A Hawaii Foreign Limited Liability Company (LLC) Annual Report is a document that must be filed annually with the State of Hawaii Department of Commerce and Consumer Affairs. It is used to provide information about the company’s business activities, assets, liabilities, and financial statements. This report must be filed by all Hawaii LCS that are registered as foreign entities in the state. There are two types of Hawaii Foreign LLC Annual Reports: Standard and Short Form. The Standard Form is a more detailed report that requires information about the company’s income, expenses, and other financial information. The Short Form is a simpler form that does not require as much information, but is still necessary to keep the LLC in good standing with the state.

Hawaii Foreign Limited Liability Company Annual Report

Description

How to fill out Hawaii Foreign Limited Liability Company Annual Report?

If you’re searching for a method to effectively finalize the Hawaii Foreign Limited Liability Company Annual Report without employing a legal advisor, then you’ve come to the correct place.

US Legal Forms has established itself as the most comprehensive and esteemed repository of formal templates for every individual and corporate circumstance.

Another great aspect of US Legal Forms is that you will never lose the documents you obtained - you can access any of your downloaded templates in the My documents tab of your profile whenever you need it.

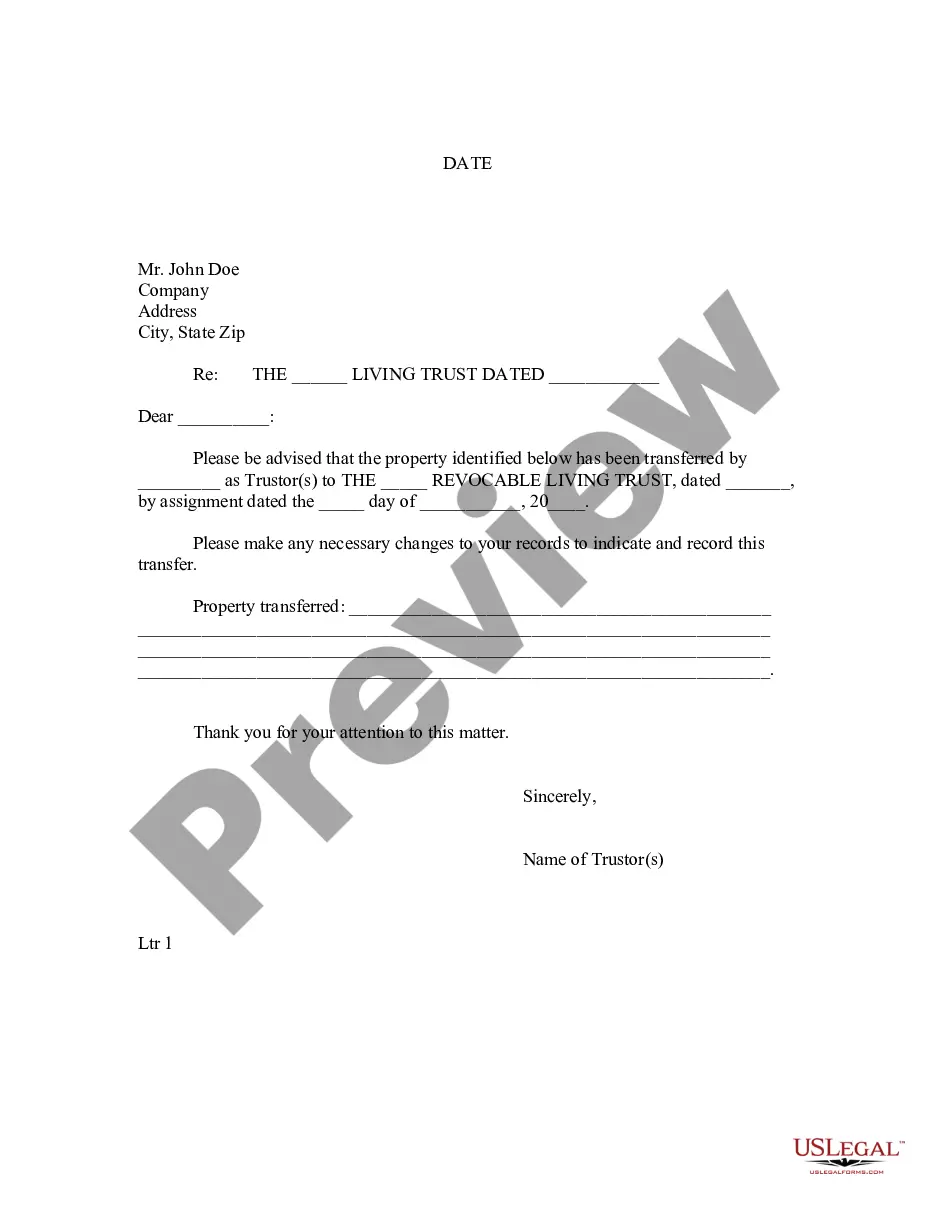

- Verify that the document displayed on the page aligns with your legal circumstances and state regulations by reviewing its text description or browsing through the Preview mode.

- Enter the form name in the Search tab at the top of the page and select your state from the dropdown to locate an alternative template if there are any discrepancies.

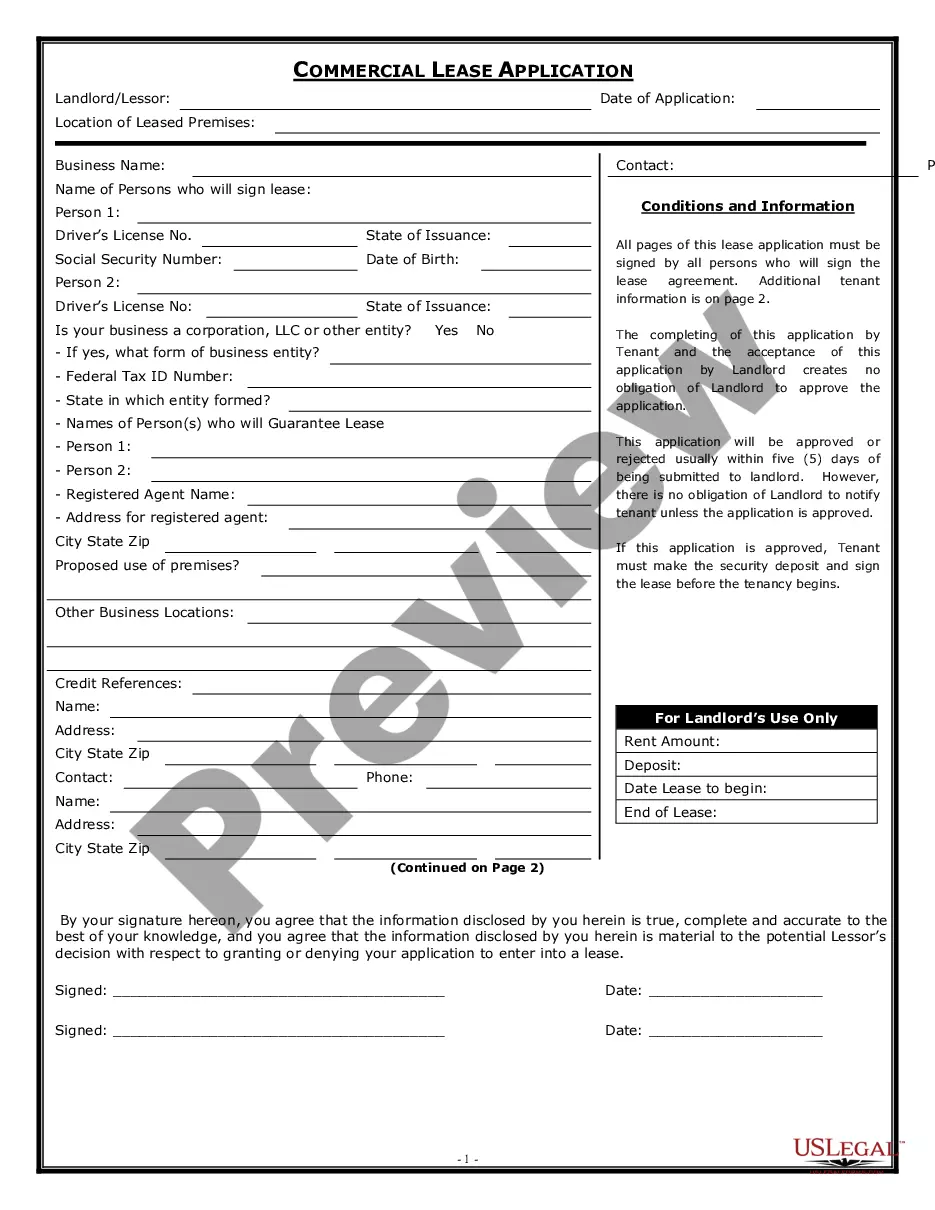

- Repeat the content verification and click Buy now when you are assured of the paperwork meeting all the requirements.

- Log in to your account and click Download. Register for the service and choose a subscription plan if you do not have one yet.

- Utilize your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank form will be available for download immediately afterward.

- Choose the format in which you want to save your Hawaii Foreign Limited Liability Company Annual Report and download it by clicking the corresponding button.

- Import your template into an online editor to complete and sign it promptly, or print it out to prepare your hard copy manually.

Form popularity

FAQ

Absolutely, if you have a foreign LLC operating in Hawaii, you need to file the Hawaii Foreign Limited Liability Company Annual Report. This filing is crucial for maintaining good standing with the state and ensures that your business complies with local regulations. Using platforms like USLegalForms can simplify the filing process, helping you stay organized and compliant effortlessly.

Yes, filing an annual report is mandatory for all LLCs operating in Hawaii, including foreign entities. The Hawaii Foreign Limited Liability Company Annual Report allows the state to maintain accurate records of your LLC's status and activities. Failing to file this report can lead to complications, such as losing your active business status. Ensure you adhere to this requirement to keep your business compliant.

If you do not file the Hawaii Foreign Limited Liability Company Annual Report, your business may face serious consequences. The state could impose penalties or fines for late filings, and ultimately, your LLC could risk being administratively dissolved. This means losing your legal right to operate in Hawaii. To avoid these issues, it’s essential to stay on top of your filings and deadlines.

A foreign limited liability company is an LLC that is formed in one state but operates in another state. For example, if you register an LLC in California and want to conduct business in Hawaii, you must register as a foreign LLC in Hawaii. This allows your business to enjoy legal protection and benefits, while still adhering to the regulations in Hawaii. Don't forget to file your Hawaii Foreign Limited Liability Company Annual Report to maintain good standing.

To register a foreign LLC in Hawaii, you must first complete an Application for Certificate of Authority. This application requires details about your LLC, such as its name, state of registration, and a designated local agent. After submitting the application along with the required fees, your foreign limited liability company will receive a Certificate of Authority, allowing it to operate in Hawaii. Ensure you stay compliant by filing your Hawaii Foreign Limited Liability Company Annual Report each year.

To register a foreign LLC in Hawaii, you must complete the Application for Certificate of Authority and submit it to the appropriate state office. This process typically requires documents such as a certificate of good standing from your home state. After registration, be aware that you will need to file your Hawaii Foreign Limited Liability Company Annual Report each year to ensure your status remains active.

Yes, LLCs registered in Hawaii are required to file an annual report. This report provides updated information about your company, including its current address, management changes, and other essential details. Filing the Hawaii Foreign Limited Liability Company Annual Report is crucial for compliance and to maintain your good standing status within the state. Ensure you check the deadlines to avoid penalties.

The primary difference between an LLC and a foreign LLC lies in where the business was formed. An LLC is registered in the state where it operates, while a foreign LLC is formed in one state but registers to do business in another. Each state has its own regulations, and a foreign LLC must adhere to these when operating outside its home state. In Hawaii, you must file a specific Hawaii Foreign Limited Liability Company Annual Report to maintain compliance.

While Hawaii does not legally require an LLC operating agreement, having one is highly advisable. An operating agreement outlines the management structure, operational procedures, and ownership percentages of an LLC. This can help prevent disputes among members and ensures everyone understands their roles. Moreover, your operating agreement can be beneficial when preparing your Hawaii Foreign Limited Liability Company Annual Report.

A foreign limited liability company (LLC) is a business entity that was formed in one state but operates in another. This means your LLC is 'foreign' in states where it was not originally created. A foreign LLC must register with each state it intends to operate in, including Hawaii. Remember that maintaining your status includes filing a Hawaii Foreign Limited Liability Company Annual Report.