This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

Hawaii Application for Certificate of Discharge of IRS Lien

Description

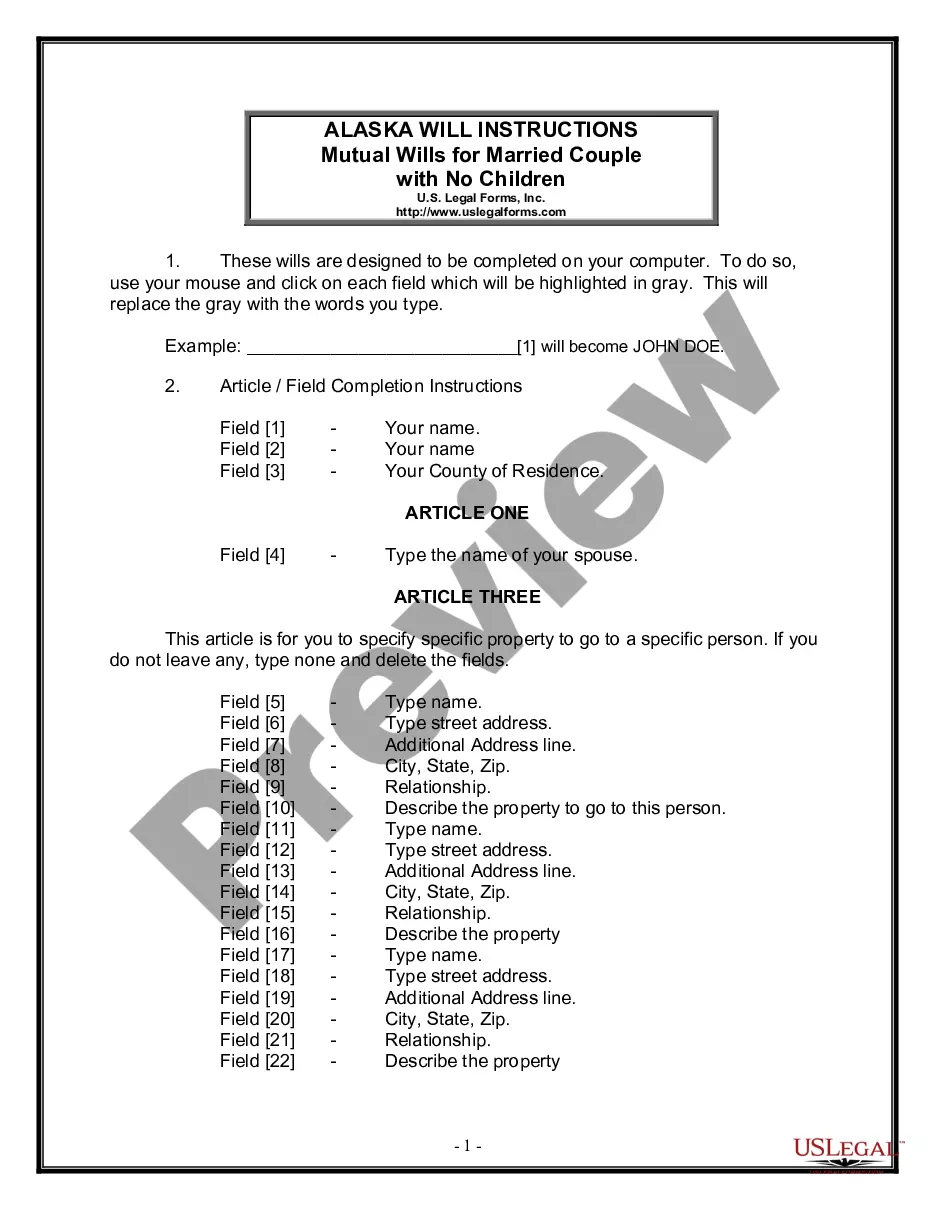

How to fill out Application For Certificate Of Discharge Of IRS Lien?

If you need to aggregate, obtain, or produce authentic document templates, utilize US Legal Forms, the largest assortment of valid forms available online.

Employ the site's straightforward and user-friendly search to find the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to locate the Hawaii Application for Certificate of Discharge of IRS Lien in just a few clicks.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Hawaii Application for Certificate of Discharge of IRS Lien.

Every legal document template you purchase is yours indefinitely. You have access to every form you saved in your account. Select the My documents section and choose a form to print or download again. Stay competitive and obtain, and print the Hawaii Application for Certificate of Discharge of IRS Lien with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the Hawaii Application for Certificate of Discharge of IRS Lien.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and input your details to register for an account.

Form popularity

FAQ

A revocation of certificate of release of federal tax lien occurs when the IRS cancels a previously issued release due to certain circumstances. This can happen if the IRS finds that the release was granted in error or if the taxpayer did not fulfill the required conditions. It is crucial to understand your rights and options in these situations. The Hawaii Application for Certificate of Discharge of IRS Lien can provide further insights and necessary forms to navigate this process.

To obtain a lien release from the IRS, you should file Form 668(Z), Notice of Federal Tax Lien, with the IRS. This form requests a release of the lien once you have satisfied the tax debt or if the statute of limitations has expired. After processing, the IRS will send you a certificate of release, which you should keep for your records. Utilizing USLegalForms can help streamline the process for your Hawaii Application for Certificate of Discharge of IRS Lien.

To apply for a certificate of discharge from a federal tax lien, you need to complete IRS Form 14135. You must provide detailed information about the property, the lien, and the reasons for your application. It is essential to ensure that all required documentation is included to avoid delays. The Hawaii Application for Certificate of Discharge of IRS Lien process can be simplified by using platforms like USLegalForms, which guide you through each step.

A federal tax lien comes into being when the IRS assesses a tax against you and sends you a bill that you neglect or refuse to pay it. The IRS files a public document, the Notice of Federal Tax Lien, to alert creditors that the government has a legal right to your property.

If you have failed to pay your tax debt after receiving a Notice and Demand for Payment from the IRS and are now facing a federal tax lien, you may be wondering when the lien will expire. At a minimum, IRS tax liens last for 10 years.

To request IRS consider discharge, complete Form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien. See Publication 783, Instructions on how to apply for a Certificate of Discharge from Federal Tax Lien, for more information on how to request discharge.

To appeal with a CDP hearing, send a written request to the IRS or file Form 12153 (Request for Collection Due Process or Equivalent Hearing). Explain why you want to appeal the lien. Then, offer an alternative for paying your tax debt.

If the Internal Revenue Service (IRS) has placed a tax lien on your property, once you've satisfied the debt, the IRS should notify you that the lien has been removed. To do so, the IRS should send you a ?Certificate of Release of Federal Tax Lien,? also known as Form 668(Z).

The IRS generally uses Form 668?W(ICS) or 668-W(C)DO to levy an individual's wages, salary (including fees, bonuses, commissions, and similar items) or other income. Form 668-W(ICS) and/or 668-W(C)(DO) also provides notice of levy on a taxpayer's benefit or retirement income.

Once a lien arises, the IRS generally can't release the lien until the tax, penalty, interest, and recording fees are paid in full or until the IRS may no longer legally collect the tax. Paying your tax debt in full is the best way to get rid of a federal tax lien.