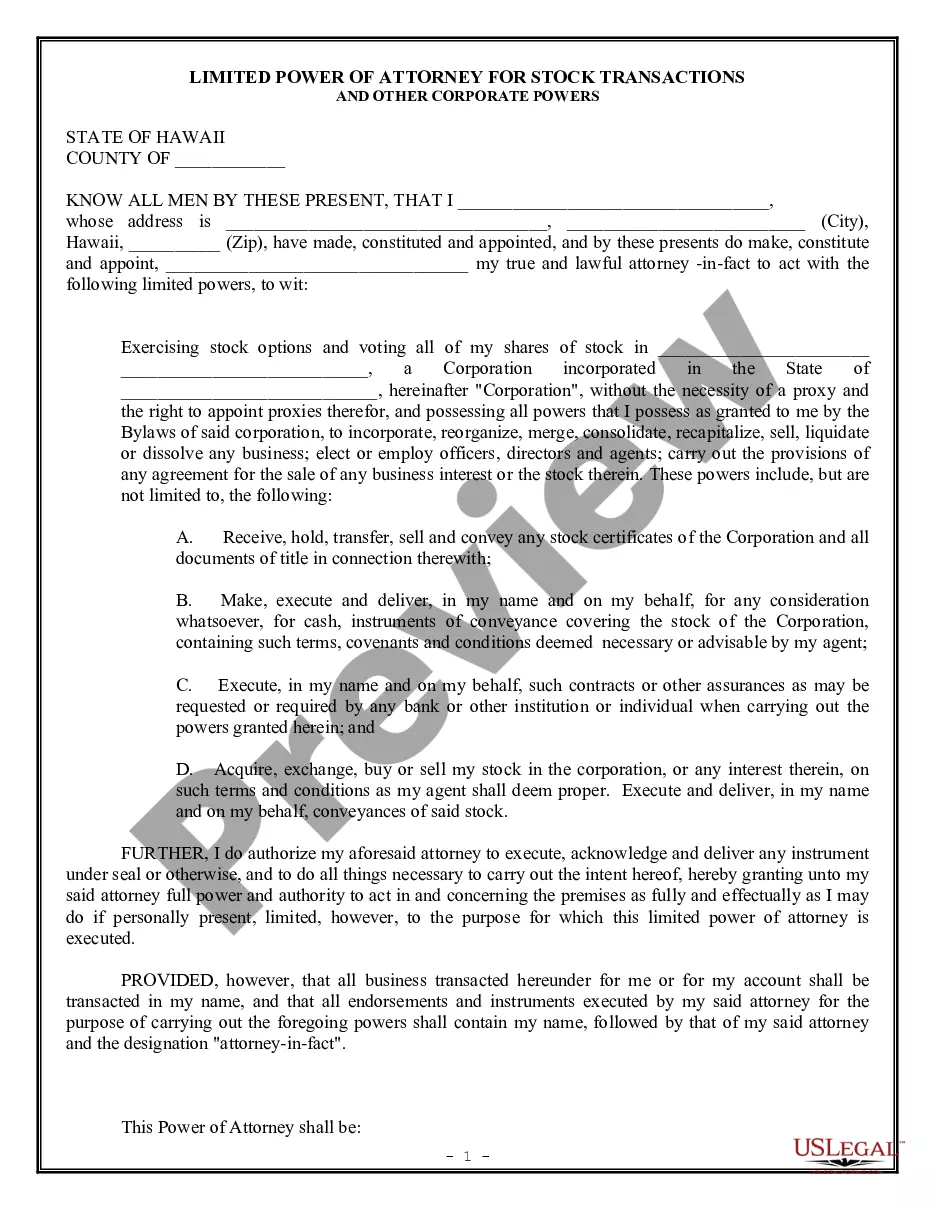

Hawaii Limited Power of Attorney for Stock Transactions and Corporate Powers

Description

How to fill out Hawaii Limited Power Of Attorney For Stock Transactions And Corporate Powers?

Access the most comprehensive collection of legal documents.

US Legal Forms serves as a resource where you can locate any state-oriented form within a few clicks, including examples of Hawaii Limited Power of Attorney for Stock Transactions and Corporate Powers.

No need to spend hours searching for a court-accepted template.

After selecting a payment plan, create your account. Pay using card or PayPal. Download the template to your device by clicking the Download button. That's all! You should fill out the Hawaii Limited Power of Attorney for Stock Transactions and Corporate Powers form and verify it. To ensure accuracy, consult your local attorney for assistance. Sign up and easily access over 85,000 beneficial forms.

- To utilize the forms library, select a subscription and set up an account.

- If you have registered already, simply Log In and subsequently click Download.

- The Hawaii Limited Power of Attorney for Stock Transactions and Corporate Powers document will be promptly stored in the My documents section (a section for each document you save on US Legal Forms).

- To establish a new account, adhere to the brief instructions below.

- If you are intending to use a state-specific template, ensure to select the correct state.

- If possible, review the description to understand all the details of the document.

- Utilize the Preview feature if available to examine the document's specifics.

- If everything appears correct, click Buy Now.

Form popularity

FAQ

The term 'limited power' refers to the specific scope and duration of authority granted within the power of attorney. In the context of a Hawaii Limited Power of Attorney for Stock Transactions and Corporate Powers, this means the agent can only act on defined matters related to stock transactions and corporate decisions. This approach protects your interests by ensuring the agent cannot act outside these specified areas. Understanding this limitation helps you make informed choices when appointing an agent for your financial needs.

A limited power of attorney for a financial advisor allows an individual to delegate specific financial authority to another person. In the context of Hawaii, this enables the designated advisor to handle stock transactions and corporate powers on behalf of the individual. This arrangement provides flexibility while maintaining control over critical financial decisions. You can create your Hawaii Limited Power of Attorney for Stock Transactions and Corporate Powers easily through uslegalforms.

In Hawaii, the duration of a power of attorney can vary based on the terms outlined in the document. Generally, a Hawaii Limited Power of Attorney for Stock Transactions and Corporate Powers remains valid until the specified tasks are completed, or the principal revokes it. It's important to check the specific language in your document for precise terms and consult legal resources if you have any questions.

Yes, a bank can notarize a power of attorney form, including the Hawaii Limited Power of Attorney for Stock Transactions and Corporate Powers. Notarization validates the document, ensuring that it meets legal standards. Most banks have notaries available during business hours, making it convenient for you to get your document notarized.

To fill out a power of attorney document effectively, begin by specifying the type of powers you wish to grant. In the case of a Hawaii Limited Power of Attorney for Stock Transactions and Corporate Powers, detail the stock transactions your agent can handle. Then, fill in the names of the principal and the agent, and include any necessary dates. Finally, review the document for accuracy before signing.

The easiest way to create a Hawaii Limited Power of Attorney for Stock Transactions and Corporate Powers is by using an online platform like US Legal Forms. This service guides you through the process, ensuring that all necessary details are included. Simply choose the correct form, fill it out, and follow the provided instructions. This approach saves you time and ensures your document meets legal requirements.

The primary difference between a power of attorney and a financial power of attorney lies in their scope. A general power of attorney provides broad authority, potentially including medical and legal decisions. In contrast, a financial power of attorney, such as the Hawaii Limited Power of Attorney for Stock Transactions and Corporate Powers, specifically focuses on managing financial matters, including assets and investments.

A limited power of attorney for an investment advisor allows them to make specific investment decisions on your behalf. This type of arrangement can be particularly beneficial if you seek professional guidance in managing your assets, including stocks. Utilizing a Hawaii Limited Power of Attorney for Stock Transactions and Corporate Powers enables you to rely on expert advice while maintaining oversight of your investments.

Certain decisions remain outside the purview of a legal power of attorney. These typically include decisions regarding the creation or amendment of a will, voting in elections, and making healthcare decisions in some jurisdictions. Understanding these limitations is essential while considering a Hawaii Limited Power of Attorney for Stock Transactions and Corporate Powers.

The four main types of power of attorney are general, durable, special (or limited), and springing. Each type serves different purposes and scopes of authority. Notably, a limited power of attorney for stock transactions and corporate powers allows you to specify exactly what financial powers you grant, ensuring clarity and overall risk management.