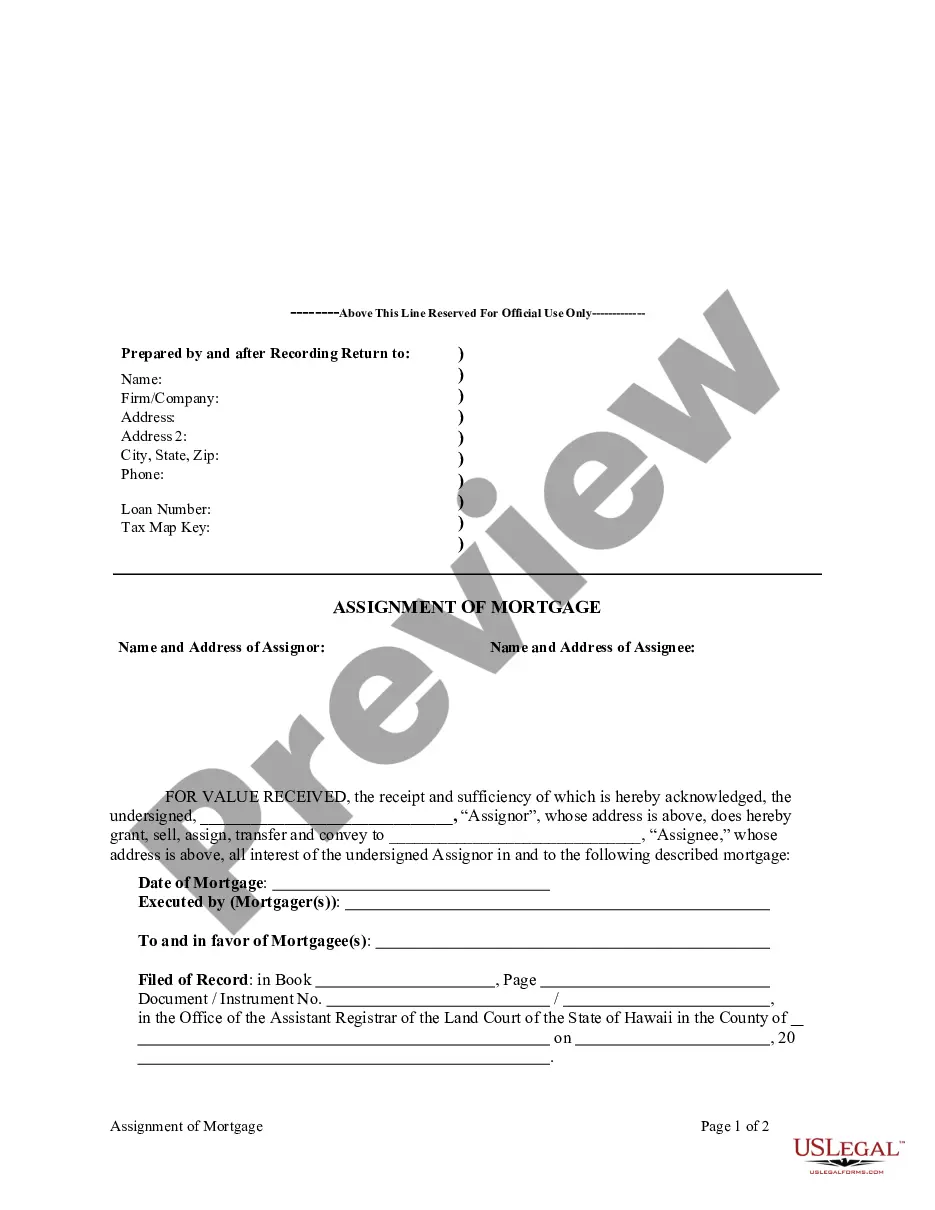

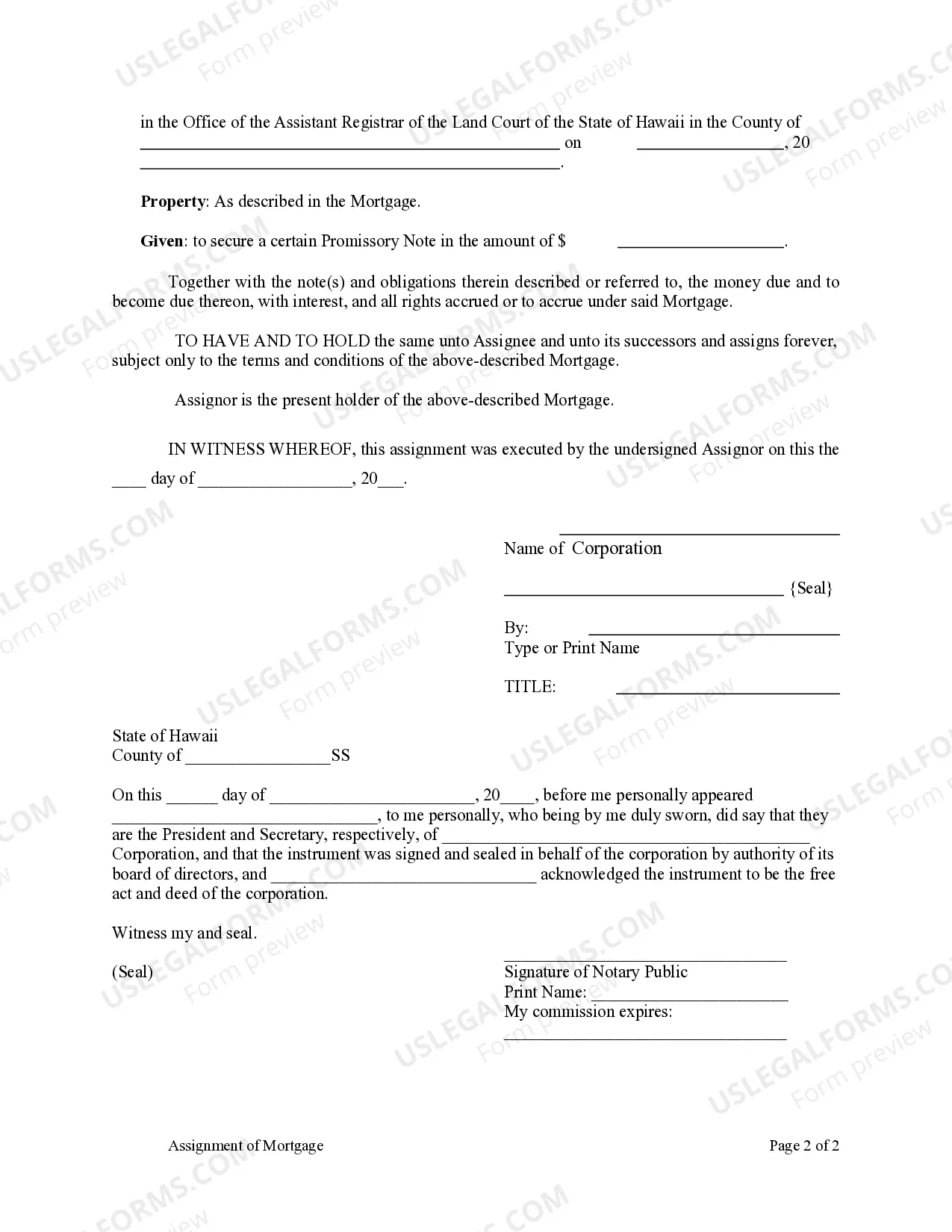

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Hawaii Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Hawaii Assignment Of Mortgage By Corporate Mortgage Holder?

Gain entry to one of the most comprehensive collections of approved forms. US Legal Forms serves as a platform where you can discover any state-specific document in just a few clicks, including examples of the Hawaii Assignment of Mortgage by Corporate Mortgage Holder.

No need to waste any of your time searching for an admissible court sample. Our certified experts guarantee you receive the latest templates every single time.

To utilize the document repository, choose a subscription and establish your account. If you have already registered, simply Log In and hit Download. The Hawaii Assignment of Mortgage by Corporate Mortgage Holder file will be automatically saved in the My documents section (a section for every document you download on US Legal Forms).

That's it! You should complete the Hawaii Assignment of Mortgage by Corporate Mortgage Holder document and verify it. To ensure accuracy, consult your local legal advisor for assistance. Register and effortlessly access over 85,000 valuable templates.

- If you plan to use a state-specific template, make sure to specify the correct state.

- If possible, examine the description to understand all the details of the document.

- Utilize the Preview option if available to review the document's contents.

- If everything appears satisfactory, click on the Buy Now button.

- After selecting a pricing package, create your account.

- Make payment via card or PayPal.

- Download the document to your computer by clicking on Download.

Form popularity

FAQ

When a mortgage is assigned, the rights and obligations of the original mortgage holder are transferred to the new holder. This means that the new mortgage holder assumes all rights to collect payments and enforce the terms of the mortgage. If you need assistance navigating this process, consider using UsLegalForms for reliable templates and detailed guidance regarding a Hawaii Assignment of Mortgage by Corporate Mortgage Holder.

For a Hawaii Assignment of Mortgage by Corporate Mortgage Holder, the assignment of a mortgage is typically signed by the mortgage holder or an authorized representative. This individual must ensure that the assignment complies with state requirements, such as notarization. It is essential to double-check this process to uphold legal standards.

The assignment of lien must usually be signed by the lien holder, which can be an individual or a corporate mortgage holder. If you are dealing with a Hawaii Assignment of Mortgage by Corporate Mortgage Holder, ensure that the signing party has the proper authority and has been duly authorized to execute the assignment. Properly executed assignments are important for maintaining the integrity of the lien.

In the context of a Hawaii Assignment of Mortgage by Corporate Mortgage Holder, the assignment is typically signed by an authorized representative of the corporate entity. This representative must have the legal authority to act on behalf of the mortgage holder. It is crucial to ensure that all signatures on the document are valid to avoid future disputes.

In Hawaii, the seller typically pays the transfer tax when a property changes ownership. However, parties can negotiate this responsibility during the transaction. It's vital to consider the potential tax implications when managing a Hawaii Assignment of Mortgage by Corporate Mortgage Holder, as they may affect overall costs. To navigate these details smoothly, consider using USLegalForms for accurate documentation and guidance.

An assignment of a mortgage occurs when the mortgage lender transfers their rights to the mortgage to another party. For instance, if a corporate mortgage holder sells the mortgage to another lender, this transaction is documented as an assignment of mortgage. When considering a Hawaii Assignment of Mortgage by Corporate Mortgage Holder, keep in mind that proper legal documentation ensures clarity and protects all parties involved. You can find helpful templates for this process on platforms like USLegalForms.

The easiest way to transfer ownership of a house is through a deed transfer. In Hawaii, this involves executing a warranty deed or a quitclaim deed that conveys title from the seller to the buyer. For those working with a Hawaii Assignment of Mortgage by Corporate Mortgage Holder, it's essential to include any mortgage assignments during the transfer. Utilizing platforms like USLegalForms can simplify the process, ensuring all documentation is compliant and accurate.

To complete an assignment of mortgage, start by drafting an assignment document that includes details about the original mortgage and the parties involved. Both the assignor and assignee must sign this document, and it should be recorded with the appropriate county office. For guidance, you can leverage platforms like USLegalForms, which simplify the process of navigating the Hawaii Assignment of Mortgage by Corporate Mortgage Holder.

A corporate assignment of a mortgage essentially transfers mortgage rights from one corporate lender to another. This transfer must be documented properly to ensure legal validity. As you explore options, the concept of Hawaii Assignment of Mortgage by Corporate Mortgage Holder can play a key role in understanding how these transfers operate.

No, an assignment of mortgage does not imply foreclosure. It simply means that the rights under the mortgage have been transferred to another lender. Understanding this distinction is crucial, especially when dealing with the Hawaii Assignment of Mortgage by Corporate Mortgage Holder, to avoid confusion about your financial obligations.