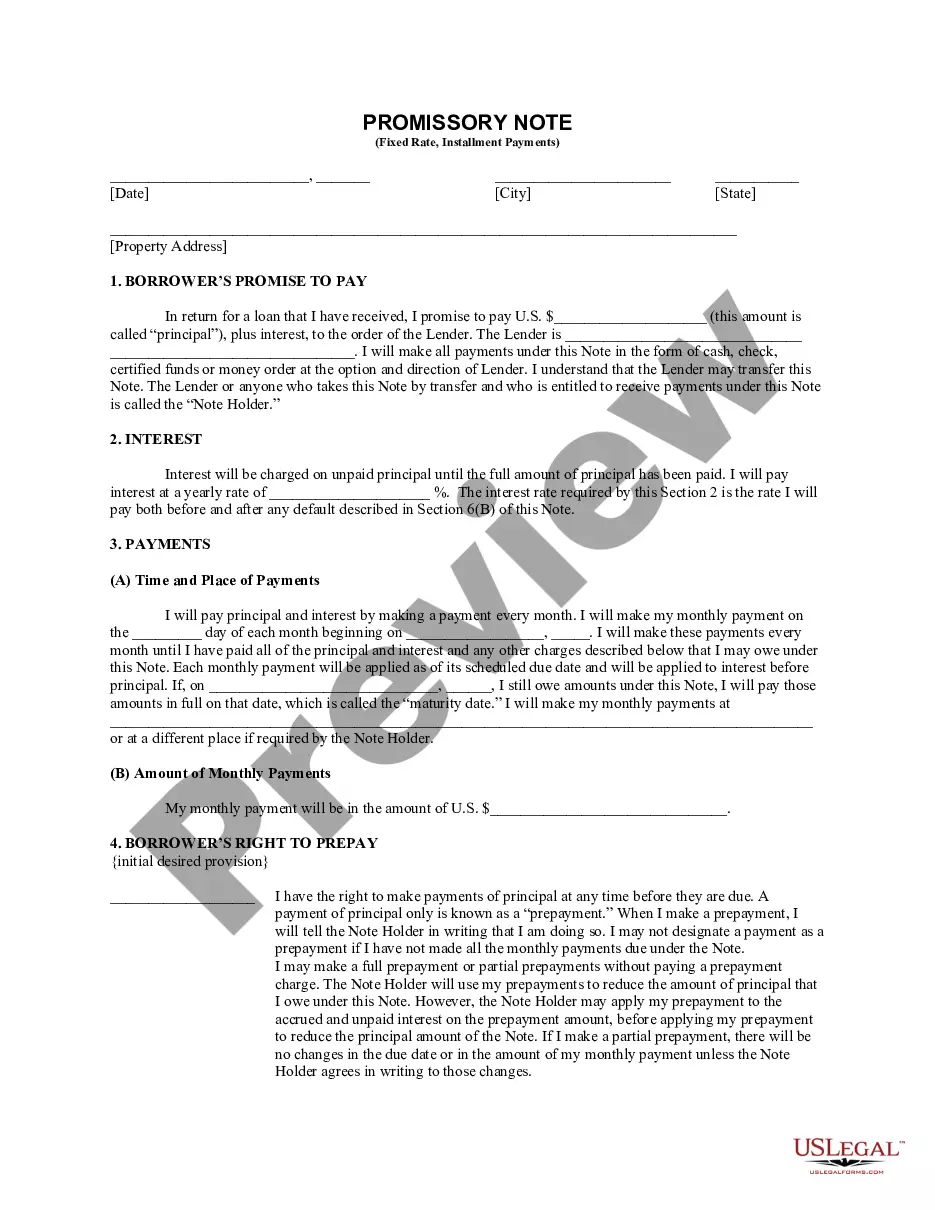

Hawaii Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Obtain access to the most comprehensive repository of legal documents.

US Legal Forms provides a means to locate any state-specific form in just a few clicks, including examples of Hawaii Installments Fixed Rate Promissory Notes Secured by Residential Real Estate.

There’s no need to squander hours searching for a legally acceptable form.

Use the Preview option if available to verify the document's information. If everything appears correct, click Buy Now. After selecting a pricing plan, register an account. Make payment via credit card or PayPal. Download the sample to your computer by clicking the Download button. That’s all! You should complete the Hawaii Installments Fixed Rate Promissory Note Secured by Residential Real Estate template and review it carefully. To ensure that everything is correct, consult your local legal advisor for assistance. Sign up and effortlessly browse more than 85,000 useful forms.

- Our knowledgeable experts guarantee that you receive current templates at all times.

- To utilize the document library, select a subscription plan and create an account.

- If you have already registered, simply Log In and then click Download.

- The Hawaii Installments Fixed Rate Promissory Note Secured by Residential Real Estate file will promptly be saved in the My documents section (a section for each form you download from US Legal Forms).

- To establish a new account, follow the straightforward instructions provided below.

- If you are going to utilize a state-specific template, ensure that you specify the accurate state.

- If possible, review the description to comprehend all the finer details of the form.

Form popularity

FAQ

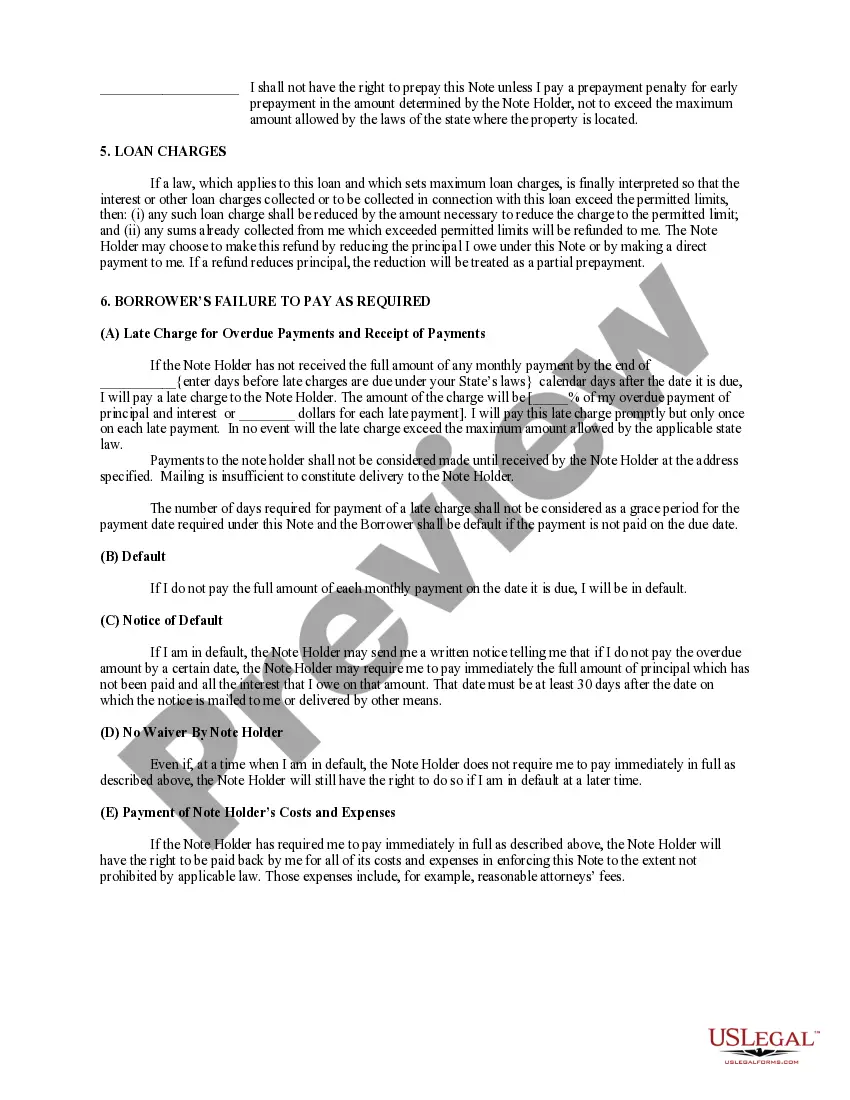

To secure a promissory note with real property, you must specify the property in the note and create a security agreement. This agreement outlines the lender's rights should the borrower default on their payments. Utilizing a Hawaii Installments Fixed Rate Promissory Note Secured by Residential Real Estate enables borrowers and lenders to clearly define these terms, ensuring a secure transaction.

A promissory note is not classified as real property; rather, it is a personal asset. However, when this note is secured by real estate, the property itself acts as collateral. In cases of default, the lender can claim the property as per the agreement outlined in the Hawaii Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

Yes, a promissory note can be secured by real property. This means that if the borrower does not fulfill their payment obligations, the lender can take possession of the property. In the context of a Hawaii Installments Fixed Rate Promissory Note Secured by Residential Real Estate, this arrangement provides security for the lender and motivates timely payments from the borrower.

You can easily obtain a Hawaii Installments Fixed Rate Promissory Note Secured by Residential Real Estate through online platforms like US Legal Forms. Their user-friendly service offers templates that meet state-specific requirements, ensuring your note is valid and enforceable. Simply choose the relevant form, fill in your details, and you will have your promissory note ready for your mortgage. This streamlined process simplifies your home financing journey.

Once you have signed the Promissory Note, the bank will make a book entry of a deposit into a bank Demand Deposit Account in the amount of your note, and show that amount as an "asset" to the bank. Remember there must be a corresponding and matching ledger entry as a liability. The loan is for $100,000.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

Enforcing a secured promissory note is simply a matter of either repossessing the secured asset through your own efforts, or hiring a professional agency to accomplish the task on your behalf. These agencies will charge a set fee for their services, but they usually have a very high rate of success.

A Promissory Note with Installment Payments specifies and documents the terms of a loan that will be paid back with consistent, equal, payments.You're a borrower and are agreeing to a loan with installments. You're in the business of loans or manage a loan company.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.