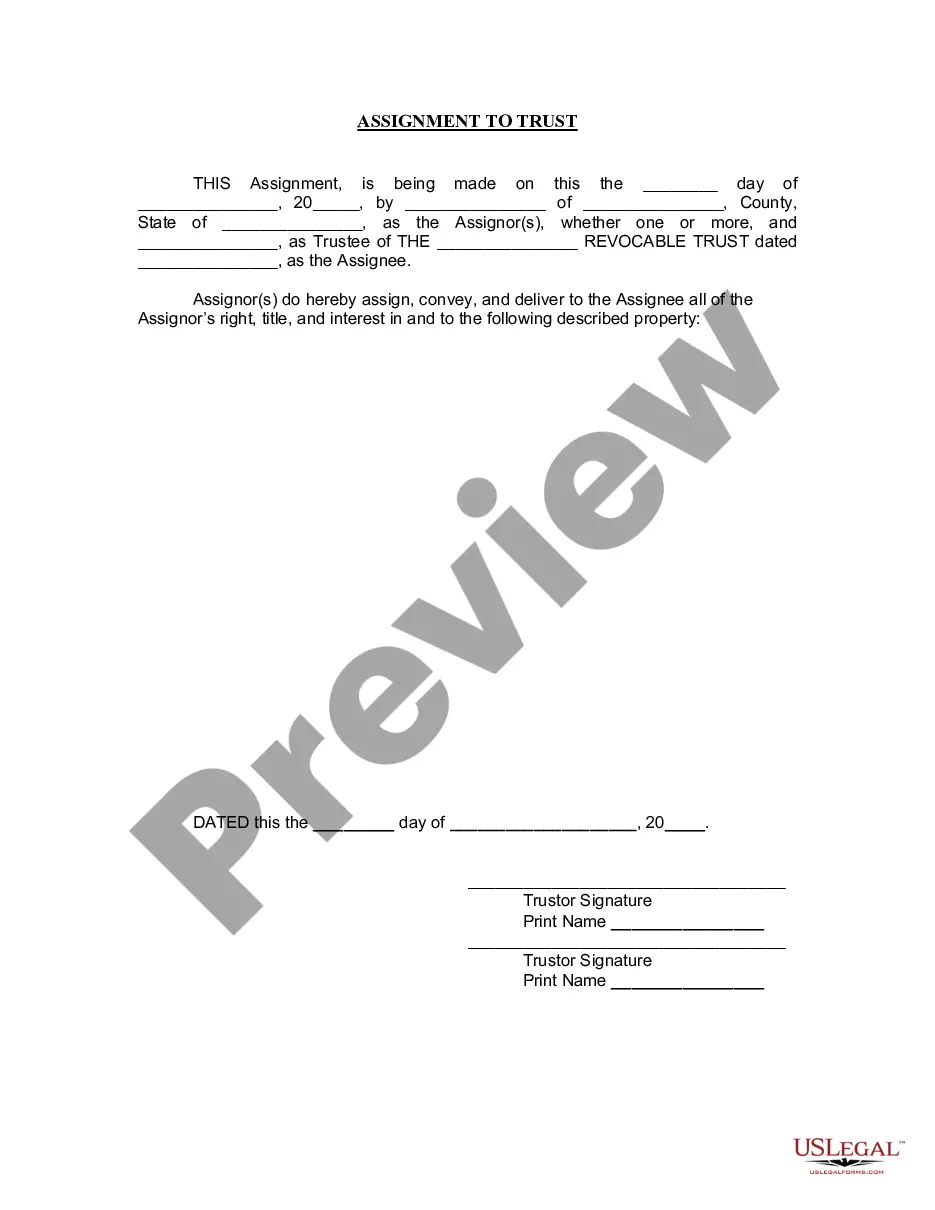

Hawaii Assignment to Living Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

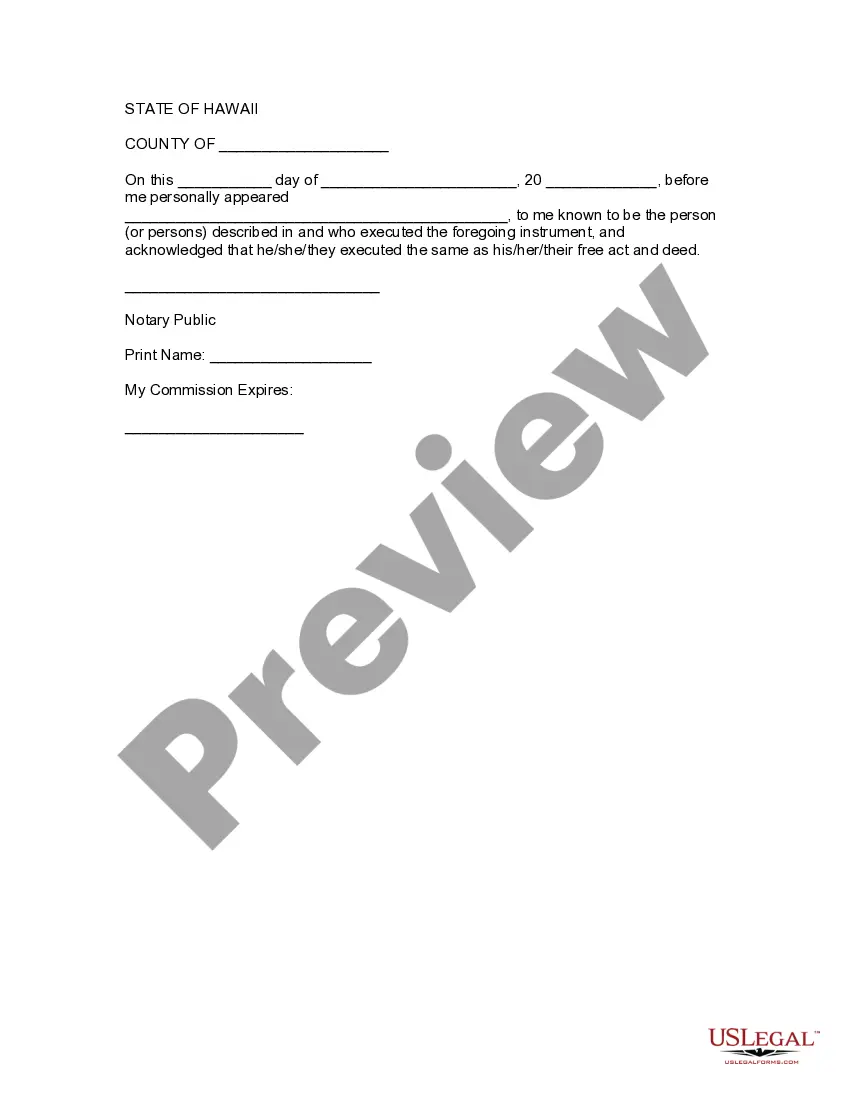

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Assignment To Living Trust?

Obtain entry to the most comprehensive collection of legal documents.

US Legal Forms serves as a resource to locate any state-specific file in just a few clicks, including Hawaii Assignment to Living Trust templates.

No need to invest countless hours searching for a court-admissible document.

Utilize the Preview option if available to view the content of the document. If everything looks correct, click Buy Now. After choosing a pricing option, create an account. Pay via credit card or PayPal. Save the document to your computer by clicking the Download button. That's all! You should submit the Hawaii Assignment to Living Trust form and review it. To ensure accuracy, contact your local legal advisor for assistance. Register and easily browse over 85,000 useful templates.

- Our certified specialists ensure that you receive up-to-date paperwork every time.

- To take advantage of the document library, choose a subscription and create your account.

- If you’ve already registered, simply Log In and click Download.

- The Hawaii Assignment to Living Trust template will be immediately stored in the My documents section (a section for each form you save on US Legal Forms).

- To create a new account, review the brief instructions provided below.

- When using state-specific documents, ensure you select the correct state.

- If possible, review the description to comprehend all the details of the document.

Form popularity

FAQ

Trust funds, including those established under a Hawaii Assignment to Living Trust, can sometimes create a sense of entitlement among beneficiaries. This could lead to poor financial habits or a lack of motivation to work. Moreover, trust funds may have tax implications that beneficiaries need to navigate carefully. To avoid these challenges, it's crucial to have open discussions about the purpose and management of the trust with family members.

One potential disadvantage of a family trust, such as a Hawaii Assignment to Living Trust, is the complexity involved in its management. Family dynamics can complicate decision-making, especially if disagreements arise over asset distribution. Additionally, depending on the trust structure, there may be limitations on how funds can be utilized. It's essential to plan carefully to avoid unintended conflicts.

While a Hawaii Assignment to Living Trust offers many benefits, it also has some drawbacks. Setting up the trust involves legal fees and time spent on documentation, which some may find cumbersome. Furthermore, transferring assets into the trust requires ongoing management and oversight. Understanding these factors can help you and your parents make informed decisions about their asset allocation.

Placing assets in a Hawaii Assignment to Living Trust can provide significant benefits for your parents. It simplifies estate management, avoids probate, and offers privacy regarding asset distribution. Additionally, it can help ensure a smooth transition of wealth to heirs, reducing the burden on family during a difficult time. By using a trust, your parents take proactive steps towards protecting their legacy.

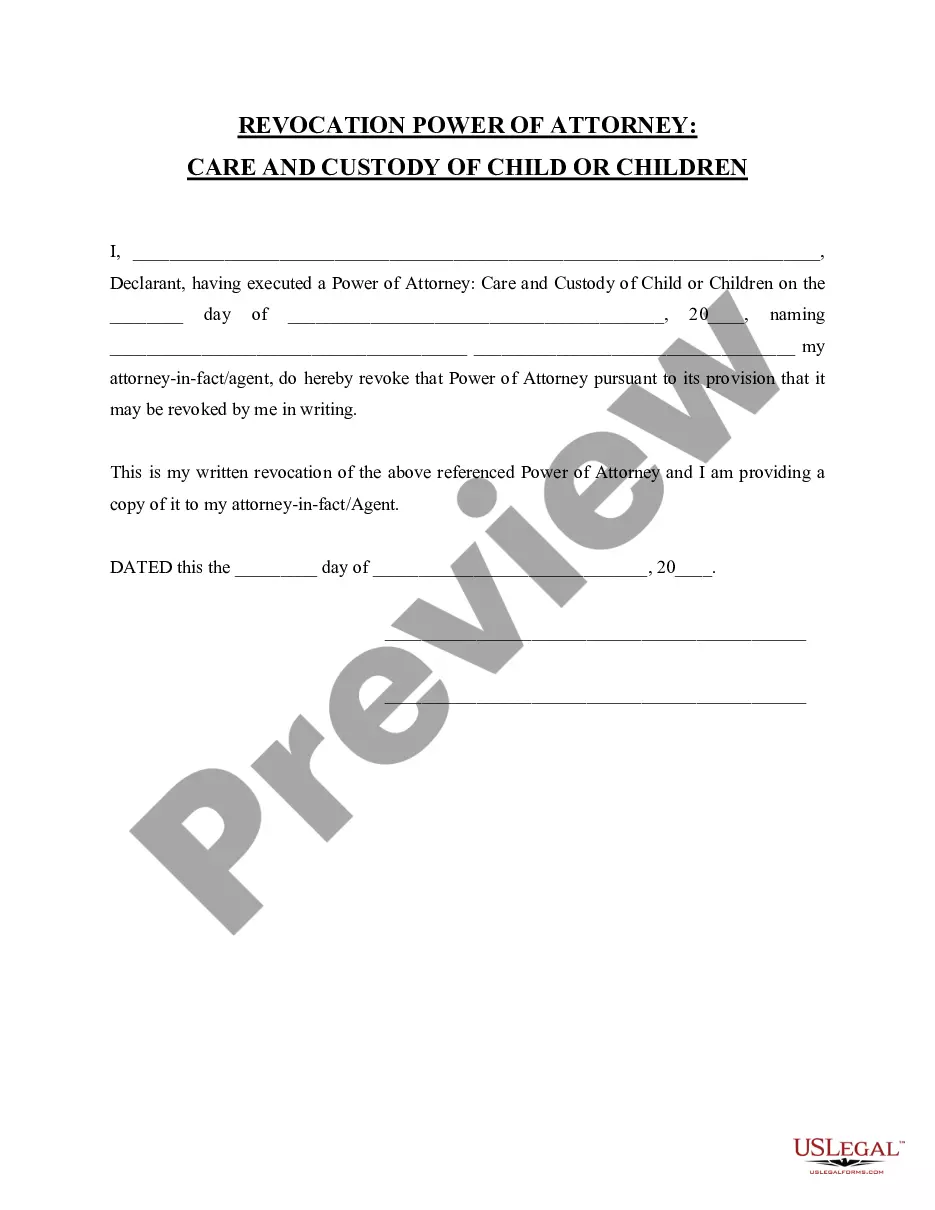

Assigning assets to a trust involves transferring ownership from yourself to the trust. Begin by identifying which assets you wish to include, such as real estate, bank accounts, or investments. You then need to complete the necessary documentation to formally transfer these assets. Familiarizing yourself with the process can support a smooth Hawaii Assignment to Living Trust.

Filling out a trust certification requires you to provide detailed information relevant to the trust. Start with the trust's name and date of creation, then list the trustees and their powers. Ensure you follow the legal formats accepted in Hawaii to avoid complications. This is vital when you're looking at the Hawaii Assignment to Living Trust.

Yes, you can create your own certificate of trust. However, it's essential to ensure it meets Hawaii's legal requirements to be valid. You must include specific information regarding the trust, its trustees, and their powers. Using templates on platforms like US Legal Forms can help you create a valid certificate that meets all necessary criteria for a Hawaii Assignment to Living Trust.

Creating a living trust in Hawaii involves several steps. You should start by drafting the trust document, which includes your specific terms and asset allocations. After that, ensure the trust is funded properly by transferring your assets into it. Engaging with tools available on the US Legal Forms platform can simplify the Hawaii Assignment to Living Trust process.

Filling out a certification of trust form is straightforward. Begin by entering the name of the trust and the date it was created. Next, list the names and addresses of the trustees, and provide a statement describing their powers. Accurate completion of this form is crucial for the Hawaii Assignment to Living Trust process, ensuring clarity and compliance.

A trust restatement is essentially a comprehensive re-writing of the original trust document, consolidating all amendments and updates into a single document. For instance, if you have made multiple amendments over the years, a trust restatement helps eliminate confusion regarding which terms apply. This is particularly beneficial for a Hawaii Assignment to Living Trust, ensuring clarity and proper management of assets according to your current wishes. Consider utilizing resources from USLegalForms to assist in creating a clear restatement.