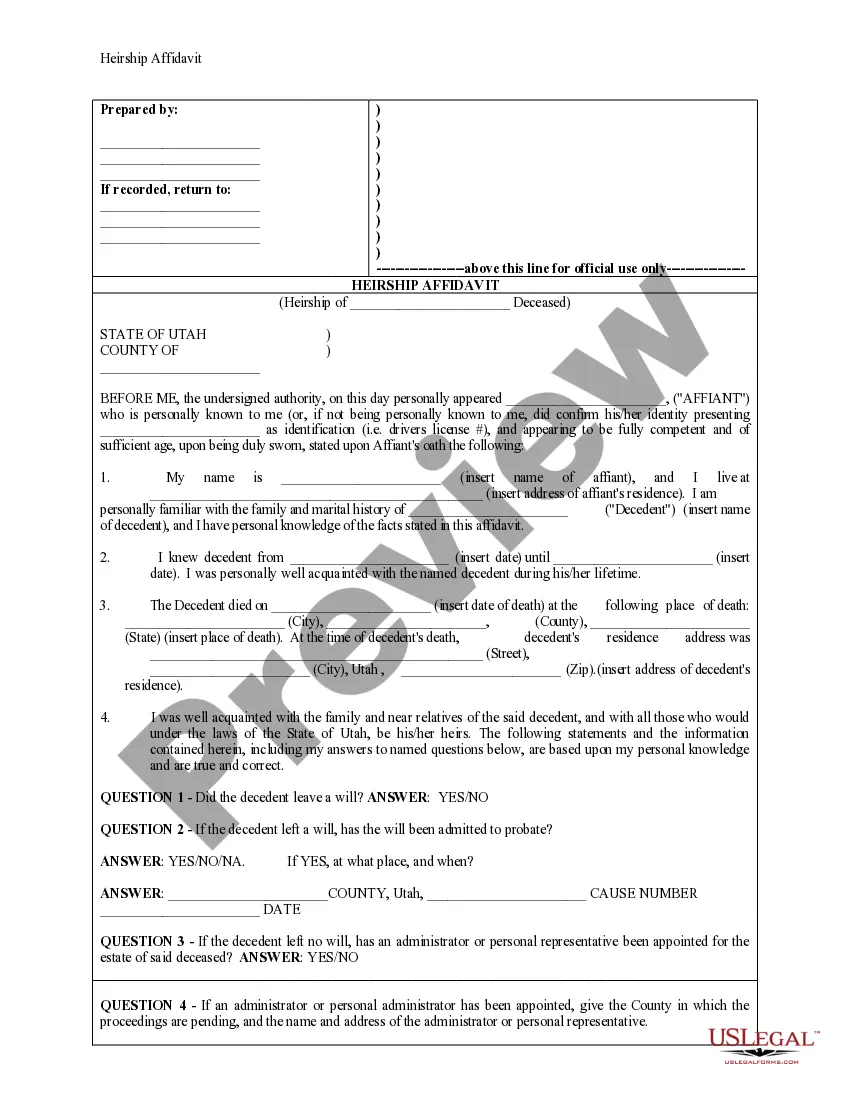

The Hawaii Declaration Regarding Attorneys Fees and Costs is a form filed in Hawaii courts that outlines the party's agreement to pay all attorneys' fees and costs. This document is used when a party has agreed to pay the attorneys' fees and costs of another party or parties. There are two types of Hawaii Declaration Regarding Attorneys Fees and Costs, the standard form, and the form used in a contingency fee arrangement. The standard form includes a section for each party to specify the amount of fees and costs that will be paid, the date of payment, and a signature line. The form used in a contingency fee arrangement includes information about the basis for the fee arrangement, the amount of fees and costs to be paid, and the date of payment. Both forms also include a provision that the fees and costs must be paid regardless of the outcome of the case.

Hawaii Decleration Regarding Attorneys Fees and Costs

Description

How to fill out Hawaii Decleration Regarding Attorneys Fees And Costs?

If you are looking for a method to accurately prepare the Hawaii Declaration Regarding Attorneys Fees and Costs without enlisting a lawyer, then you have found the right destination.

US Legal Forms has established itself as the most comprehensive and dependable collection of official templates for every personal and business circumstance. Each document available on our web service is crafted in alignment with national and state laws, ensuring that your paperwork is properly structured.

Another fantastic aspect of US Legal Forms is that you will never lose the documents you have purchased - you can access any of your downloaded templates in the My documents section of your profile whenever you need them.

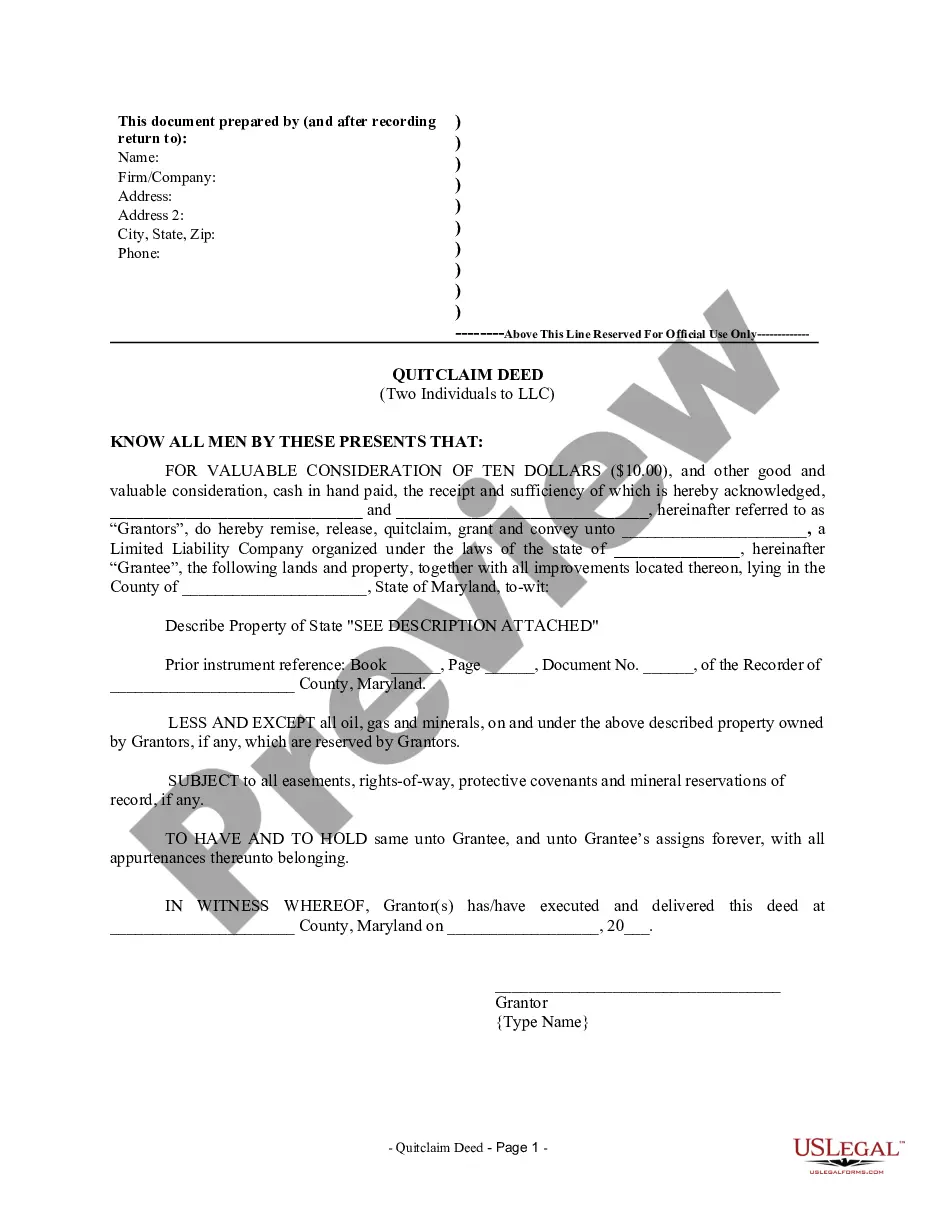

- Verify that the document displayed on the page aligns with your legal circumstances and state regulations by examining its text description or exploring the Preview mode.

- Input the document title in the Search tab at the top of the page and select your state from the dropdown list to find an alternative template if any discrepancies arise.

- Proceed with content validation and click Buy now when you feel assured that the paperwork adheres to all necessary standards.

- Log in to your account and click Download. Sign up for the service and select a subscription plan if you haven't done so already.

- Utilize your credit card or the PayPal option to acquire your US Legal Forms subscription. The document will be ready for download immediately after.

- Choose the format in which you want to save your Hawaii Declaration Regarding Attorneys Fees and Costs and download it by clicking the correct button.

- Upload your template to an online editor for quick completion and signing, or print it out to prepare your hard copy manually.

Form popularity

FAQ

To report legal fees, you need to include them in the appropriate section of your tax return. The Hawaii Declaration Regarding Attorneys Fees and Costs can guide you on how to categorize these fees properly. Consultation with a tax professional can also ensure you comply with all necessary regulations.

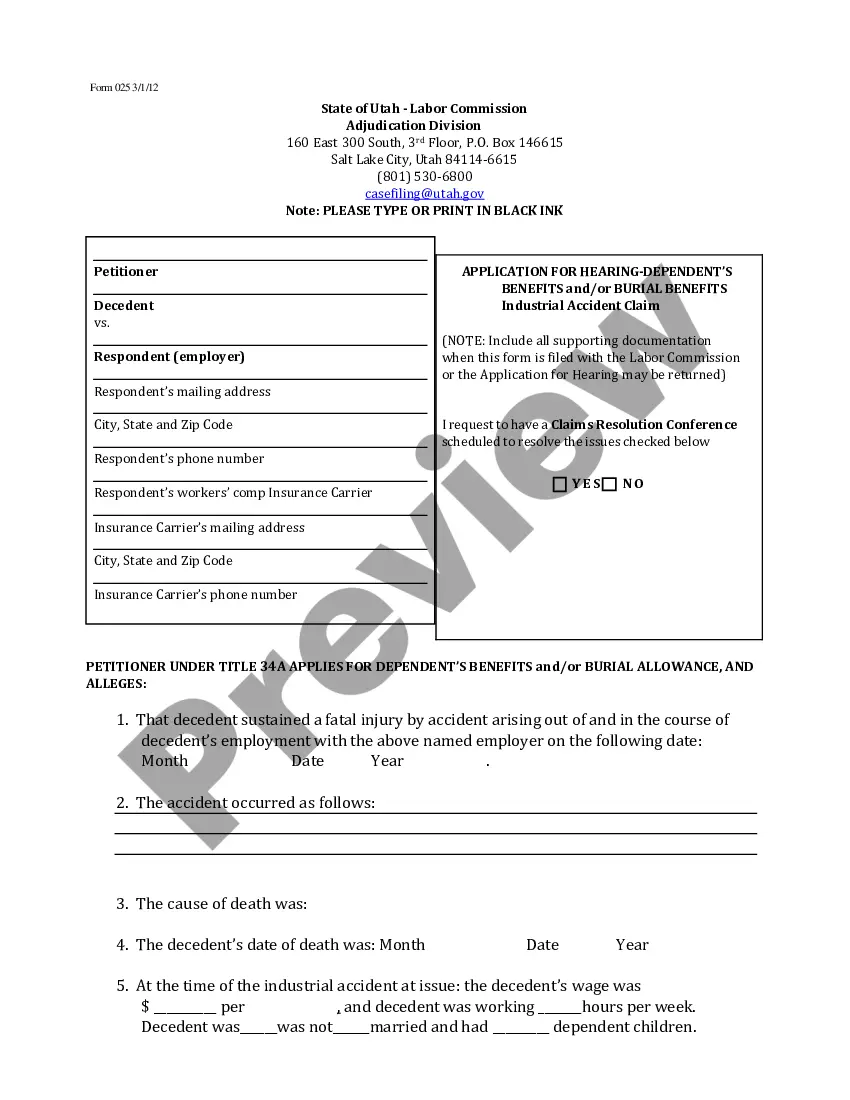

Attorney fees refer to the payments made for legal services, while attorney costs include expenses incurred in the legal process, such as filing fees and expert witness fees. The Hawaii Declaration Regarding Attorneys Fees and Costs distinguishes between these two types of expenses. Understanding this difference can aid in planning your legal budget.

Deducting attorney fees from your taxes is possible in specific situations, particularly when the fees are connected to business operations. Referencing the Hawaii Declaration Regarding Attorneys Fees and Costs can provide you with precise scenarios where deductions apply. Keeping accurate records is vital for any claims you intend to make.

In general, you cannot deduct legal settlement payments from your taxes. However, under certain circumstances, specific fees related to the settlement may be deductible. Reviewing the Hawaii Declaration Regarding Attorneys Fees and Costs will help clarify what can be claimed.

The American Rule typically states that each party pays its own attorney's fees unless a statute or contract provides otherwise. The Hawaii Declaration Regarding Attorneys Fees and Costs may offer insights on exceptions to this rule. Understanding this can help you navigate your legal expenses better.

Legal and professional fees that directly relate to business activities may be tax deductible. The Hawaii Declaration Regarding Attorneys Fees and Costs provides guidance on what constitutes these eligible fees. Always keep receipts and documentation to support your claims when filing taxes.

Yes, you can claim attorney fees under certain conditions. The Hawaii Declaration Regarding Attorneys Fees and Costs outlines specific scenarios where these fees are recoverable. It's crucial to consult with a legal expert who can guide you through the process of claiming these fees effectively.

Examples of legal fees include attorney charges for case management, consultations, and representation in court. Professional fees can encompass various services, such as fees for accountants or consultants involved in a legal case. The Hawaii Declaration Regarding Attorneys Fees and Costs recognizes the importance of itemizing these fees for transparency. Using platforms like USLegalForms can make it easier to document and manage these fees efficiently.

Attorney fees refer to the payments made for legal services provided by an attorney. Costs, on the other hand, include additional expenses related to a case, such as court fees or costs for expert witnesses. The Hawaii Declaration Regarding Attorneys Fees and Costs aims to clarify both components to ensure clients understand what they are paying for. This distinction is critical for budgeting and planning your legal expenditures.

Most lawyer fees vary greatly depending on the type of case and the attorney's level of experience. Generally, hourly rates can range from $100 to $500 or more. The Hawaii Declaration Regarding Attorneys Fees and Costs suggests that attorneys should provide a written estimate to clients upfront. This practice promotes transparency and helps clients manage their legal expenses effectively.