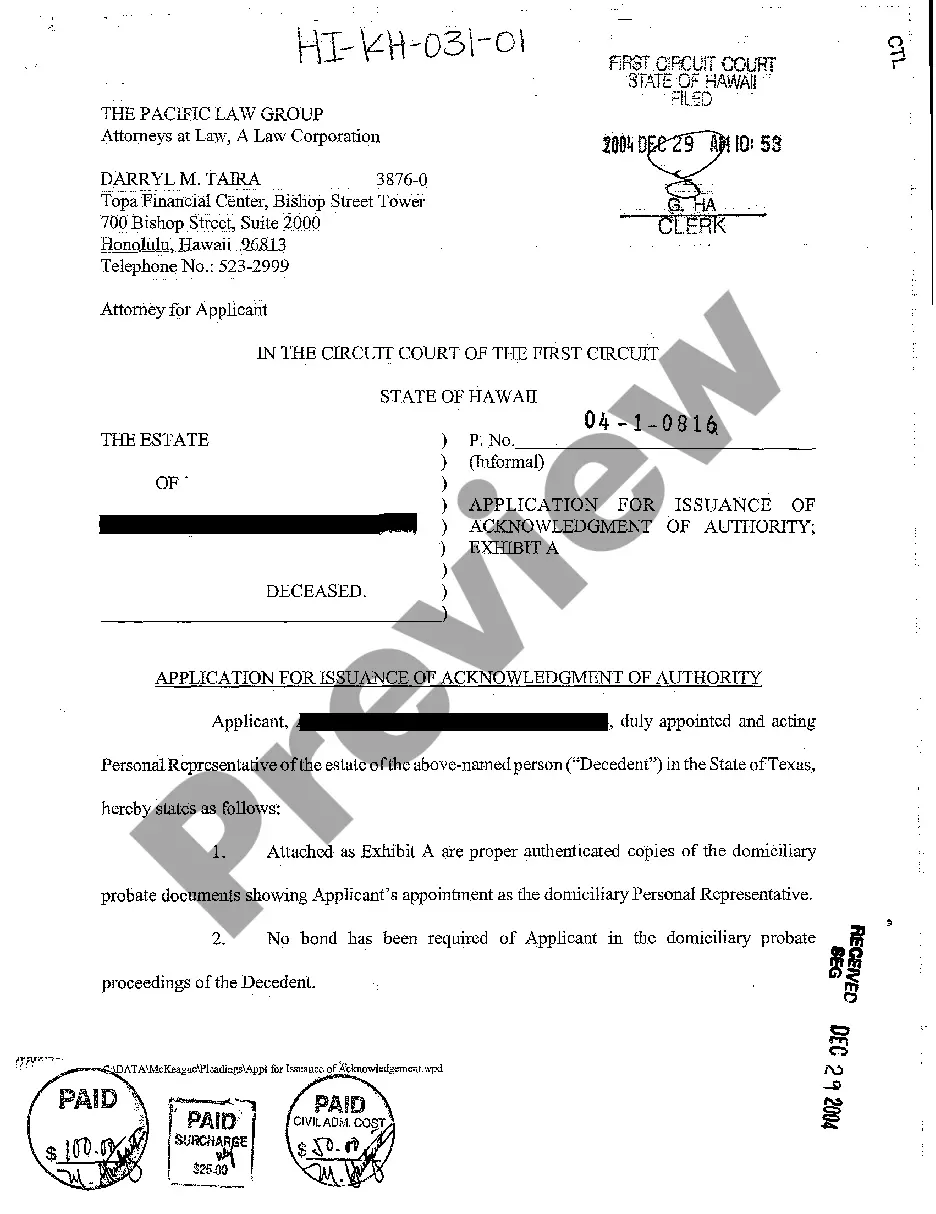

Hawaii Application for Issuance of Acknowledgment of Authority

Description

How to fill out Hawaii Application For Issuance Of Acknowledgment Of Authority?

Among countless paid and free templates that you can discover online, you cannot be certain about their validity.

For instance, who created them or if they possess the necessary qualifications to fulfill your requirements.

Stay calm and utilize US Legal Forms!

Check the template by reviewing the information using the Preview option. Click Buy Now to initiate the purchase process or look for another template using the Search function located in the header. Select a pricing plan and set up an account. Complete the payment for the subscription using your credit/debit card or Paypal. Download the document in your desired format. Once you’ve registered and purchased your subscription, you can use your Hawaii Application for Issuance of Acknowledgment of Authority as many times as you want or as long as it remains active where you reside. Edit it in your preferred offline or online editor, complete it, sign it, and print it. Achieve much more for less with US Legal Forms!

- Find Hawaii Application for Issuance of Acknowledgment of Authority templates crafted by experienced lawyers.

- Avoid the expensive and lengthy process of seeking an attorney and then compensating them to create a document for you that you can easily locate on your own.

- If you already have a subscription, Log In to your account and find the Download button adjacent to the form you are looking for.

- You'll also have access to all of your previously obtained documents in the My documents section.

- If you are using our website for the first time, follow the instructions below to quickly obtain your Hawaii Application for Issuance of Acknowledgment of Authority.

- Ensure that the document you find is applicable in your state.

Form popularity

FAQ

In Hawaii, you typically must file probate within three months of the person's death. This timeline is crucial for ensuring that debts are settled and assets are distributed according to the deceased's wishes. Delaying the filing can lead to complications and potential disputes among heirs. Using resources like the Hawaii Application for Issuance of Acknowledgment of Authority can guide you through the process and help you meet critical deadlines effectively.

To avoid probate in Hawaii after death, consider setting up a revocable living trust. This allows your assets to pass directly to beneficiaries without going through the court process. Additionally, you can designate beneficiaries on accounts and property, which helps transfer your assets efficiently. Using the Hawaii Application for Issuance of Acknowledgment of Authority can further streamline the management of your estate and help avoid potential probate complications.

The minimum estate value for probate in Hawaii is generally set at $100,000. If the total value of the deceased's assets falls below this threshold, probate is often not required. However, unique circumstances can influence this decision, so it’s wise to consult with a legal professional. Leveraging the Hawaii Application for Issuance of Acknowledgment of Authority can assist you in navigating legal requirements and effectively managing the estate.

Yes, in Hawaii, there is a minimum estate value that typically necessitates probate. As mentioned, if the estate exceeds $100,000, probate becomes necessary. This value encompasses all real and personal property left by the deceased. For efficient handling of the estate, you may want to consider using the Hawaii Application for Issuance of Acknowledgment of Authority to facilitate the probate process.

Probate in Hawaii is triggered when an individual passes away and leaves behind assets that are solely in their name. Factors like value and type of assets often play a role in determining whether probate is necessary. If your loved one had a will, the probate process will also validate that document. Utilizing the Hawaii Application for Issuance of Acknowledgment of Authority can streamline this process and ensure compliance with state laws.

In Hawaii, the threshold for probate is generally based on the total value of the estate. If the estate's value exceeds $100,000, it typically triggers the probate process. This includes all assets owned by the deceased. To navigate this process smoothly, obtaining a Hawaii Application for Issuance of Acknowledgment of Authority can be essential for managing estate affairs.

The probate threshold in Hawaii is currently set at $100,000, which determines when an estate must undergo probate proceedings. This threshold influences how you file the Hawaii Application for Issuance of Acknowledgment of Authority. If your estate exceeds this threshold, take appropriate steps to manage it effectively. Keeping this amount in mind aids in navigating the complexities of the probate process.

In Hawaii, an estate must typically be valued at more than $100,000 to require probate proceedings. This threshold is crucial for understanding your legal obligations regarding the Hawaii Application for Issuance of Acknowledgment of Authority. If an estate falls below this amount, it may not need to go through probate, potentially simplifying the process. Knowing your estate's value helps in planning effectively.

To file a will in Hawaii, you begin by submitting the document to the appropriate probate court in your district. It is important to include the Hawaii Application for Issuance of Acknowledgment of Authority as part of your filing. Following the necessary protocols can help streamline the probate process. Utilizing platforms like uslegalforms can simplify making sure you have all required documents ready.

Rule 48 addresses the requirements for filing claims against an estate in Hawaii probate. When you are involved in probate, knowing this rule can help you navigate your responsibilities effectively. It ensures that your submissions, including the Hawaii Application for Issuance of Acknowledgment of Authority, comply with the court’s expectations. Proper adherence to these requirements helps protect your rights and interests.