Hawaii Schedule of Fees & Costs is a list of fees and costs associated with services provided by the state government of Hawaii. The list is updated and published annually by the Hawaii State Department of Budget and Finance. It includes fees and costs for professional services, court fees, regulatory fees, and other miscellaneous services. There are two types of Hawaii Schedule of Fees & Costs: the Hawaii Executive Branch Schedule of Fees and Costs and the Hawaii Judicial Branch Schedule of Fees and Costs. The Executive Branch Schedule of Fees and Costs lists fees and costs for services provided by government agencies such as the Department of Health, the Department of Land and Natural Resources, and the Department of Taxation. The Judicial Branch Schedule of Fees and Costs lists fees and costs for services provided by the judiciary, such as court filing fees, court transcripts, and court interpreter fees.

Hawaii Schedule of Fees & Costs

Description

How to fill out Hawaii Schedule Of Fees & Costs?

Handling official documents necessitates focus, precision, and utilizing correctly formulated templates. US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Hawaii Schedule of Fees & Costs template from our platform, you can trust it complies with federal and state regulations.

Interacting with our service is simple and efficient. To acquire the necessary documents, all you'll require is an account with an active subscription. Here's a concise guide for you to access your Hawaii Schedule of Fees & Costs in just a few minutes.

All documents are created for multiple uses, just like the Hawaii Schedule of Fees & Costs shown on this page. If you need them again, you can fill them out without additional payment - just navigate to the My documents tab in your profile and finalize your document whenever you require it. Experience US Legal Forms and prepare your business and personal documents swiftly and in full legal conformity!

- Ensure to thoroughly verify the form details and its alignment with general and legal requirements by reviewing it or examining its summary.

- Search for an alternative official template if the previously accessed one does not suit your circumstances or state laws (the link for that is located on the top corner of the page).

- Log in to your account and save the Hawaii Schedule of Fees & Costs in your preferred format. If this is your first visit to our site, click Buy now to proceed.

- Establish an account, select your subscription plan, and complete the payment using your credit card or PayPal account.

- Decide on the format in which you wish to obtain your document and click Download. Print the template or upload it to a professional PDF editor for electronic submission.

Form popularity

FAQ

In Hawaii, both parties do not necessarily have to agree for a divorce to occur. If one party files for divorce, the process can continue even if the other party disagrees. However, an uncontested divorce, where both parties agree on major issues, typically makes the process faster and less complicated. Consulting a reliable resource like US Legal Forms can help you navigate the Hawaii Schedule of Fees & Costs while ensuring your rights are protected.

The duration of a divorce in Hawaii can vary based on several factors, such as the complexity of the case and whether there are disagreements between the parties. Generally, an uncontested divorce may take about three to six months to finalize. If the divorce involves disputes or additional legal proceedings, it could take longer. Understanding the Hawaii Schedule of Fees & Costs can help you budget for the entire process.

The schedule of charges is similar to a fees schedule, as it details the specific expenses that may incur during a legal process. When it comes to the Hawaii Schedule of Fees & Costs, this schedule helps users understand the different charges related to various services. It provides a comprehensive view of the potential costs, making it easier to navigate your legal journey. Accessing this information can reduce surprises and enhance your overall experience.

A fees schedule is a documented list that outlines the costs associated with various legal services. In the context of the Hawaii Schedule of Fees & Costs, it provides transparency for users regarding what to expect when seeking legal assistance in Hawaii. By referring to this fees schedule, you can make informed decisions about your legal expenses. This clarity helps individuals plan their budgets effectively.

Court filing fees are charges made by the court to process your legal documents. These fees vary depending on the type of case you are filing, such as civil, small claims, or land court petitions. For precise amounts, you can refer to the Hawaii Schedule of Fees & Costs, which provides a detailed breakdown of necessary fees. Understanding these costs can help you plan your budget effectively when pursuing legal action.

Yes, LLCs in Hawaii must file an annual report. This report is an essential requirement to maintain your LLC's active status. It provides updated information that keeps your business compliant with state regulations, and the details are included in the Hawaii Schedule of Fees & Costs. Platforms like US Legal Forms can help simplify this process, ensuring you stay on track with your filing obligations.

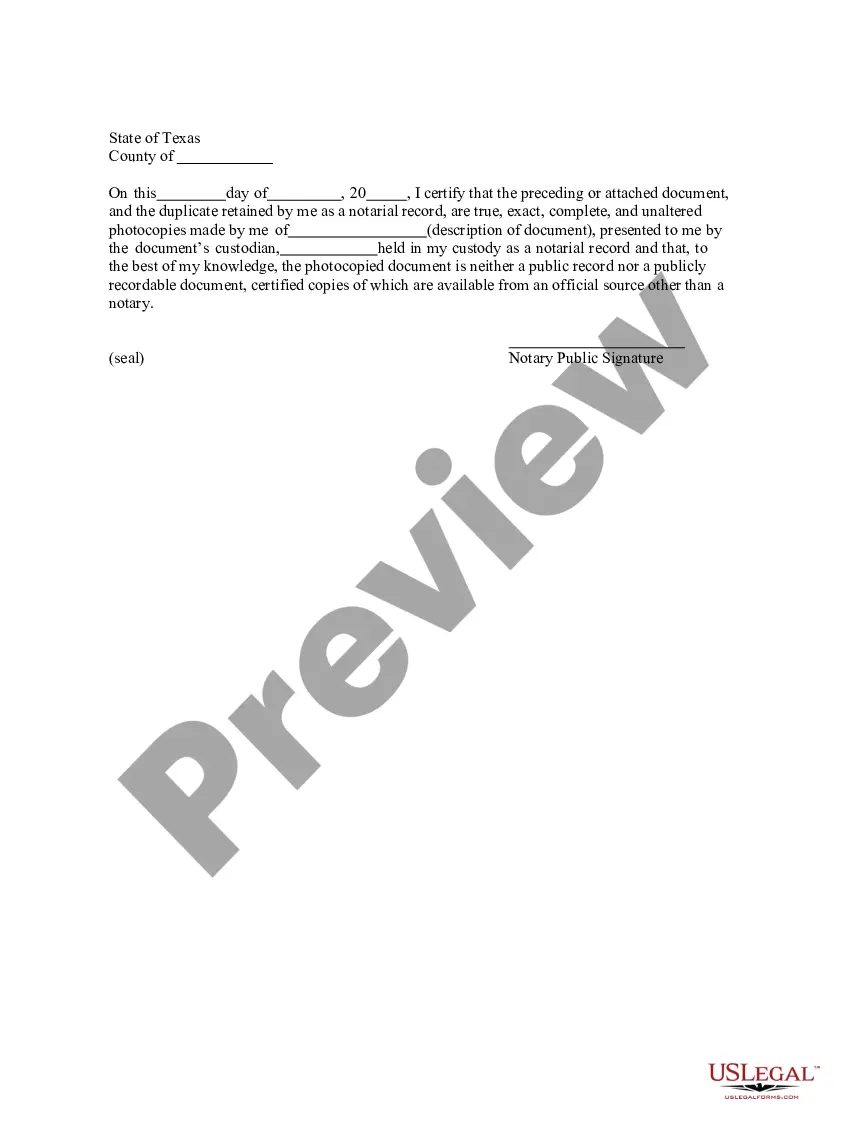

The deed or assignment of lease must be signed (in black ink) by the current owner and the new owner before a notary public. The deed or assignment of lease must be recorded in the State of Hawaii Bureau of Conveyances or Land Court. A Conveyance Tax Certificate must be filed and any tax due must be paid.

The bureau also charges a conveyance tax, which must be paid by the seller before the bureau will record the new deed. Hawaii's base conveyance tax rate is 10 cents for each $100.00 of the property's sale price up to $600,000.00.

How much does it cost to start a business in Hawaii? It costs $50 to register a business with the Business Services Division in Hawaii. A General Excise Tax (GET) license is required to conduct business, which costs $20.

The fee to record a Hawaii deed depends on the system in which the deed is recorded. Land Court System deeds require a $36.00 recording fee?increased to $101.00 for deeds exceeding 50 pages. Regular System deeds require a $41.00 recording fee?increased to $106.00 for deeds exceeding 50 pages.