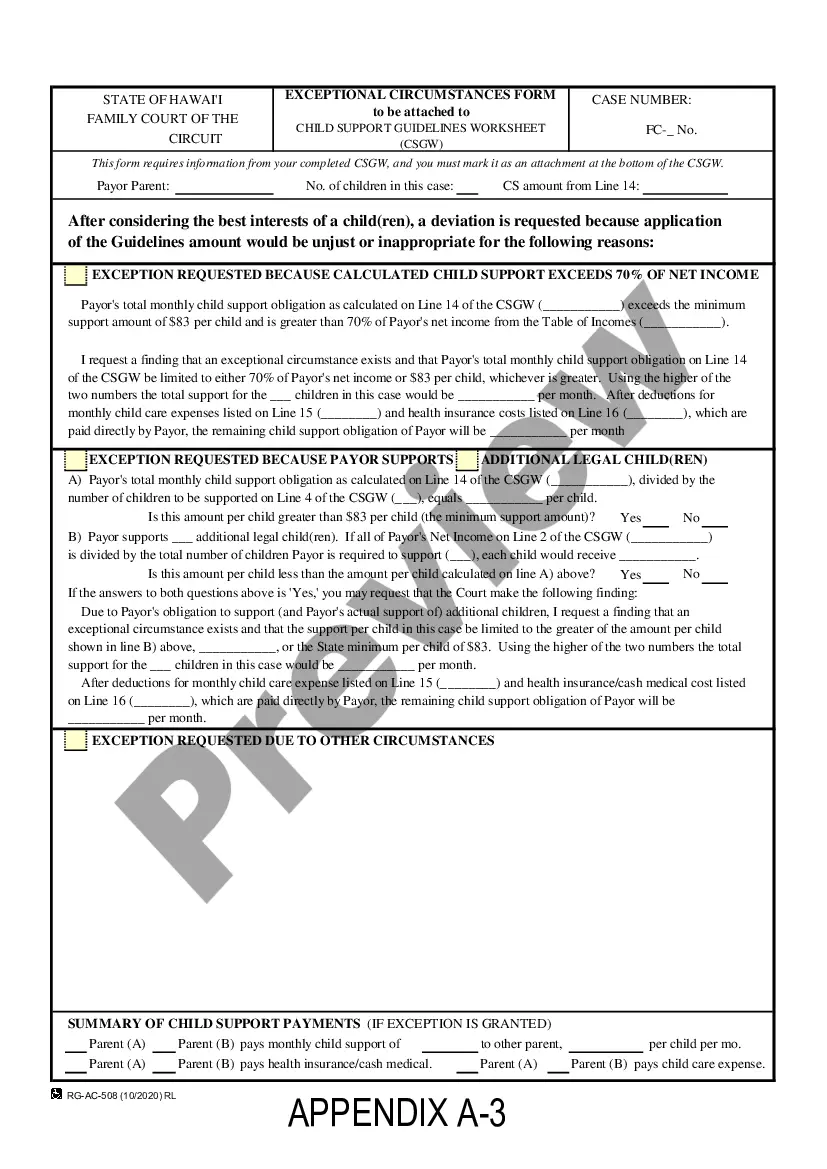

This is an official Hawaii court form for use in a family law case, an Exceptional Circumstance Form. USLF amends and updates these forms as is required by Hawaii Statutes and Law.

Hawaii Exceptional Circumstance Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Exceptional Circumstance Form?

Gain access to the most extensive collection of legal documents.

US Legal Forms is a service to discover any state-specific file in mere moments, including samples of the Hawaii Exceptional Circumstance Form.

There’s no necessity to spend hours searching for a court-acceptable form.

That’s it! You must submit the Hawaii Exceptional Circumstance Form and review it. To ensure that everything is accurate, consult your local legal advisor for assistance. Register and simply browse over 85,000 beneficial forms.

- Our certified professionals ensure that you obtain current documents each time.

- To utilize the document library, choose a subscription plan, and create an account.

- If you have done so, just Log In and then click Download.

- The sample of the Hawaii Exceptional Circumstance Form will be instantly stored in the My documents section (a section for every document you acquire from US Legal Forms).

- To create a new account, follow the brief instructions provided below.

- If you plan to utilize a state-specific sample, ensure that you select the correct state.

- If feasible, examine the description to understand all the specifics of the form.

- Utilize the Preview feature if it’s available to review the document's content.

- If all is correct, click Buy Now.

- After selecting a pricing option, create an account.

- Make your payment via credit card or PayPal.

- Download the document by clicking Save.

Form popularity

FAQ

In Hawaii, the age limit for child support is usually 18 years, but it can extend until 19 if the child is still in high school. Exceptions can also apply in cases of special needs or other compelling factors. To navigate these complexities, utilizing the Hawaii Exceptional Circumstance Form helps articulate your specific situation to the court. Leveraging platforms such as USLegalForms can provide essential support and guidance in these matters.

To stop child support in Hawaii, you must petition the court for modification or termination. This involves presenting valid reasons, ideally using the Hawaii Exceptional Circumstance Form to provide necessary details. Courts want to ensure that any changes serve the best interest of the child. Therefore, it is advisable to seek guidance from legal resources like USLegalForms for clear instructions in this process.

Hawaii determines child support using guidelines that consider both parents' income, the child's needs, and other relevant factors. This calculation aims to ensure fair support based on each parent's financial situation. For unique situations that might not fit standard calculations, the Hawaii Exceptional Circumstance Form can be used to request adjustments. Accessing tools through platforms like USLegalForms can simplify this complicated process.

In Hawaii, you typically stop paying child support when the child turns 18 or graduates high school, whichever comes later. However, certain circumstances may change this timeline, such as disability or other special needs. Utilizing the Hawaii Exceptional Circumstance Form can help explain your unique situation to the court. Engaging with resources like USLegalForms can improve your understanding and compliance with child support laws.

Generally, child support in Hawaii stops automatically when a child turns 18, unless they are still in high school. If you believe there are exceptional circumstances that warrant continued support, the Hawaii Exceptional Circumstance Form can provide the necessary documentation for the court's consideration. It's important to stay informed about your obligations and work with legal platforms like USLegalForms for best practices in these situations.

In Hawaii, child support obligations typically end when the child turns 18 years old. However, if the child is still attending high school, support may continue until graduation or until they reach 19 years old. To manage these arrangements effectively, referencing the Hawaii Exceptional Circumstance Form can be beneficial. This form allows you to explain any specific situations that may extend or alter this timeline.

Yes, you can waive child support in Hawaii under certain exceptional circumstances. Using the Hawaii Exceptional Circumstance Form can help articulate your situation to the court, making it easier to seek a waiver. Keep in mind that the court may only approve waivers if there is clear justification. Therefore, it is crucial to provide detailed information about your circumstances.

VA disability benefits often do not count as taxable income, which means they do not impact your overall income for various assessments. However, different entities may view them differently based on regulations or policies. It is advisable to check with the relevant organizations regarding any reporting requirements. For more assistance, the Hawaii Exceptional Circumstance Form can help address specific inquiries or needs related to your benefits.

In Hawaii, VA disability benefits are typically not classified as income for child support calculations. This distinction can protect veterans from having their benefits used to determine financial obligations towards child support. Each case can be unique, so it is essential to consult with a family law attorney. They may suggest the Hawaii Exceptional Circumstance Form to clarify your specific situation.

The responsibility to report VA disability for child support purposes can depend on state laws and individual court orders. In many cases, VA disability is not considered a traditional income source, thereby not increasing your obligation. If you have questions, consulting a legal expert familiar with Hawaii’s regulations can provide clarity. Utilizing the Hawaii Exceptional Circumstance Form may also help address any unique situations.