The Hawaii Application For Certificate of Cancellation (Form N-301) is a document issued by the State of Hawaii that cancels a business’s registration with the state. It is used to officially close a business's operations in the state. The form is used to cancel a domestic or foreign corporation, a domestic or foreign limited liability company, a domestic or foreign limited partnership, a domestic or foreign nonprofit corporation, and a domestic or foreign limited liability partnership. There are two types of Hawaii Application For Certificate of Cancellation: Form N-301 (General) and Form N-302 (Dissolution). Form N-301 is used to cancel a business’s registration regardless of the reason for the cancellation, while Form N-302 is used to cancel a business’s registration due to the dissolution of the business.

Hawaii Application For Certificate of Cancellation

Description

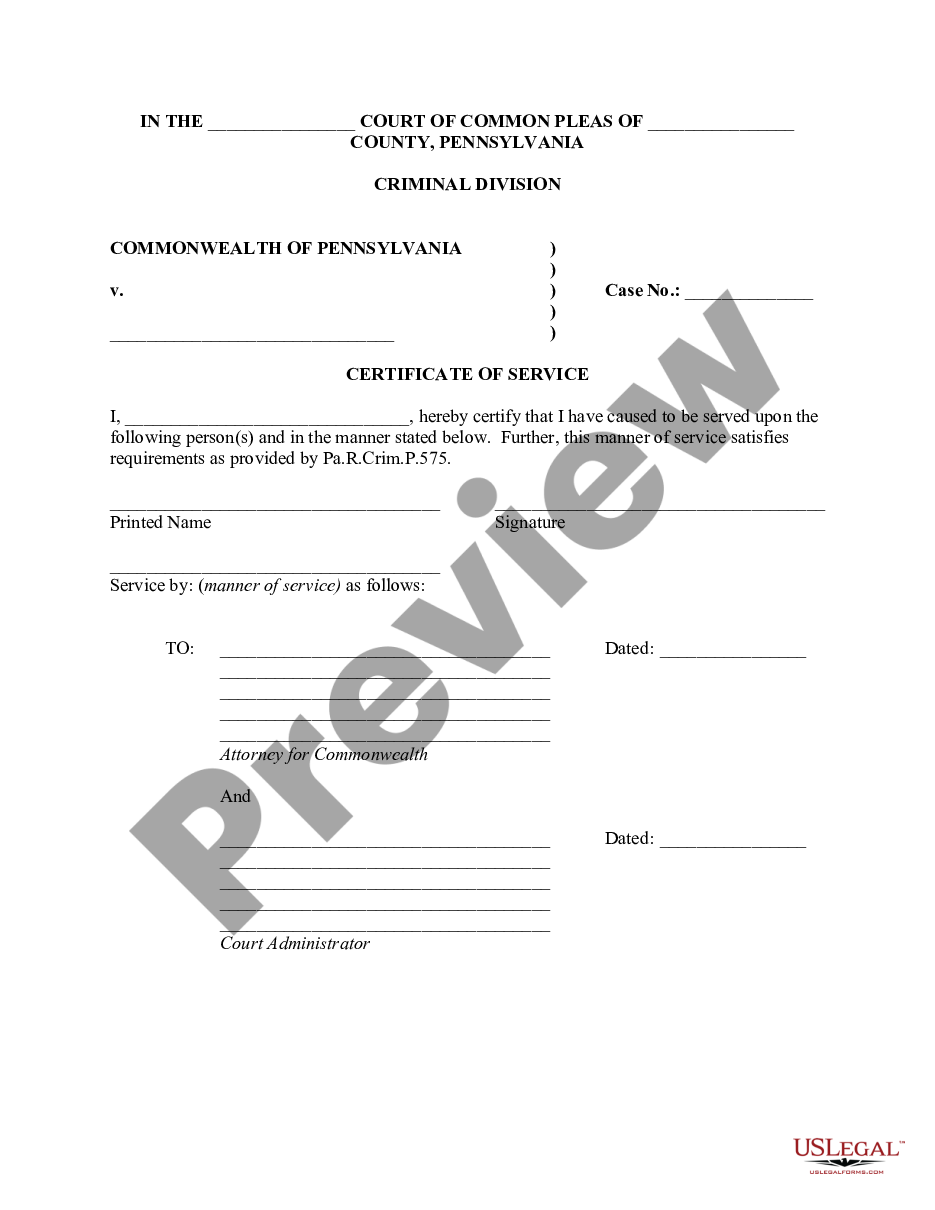

How to fill out Hawaii Application For Certificate Of Cancellation?

US Legal Forms is the easiest and most economical method to locate suitable formal templates.

It boasts the largest online collection of business and personal legal documents created and reviewed by legal experts.

Here, you can discover printable and fillable forms that adhere to national and regional regulations - just like your Hawaii Application For Certificate of Cancellation.

Review the form description or preview the document to ensure you’ve located the one that fulfills your requirements, or find another using the search feature above.

Click Buy now when you’re confident of its suitability with all the criteria, and select the subscription plan that you prefer.

- Acquiring your template takes merely a few straightforward steps.

- Users with an existing account and valid subscription simply need to Log In to the site and download the form to their device.

- Afterward, they can locate it in their profile under the My documents section.

- And here’s how you can obtain a correctly drafted Hawaii Application For Certificate of Cancellation if you are utilizing US Legal Forms for the first time.

Form popularity

FAQ

Dissolving a business in Hawaii includes several critical steps to ensure that you meet all legal requirements. Start by holding a formal meeting to discuss and agree on the dissolution. Once you have made this decision, file the Application for Certificate of Cancellation with the state. This document is pivotal in finalizing the dissolution process and can be easily managed through platforms like uslegalforms.

To dissolve a nonprofit with the IRS, you must follow specific procedures to notify them of your dissolution. This involves filing the final tax return and completing IRS Form 990 for the last operational year. Additionally, ensure that you settle any outstanding debts before filing. Finally, after clearing all state obligations, use the Hawaii Application For Certificate of Cancellation to finalize your nonprofit's dissolution in Hawaii.

Shutting down a nonprofit organization requires a clear process to ensure legal compliance. Begin with a formal vote among your board members to agree on the dissolution. After that, complete the necessary state forms, including the Certificate of Dissolution. Following these steps, it is essential to file the Hawaii Application For Certificate of Cancellation, which formally completes the process.

Dissolving a nonprofit organization in Hawaii involves several essential steps. First, ensure that all directors and members agree to the dissolution. Next, you’ll need to submit a Certificate of Dissolution to the state. Afterward, if applicable, complete the Hawaii Application For Certificate of Cancellation to officially close out your nonprofit so that all legal ties are severed.

To register a foreign LLC in Hawaii, you must file an Application for Certificate of Authority with the state. This involves submitting the required paperwork and paying the necessary fees. Make sure to include all pertinent information about your foreign LLC for the application to be processed. If you decide to withdraw your registration later, you will need to submit the Hawaii Application For Certificate of Cancellation.

Yes, you need a business license to operate legally in Hawaii. This applies to different types of businesses including LLCs and corporations. Obtaining a business license ensures compliance with local regulations and allows you to operate smoothly. If you are considering closing your business, you may also need to complete the Hawaii Application For Certificate of Cancellation.

Deactivating your business in Hawaii involves filing a Hawaii Application For Certificate of Cancellation to formally terminate its operations. You must address any pending liabilities and notify stakeholders before taking this step. By completing this process, you can protect yourself from unexpected future obligations. Consider using our platform for guidance and assistance throughout this procedure.

To cancel your business in Hawaii, you should file a Hawaii Application For Certificate of Cancellation with the state. This application serves as a formal notice of your intent to close the business. Be sure to fulfill any outstanding obligations, such as settling debts and filing final tax returns, to avoid penalties. Once your application is approved, your business will officially cease to exist.

Dissolving an LLC typically refers to the process of officially ending its existence, while terminating may involve stopping operations without formal legal dissolution. For a thorough termination, you need to file a Hawaii Application For Certificate of Cancellation to comply with state laws. This distinction is essential for ensuring that all legal obligations are concluded properly. Understanding this difference helps you choose the right course of action.

Dissolving an S Corp in Hawaii requires filing a Hawaii Application For Certificate of Dissolution with the appropriate state authority. Before submitting, ensure all corporate debts are settled and tax returns are filed. This step prevents any legal complications in the future. Once you dissolve your S Corp, you will no longer have legal obligations as a company.