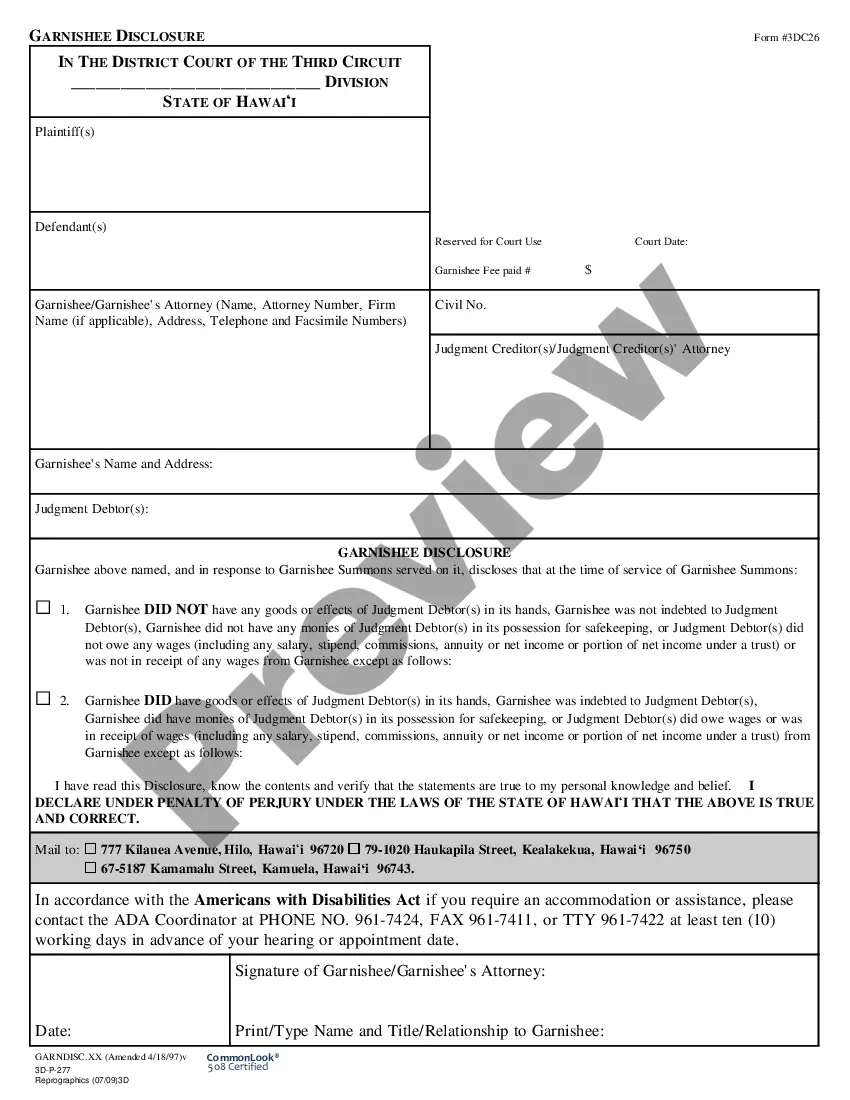

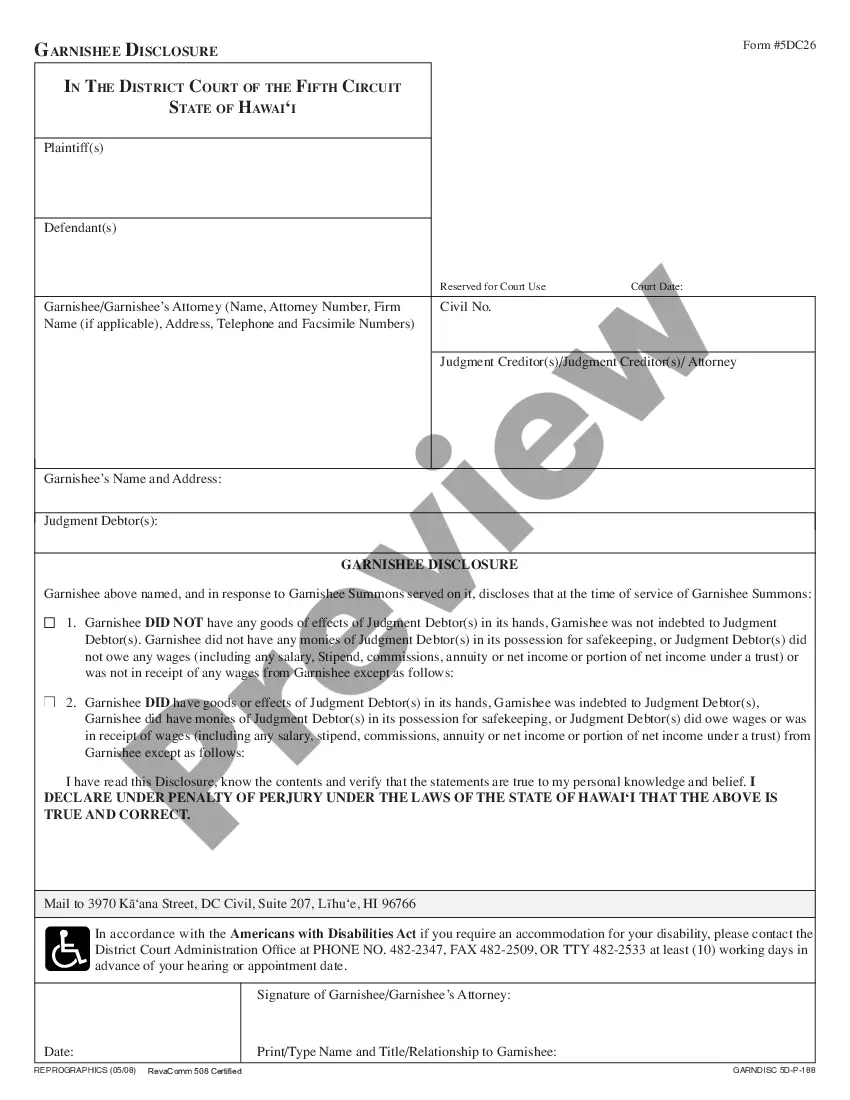

This is an official Hawaii court form for use in a garnishment case, a Garnishee Information form. USLF amends and updates these forms as is required by Hawaii Statutes and Law.

Hawaii Garnishee Information

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Garnishee Information?

Obtain the most extensive directory of legal documents.

US Legal Forms is indeed a platform where you can discover any state-specific document in just a few clicks, including Hawaii Garnishee Information templates.

No need to squander your time searching for a court-acceptable document.

If everything is accurate, click the Buy Now button. After selecting a payment plan, create your account. Pay using a credit card or PayPal. Download the document to your computer by clicking Download. That’s it! You need to complete the Hawaii Garnishee Information document and finalize it. To verify that everything is correct, consult your local legal advisor for guidance. Register and easily access approximately 85,000 useful forms.

- To utilize the forms library, select a subscription and register your account.

- If you have already created it, simply Log In and then hit Download.

- The Hawaii Garnishee Information sample will swiftly be stored in the My documents section (a section for each document you save on US Legal Forms).

- To establish a new account, refer to the quick guidelines outlined below.

- If you're planning to utilize a state-specific template, make sure to specify the correct state.

- If feasible, review the description to understand all of the details of the document.

- Use the Preview feature if it’s available to examine the document's details.

Form popularity

FAQ

To write a letter to the judge regarding wage garnishment, present your case respectfully and accurately. Begin with a clear introduction, stating who you are and the purpose of your letter. Then, explain your circumstances and provide any supporting information. For assistance, consider using USLegalForms to access resources that include Hawaii Garnishee Information, ensuring your letter contains all pertinent details.

Usually, you receive notification of a garnishment through official court documents sent by mail. This notification includes essential details such as the amount to be garnished and the creditor involved. Additionally, it's crucial to understand your rights in relation to garnishments, which is where Hawaii Garnishee Information can be beneficial. Staying informed will help you take the necessary steps to address the situation.

Writing a hardship letter for wage garnishment requires clarity and sincerity. Start by explaining your financial situation in a straightforward manner. Detail how the garnishment impacts your ability to meet essential expenses. Use resources like USLegalForms to find templates that can help guide you in creating a professional and effective letter while incorporating Hawaii Garnishee Information.

If you ignore a garnishment, the creditor may proceed with further collection actions, which can lead to additional financial burdens or even legal penalties. Furthermore, your wages may continue to be garnished without your participation in the process. To stay proactive, consult USLegalForms, where you can learn more about how to handle garnishments responsibly.

Ignoring a garnishee order is not advisable, as it can lead to serious consequences such as additional legal actions. Courts take such orders seriously, and failure to comply may result in wage garnishment or asset seizure. USLegalForms offers resources that can help you navigate your options if you are unsure how to respond to a garnishee order.

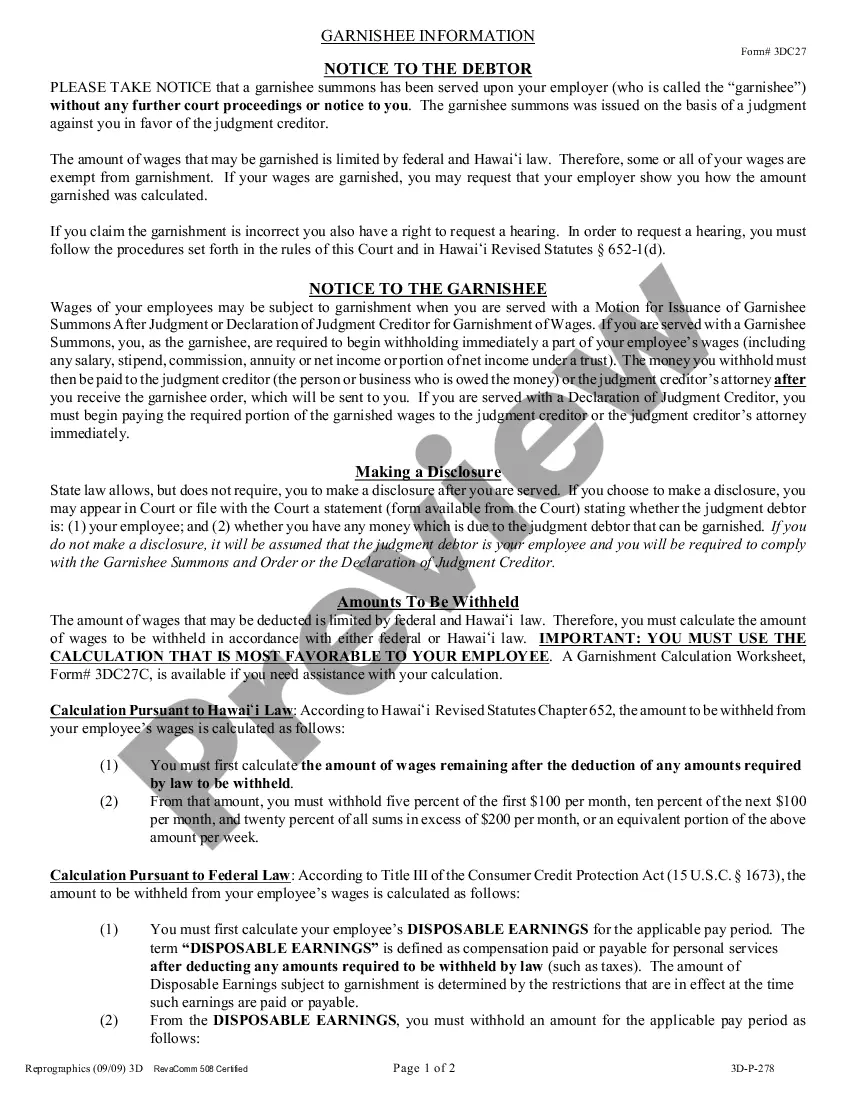

In Hawaii, the maximum amount that can be garnished from your paycheck is 25% of your disposable income, or the amount by which your disposable income exceeds 40 times the federal minimum wage, whichever is lower. This regulation is in place to protect your financial well-being during the garnishment process. For further clarifications on garnishment limits, you can refer to USLegalForms for detailed Hawaii garnishee information.

You typically receive a notice of garnishment through certified mail from the court or the creditor's attorney. This notice outlines the amount being garnished and provides a timeframe for any appeals. Staying informed is crucial, and USLegalForms can help you understand the notification process more clearly with their comprehensive resources.

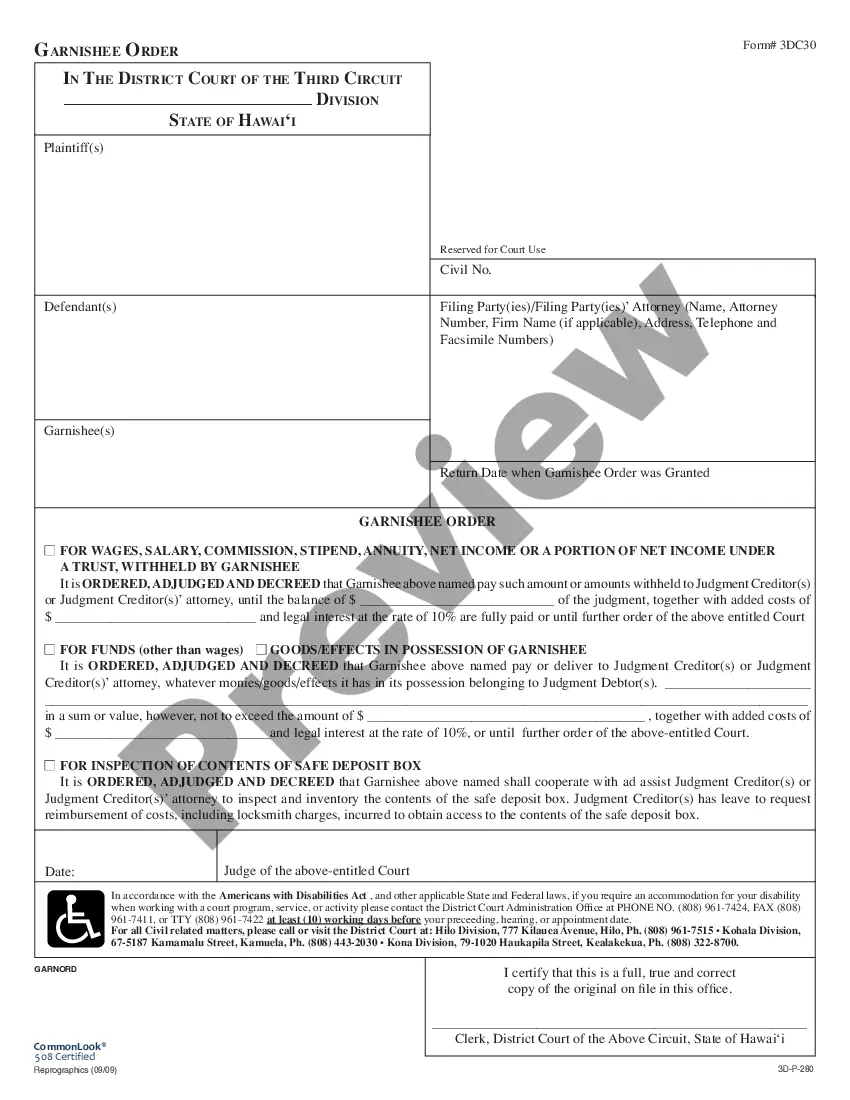

To garnish wages in Hawaii, you must file a garnishment action with the court where you obtained your judgment. After you receive the garnishment order, notify the employer of the garnish. For streamlined guidance, visit USLegalForms, which provides useful insights and templates for initiating the wage garnishment process in Hawaii.

You can find your garnishment information by contacting the court that issued the garnishment order. Additionally, you may step into your local district court or visit their website for specific case details. If you want a seamless experience, consider using USLegalForms to access your garnishment information in Hawaii quickly.

Garnishment laws in Hawaii outline how creditors can collect debts from your wages or accounts. Generally, creditors must obtain a court order before garnishing your wages. Furthermore, you are entitled to certain exemptions that protect a portion of your income. For comprehensive Hawaii garnishee information, it is advisable to consult legal experts or use resources that specialize in understanding these laws.