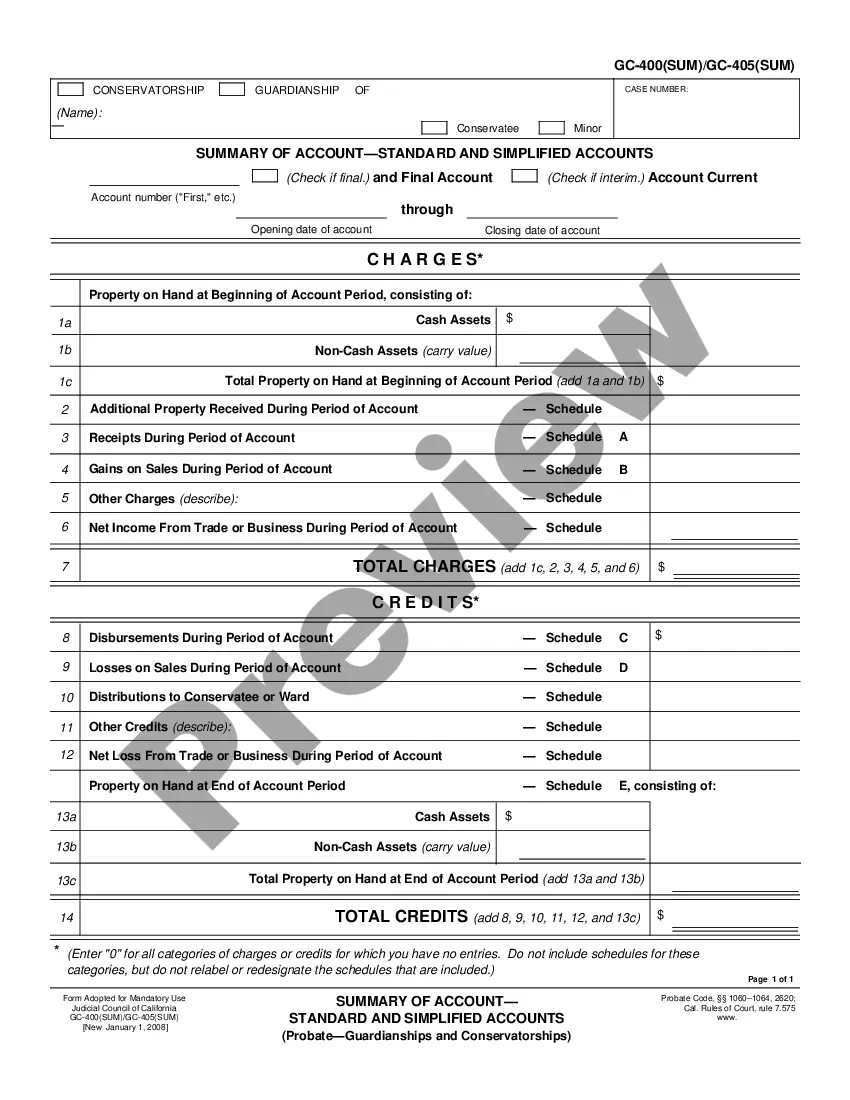

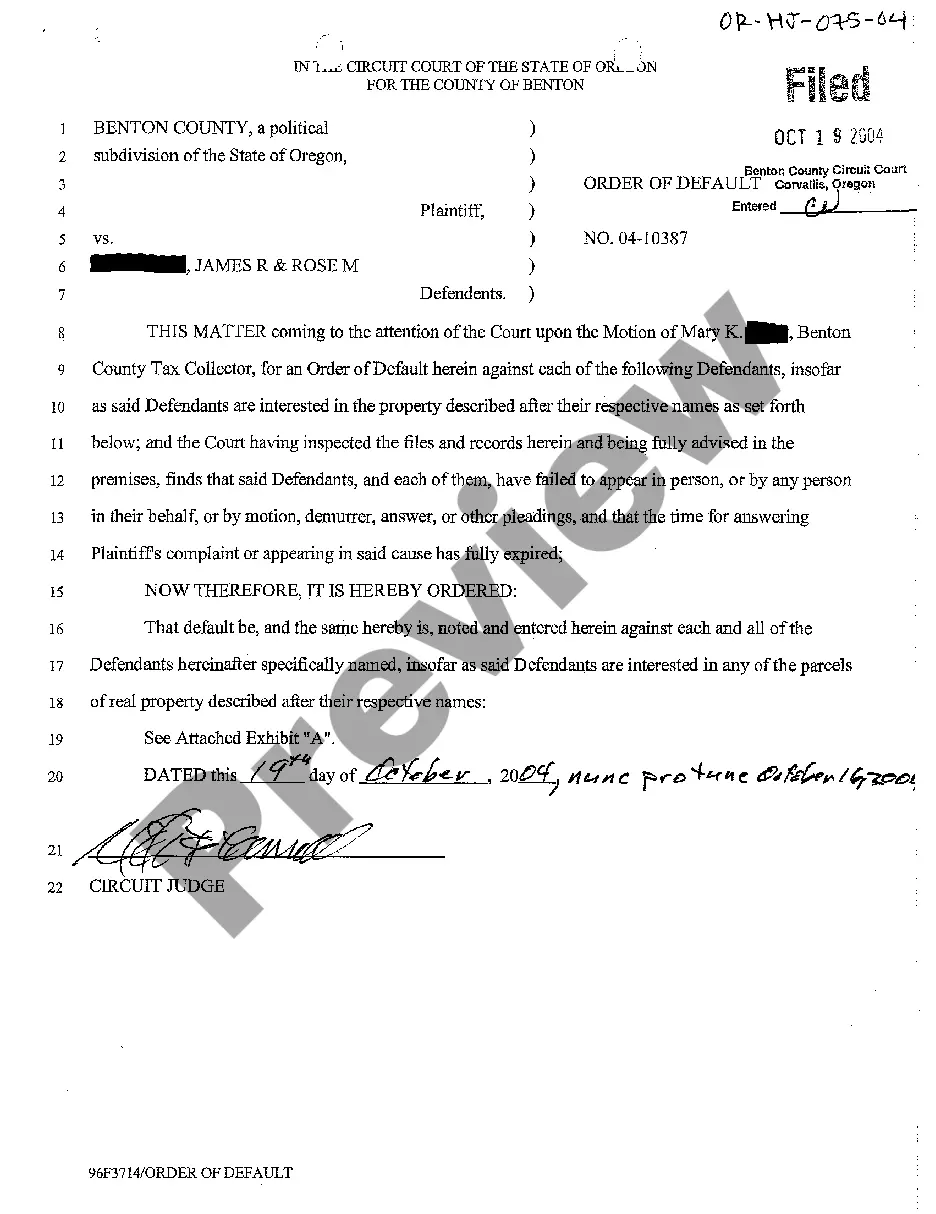

This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Hawaii Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

Selecting the optimal legal document template can be a challenge. Of course, there are numerous templates available online, but how do you find the legal form you need? Utilize the US Legal Forms website. The platform provides thousands of templates, including the Hawaii Application for Release of Right to Redeem Property from IRS After Foreclosure, suitable for both business and personal purposes. All documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Obtain button to access the Hawaii Application for Release of Right to Redeem Property from IRS After Foreclosure. Use your account to browse the legal documents you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, ensure you have selected the correct form for your city/region. You can review the document using the Preview button and examine the form outline to confirm it’s suitable for you. If the form does not meet your requirements, use the Search field to find the correct document. Once you are sure the form is appropriate, click the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Hawaii Application for Release of Right to Redeem Property from IRS After Foreclosure.

- US Legal Forms is the largest collection of legal documents where you can find a variety of file templates.

- Utilize the service to obtain well-crafted paperwork that complies with state regulations.

- Explore thousands of themes available on the platform.

- Access your previously purchased documents easily.

- Follow straightforward steps to secure the legal forms you need.

- Ensure compliance with regulatory standards when using the templates.

Form popularity

FAQ

A foreclosed property owner may redeem their property under certain conditions, primarily when they apply for a Hawaii Application for Release of Right to Redeem Property from IRS After Foreclosure. This process allows the owner to reclaim their property by paying the necessary fees and taxes owed. Additionally, if the foreclosure sale has not yet been finalized, the owner may still have the opportunity to redeem their property by settling outstanding debts. Utilizing the US Legal Forms platform can provide you with the necessary forms and guidance to navigate this process effectively.

The IRS right to redeem foreclosure allows the IRS to reclaim properties sold at a foreclosure auction due to unpaid taxes. This right serves as a means for the IRS to recover tax debts and can complicate the foreclosure process for homeowners. To navigate this challenge, it is essential to understand the Hawaii Application for Release of Right to Redeem Property from IRS After Foreclosure, which can assist in protecting your rights.

Foreclosure redeemed means that a property owner has successfully reclaimed their property after it has been foreclosed. This generally involves paying off the outstanding mortgage and any associated debts. For homeowners in Hawaii, submitting the Hawaii Application for Release of Right to Redeem Property from IRS After Foreclosure is an important step in this redemption process.

To obtain a lien payoff from the IRS, you must contact the IRS directly to request a payoff statement. This statement will outline the total amount owed, including any penalties and interest. The process can be complicated, but using the Hawaii Application for Release of Right to Redeem Property from IRS After Foreclosure can provide guidance and simplify your steps towards resolving the lien.

The IRS 7 year rule refers to the timeframe in which the IRS can collect unpaid taxes before the debt is considered uncollectible. This rule is crucial for homeowners facing foreclosure, as it can influence their financial obligations. Completing the Hawaii Application for Release of Right to Redeem Property from IRS After Foreclosure can help manage these obligations effectively.

Yes, a Hawaii property owner can often redeem their property within one year after a foreclosure, depending on the circumstances. This period provides an essential opportunity for homeowners to regain ownership. Utilizing the Hawaii Application for Release of Right to Redeem Property from IRS After Foreclosure can streamline this process and ensure compliance with state laws.

The IRS right of redemption allows the IRS to reclaim properties sold at foreclosure to recover unpaid taxes. This right usually lasts for a specified period, often up to 120 days. To navigate this process effectively, consider using the Hawaii Application for Release of Right to Redeem Property from IRS After Foreclosure, which can guide you through the necessary steps.

After foreclosure, a federal tax lien can remain attached to the property. This means that even if the property is sold, the IRS may still have a claim against the proceeds. It is crucial to address this issue by filing a Hawaii Application for Release of Right to Redeem Property from IRS After Foreclosure, which can help clear the lien and protect your financial future.

The right to redeem property after a foreclosure allows property owners to reclaim their property by paying off the outstanding debt. In Hawaii, this process can be complex, but understanding the Hawaii Application for Release of Right to Redeem Property from IRS After Foreclosure can simplify it. This right typically exists for a specific period, giving homeowners a chance to regain their property before it is sold.