Hawaii Garnishee Order

Description

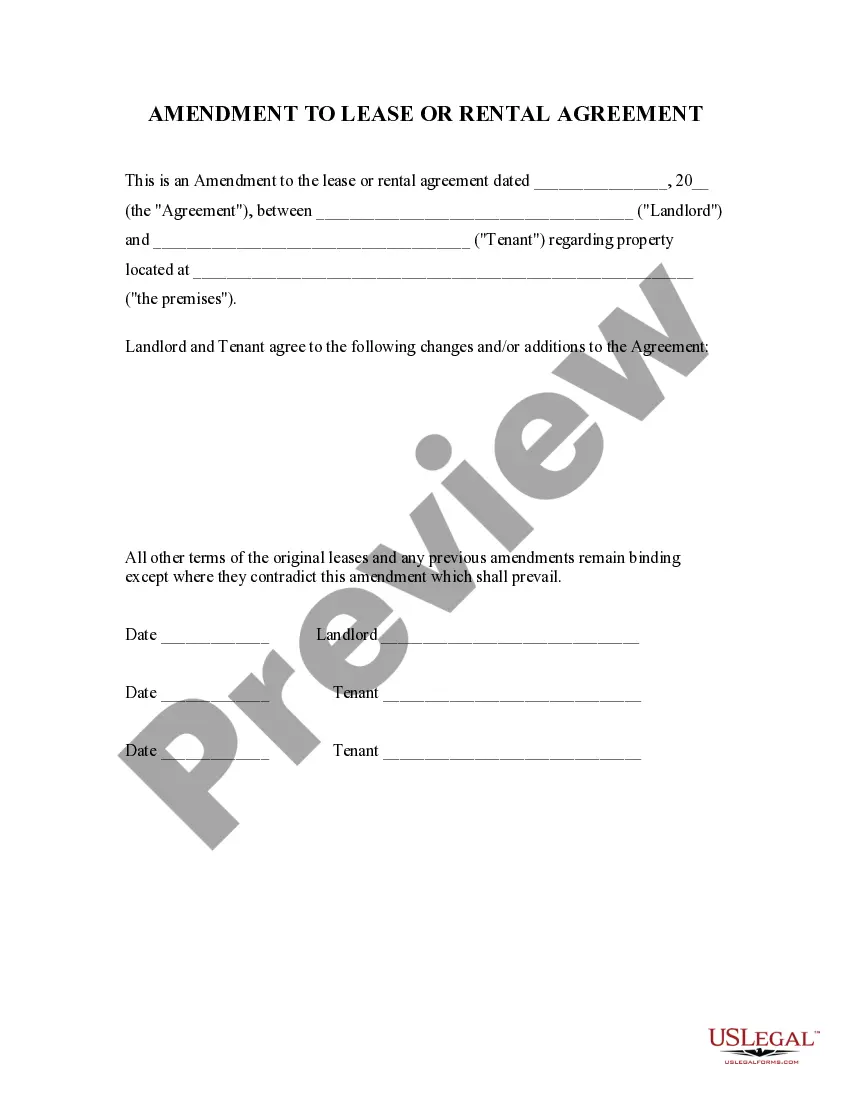

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Garnishee Order?

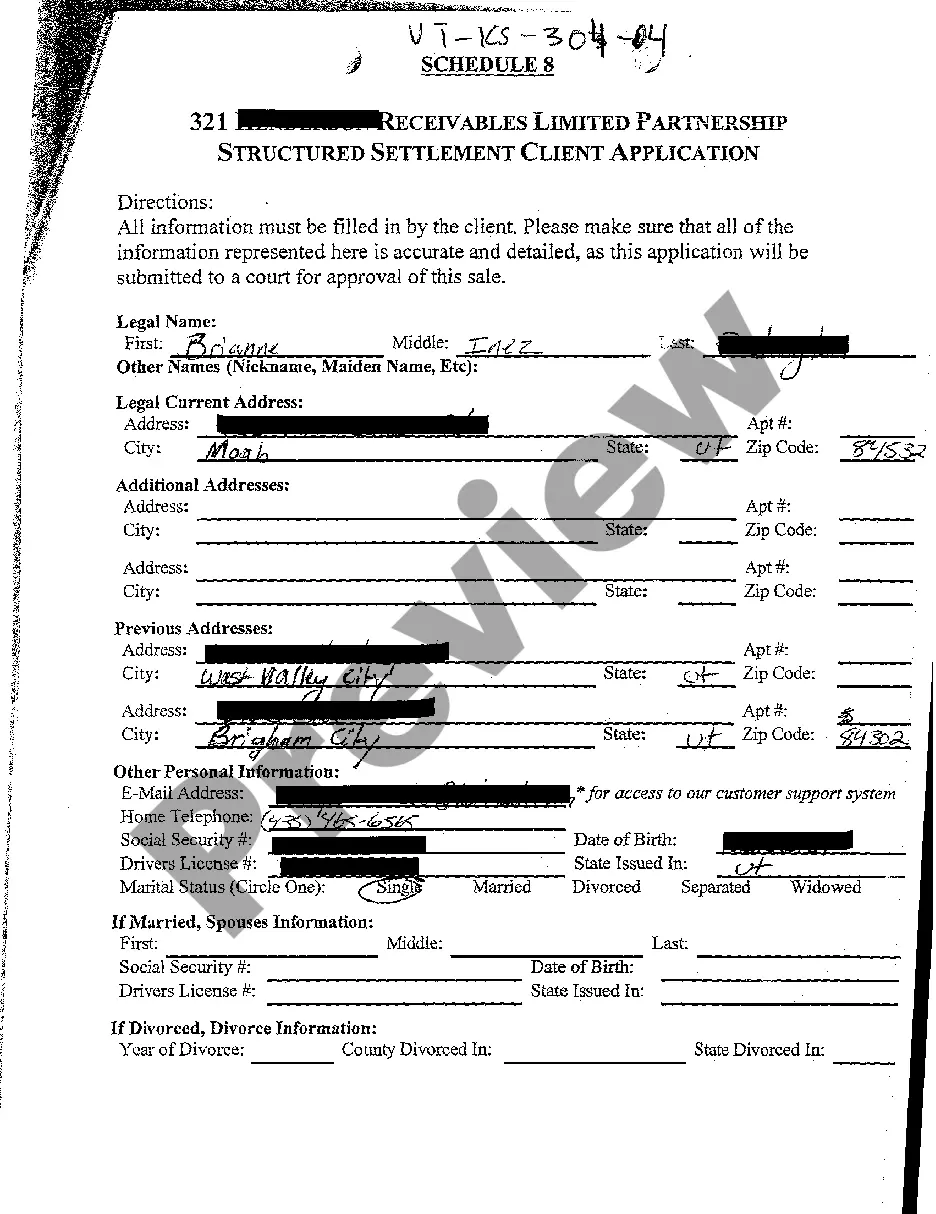

If you’re seeking a method to properly finalize the Hawaii Garnishee Order without employing an attorney, you’ve come to the correct place.

US Legal Forms has established itself as the most comprehensive and trusted repository of official templates for all personal and commercial situations.

Another excellent feature of US Legal Forms is that your purchased documents are never lost - you can access any of your downloaded forms in the My documents section of your profile whenever you require them.

- Ensure the document displayed on the page aligns with your legal circumstances and state regulations by reviewing its text description or exploring the Preview mode.

- Enter the form name in the Search tab at the top of the page and select your state from the dropdown menu to locate an alternative template if needed.

- Repeat the content verification process and click Buy now when you are sure the paperwork meets all the specifications.

- Log in to your account and click Download. Create an account with the service and choose a subscription plan if you do not already have one.

- Utilize your credit card or PayPal option to purchase your US Legal Forms subscription. The document will be available for download immediately after.

- Select the format in which you prefer to save your Hawaii Garnishee Order and download it by clicking the appropriate button.

- Incorporate your template into an online editor to complete and sign it swiftly or print it out to prepare your physical copy manually.

Form popularity

FAQ

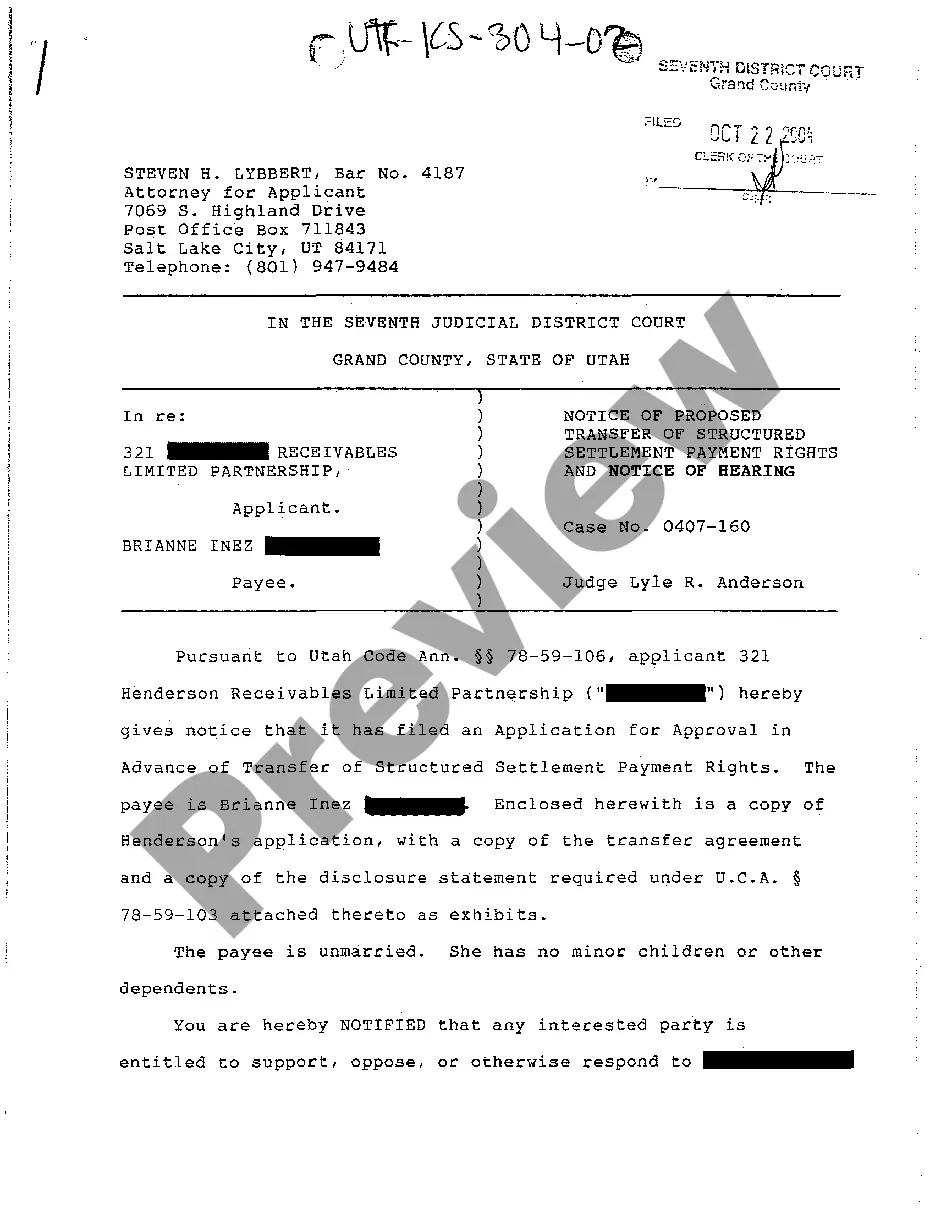

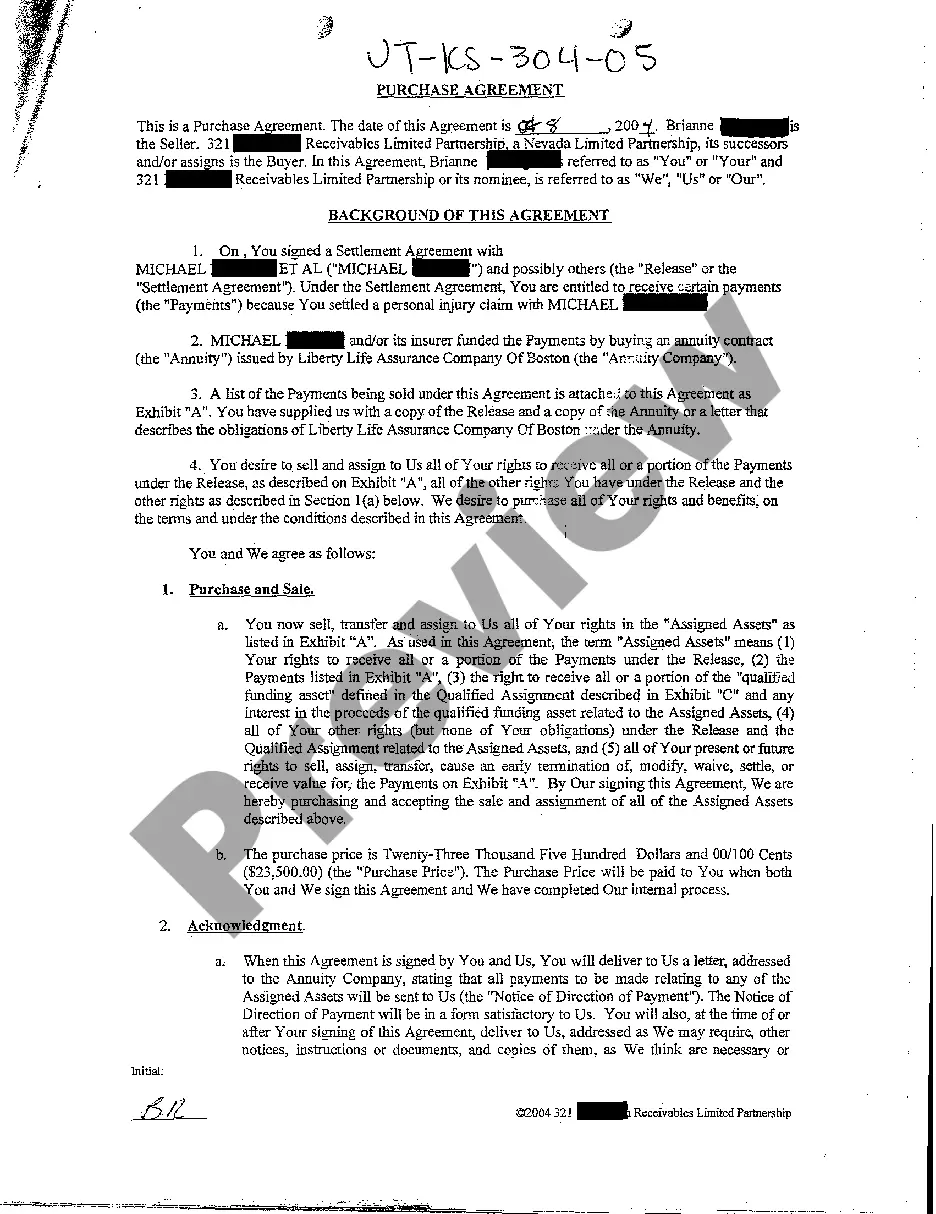

Garnishing someone's wages in Hawaii can be a straightforward process if you follow the law correctly. First, you need a valid Hawaii garnishee order from the court. Then, you must notify the employer and provide them with the necessary documentation. While the process may seem challenging, U.S. Legal Forms can provide templates and tools to simplify your experience, guiding you at every step.

In Hawaii, the time limit to file a lawsuit usually depends on the nature of the claim. Generally, you have two years from the date of the incident to initiate most civil actions. However, certain claims may have different timelines, so it’s crucial to understand your specific situation. Utilizing U.S. Legal Forms can help ensure you adhere to these time limits and streamline your legal journey.

In Hawaii, a creditor who has obtained a judgment can file a writ of garnishment. This legal action allows them to collect debts by seizing a debtor's assets, such as wages or bank accounts. To initiate a Hawaii garnishee order, the creditor must follow specific court procedures and demonstrate entitlement to the funds. If you need guidance through this process, consider using U.S. Legal Forms for the necessary resources and legal documents.

Hawaii garnishment laws are designed to protect both creditors and debtors. Generally, the laws dictate the maximum amount that can be garnished from your wages and outline the process creditors must follow to collect debts. Understanding these laws can empower you in making informed decisions, whether you are facing a garnishment order or looking to set one aside. For detailed information, consider resources like US Legal Forms, which offer insights into specific state regulations.

Winning a garnishment case requires a clear understanding of your situation and the laws surrounding the Hawaii garnishee order. You may need to gather evidence that supports your defense, such as proving financial hardship or contesting the validity of the order. Consulting with a legal professional can also equip you with strategies tailored to your specific case and improve your chances of success.

Filling out a challenge to garnishment form involves several important steps. Start by gathering all necessary information regarding your case, including the details of the Hawaii garnishee order. Complete the form carefully, ensuring that you address the grounds for your challenge clearly and accurately. If you feel uncertain, using a platform like US Legal Forms can provide helpful templates and guidance for this process.

In Hawaii, garnishment laws dictate how creditors can collect debts through garnishee orders. These laws detail the process, including limits on the amount that can be garnished. Familiarizing yourself with the Hawaii Garnishee Order process is vital for understanding your rights and obligations as a debtor.

A garnishment can be deemed invalid for several reasons, including failure to follow legal procedures or if the debt is not owed. Other issues can include inaccurate information provided during the legal process. It’s wise to consult legal assistance if you believe a Hawaii Garnishee Order has been incorrectly issued.

While you cannot completely avoid a garnishment once it's initiated, there are potential strategies to manage it. You can negotiate with your creditor or seek legal counsel to challenge the validity of the garnishment. Learning about a Hawaii Garnishee Order may reveal options that could lessen its impact on your finances.

Ignoring a garnishee order is not advisable, as it can lead to serious legal consequences. Creditors can escalate their actions, resulting in further deductions from your wages or bank account. Instead of ignoring it, consider seeking advice on how to handle a Hawaii Garnishee Order properly to avoid unwanted escalation.