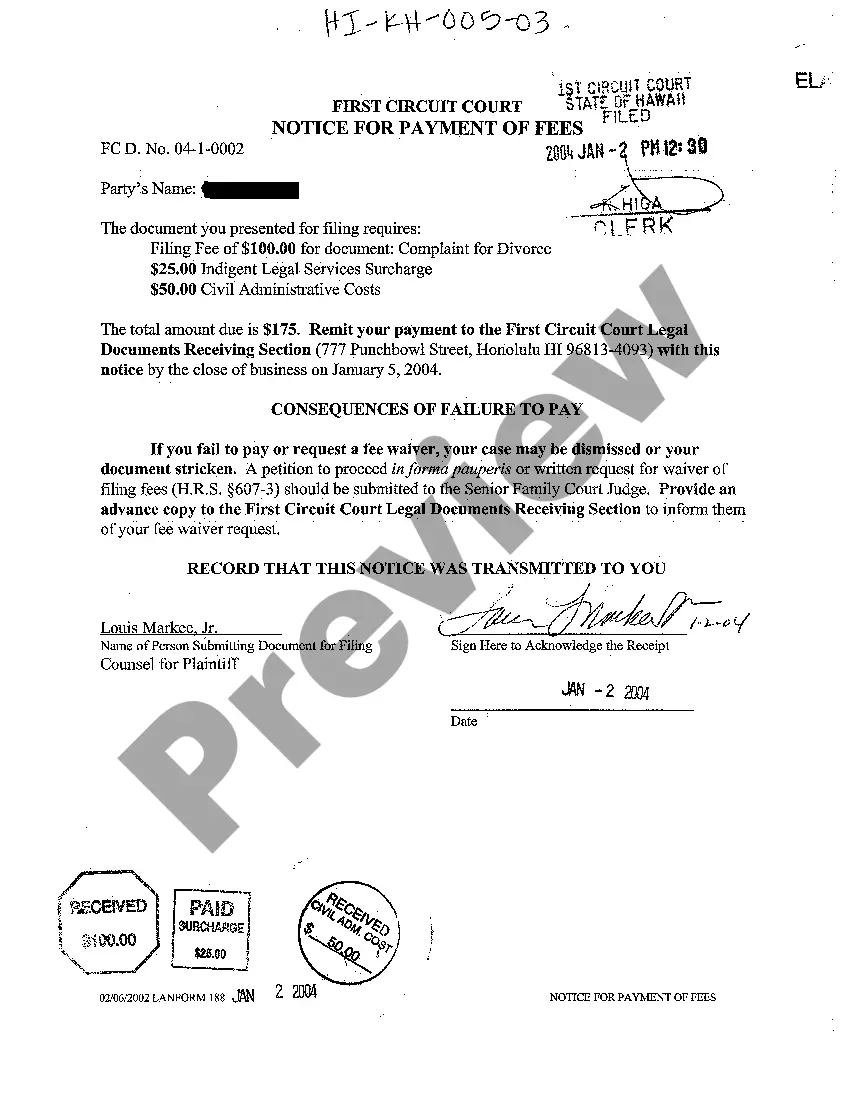

Hawaii Notice for Payment of Fees

Description

How to fill out Hawaii Notice For Payment Of Fees?

Among numerous paid and complimentary examples available online, you cannot guarantee their precision.

For instance, who created them or if they possess the necessary skills to handle your requirements.

Always remain calm and take advantage of US Legal Forms!

Click Buy Now to commence the purchasing process or search for another example using the Search bar located in the header. Select a pricing plan to register for an account. Complete the payment for the subscription using your credit/debit card or Paypal. Download the form in the desired format. Once you have registered and purchased your subscription, you can utilize your Hawaii Notice for Payment of Fees as many times as necessary or as long as it remains valid in your area. Revise it with your preferred editor, fill it out, sign it, and print it. Achieve more for less with US Legal Forms!

- Find Hawaii Notice for Payment of Fees templates crafted by expert attorneys and avoid the expensive and time-draining task of searching for a lawyer, only to pay them for drafting a document for you that you may obtain yourself.

- If you have a subscription, Log In to your account and locate the Download button adjacent to the file you are seeking.

- You will also have access to all your previously saved templates in the My documents section.

- If this is your first time using our platform, adhere to the steps below to quickly acquire your Hawaii Notice for Payment of Fees.

- Ensure the document you are viewing is suitable for your location.

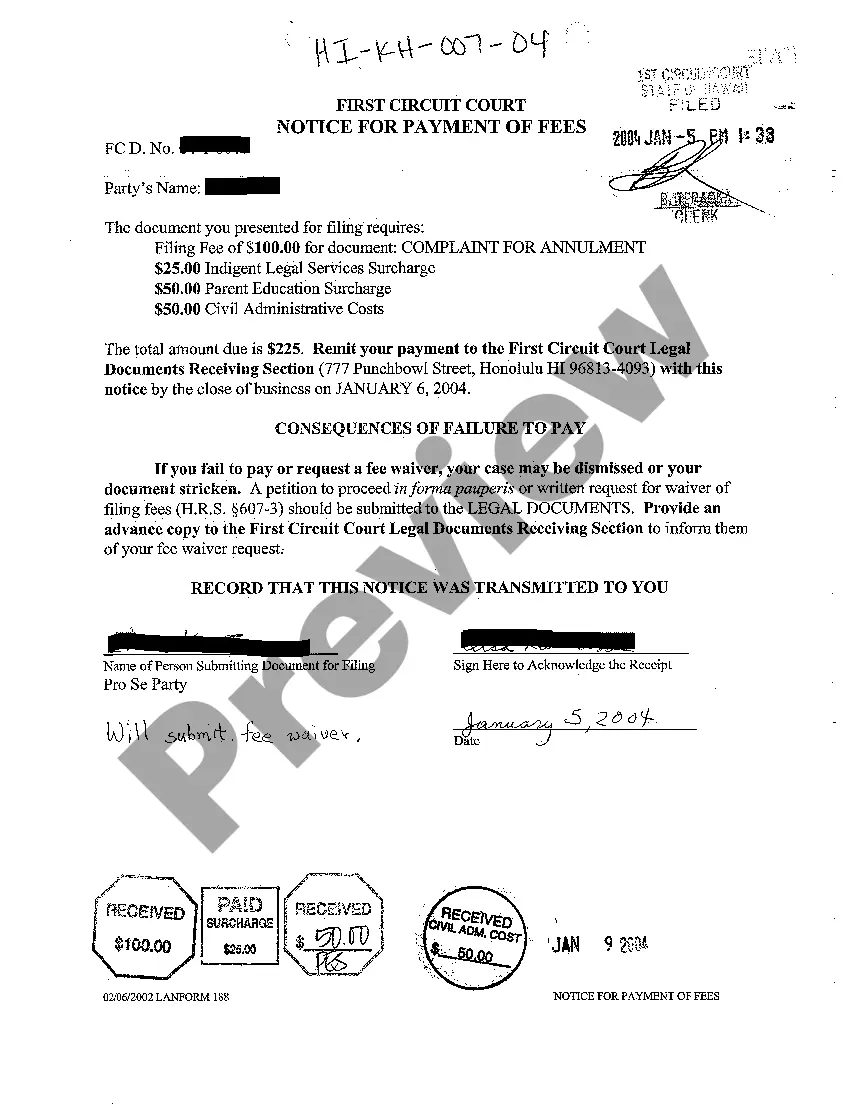

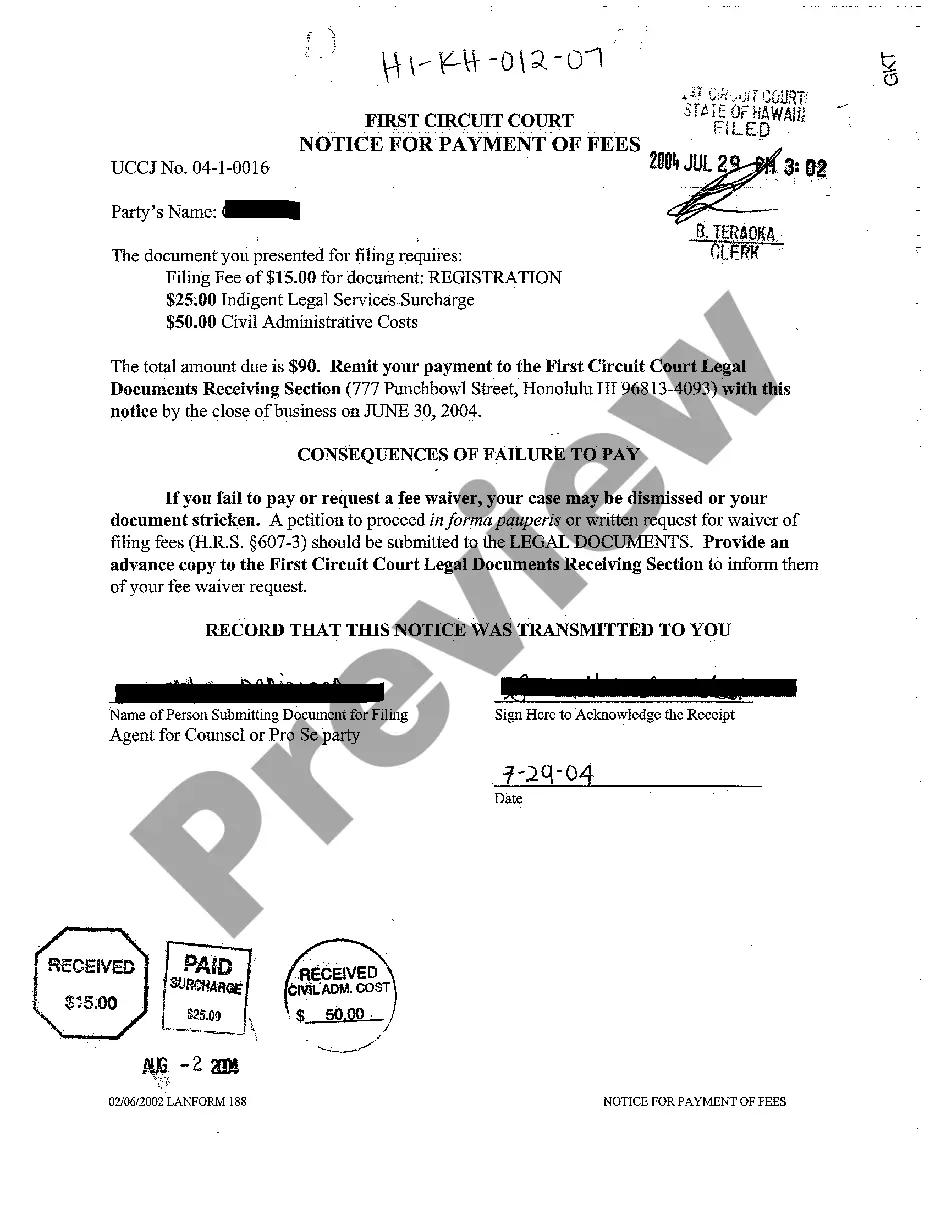

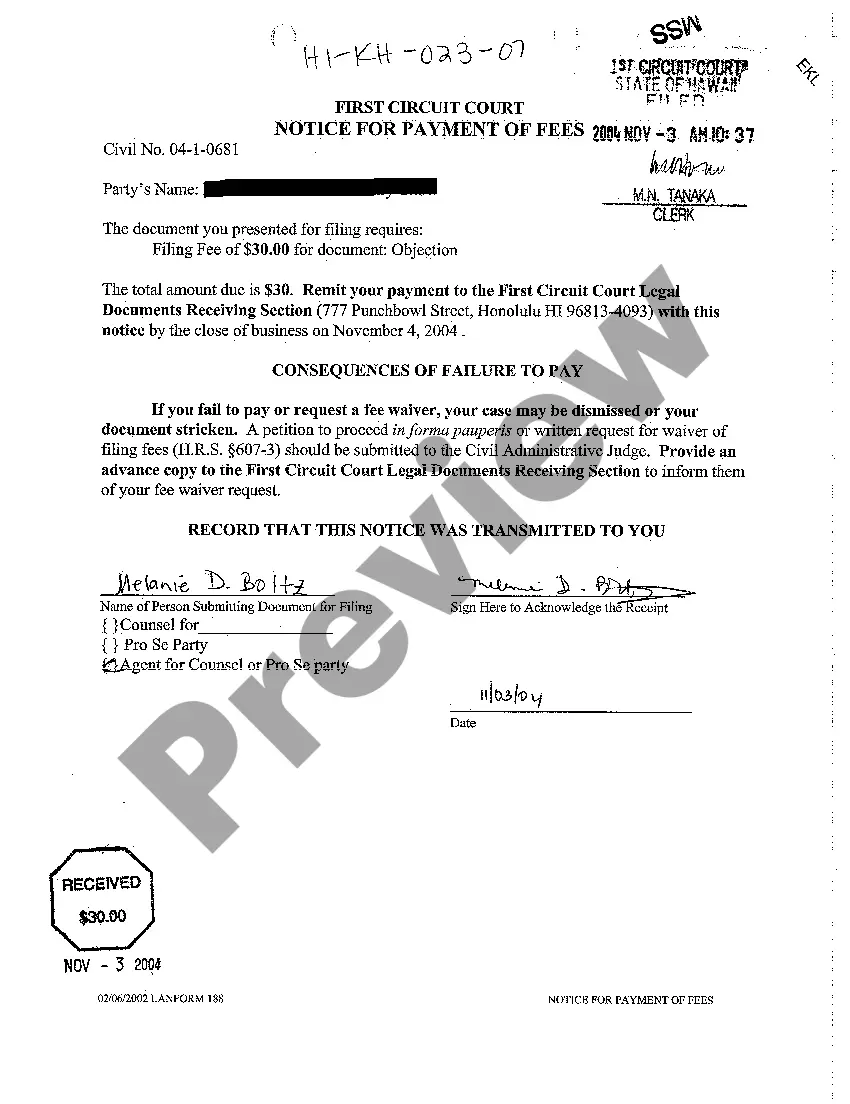

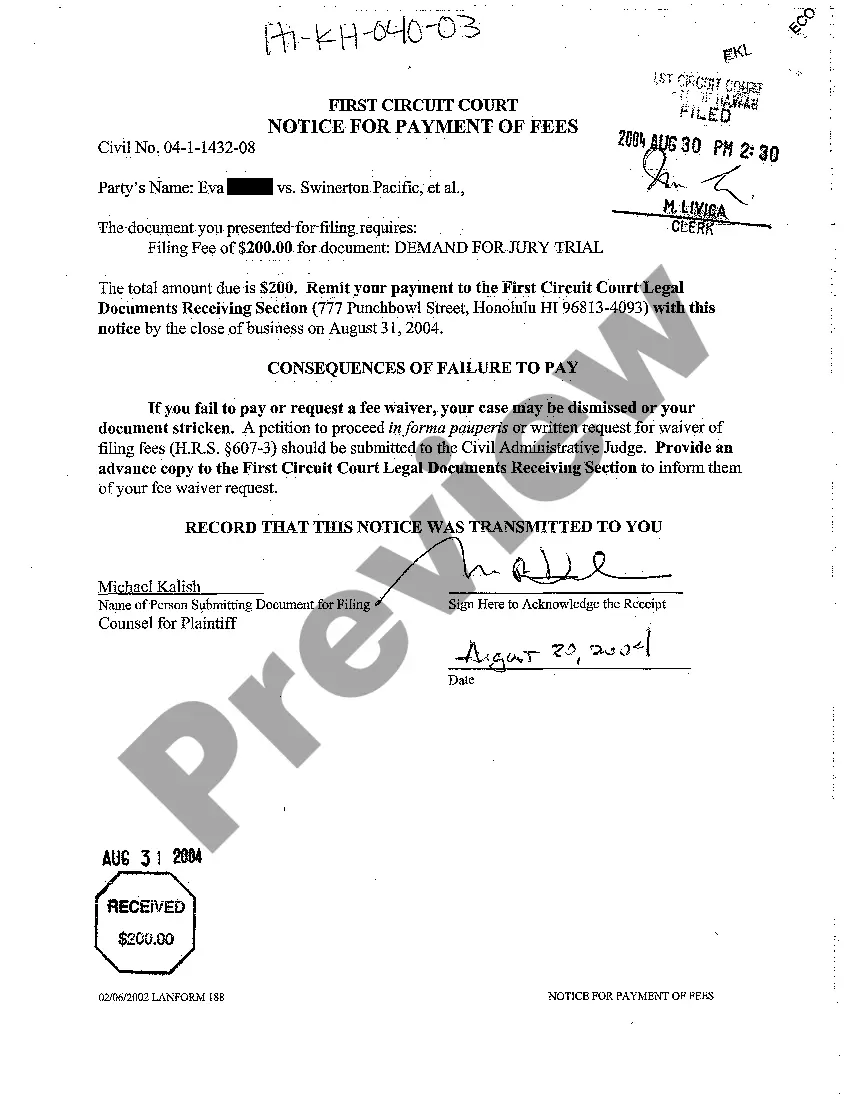

- Examine the template by reviewing the description using the Preview feature.

Form popularity

FAQ

To set up a payment plan in Hawaii, start by visiting the official tax office website or calling them for guidance. You will need to complete an application detailing your financial situation and payment capability. Including the Hawaii Notice for Payment of Fees in your application may provide additional support for your case. Once your application is reviewed, the tax office will inform you of the terms of your payment plan.

Requesting a payment plan for taxes owed in Hawaii involves contacting the tax office directly or using their online services. You'll need to provide your tax information and specify the amount you owe, along with your proposed monthly payments. Utilizing the Hawaii Notice for Payment of Fees as part of your documentation can strengthen your request. Make sure your proposal is reasonable to increase your chances of approval.

To obtain penalty abatement in Hawaii, you must submit a request through the appropriate tax authority. Typically, this request should include a valid reason for the abatement and any supporting documentation. Using the Hawaii Notice for Payment of Fees can help clarify your situation and expedite the process. It's advisable to consult with a tax professional to ensure you meet all requirements and effectively present your case.

The main difference between G45 and G49 forms in Hawaii lies in their purpose and usage. Form G45 is for periodic tax returns, while Form G49 is specifically for annual reconciliation. It's important to recognize these distinctions to adhere to the requirements of the Hawaii Notice for Payment of Fees effectively. Utilizing resources such as USLegalForms can assist you in selecting the appropriate forms and ensuring accurate submissions.

In Hawaii, failing to properly execute an Electronic Funds Transfer (EFT) can result in penalties. These penalties may involve fines or additional fees attached to missed deadlines set forth in the Hawaii Notice for Payment of Fees. Ensuring your payments are submitted correctly and on time can help you avoid these financial setbacks. You can manage and monitor your filing obligations through platforms like USLegalForms to mitigate risks.

Mail Hawaii Form G-49 to the Department of Taxation as indicated on the form instructions. It is crucial to send this form to the right address to avoid any delays in processing. Properly following the guidelines in the Hawaii Notice for Payment of Fees can help you maintain compliance. For further assistance with form submissions, check out the resources available on USLegalForms.

You should mail Form n=20 in Hawaii to the Department of Taxation. Specifically, send it to the address provided on the form, ensuring you use the correct postage. Keep in mind that timely submission is essential to meet the requirements outlined in the Hawaii Notice for Payment of Fees. To simplify this process, consider using USLegalForms for reliable mailing options.

For regular claims, Hawaii does not impose a set maximum, but each court type has its distinct limits. For example, if you pursue a claim in district court, the limits are higher than in small claims court. If you find yourself in need of settlements, consider sending a Hawaii Notice for Payment of Fees. This notice can clarify obligations and prompt timely payments, ensuring you're moving in the right direction.

In Hawaii, the maximum amount you can sue for typically depends on the court in which you file. Small claims court allows claims up to $3,500, while other civil courts may permit larger claims. If you need to recover fees owed to you, a Hawaii Notice for Payment of Fees can be a helpful tool. It sets clear expectations for payment and may expedite the resolution process.

To close an LLC in Hawaii, you must file the necessary dissolution form with the Department of Commerce and Consumer Affairs. Additionally, settle any outstanding debts and notify all relevant parties. Using a Hawaii Notice for Payment of Fees can help you collect any outstanding payments before formal dissolution. This step ensures a smoother closure process and protects your interests.