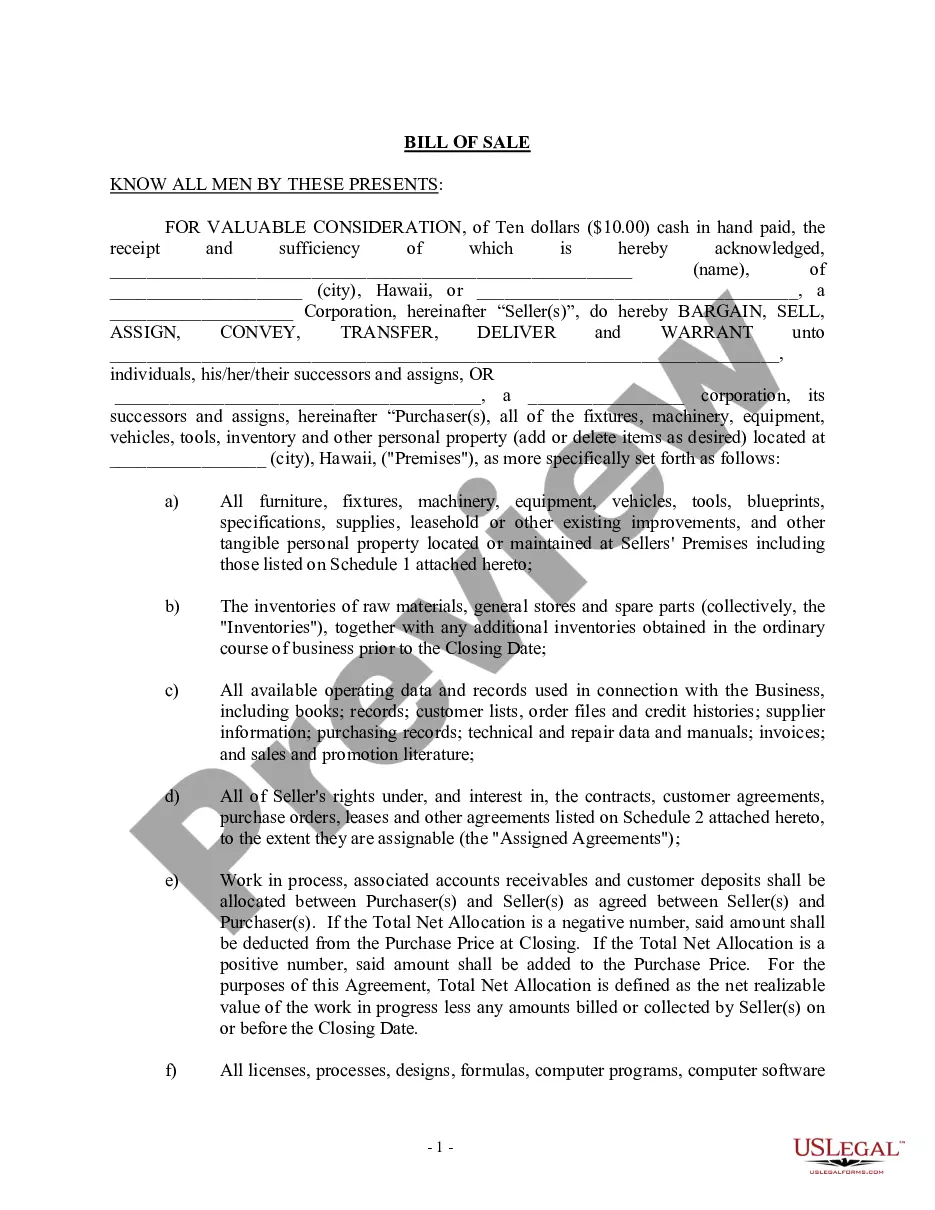

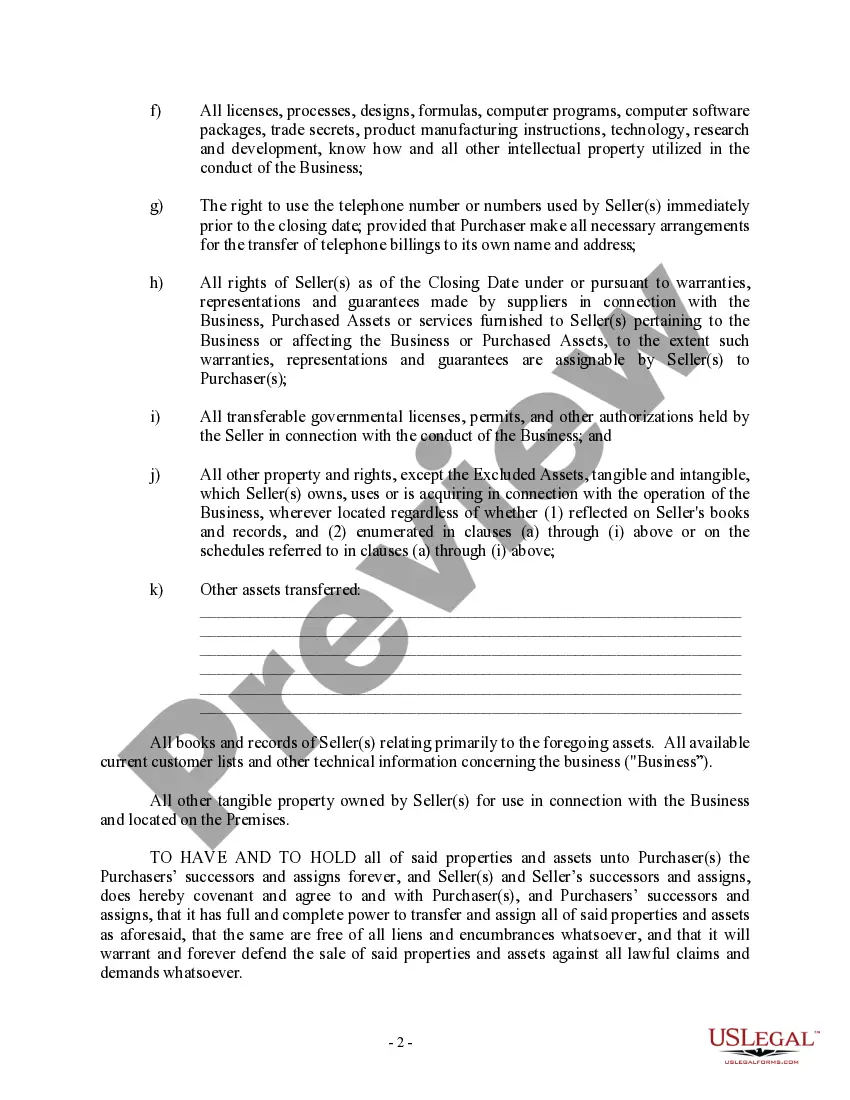

This form is a detailed Bill of Sale. It is to be used when an individual and/or a corporation wishes to sell their business in the State of Hawaii.

Hawaii Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out Hawaii Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

Obtain one of the most comprehensive collections of legal documents.

US Legal Forms is essentially a service where you can discover any state-specific paperwork in just a few clicks, such as the Hawaii Bill of Sale related to the Sale of a Business by Individual or Corporate Seller templates.

There’s no need to squander hours searching for a court-admissible document. Our certified professionals ensure that you receive the latest samples every time.

That's it! You should fill out the Hawaii Bill of Sale related to the Sale of a Business by Individual or Corporate Seller form and review it. To ensure that everything is accurate, consult your local attorney for assistance. Join and easily discover around 85,000 valuable samples.

- To access the document library, choose a subscription and create an account.

- Once registered, simply Log In and click Download.

- The Hawaii Bill of Sale related to the Sale of a Business by Individual or Corporate Seller sample will be instantly saved in the My documents tab (a section for all forms you download on US Legal Forms).

- To create a new profile, follow the brief instructions below.

- If you plan to use state-specific documents, make sure to specify the correct state.

- If possible, review the description to understand all the details of the document.

- Utilize the Preview feature if it’s available to inspect the content of the document.

- If everything appears correct, click on the Buy Now button.

- After selecting a pricing plan, create an account.

- Process payment via credit card or PayPal.

- Download the document to your computer by clicking the Download button.

Form popularity

FAQ

To get a bill of sale notarized without the seller, you can call on a notary who can guide you through the proper steps. This may involve the use of alternative methods such as gathering signatures or proof of identity. For documents like a Hawaii Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, consider using a platform like uslegalforms that provides the necessary resources and templates to help streamline your transaction. This is an effective way to ensure all parties comply with legal requirements.

In Texas, a bill of sale does not necessarily need to be notarized unless specified by the seller or required by the state for specific transactions. However, having a Hawaii Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller notarized can add an extra layer of legal assurance. It is always prudent to consult a legal expert to determine if notarization would benefit your specific sale scenario. This way, you ensure compliance with all necessary laws.

Yes, you can have a bill of sale notarized without the seller present, particularly if you use an intermediary or a notary who understands the situation. When dealing with a Hawaii Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, it's critical to follow legal guidelines. The notary may require additional verification or documentation to proceed. It's advisable to communicate this clearly to the notary to ensure the process is smooth.

To notarize a document like a Hawaii Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller without being present, you might consider using remote online notarization services. Many states allow this option where you can connect with a notary through video conferencing. Ensure that the notary is familiar with the laws concerning business sales in Hawaii. Always check the specific regulations in your state to ensure validity.

When selling a car in Hawaii, you'll need to provide the vehicle's title, a bill of sale, and a completed application for the registration transfer. The bill of sale serves as a crucial record of the transaction, so consider utilizing a Hawaii Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller. This documentation helps ensure a smooth transfer of ownership and protects you from future liability.

While a bill of sale is not always legally required in Hawaii, it is very beneficial for documenting the sale of personal property or business assets. A Hawaii Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is crucial for providing proof of transaction and protecting both parties' interests. It can serve as a vital reference in case of disputes or for tax purposes.

To transfer a title in Hawaii, you typically need the original title signed over by the current owner, a completed application for the title transfer, and payment for any fees. If you are involved in a business sale, a Hawaii Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can also support your transaction. Taking these steps helps avoid any potential complications during the process.

Some states do not mandate a bill of sale for every transaction, particularly when transferring personal property. However, it is advisable to have a Hawaii Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller to protect your interests, especially during business transactions. Always check the specific requirements of your state as laws may vary.

Yes, a bill of sale is designed to facilitate the transfer of ownership from the seller to the buyer. This document serves as proof that the transaction occurred and clarifies the transfer of rights over the item or business. In the context of the Hawaii Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, it is essential to properly complete this document to validate the ownership change.

Typically, the seller initiates the bill of sale when they decide to sell an item or a business. However, buyers can also request this document if they need proof of sale for their records. For transactions involving the Hawaii Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, clear communication is vital to ensure both parties agree on the terms.