Hawaii Reimbursement plans are a type of Preferred Provider Organization (PPO) health plan that offers comprehensive coverage with low out-of-pocket costs. These plans provide a wide range of coverage, including preventive care, hospitalization, emergency services, and specialized care. Hawaii Reimbursement plans usually have a network of providers that offer discounted rates, and in some cases, direct reimbursement for services. The plans also offer coverage for prescription drugs, mental health services, and vision care. Depending on the plan, members may have access to additional benefits such as telemedicine or discounts on fitness club memberships. The most common types of Hawaii Reimbursement plans are HMO's, EPOS, and PPO's.

Hawaii Reimbursement" type plans (A summary of benefits of the prevalent PPO plan.)

Description

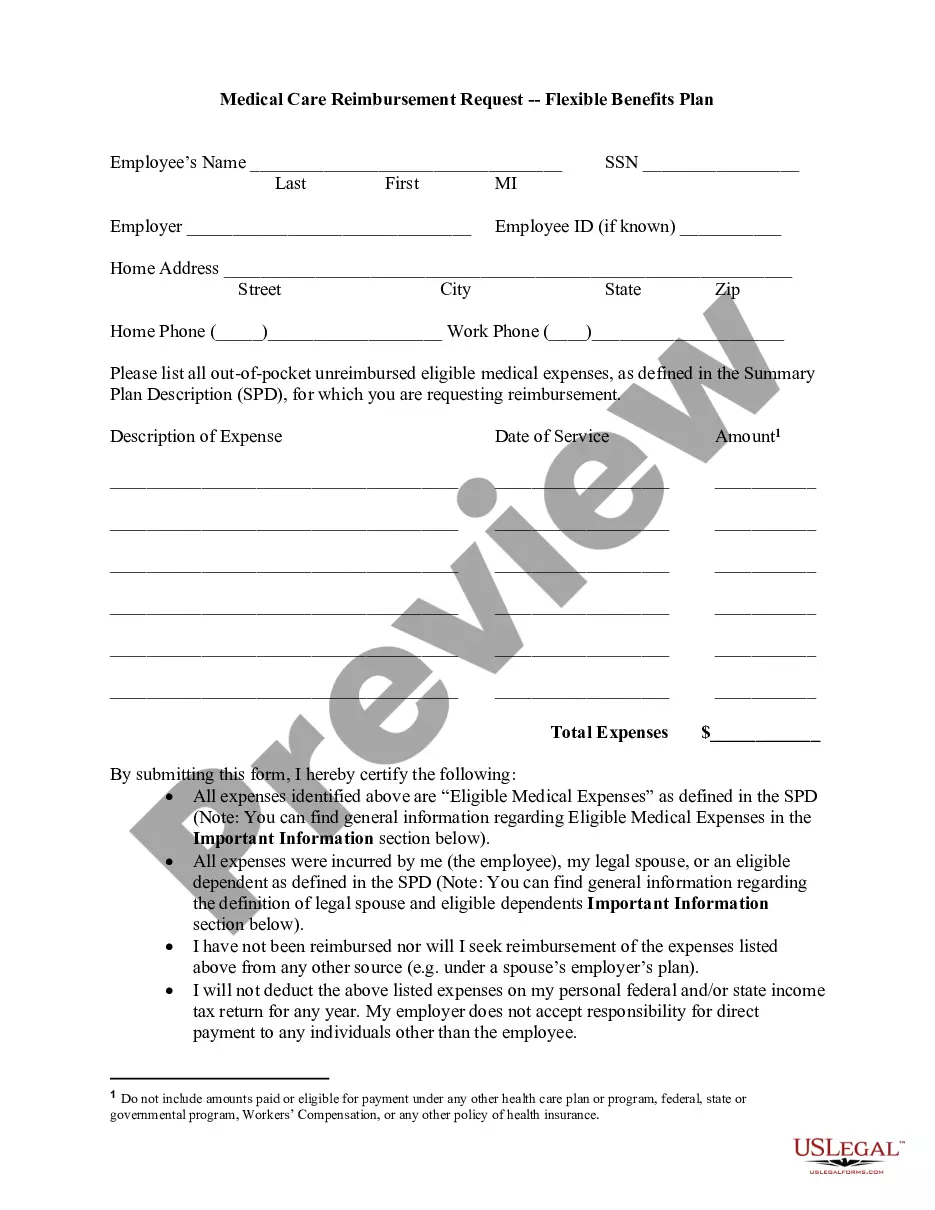

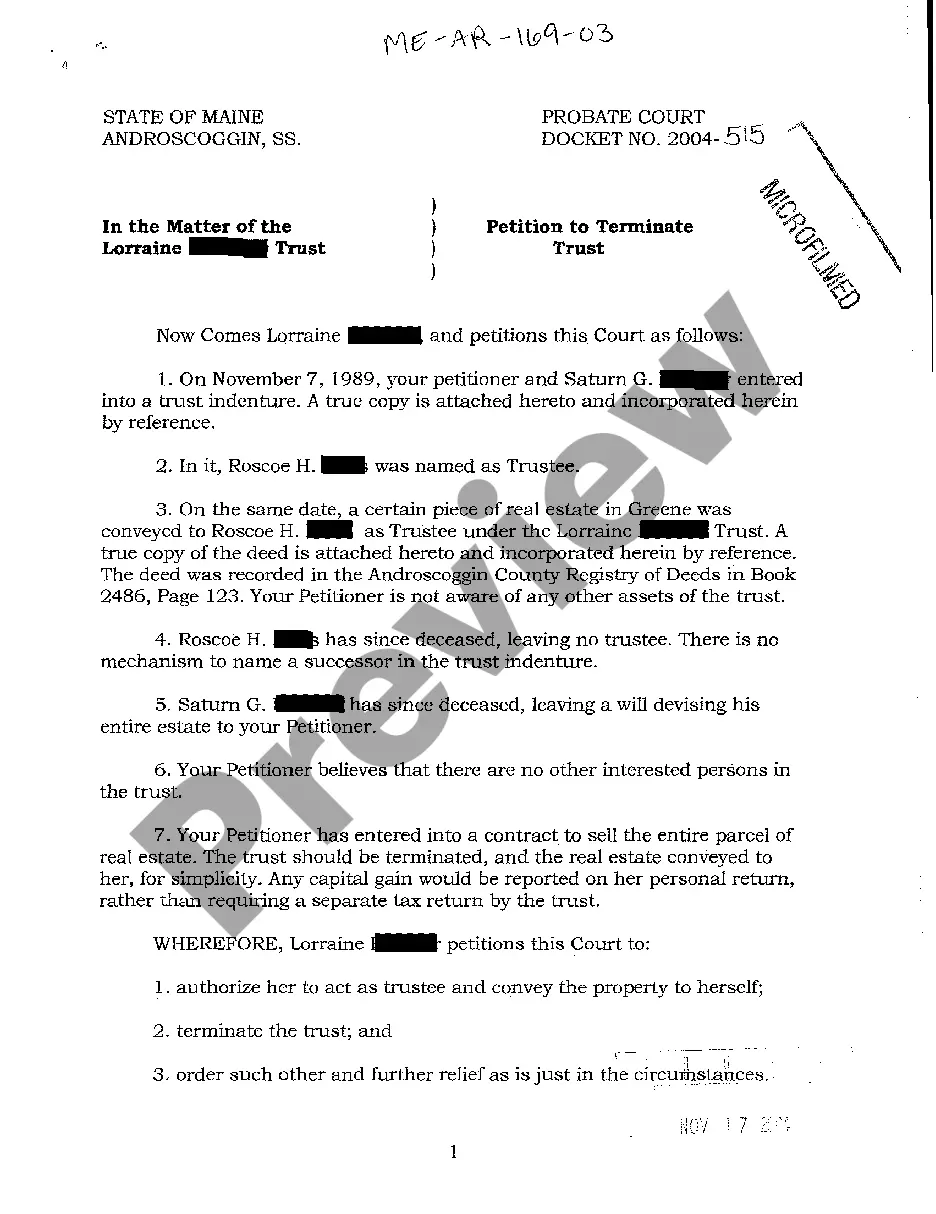

How to fill out Hawaii Reimbursement" Type Plans (A Summary Of Benefits Of The Prevalent PPO Plan.)?

US Legal Forms is the easiest and most cost-effective method to find appropriate legal templates.

It’s the largest online collection of business and personal legal documents prepared and verified by legal experts.

Here, you can access printable and fillable templates that adhere to federal and state regulations - just like your Hawaii Reimbursement" type plans (A summary of benefits of the prevalent PPO plan.).

Review the form description or preview the document to ensure you’ve identified the one that meets your criteria, or search for another one using the search tab above.

Click Buy now when you’re confident of its compliance with all the requirements, and choose the subscription plan that suits you best.

- Obtaining your template requires just a few straightforward steps.

- Users who already possess an account with an active subscription only need to Log In to the service and download the document onto their device.

- Later, they can locate it in their profile under the My documents section.

- And here’s how you can acquire a professionally crafted Hawaii Reimbursement" type plans (A summary of benefits of the prevalent PPO plan.) if you are utilizing US Legal Forms for the first time.

Form popularity

FAQ

Hawaii PPO refers to various Preferred Provider Organization plans available to residents of Hawaii. These plans are designed to provide flexibility and a wide choice of healthcare providers while maintaining affordability. Members benefit from a range of services, from routine check-ups to specialized treatments. By opting for Hawaii Reimbursement type plans, you gain access to a summary of the benefits associated with these prevalent PPO plans, ensuring you understand your options thoroughly.

A PPO, or Preferred Provider Organization, operates by offering access to a network of healthcare providers who agree to provide services at discounted rates. Patients can choose to visit any provider, but those who stick to the network typically enjoy lower costs. Copayments and deductibles apply, and understanding these elements can optimize your healthcare spending. Consequently, Hawaii Reimbursement type plans serve as an excellent guide to navigating the prevalent benefits of PPO options in Hawaii.

PPO stands for Preferred Provider Organization. This type of health insurance plan allows members to see any healthcare provider, although staying within the preferred network can lead to lower out-of-pocket costs. Understanding the benefits of a PPO plan can help you make informed decisions about your healthcare options. The Hawaii Reimbursement type plans exemplify this flexibility by summarizing the benefits of the prevalent PPO plan available to residents.

The HMSA PPO plan is a popular health insurance option in Hawaii that offers flexibility in choosing healthcare providers. With this plan, you can see any doctor or specialist, both in and out of network, without needing a referral. This flexibility is particularly beneficial for those seeking specialized care. Hawaii Reimbursement type plans, like this PPO, provide a summary of benefits that ensure members receive a broad range of healthcare services.

In Hawaii, the duration for which you can receive TDI benefits is up to 26 weeks. This time frame is designed to provide support during recovery from illness or injury. By leveraging Hawaii Reimbursement type plans, you can gain a clearer perspective on how these benefits interconnect with other aspects of financial and health management.

The maximum benefit for Hawaii's TDI program in 2025 is calculated based on the employee's average weekly wage, capped at a maximum of $640 per week. This benefit ensures that those who are temporarily unable to work due to illness receive adequate financial support. With Hawaii Reimbursement type plans, you can easily navigate these benefits and understand how they align with PPO plans.

For 2025, the wage base in Hawaii is $50,400. This base figure is important for calculating various benefits, including unemployment and TDI. Utilizing Hawaii Reimbursement type plans, individuals can derive insights on how these wage standards play a role in their financial planning.

In Hawaii, Temporary Disability Insurance (TDI) offers benefits that can amount to a maximum of $640 per week. This financial assistance is vital for those unable to work due to medical conditions. You can enhance your understanding of TDI benefits through Hawaii Reimbursement type plans, which summarize the advantages provided by prevalent PPO plans.

In 2025, the maximum unemployment benefit in Hawaii is set at $780 per week. This figure is crucial for those navigating temporary financial hardships. By utilizing Hawaii Reimbursement type plans, individuals can better understand how these benefits affect their financial landscape while exploring additional support options.

In Hawaii, the minimum number of hours required to access benefits typically starts at 20 hours per week. This threshold may vary depending on employer-specific plans or industry standards. Therefore, it's wise to consult your employer for these details. Familiarizing yourself with the benefit structures will improve your understanding when considering Hawaii reimbursement type plans and their advantages.