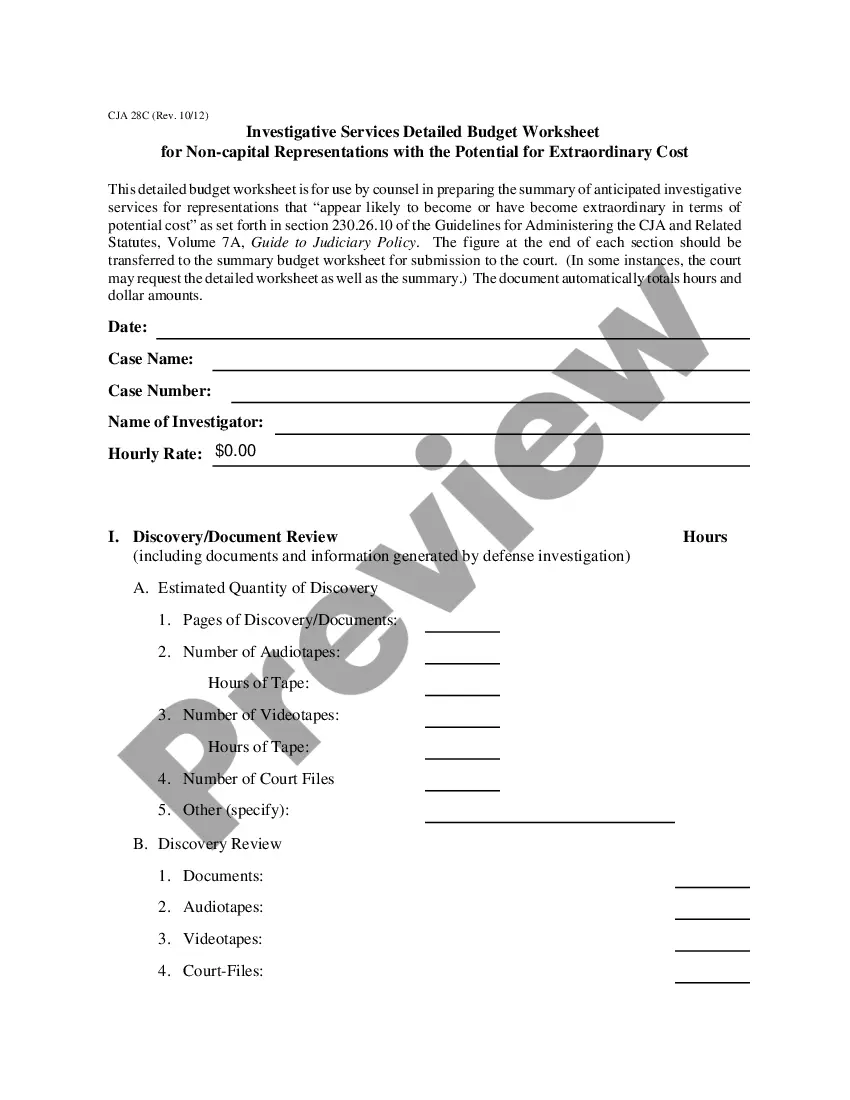

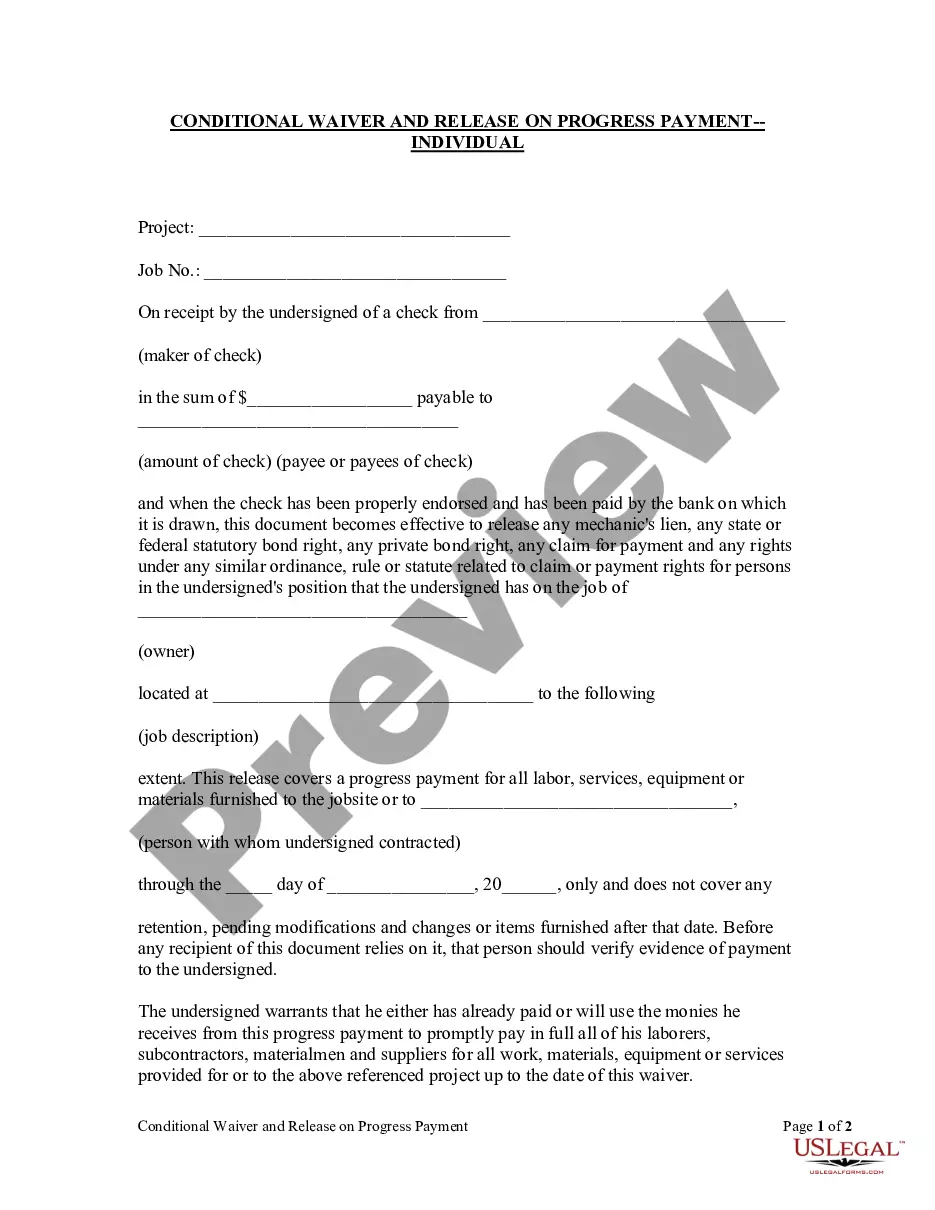

The Hawaii Other Expense Worksheet is a spreadsheet designed to help Hawaii taxpayers calculate their other applicable expenses when filing their state taxes. It allows individuals to enter their various expenses, such as medical expenses, job-related expenses, and charitable contributions, and then calculate the total amount of deductions they can take. There are two types of Hawaii Other Expense Worksheets: an individual worksheet for taxpayers who are filing as single, and a joint worksheet for taxpayers who are married filing jointly. Both worksheets provide a comprehensive list of applicable deductions and allow taxpayers to total their deductions and calculate their net other expenses for the year.

Hawaii Other Expense Worksheet

Description

How to fill out Hawaii Other Expense Worksheet?

If you're seeking a method to properly prepare the Hawaii Other Expense Worksheet without enlisting the help of an attorney, then you've come to the right place.

US Legal Forms has established itself as the largest and most trustworthy collection of official documents for all personal and business needs.

Choose the format in which you wish to receive your Hawaii Other Expense Worksheet and download it by clicking the corresponding button. Add your template to an online editor for quick filling and signing, or print it out for manual completion. Another fantastic feature of US Legal Forms is that you won't lose any of the documents you have purchased; you can access any of your downloaded templates in the My documents tab of your profile whenever you require them.

- Each document you discover on our online platform is crafted in alignment with federal and state laws, ensuring that your paperwork is accurate.

- Follow these straightforward steps for obtaining the ready-to-use Hawaii Other Expense Worksheet.

- Verify that the document displayed on the page adheres to your legal context and state regulations by reviewing its description or checking the Preview mode.

- Enter the form name in the Search tab at the top of the page and select your state from the dropdown to find another template if you encounter any discrepancies.

- Repeat the content verification and click Buy now when you are assured of the document's compliance with all requirements.

- Log in to your account and click Download. Create an account if you haven't already, and choose a subscription plan.

- Use your credit card or the PayPal option to complete the payment for your US Legal Forms subscription. The document will be available for download immediately.

Form popularity

FAQ

To file AG 49 in Hawaii, you will first need to gather all relevant financial information, including your income and other expenses. The Hawaii Other Expense Worksheet can help you organize this information effectively. Once you complete the worksheet, you can submit it along with your filing to the appropriate state office. Using platforms like US Legal Forms simplifies this process, ensuring you have the correct forms and guidance to file AG 49 accurately.

In Hawaii, taxpayers can deduct eligible medical expenses that exceed a certain percentage of their adjusted gross income. These deductions can provide substantial tax relief, so it's important to track all qualified expenses. For better management of these deductions, consider using the Hawaii Other Expense Worksheet to optimize your claims.

Hawaii's personal income tax rates are progressive, meaning they increase as income rises. These rates can vary significantly depending on your total income. To ensure you understand how these rates apply to your situation, the Hawaii Other Expense Worksheet is an excellent resource for tax planning.

Hawaii does allow taxpayers to choose between taking the standard deduction and itemizing deductions. If itemizing provides more tax benefits for you, it might be the better route. To assist in these calculations, the Hawaii Other Expense Worksheet can help you compare both options effectively.

Yes, Hawaii has a standard deduction that taxpayers can claim. The amount varies based on your filing status, and it can significantly reduce taxable income. To accurately determine your eligibility and the deduction amount, consider the Hawaii Other Expense Worksheet, which simplifies this process.

In Hawaii, seniors over 65 can benefit from an additional standard deduction that increases their potential tax savings. This extra deduction can help reduce taxable income even further. To navigate these deductions effectively, the Hawaii Other Expense Worksheet serves as a useful tool in maximizing your tax benefits.

Hawaii does not typically allow moving expense deductions for most taxpayers. However, if you are an active-duty member of the military, your moving expenses may qualify. For more detailed information on unique situations, the Hawaii Other Expense Worksheet can help guide you through the specifics.

The standard deduction in Hawaii is the amount you can subtract from your taxable income, which can lower your overall tax bill. For individuals, the standard deduction is typically higher compared to other states. For detailed calculations and guidance, consider using the Hawaii Other Expense Worksheet to ensure accuracy in your tax filings.

You can obtain Hawaii tax forms from the Department of Taxation's website or local tax offices. Additionally, various online platforms, such as uslegalforms, offer downloadable tax forms and guidance. To better manage your records, consider using a Hawaii Other Expense Worksheet to track expenses that may not be included on standard forms. This approach can help ensure you're fully prepared when tax season arrives.

The N11 form is a basic individual income tax return for residents of Hawaii. This form is used by taxpayers whose income is below a certain threshold, allowing for a simpler filing process. If you need assistance with tax forms like the N11, utilizing the Hawaii Other Expense Worksheet can streamline your financial records. Remember to gather all relevant documentation before starting your filing.