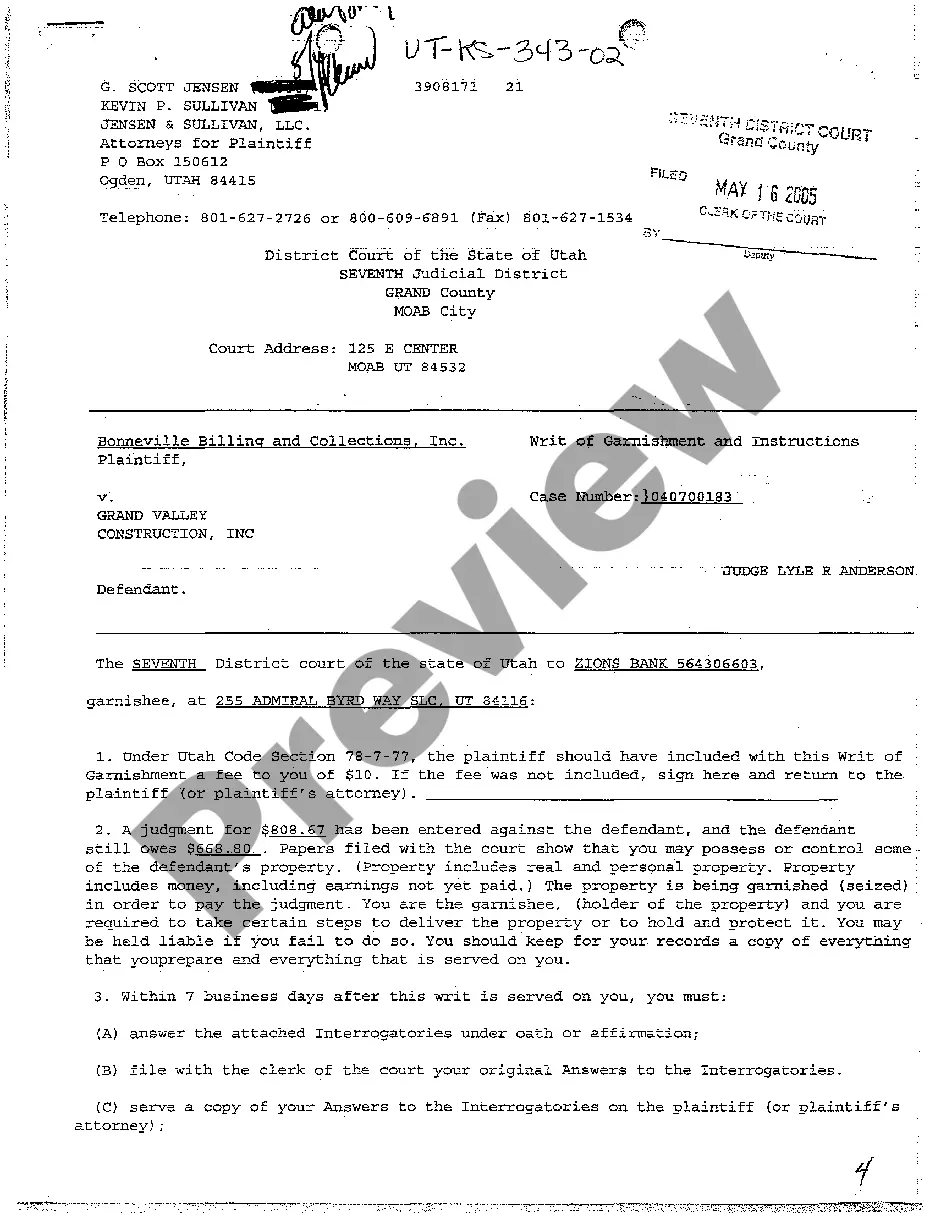

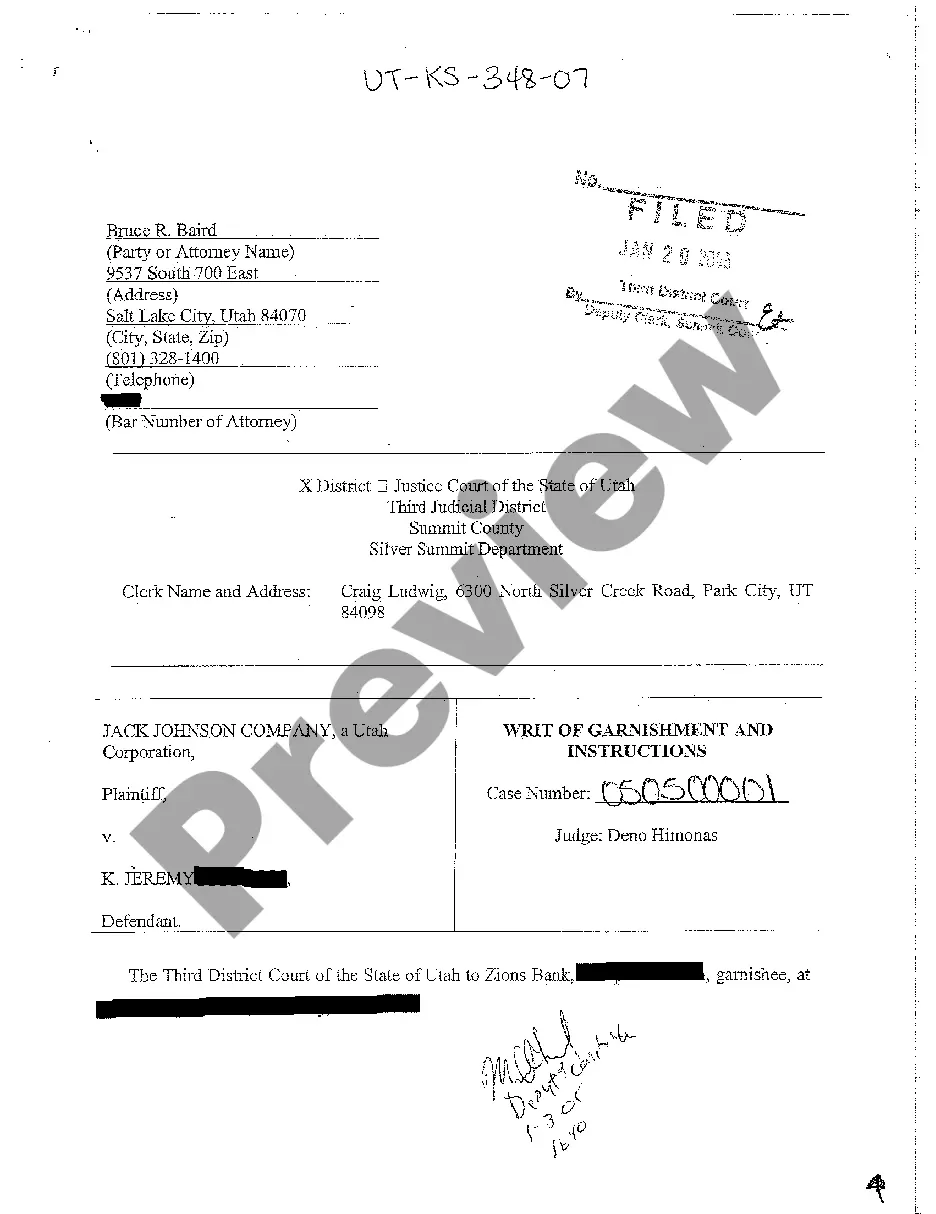

Utah Garnishment Packet — Personal Service is a set of documents used to garnish wages of an employee in the state of Utah. These documents are used to calculate the amount of money to be garnished from the employee's wages, as well as containing instructions on how to serve the garnishment packet to the employer. There are three types of Utah Garnishment Packet — Personal Service: Levy on Wages, Levy on Property, and Levy on Accounts Receivable. The Levy on Wages packet is used to garnish the wages of an employee, the Levy on Property packet is used to garnish the property of an employee, and the Levy on Accounts Receivable packet is used to garnish the accounts receivable of an employee. All packets contain instructions on how to serve the packet to the employer, as well as instructions on how to calculate the amount of money to be garnished.

Utah Garnishment Packet - Personal Service

Description

How to fill out Utah Garnishment Packet - Personal Service?

How much time and resources do you often spend on drafting official documentation? There’s a better way to get such forms than hiring legal specialists or wasting hours browsing the web for an appropriate template. US Legal Forms is the top online library that provides professionally drafted and verified state-specific legal documents for any purpose, like the Utah Garnishment Packet - Personal Service.

To acquire and complete an appropriate Utah Garnishment Packet - Personal Service template, follow these easy steps:

- Examine the form content to ensure it complies with your state requirements. To do so, read the form description or utilize the Preview option.

- If your legal template doesn’t meet your needs, locate a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Utah Garnishment Packet - Personal Service. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Select the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally safe for that.

- Download your Utah Garnishment Packet - Personal Service on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you safely store in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most reliable web services. Join us now!

Form popularity

FAQ

Filing for bankruptcy can be an effective way to stop or prevent a wage garnishment. When your attorney files a Utah bankruptcy case, an automatic stay kicks in. The automatic stay acts like a court order that puts an immediate halt to garnishments and most other creditor collection actions.

A wage or bank account garnishment occurs when a creditor takes a portion of your paycheck or money from your bank account to collect a debt.

It is possible to stop a wage garnishment order by attacking the underlying court order (such as by filing a motion to vacate the judgment), petitioning the court, or seeking an exemption. However, the fastest way to stop wage garnishment in Washington is to file for bankruptcy.

The notice instructs the garnishee to withhold up to 25 percent of your take home wages. In addition, for garnishments on non-tax debt collected by OAA, a minimum wage exemption applies. This means that you must make over a certain amount before the garnishee can withhold and send payments to OAA.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673).

You can avoid a levy by filing returns on time and paying your taxes when due. If you need more time to file, you can request an extension. If you can't pay what you owe, you should pay as much as you can and work with the IRS to resolve the remaining balance.

You will file a document with the court that gave the garnishment order. You'll describe the exemption and also provide any proof of dependents. A hearing will be scheduled where you'll have a chance to prove that your income is exempt. This is commonly known as Challenge to Garnishment.

Pay the filing fee and file these documents with the court: Application for Writ of Garnishment.Writ of Garnishment.Garnishee's Answers.Notice of Garnishment and Exemptions form. Reply and Request for Hearing form - 2 copies. A check payable to the garnishee for their fee.