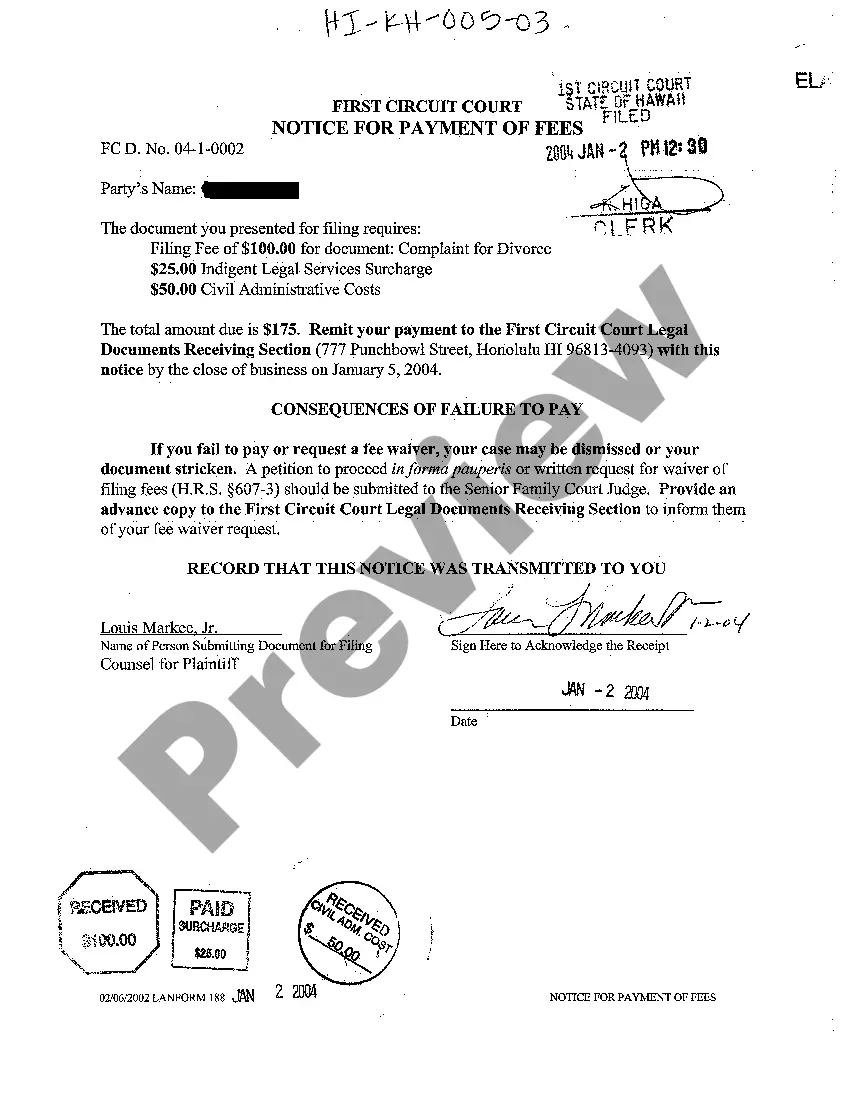

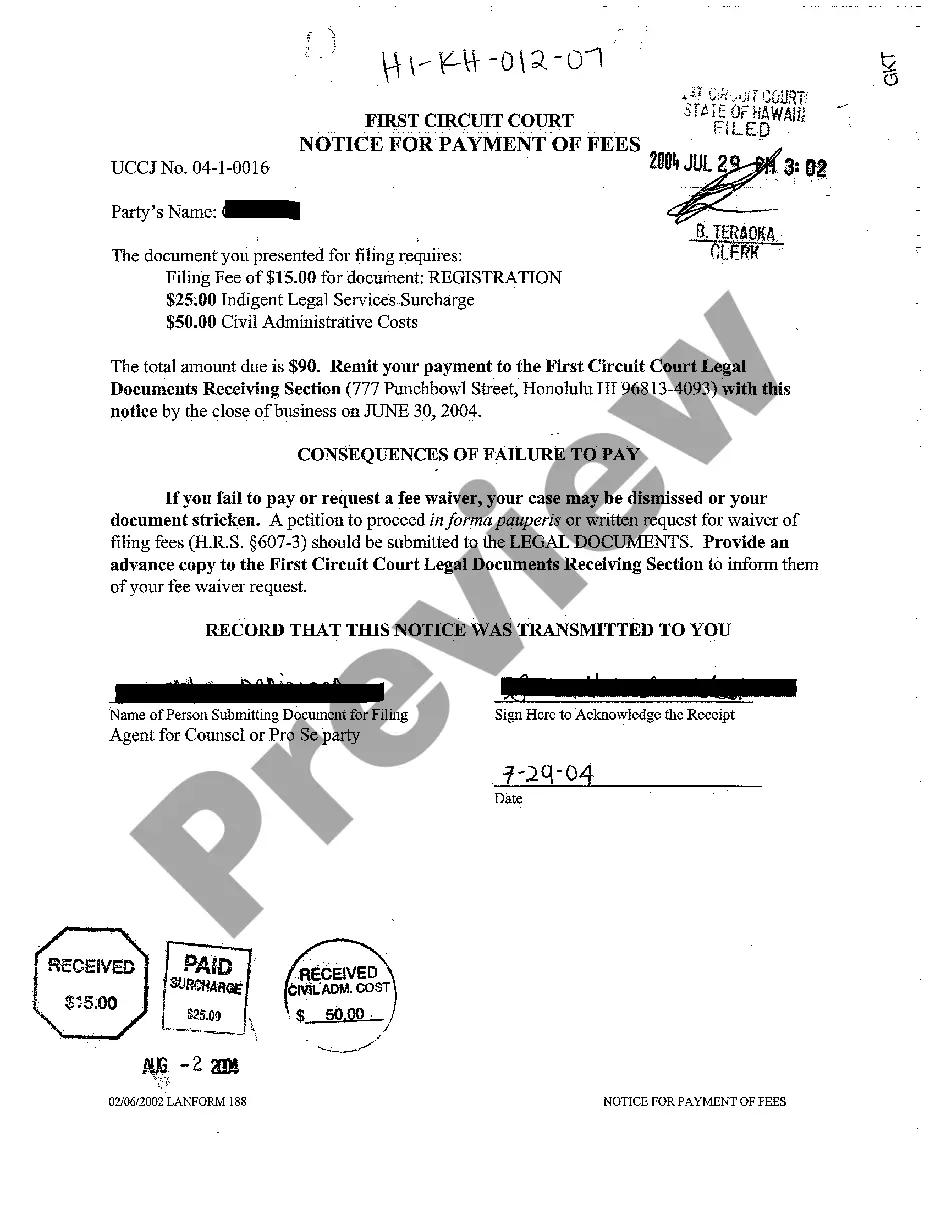

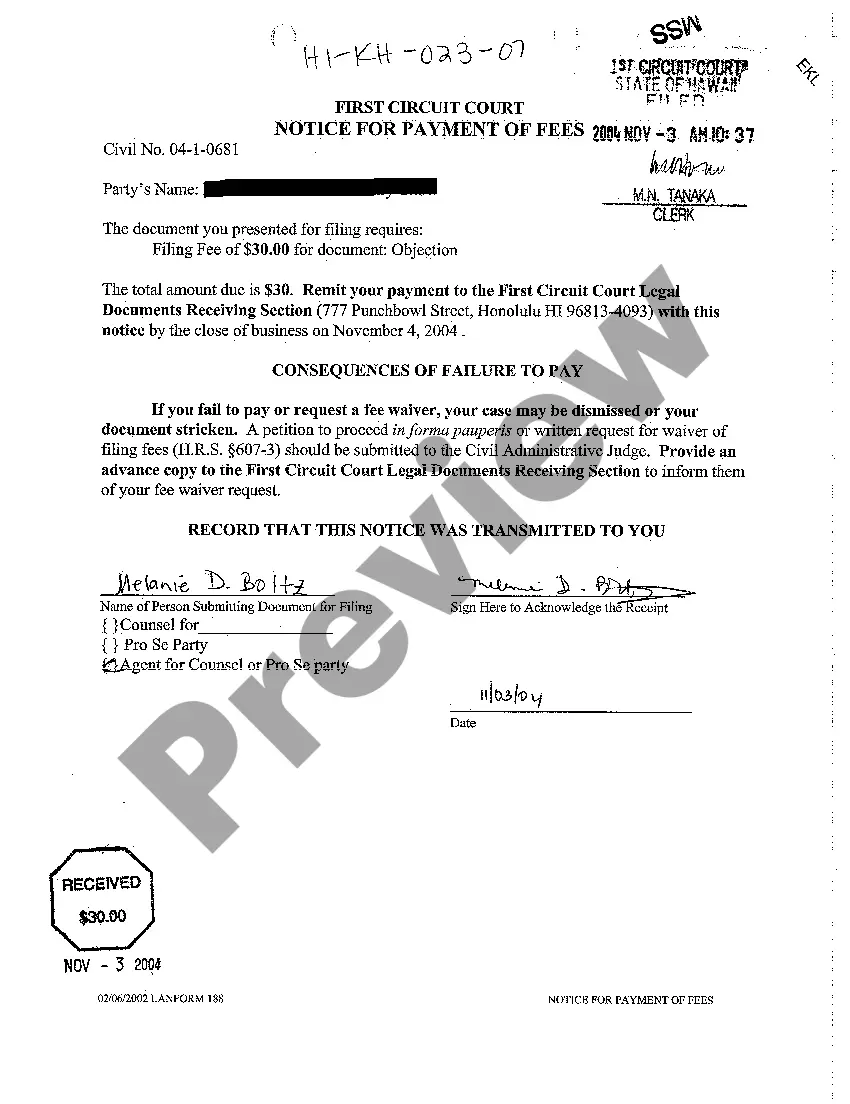

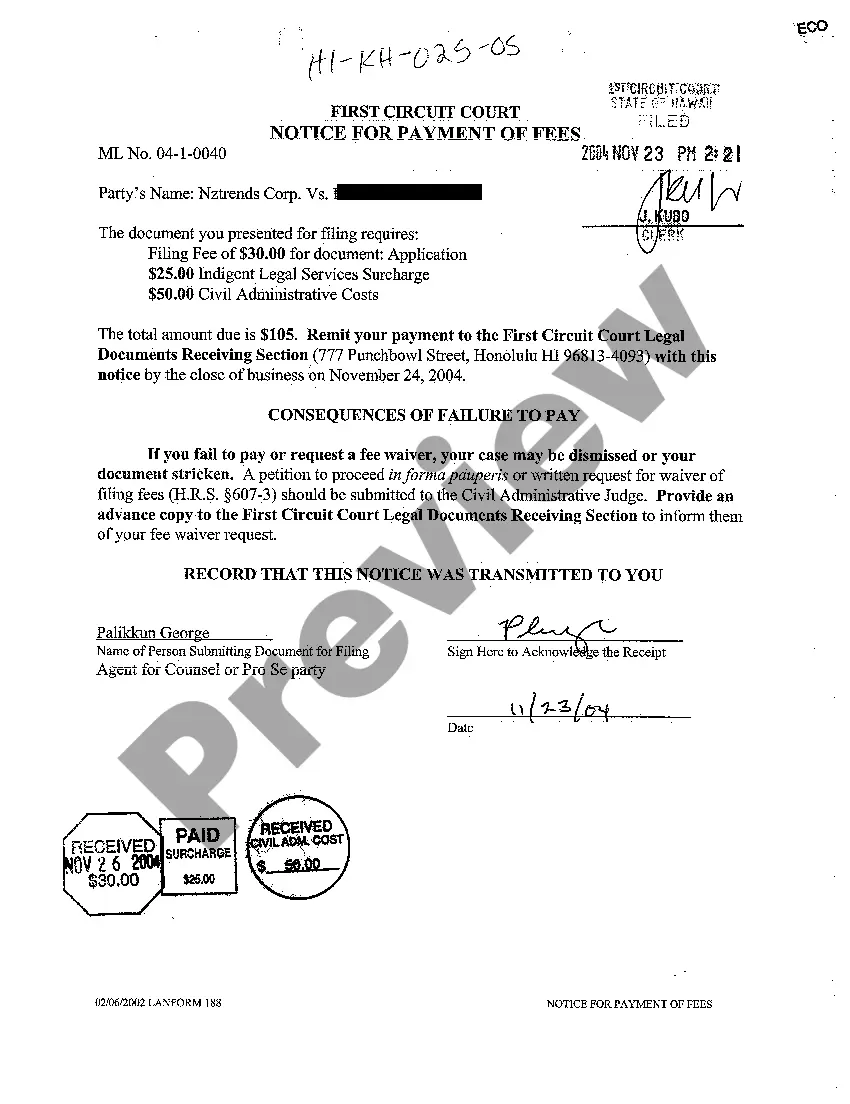

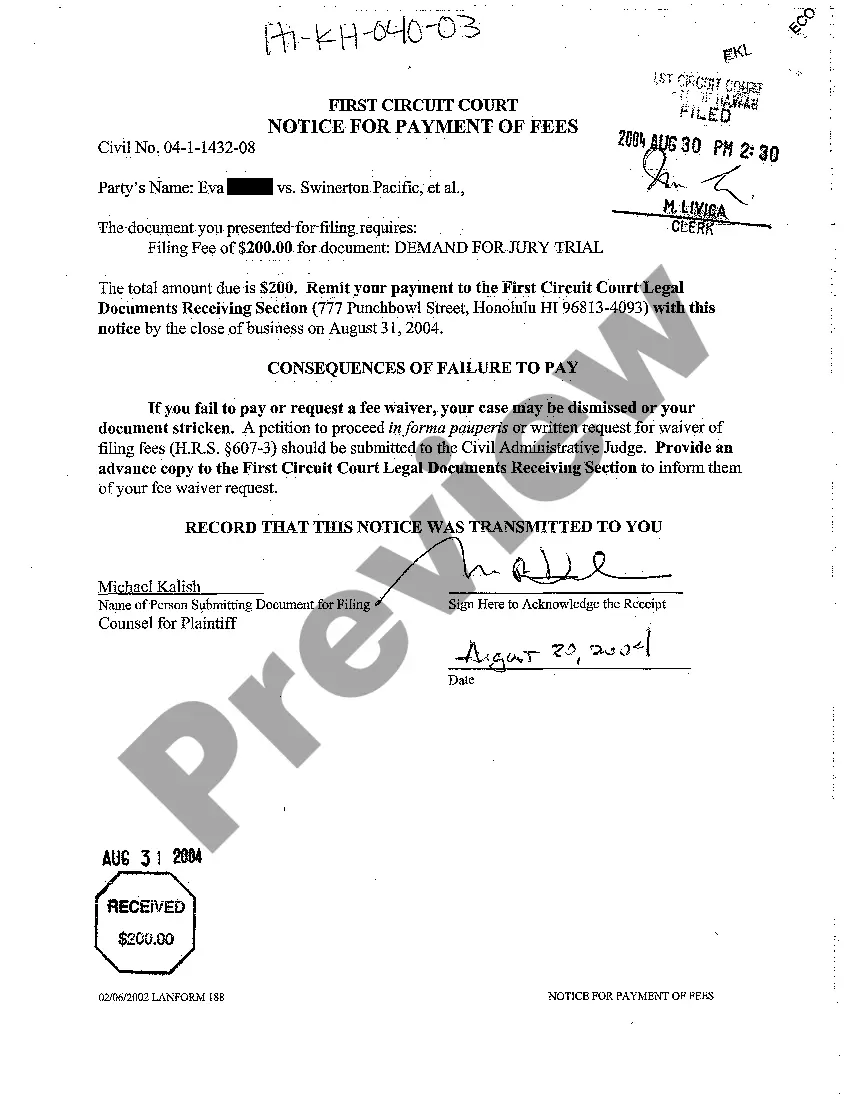

Hawaii Notice for Payment of Fees

Description

How to fill out Hawaii Notice For Payment Of Fees?

Amidst numerous paid and complimentary instances available online, you cannot be certain of their precision and dependability.

For instance, who created them or if they possess the expertise required to address your specific needs.

Always stay composed and utilize US Legal Forms!

Click Buy Now to initiate the ordering procedure or search for another template using the Search field in the header. Select a pricing plan, register for an account, and make your payment using your credit/debit card or Paypal. Download the form in your desired file format. Once you have registered and purchased your subscription, you can utilize your Hawaii Notice for Payment of Fees as frequently as needed while it remains active in your location. Edit it in your preferred editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Discover Hawaii Notice for Payment of Fees templates crafted by proficient attorneys and bypass the expensive and laborious task of seeking out a lawyer and subsequently paying them to draft documents that you can locate yourself.

- If you currently hold a subscription, Log In to your account and locate the Download button next to the file you are searching for.

- You will also have access to your previously saved files in the My documents section.

- If you are using our service for the first time, adhere to the instructions below to quickly obtain your Hawaii Notice for Payment of Fees.

- Ensure that the document you find is legitimate in the state where you reside.

- Examine the file by reviewing the description using the Preview feature.

Form popularity

FAQ

To obtain a payment plan in Hawaii, contact your local tax office and express your need for assistance. They will review your financial situation and the details specified in the Hawaii Notice for Payment of Fees. It is important to be prepared with your income and expense information to discuss potential options. The uslegalforms platform may also have resources to help you draft necessary forms for setting up your payment plan.

Qualifying for penalty abatement typically includes individuals who have faced financial hardships, medical emergencies, or other significant life events. Each case is assessed based on the circumstances surrounding the penalties indicated in the Hawaii Notice for Payment of Fees. It is essential to gather thorough documentation that supports your claim and demonstrates the reasons for your request. If you're unsure, uslegalforms offers guidance on eligibility and the required steps.

In Hawaii, property taxes can go unpaid for up to three years before the county can initiate foreclosure proceedings. It is essential to keep an eye on the Hawaii Notice for Payment of Fees, as accruing penalties can add to the total amount owed. To avoid complications, consider setting up a payment plan or addressing any penalties through abatement if necessary. Staying proactive is crucial to maintaining your property ownership.

Writing a penalty abatement request letter involves clearly stating the reasons for your request while including relevant details. Be sure to reference the Hawaii Notice for Payment of Fees to align your request with local requirements. Start with your personal information, specify the penalties in question, and provide a compelling explanation of your circumstances. Using templates from uslegalforms can give you a professional format to present your case.

To get a penalty abatement in Hawaii, you must submit a request along with any supporting documentation that explains your situation. The Hawaii Notice for Payment of Fees provides a clear outline of the process, making it easier for you to understand your rights and responsibilities. You may also want to check eligibility criteria and gather necessary records to strengthen your case. Utilizing the tools available on the uslegalforms platform can help you create the appropriate forms effectively.

The G45 form is used for filing periodic general excise tax returns, while the G49 form functions as an annual reconciliation report. The G45 is submitted monthly or quarterly, depending on your business, while the G49 summarizes your tax obligations for the entire year. Understanding these differences facilitates compliance with your Hawaii Notice for Payment of Fees.

The Hawaii G-49 form is an annual reconciliation form for general excise tax. This form allows taxpayers to reconcile their gross income and tax payments throughout the year. Being diligent about this form helps in managing responsibilities related to your Hawaii Notice for Payment of Fees.

The 1099-G form in Hawaii is used to report certain government payments, such as tax refunds, credits, or offsets, issued to individuals. It helps taxpayers understand their financial standing and potential tax obligations. Keeping track of these forms is important for clarity regarding your Hawaii Notice for Payment of Fees.

To submit Hawaii form G-49, you should send it to the Department of Taxation at P.O. Box 1425, Honolulu, Hawaii 96806-1425. Proper mailing is essential for ensuring that your forms are processed efficiently, especially in relation to your Hawaii Notice for Payment of Fees.

The G45 and G49 forms serve different purposes in Hawaii's tax system. Form G45 is used for general excise tax returns, while G49 serves as the annual reconciliation form. Understanding these differences helps ensure you accurately complete your Hawaii Notice for Payment of Fees.