Hawaii Reaffirmation Agreement Cover Sheet

Description

How to fill out Hawaii Reaffirmation Agreement Cover Sheet?

If you’re looking for a method to accurately fill out the Hawaii Reaffirmation Agreement Cover Sheet without engaging a legal expert, then you’ve found the perfect place.

US Legal Forms has established itself as the most comprehensive and respected collection of official templates for every personal and business circumstance. Each piece of documentation you encounter on our online platform is designed in alignment with federal and state regulations, ensuring your forms are correct.

Another fantastic aspect of US Legal Forms is that you will never misplace the documents you obtained - you can access any downloaded templates in the My documents section of your profile whenever you need.

- Confirm that the document displayed on the screen aligns with your legal scenario and state regulations by reviewing its text description or checking the Preview mode.

- Enter the form title in the Search tab at the top of the page and choose your state from the dropdown list to find an alternate template if there are any discrepancies.

- Repeat the content verification and click Buy now when you are assured that the paperwork meets all standards.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you lack one.

- Utilize your credit card or the PayPal option to buy your US Legal Forms subscription. The document will be ready for download immediately after.

- Choose the format in which you wish to save your Hawaii Reaffirmation Agreement Cover Sheet and download it by clicking the appropriate button.

- Upload your template to an online editor for quick completion and signing, or print it out to prepare your hard copy manually.

Form popularity

FAQ

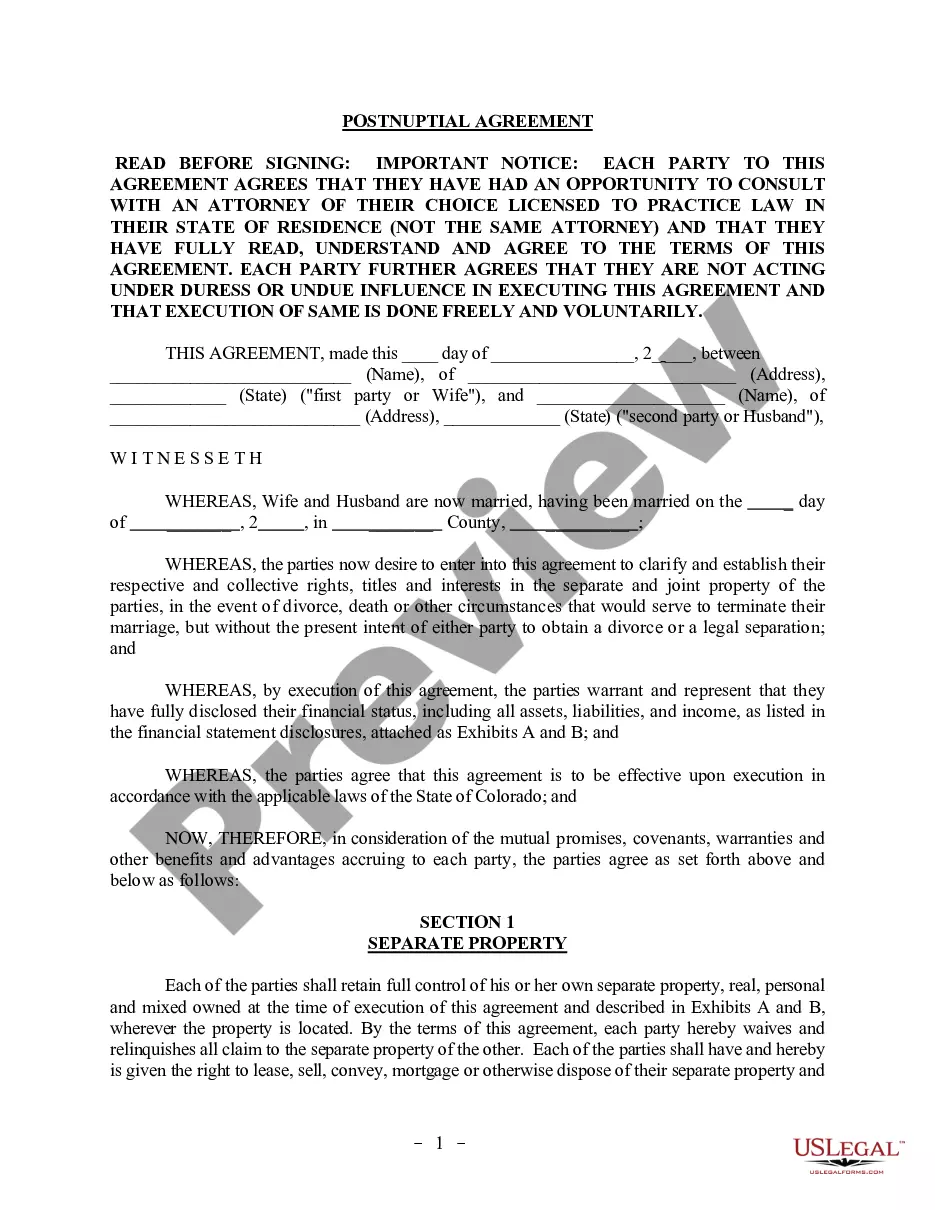

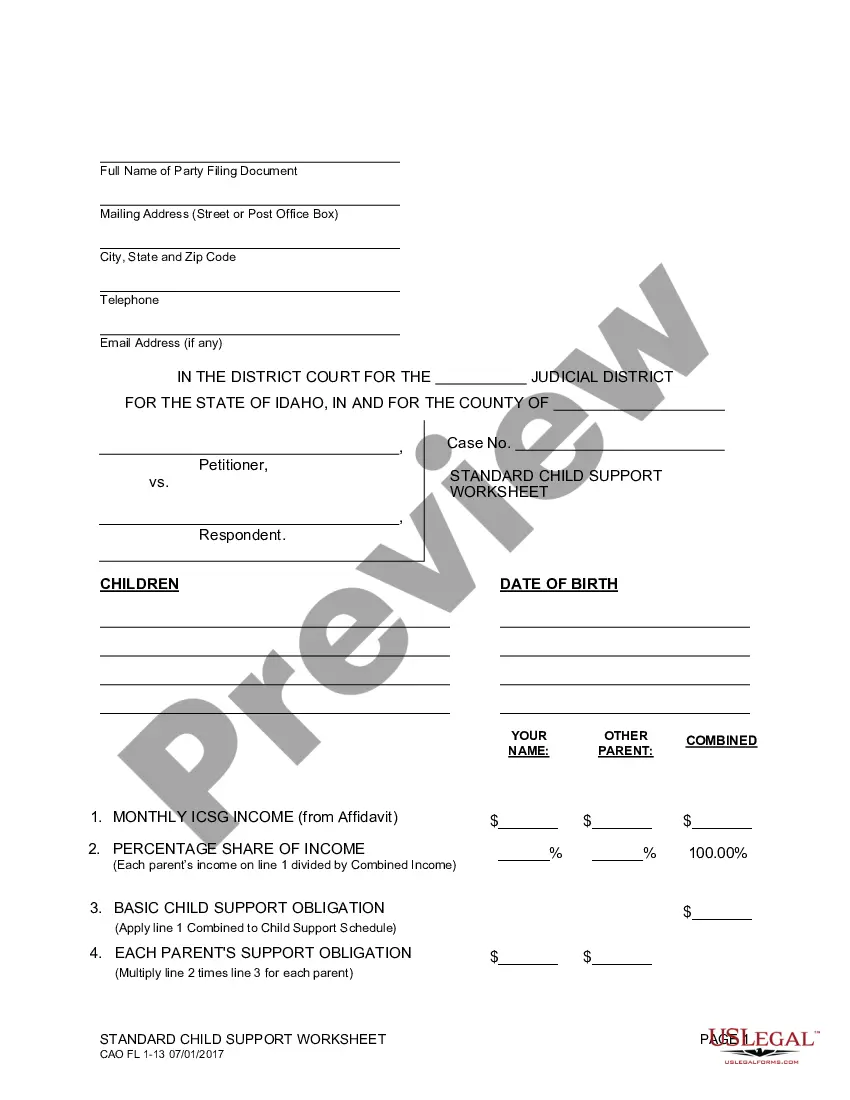

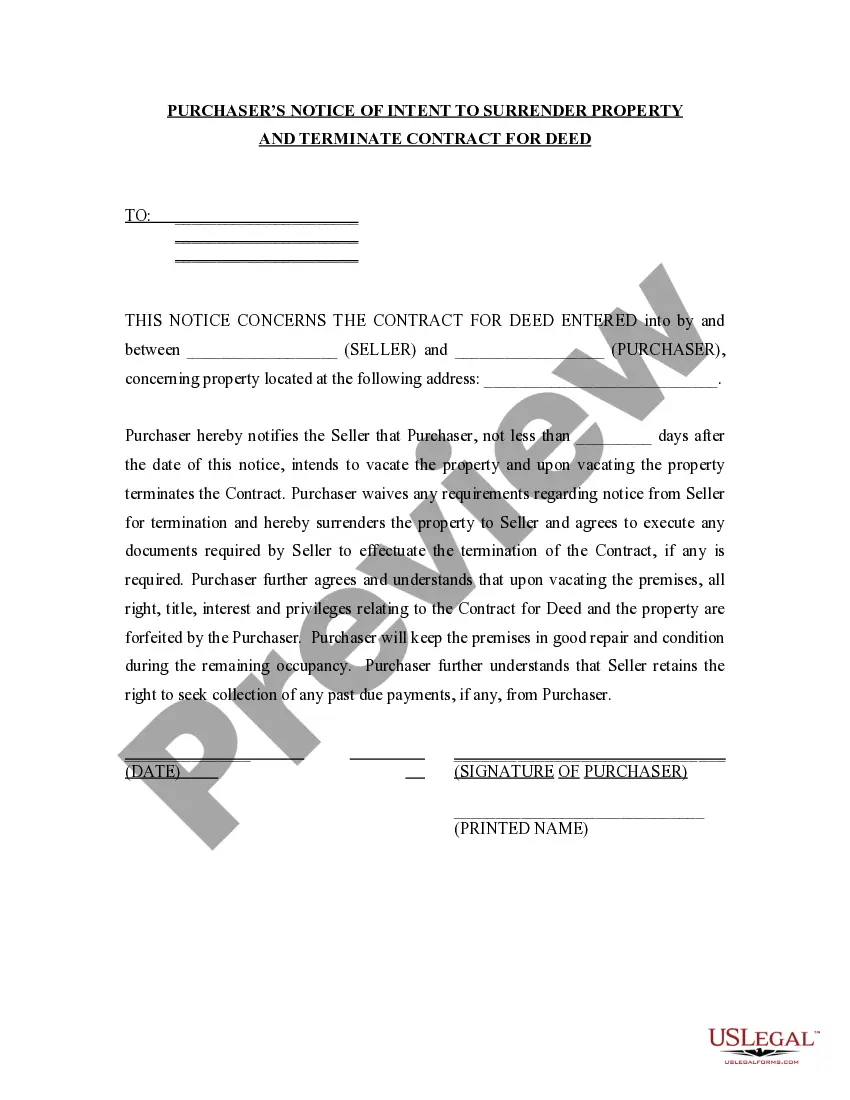

A reaffirmation agreement form is a legal document used during bankruptcy proceedings to keep certain assets, like a home or a car, while continuing to make payments. By signing this form, debtors affirm their commitment to repay specific debts and ensure their creditors retain rights to the collateral. The Hawaii Reaffirmation Agreement Cover Sheet is an essential part of this process, as it outlines the agreement clearly for the court. Utilizing uSlegalforms can help you understand and complete this necessary documentation with ease.

Choosing to reaffirm a debt can often be a strategic financial move. By signing a Hawaii Reaffirmation Agreement Cover Sheet, you can keep valuable assets while ensuring your credit score remains intact. This option allows you to continue making payments on debts you want to retain, such as a home or vehicle. Ultimately, reaffirmation can help rebuild your financial future by demonstrating commitment to your obligations.

Typically, the reaffirmation agreement is prepared by the creditor or their representative, but you can also create a Hawaii Reaffirmation Agreement Cover Sheet using legal services to ensure accuracy. It's important for both parties to agree on the terms documented in the reaffirmation agreement. You may also consult with a bankruptcy attorney or a legal platform like uslegalforms to guide you through the process. This ensures that your rights and interests are protected throughout the reaffirmation.

During a reaffirmation hearing, the judge reviews the Hawaii Reaffirmation Agreement Cover Sheet to ensure it complies with legal requirements. The judge assesses whether the reaffirmation is in the best interest of the debtor and confirms that the debtor understands the agreement's implications. Additionally, the judge may ask questions to clarify any concerns and ensure that the debtor's rights are protected. This process helps maintain transparency and protect both parties involved in the reaffirmation agreement.

A reaffirmation agreement is a new contract with the lender that says you'll be responsible for the debt on your car and the lien will stay in place, even though your other debts are being discharged in bankruptcy. Most lenders will require a reaffirmation agreement if you want to keep your car.

If you want to request a reaffirmation agreement, you must agree after filing for bankruptcy but before any collateral is discharged to the lender. An agreement is filed by submitting a Statement of Intent to the court. Then, you must also send the Statement of Intent to the lender.

To ensure that creditors do not defraud their debtors, reaffirmation agreements must be: In writing; Filed with the court; and. Certified by the debtor's attorney.

For example, if a replacement used car costs $5,000 at a 5% interest rate and the reaffirmation agreement would require the debtor to pay $6,000 at a 5% interest rate or $5,000 at a 6% interest rate, then the debtor should not enter into the reaffirmation agreement.

A reaffirmation agreement is an agreement between a chapter 7 debtor and a creditor that the debtor will pay all or a portion of the money owed, even though the debtor has filed bankruptcy. In return, the creditor promises that, as long as payments are made, the creditor will not repossess or take back its collateral.

A reaffirmation agreement is a legally-binding document that establishes the legal obligations of a borrower to repay some or all of it during bankruptcy.