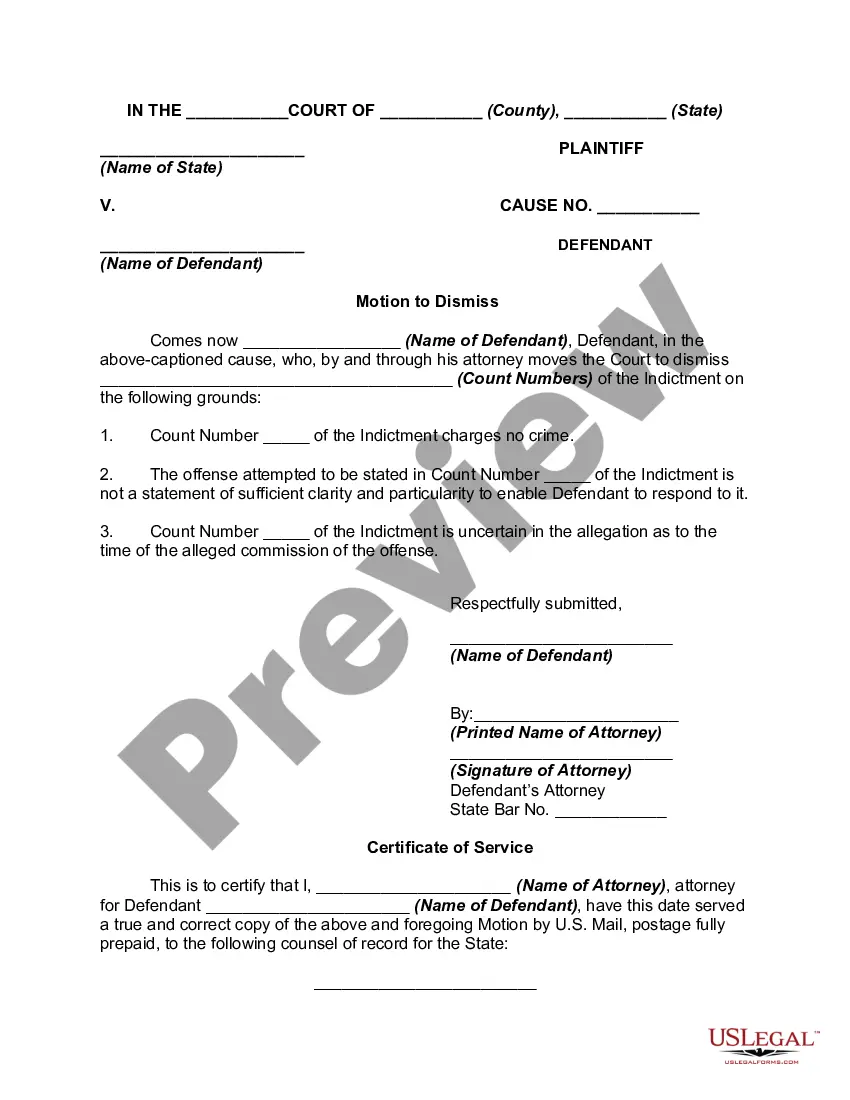

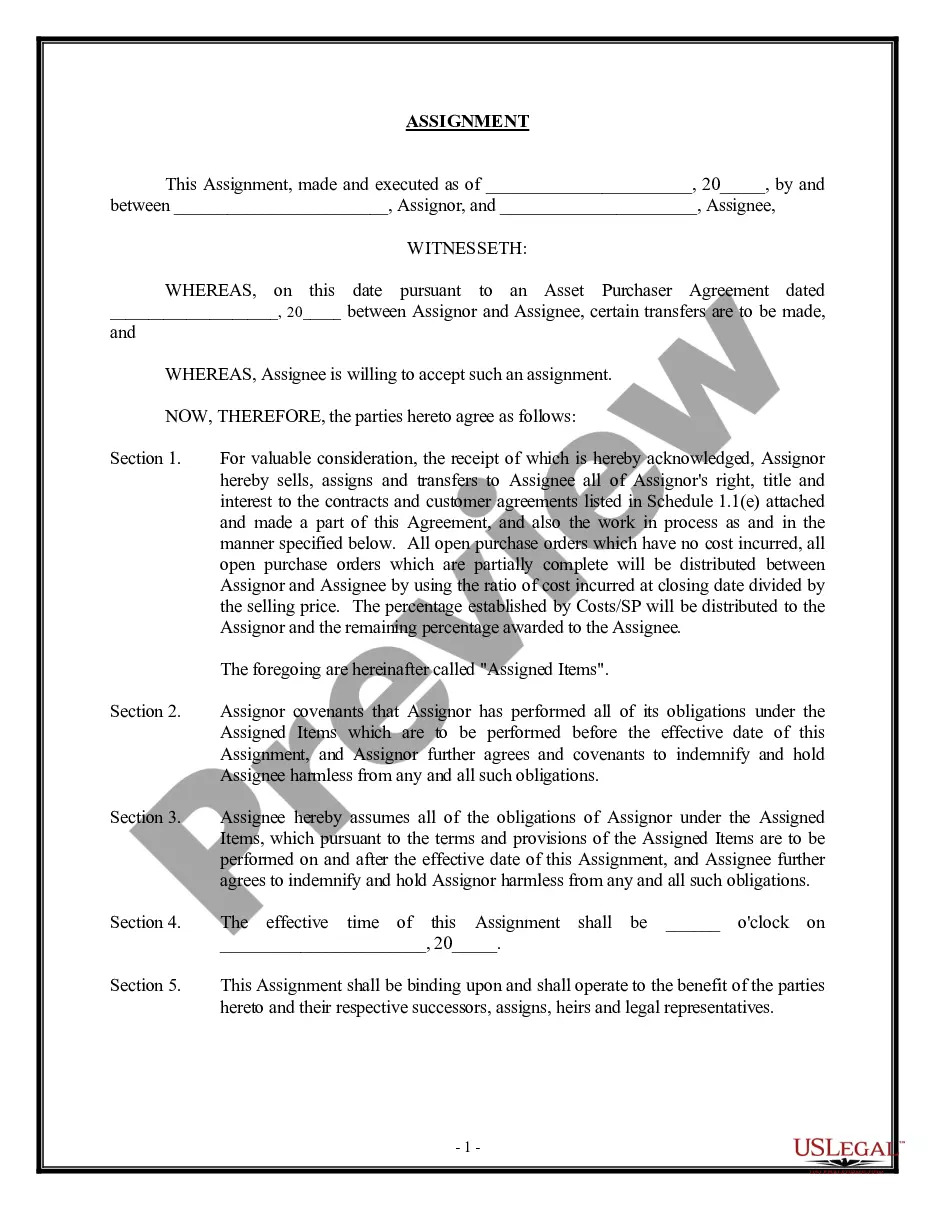

This form is an Authority to Release. The county clerk is authorized and requested to release from a deed of trust a parcel of land to the executor of the estate. The form must be signed in the presence of a notary public.

Hawaii Authority to Release of Deed of Trust

Description

How to fill out Authority To Release Of Deed Of Trust?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides an extensive selection of legal form templates that you can download or print. Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Hawaii Authority to Release of Deed of Trust in just minutes.

If you already have a monthly subscription, Log In and retrieve the Hawaii Authority to Release of Deed of Trust from the US Legal Forms library. The Download option will be available on each form you view. You can access all previously purchased forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are some straightforward instructions to help you get started: Make sure you have selected the correct form for your city/county. Click on the Review option to examine the form's content. Check the form description to ensure you have selected the appropriate document. If the form doesn’t meet your needs, use the Search bar at the top of the screen to find the one that does. Once you are satisfied with the form, confirm your selection by clicking the Acquire now option. Next, choose the pricing plan you prefer and provide your information to create an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Make adjustments. Complete, edit, print, and sign the obtained Hawaii Authority to Release of Deed of Trust. Every template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the Hawaii Authority to Release of Deed of Trust with US Legal Forms, the most comprehensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

Form popularity

FAQ

To transfer ownership of a property in Hawaii, you typically need to execute a deed, such as a quitclaim or warranty deed. This document must be signed, notarized, and recorded with the county clerk's office. Additionally, if a deed of trust is involved, the Hawaii Authority to Release of Deed of Trust may need to be engaged to ensure all liens are properly addressed.

The trustee holds legal ownership of the assets in a trust, while the beneficiaries enjoy the benefits of those assets. In most cases, the grantor, or creator of the trust, appoints the trustee to manage the assets according to the trust's terms. Understanding the Hawaii Authority to Release of Deed of Trust can clarify ownership issues when dealing with real estate held in trust.

Yes. The Hawaii Uniform Real Property Transfer on Death Act allows a single TOD deed to be signed by joint owners. The law sees a property owner who owns property with another owner with right of survivorship as a joint owner.

The deed or assignment of lease must be signed (in black ink) by the current owner and the new owner before a notary public. The deed or assignment of lease must be recorded in the State of Hawaii Bureau of Conveyances or Land Court. A Conveyance Tax Certificate must be filed and any tax due must be paid.

Hawaii is a lien theory state and uses mortgages instead of deeds of trust. The question regarding the trustee on the deed of trust, therefore, is not applicable.

The deed or assignment of lease must be signed (in black ink) by the current owner and the new owner before a notary public. The deed or assignment of lease must be recorded in the State of Hawaii Bureau of Conveyances or Land Court. A Conveyance Tax Certificate must be filed and any tax due must be paid.

A basic trustee's deed conveys title in fee simple to the grantee in exchange for consideration (something of value, usually money). It must meet the same requirements for form and content as other conveyances affecting real property, and it contains additional information about the trust.

A "Revocation of a Beneficiary Deed" is a document that revokes and cancels a beneficiary deed that is filed. This will void any distributions that are made on the beneficiary deed. A property owner may revoke the beneficiary deed anytime before his/her death.

Revoking the deed. You have two options: (1) sign and record a revocation or (2) record another TOD deed, leaving the property to someone else. You cannot use your will to revoke or override a TOD deed.

An individual may transfer property to one or more beneficiaries effective at the transferor's death by a transfer on death deed. § -6 Transfer on death deed revocable. A transfer on death deed is revocable even if the deed or another instrument contains a contrary provision.