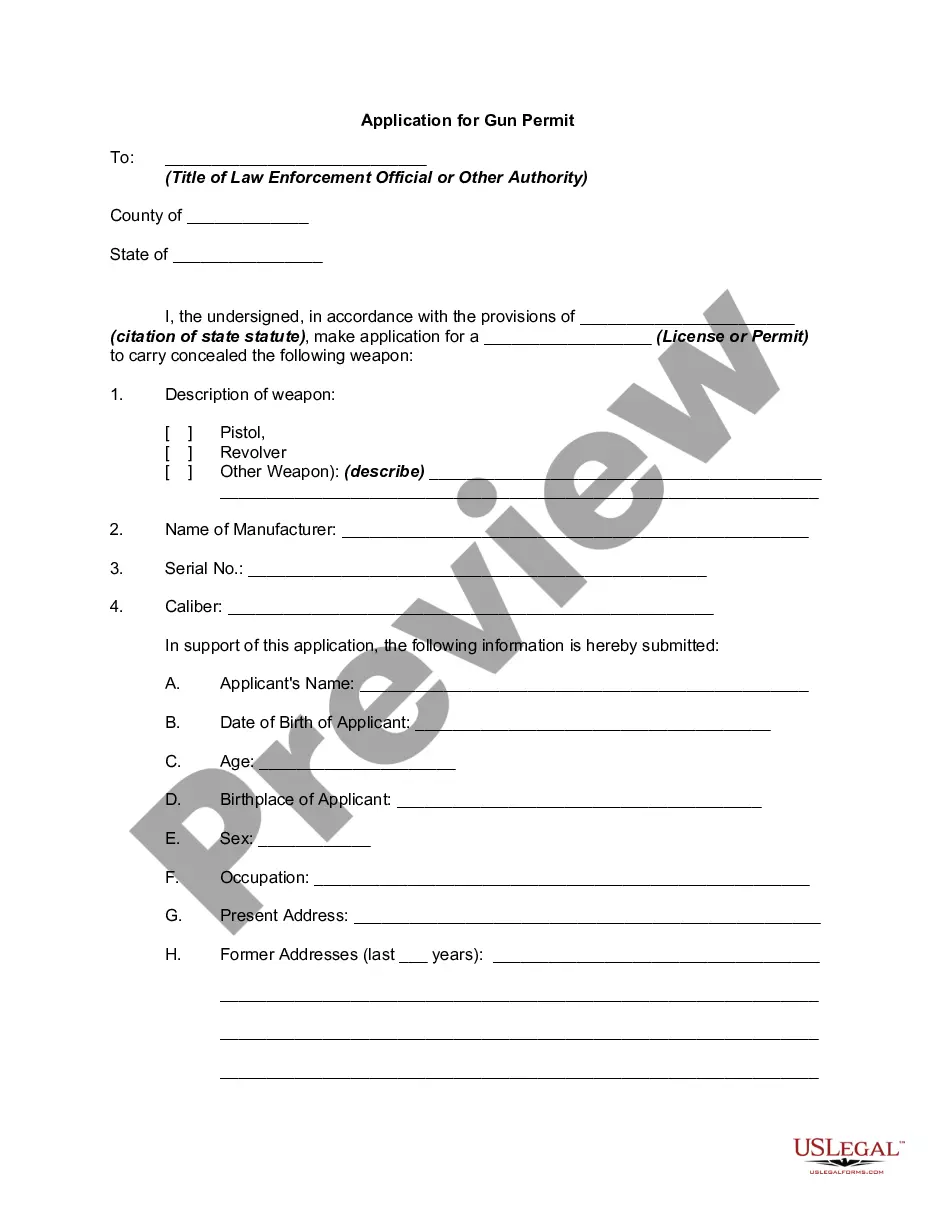

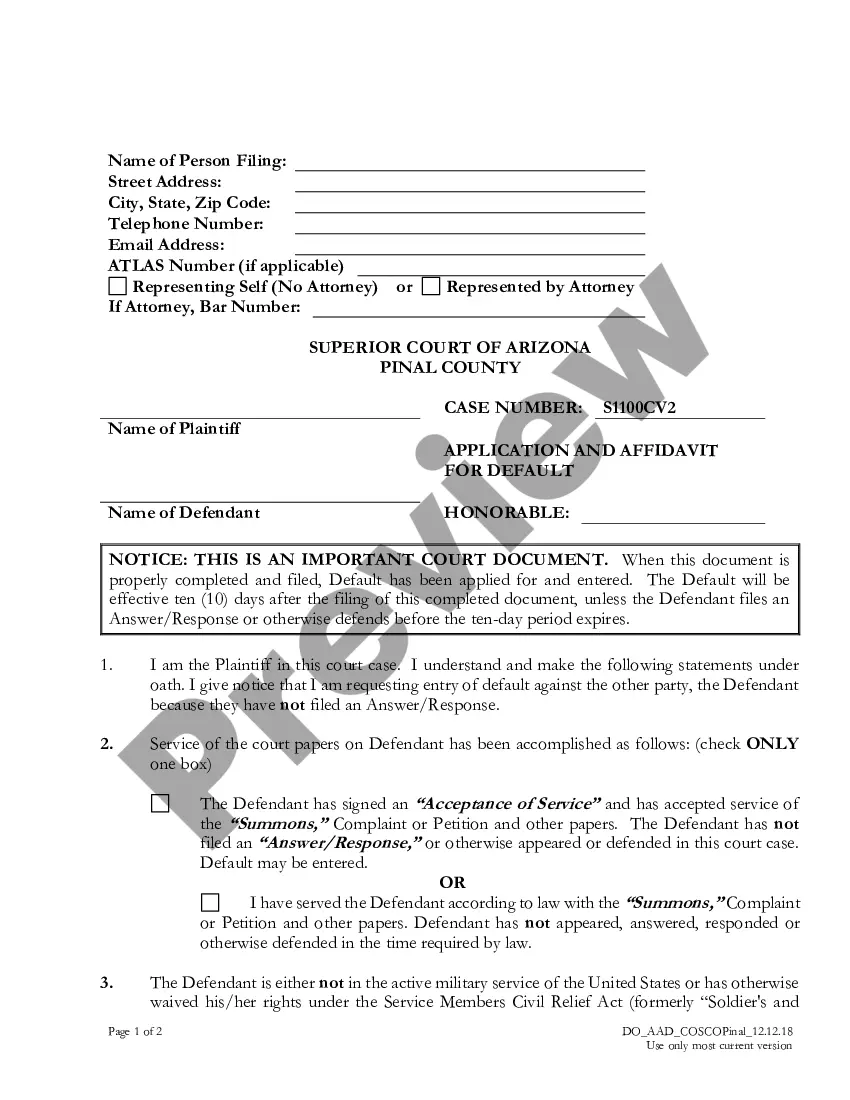

How to fill out Demand Bond?

If you desire to be thorough, acquire, or create official document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the website's straightforward and efficient search to locate the documentation you require.

A range of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to find the Hawaii Demand Bond with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Hawaii Demand Bond.

- You can also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the directions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions in the legal document template.

Form popularity

FAQ

A surety bond requires a third party to guarantee payment if the principal fails to fulfill their obligations. In contrast, an on demand bond, such as a Hawaii Demand Bond, allows the bondholder to claim the bond amount without proving a default. This means that the process is often faster and simpler for the bondholder. Understanding these differences is crucial when selecting the right bond for your needs.

The difficulty of obtaining a surety bond can depend on your individual circumstances, including your creditworthiness and the type of bond you seek, such as a Hawaii Demand Bond. While some may find the process challenging, resources like USLegalForms can make it easier. They offer guidance and templates to help you prepare your application effectively. With the right approach, securing a surety bond is achievable for most applicants.

The credit score required for a surety bond, including a Hawaii Demand Bond, usually falls between 600 and 700. However, each surety company may have different criteria for approval. Good credit can help lower your premium costs, while those with lower scores may still qualify but at a higher rate. Utilizing platforms like USLegalForms can help you understand your options and find the best bond for your needs.

Getting bonded in Hawaii typically involves applying for a Hawaii Demand Bond through a licensed surety company. You will need to provide necessary documentation, such as your financial statements and proof of identity. USLegalForms provides a streamlined platform to guide you through the application process, ensuring you have all the required information at your fingertips. With the right support, securing a bond in Hawaii becomes a straightforward task.

Obtaining a surety bond, such as a Hawaii Demand Bond, can vary in difficulty based on several factors. Your credit history and financial stability play a significant role in the process. However, platforms like USLegalForms simplify the application process, making it easier for you to secure the bond you need. With the right documentation and preparation, you can navigate the requirements smoothly.

Surety bonds work like the way that insurance functions. The insurance, in this case, is provided by the surety company, which is obliged to pay out a sum of money equal to or less than the face value of the bond itself, depending on the amount of any claim advanced by the obligee.

What Do Hawaii Surety Bonds Cost? Surety bonds generally cost 1-15% of the required bond amount. Costs vary significantly depending on the bond amount you need and your rate (which is the percentage of the full bond amount you must pay).

A "de minimis structure position discrepancy" is where a structure extends onto the adjoining property by no more than: For commercial, industrial, and multi-unit residential property - 0.25 feet. For all other residential property - 0.5 feet. For agricultural and rural property - 0.75 feet.

In fact, unlicensed contracting is so against the public policy of our state that it is a crime too. (HRS Section 708-8300).

When a contractor fails to abide by any of the conditions of the contract, the surety and contractor are both held liable. The three main types of construction bonds are bid, performance, and payment.