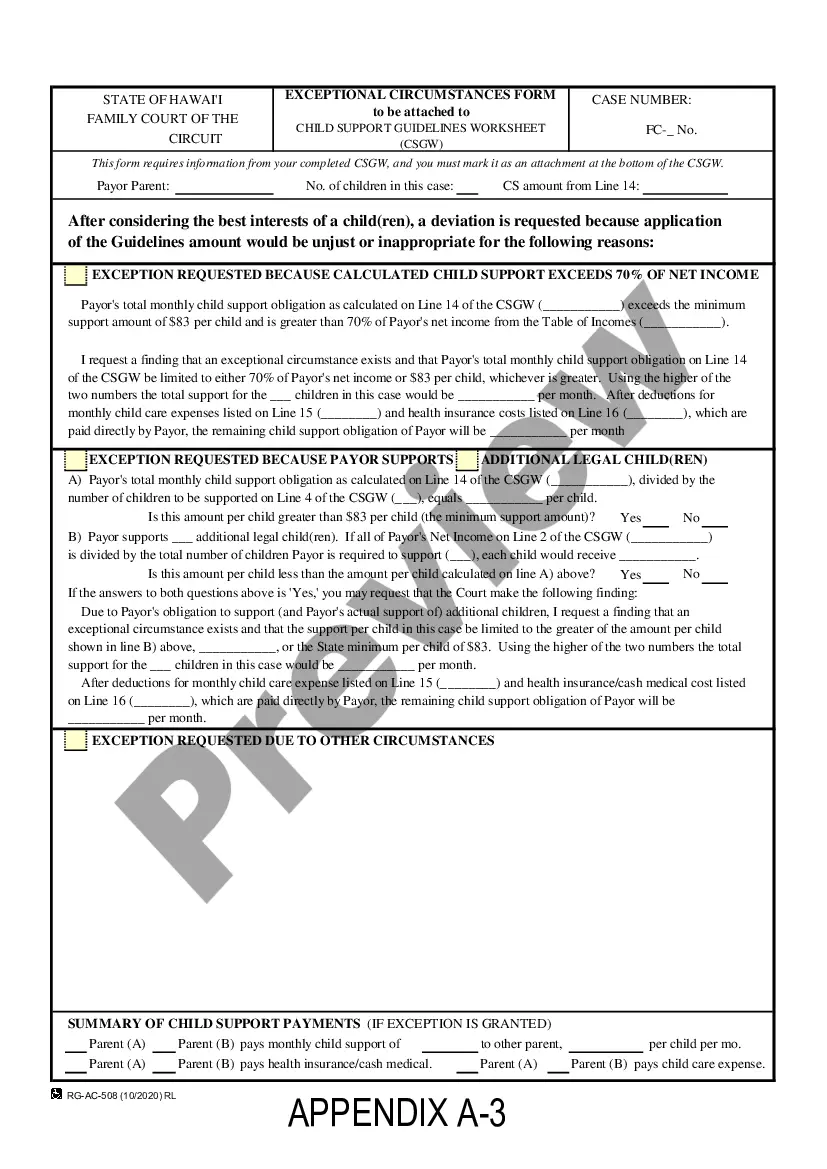

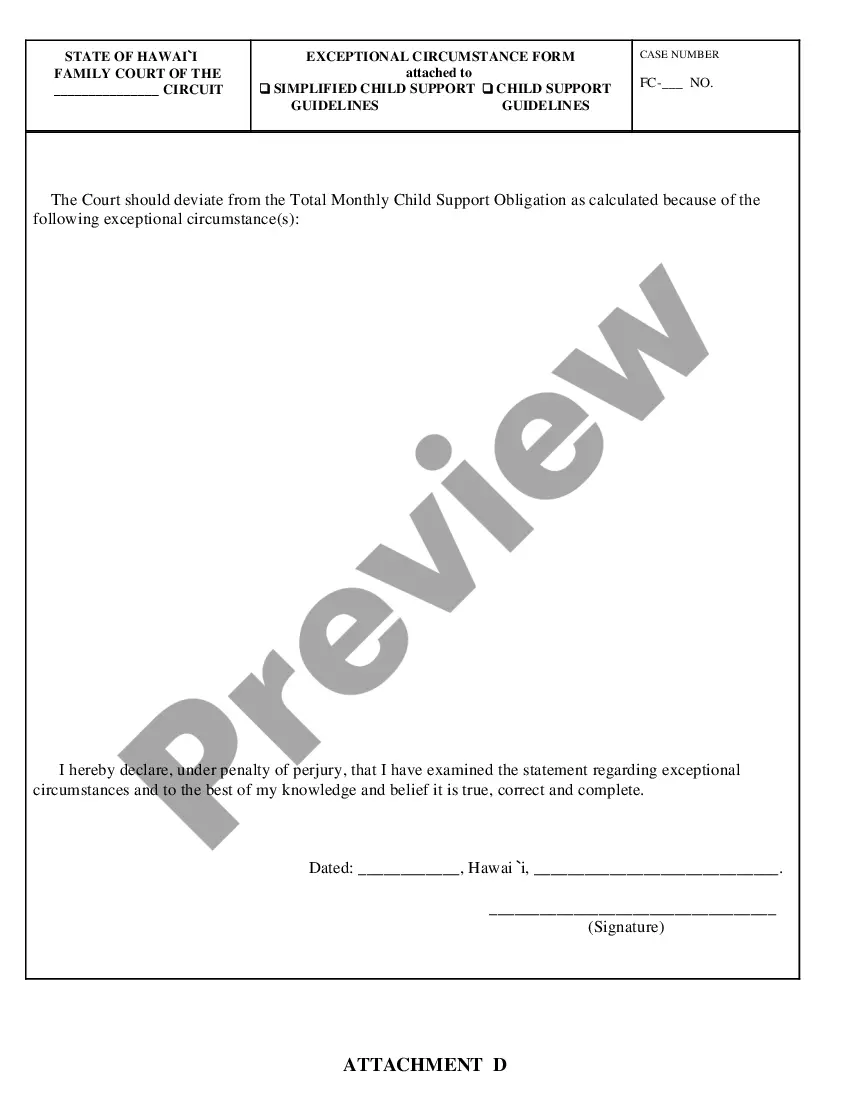

The Hawaii Exceptional Circumstances Form is a document used to request an exception to certain rules or regulations. This form is used when a person or company is unable to meet the requirements of a state or federal policy due to a compelling and unique set of circumstances. It is typically used to request a waiver, deferment, or other form of relief from a rule or policy. There are three types of Hawaii Exceptional Circumstances Form: (1) U.S. Department of Agriculture (USDA) Exceptional Circumstances Form, (2) Hawaii Unemployment Insurance Exceptional Circumstances Form, and (3) Hawaii Department of Taxation Exceptional Circumstances Form. The USDA Exceptional Circumstances Form is used to request an exception to the USDA’s policy for subsidies, loan guarantees, or other financial assistance. The Hawaii Unemployment Insurance Exceptional Circumstances Form is used by individuals who are unable to comply with the requirements of the Hawaii Unemployment Insurance program. The Hawaii Department of Taxation Exceptional Circumstances Form is used to request an exception to the Hawaii Department of Taxation’s policy for filing, payment, or other tax-related matters.

Hawaii Exceptional Circumstances Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Exceptional Circumstances Form?

How much duration and resources do you typically allocate for preparing official documents.

There’s a better chance to obtain such forms than engaging legal experts or spending hours browsing the internet for an appropriate template. US Legal Forms is the premier online repository that offers professionally crafted and verified state-specific legal papers for any purpose, such as the Hawaii Exceptional Circumstances Form.

Another advantage of our library is that you can retrieve previously acquired documents that you securely store in your profile in the My documents tab. Access them anytime and re-complete your paperwork as often as you wish.

Conserve time and energy managing legal documents with US Legal Forms, one of the most reliable online solutions. Register with us today!

- Review the form content to ensure it meets your state's criteria. To do this, examine the form description or utilize the Preview option.

- If your legal document does not fulfill your requirements, search for another one using the search tab at the top of the page.

- If you already possess an account with us, Log In and download the Hawaii Exceptional Circumstances Form. If not, continue to the following steps.

- Click Buy now once you locate the appropriate document. Select the subscription plan that best fits your needs to gain access to our library’s complete service.

- Establish an account and pay for your subscription. Payment can be made with your credit card or via PayPal - our service is entirely secure for that.

- Download your Hawaii Exceptional Circumstances Form onto your device and fill it out on a printed hard copy or electronically.

Form popularity

FAQ

Calculating child support in Hawaii involves considering both parents' incomes, necessary expenses, and the number of children. The state guidelines offer a structured approach to ensure fairness. If you have unique circumstances affecting your situation, completing the Hawaii Exceptional Circumstances Form can help you articulate those factors and possibly adjust the calculations.

The lowest child support payment in Hawaii can vary, but it must meet the established guidelines set by the state. Factors like income and the number of children involved can influence this minimum amount. To address specific needs or request adjustments, the Hawaii Exceptional Circumstances Form can be an essential tool in your journey.

In Hawaii, the minimum child support amount usually depends on various factors, including both parents' income. The guidelines provide a baseline for calculations, but they can be adjusted based on specific needs or circumstances. For those in unique situations, the Hawaii Exceptional Circumstances Form allows you to propose different amounts that better suit your needs.

The statute of limitations for collecting unpaid child support in Hawaii is generally six years. However, this timeframe can differ based on specific circumstances or modifications made to the order. It's crucial to be aware of these details, and using the Hawaii Exceptional Circumstances Form can assist you in addressing any unique situations related to your case.

In Hawaii, child support can typically continue beyond the age of 18, especially if the child is still pursuing education. Under certain circumstances, such as the child having special needs, payments might extend further. To navigate these exceptional situations, the Hawaii Exceptional Circumstances Form can be utilized to help you apply for continued support.

Hawaii determines child support using a formula that considers the income of both parents, the needs of the child, and any special circumstances. The state aims to ensure that both parents contribute fairly to the child's upbringing. If you have exceptional circumstances that don’t fit the standard guidelines, filing a Hawaii Exceptional Circumstances Form is essential to potentially adjust the support obligations.

Fathers in Hawaii have the right to seek custody and visitation rights, ensuring they remain an active part of their children's lives. They also have the right to be involved in decisions regarding their children's education and healthcare. Filing for a Hawaii Exceptional Circumstances Form can help fathers assert their rights in unique situations where standard arrangements may not suffice.

In Hawaii, child support generally continues until the child reaches the age of 18. However, if a child is still in high school, support may extend until the child graduates, or turns 19, whichever comes first. It is important to file a Hawaii Exceptional Circumstances Form if you believe your situation warrants a change in the child support agreement, so be sure to explore that option for your specific needs.

VA disability benefits are generally viewed as income, which can impact various financial obligations, including child support and eligibility for state assistance programs. While these benefits are intended to support veterans, their classification as income can create complex financial scenarios. For adjustments or clarifications, the Hawaii Exceptional Circumstances Form serves as a useful tool.

In Hawaii, child support obligations typically continue until the child turns 18 or graduates from high school, whichever occurs later. However, if special circumstances exist, such as the child's disability, support may continue beyond this age. Filing the Hawaii Exceptional Circumstances Form can aid in exploring these exceptions based on unique family situations.