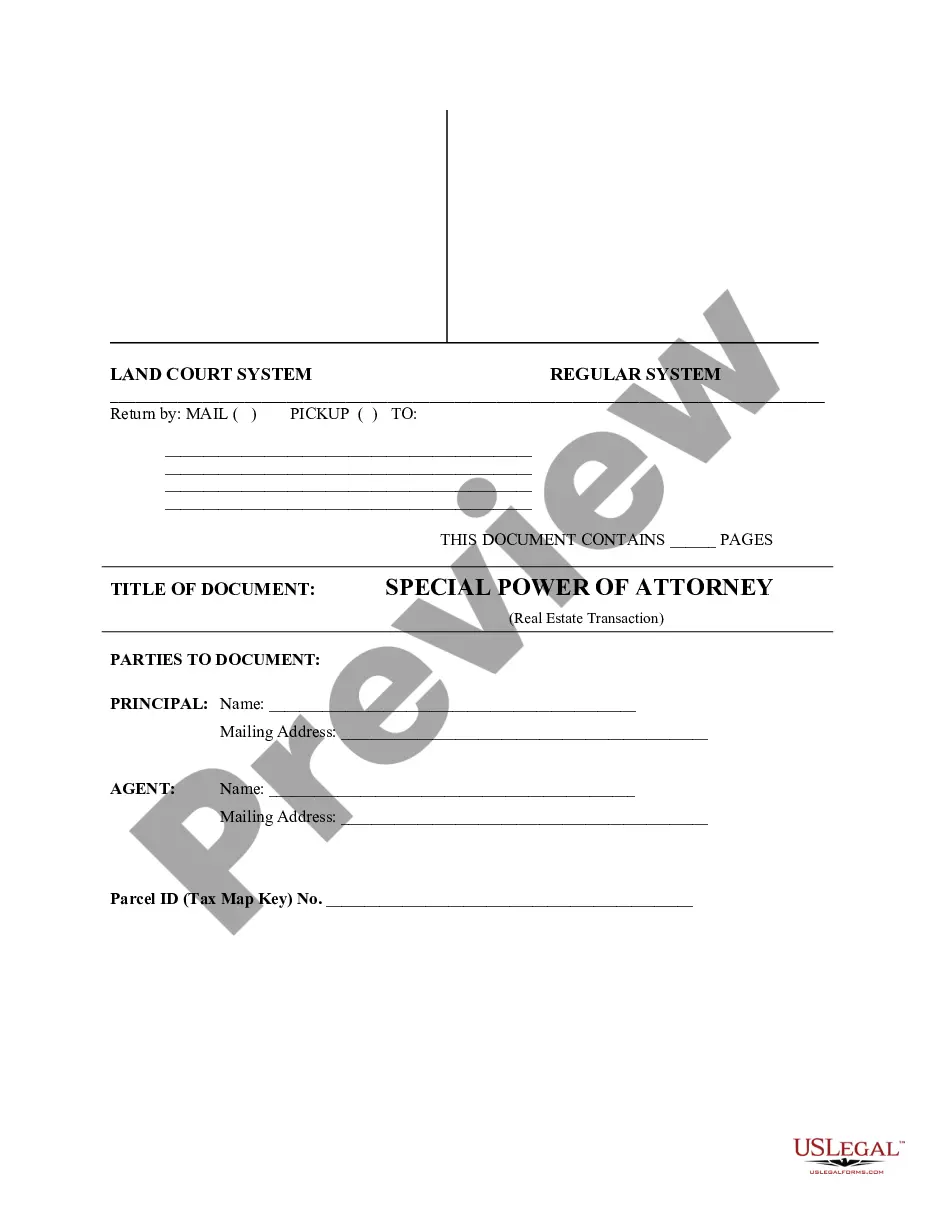

Hawaii Limited Power of Attorney - Limited Powers - Specific Real Estate Transaction

Description

How to fill out Hawaii Limited Power Of Attorney - Limited Powers - Specific Real Estate Transaction?

Gain entry to one of the most comprehensive collections of legal documents.

US Legal Forms serves as a platform where you can locate any state-specific file with just a few clicks, including Hawaii Limited Power of Attorney - Limited Powers - Specific Real Estate Transaction templates.

There's no need to squander hours searching for a court-acceptable example. Our certified professionals guarantee that you receive current templates at all times.

After selecting a pricing option, create an account. Pay via card or PayPal. Save the document to your device by clicking Download. That's it! You should submit the Hawaii Limited Power of Attorney - Limited Powers - Specific Real Estate Transaction form and verify it. To ensure accuracy, consult your local legal advisor for assistance. Register and browse over 85,000 useful templates.

- To take advantage of the forms library, choose a subscription and create an account.

- If you have already registered, simply Log In and press the Download button.

- The Hawaii Limited Power of Attorney - Limited Powers - Specific Real Estate Transaction template will be automatically saved in the My documents section (a section for all forms you download from US Legal Forms).

- To set up a new account, follow the quick guidelines provided below.

- If you need to use a state-specific template, be sure to specify the correct state.

- If possible, review the description to grasp all the details of the document.

- Use the Preview feature if it’s offered to examine the document's details.

- If everything seems correct, click Buy Now.

Form popularity

FAQ

Limited power of attorney and specific power of attorney both focus on giving authority for certain tasks, but they differ in scope. A limited power of attorney allows the agent to perform a broad range of actions under specific circumstances, while a specific power of attorney limits authority to one particular task or decision. When navigating the complexities of a Hawaii Limited Power of Attorney - Limited Powers - Specific Real Estate Transaction, understanding these differences ensures that you choose the right option for your needs.

A limited power of attorney for an investment advisor grants them the right to make investment decisions on your behalf. This arrangement is especially useful when you want expert guidance without fully relinquishing control of your assets. By opting for a Hawaii Limited Power of Attorney - Limited Powers - Specific Real Estate Transaction, you can ensure that your investment objectives align with your overall financial goals, while also protecting your interests.

When considering different types of power of attorney, a limited power of attorney is often recommended for specific situations. This option restricts the authority granted to a designated person, making it ideal for tasks like real estate transactions or financial decisions. For those dealing with a Hawaii Limited Power of Attorney - Limited Powers - Specific Real Estate Transaction, this allows you to streamline the process while maintaining control over your affairs.

There are four primary types of power of attorney: general, limited, durable, and medical. A Hawaii Limited Power of Attorney - Limited Powers - Specific Real Estate Transaction falls under limited power, allowing you to grant authority for a specific task, such as handling a real estate transaction. General power of attorney provides broader authority for financial and legal matters, while durable power remains effective even if you become incapacitated. For medical decisions, a medical power of attorney is needed. USLegalForms offers detailed resources to help you understand these types and create the ideal document for your needs.

In Hawaii, the duration of a power of attorney depends on the terms laid out in the document. Typically, a Hawaii Limited Power of Attorney - Limited Powers - Specific Real Estate Transaction remains effective until the completion of the specified transaction or until revoked by the principal. It's important to specify the duration in the document to avoid any confusion. Consulting resources from USLegalForms can help provide clarity on how to set this appropriately.

Yes, for a Hawaii Limited Power of Attorney - Limited Powers - Specific Real Estate Transaction to be valid, it generally requires notarization. This step ensures that the document meets legal standards and protects the parties involved. Notarization helps verify the identity of the signers and confirms that they are signing voluntarily. Using a service like USLegalForms can streamline this process for you.

The limitations of a power of attorney include restrictions on the type of decisions the agent can make and the duration of the authority granted. Generally, a Hawaii Limited Power of Attorney is valid only for a specific time period or until a particular task is completed. Understanding these limitations is crucial when drafting or using a limited power of attorney for real estate transactions.

While a power of attorney offers flexibility, it also has drawbacks. It can potentially lead to misuse if the agent does not act in the principal's best interest. Furthermore, a Hawaii Limited Power of Attorney is only effective as long as the principal is legally capable, which may change if the principal's health deteriorates.

A power of attorney (POA) is not allowed to make decisions about the principal's personal matters, such as medical decisions, which may conflict with the principal's wishes. Additionally, a POA cannot alter or revoke a will, nor can they handle financial matters that fall outside of the granted powers. When using a Hawaii Limited Power of Attorney for a Specific Real Estate Transaction, it's essential to understand these limitations.

A special power of attorney in Hawaii is a legal document that allows an individual to appoint someone else to make decisions on their behalf for specific tasks. This can include activities like selling property or managing a real estate transaction. Effectively, a Hawaii Limited Power of Attorney is a common type of special power of attorney when focused on limited powers related to real estate.