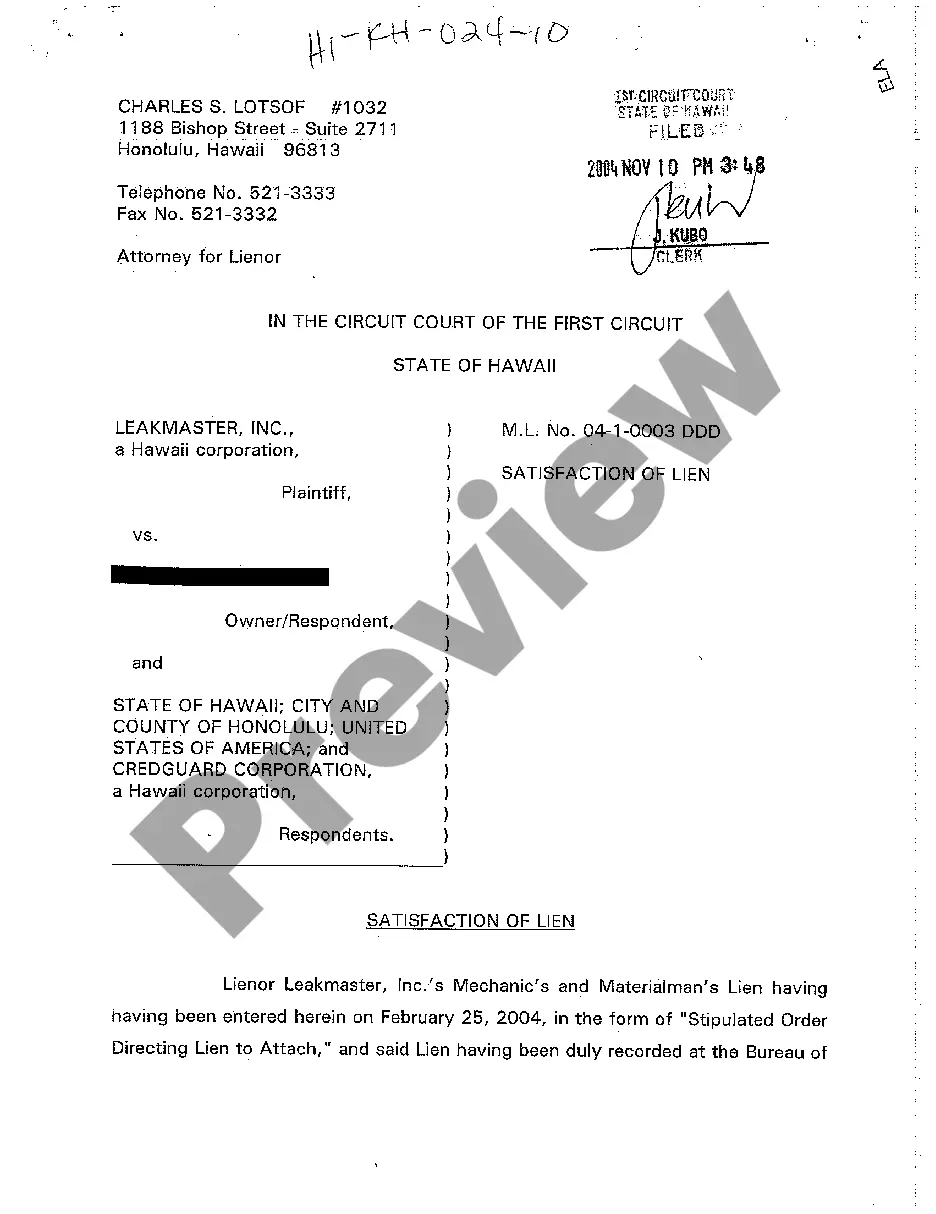

Hawaii Satisfaction of Lien

Description

How to fill out Hawaii Satisfaction Of Lien?

Among numerous paid and complimentary examples that you can locate on the web, you cannot guarantee their precision.

For instance, who developed them or if they possess enough expertise to address your requirements.

Always stay calm and utilize US Legal Forms!

Click Buy Now to initiate the purchasing process or search for another template utilizing the Search field located in the header.

- Find Hawaii Satisfaction of Lien templates crafted by proficient attorneys and steer clear of the costly and lengthy task of searching for a lawyer and subsequently compensating them to draft a document for you that you can effortlessly obtain yourself.

- If you currently hold a subscription, Log In to your account and locate the Download button adjacent to the file you need.

- You will also gain access to all of your previously downloaded templates in the My documents section.

- If this is your first time utilizing our service, follow the guidance below to acquire your Hawaii Satisfaction of Lien effortlessly.

- Ensure that the document you find is applicable in the state where you reside.

- Examine the template by reviewing the description using the Preview function.

Form popularity

FAQ

A lien release itself does not expire, but it’s essential to ensure it is filed properly and recorded. Once a debt is satisfied, the lien release should be documented with the Bureau of Conveyances to formally remove the lien from the property records. If not completed, the lien may still appear on public records, impacting future transactions. Understanding the Hawaii Satisfaction of Lien process helps ensure your records remain clear.

In Hawaii, the statute of limitations on tax liens is generally 10 years. After this period, the lien may become unenforceable unless it has been renewed or extended. Tax authorities in Hawaii have specific guidelines for lien management, so it's crucial to stay informed. Once a tax lien is resolved, you can focus on achieving a Hawaii Satisfaction of Lien.

You can check for liens on a property in Hawaii by visiting the Bureau of Conveyances’ website or their office. They provide access to public records that list all recorded liens. Searching by the property address or the owner's name will yield the most accurate results. Understanding any existing liens is crucial before pursuing a Hawaii Satisfaction of Lien later.

To file a lien on a property in Hawaii, you must complete the appropriate lien form and submit it to the Bureau of Conveyances. Make sure to provide all necessary information, such as the property details and the amount owed. After submitting it, the Bureau will record your lien, officially making it part of the public record. Once filed, you can focus on the process of Hawaii Satisfaction of Lien when payments are made.

In Hawaii, the minimum amount for filing a mechanic's lien is generally $1,000. This threshold represents the minimum value of work or materials provided that allows a contractor or supplier to complain legally. Knowing this amount can aid in determining whether you qualify for a Hawaii Satisfaction of Lien.

Hawaii mechanic's liens are enforced through legal procedures, primarily by filing a lawsuit against the property owner. If the case is successful, the court may mandate that payment is made or allow for the property to be sold to recover the owed amounts. Understanding how to pursue a Hawaii Satisfaction of Lien can be crucial for effective enforcement.

To place a lien on a property in Hawaii, you will need to complete specific documents that declare the amount owed and provide a description of the property. Submit these documents to the appropriate office, which is typically the Bureau of Conveyances. Additionally, working with UsLegalForms can help ensure a smooth process for achieving a Hawaii Satisfaction of Lien.

Yes, a contractor can file a lien without the homeowner's prior knowledge if they fulfill legal requirements. The law dictates that necessary notices must be provided, but not all homeowners are aware of these obligations. To avoid surprises, educating yourself about the potential for a Hawaii Satisfaction of Lien is beneficial.

The mechanic's lien is powerful because it grants workers a legal claim to the property until they receive payment for services rendered. This lien can affect the property's ability to be sold or refinanced, encouraging owners to settle debts promptly. Understanding how to navigate a Hawaii Satisfaction of Lien can strengthen your position in negotiations.

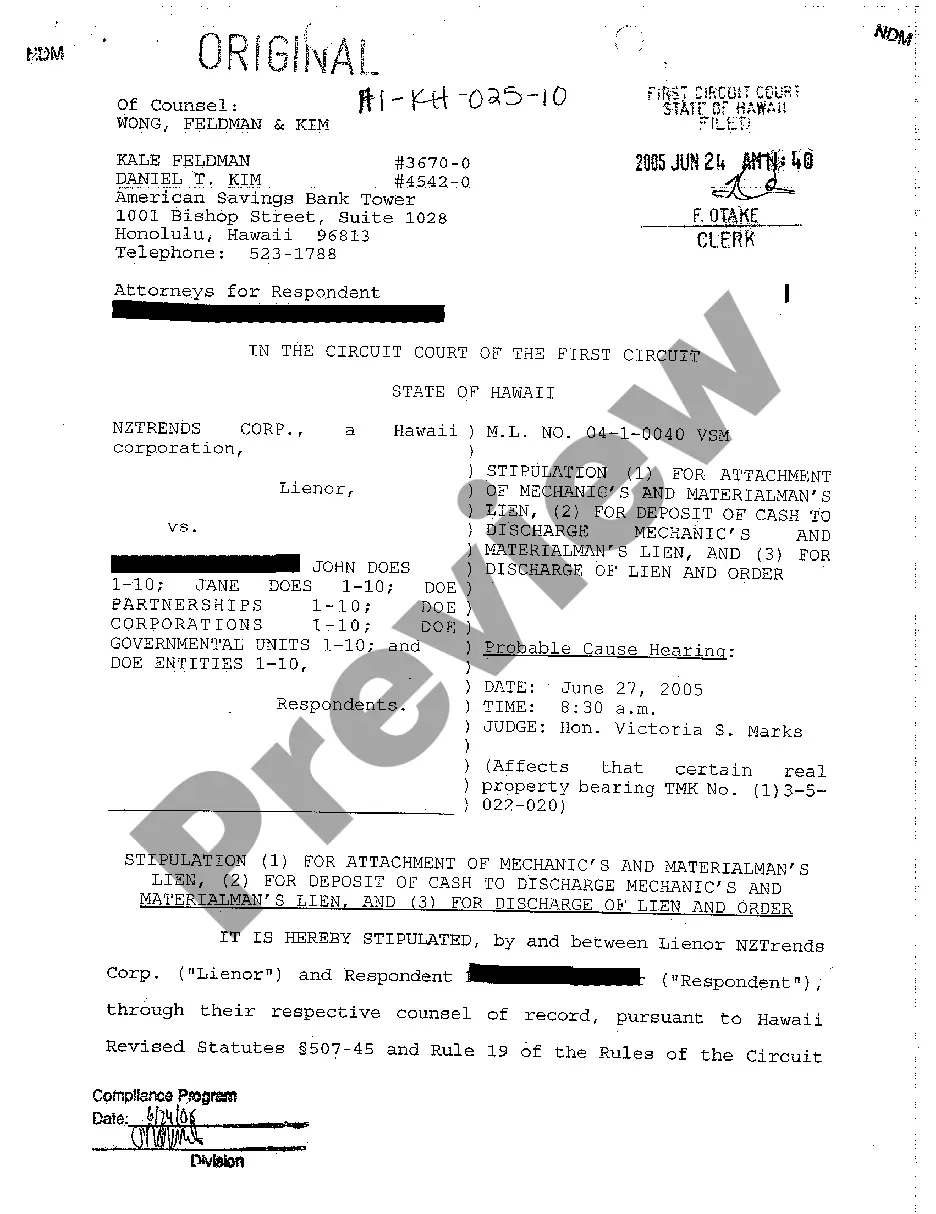

To file a mechanics lien in Hawaii, you must prepare a detailed document that states the amount due and describes the property. You then submit this document to the Bureau of Conveyances within a specific time frame, generally within 45 days of completing your work. For assistance, consider using platforms like UsLegalForms to streamline your Hawaii Satisfaction of Lien process.