Guam Notice of Claim of Mineral Interest for Dormant Mineral Interest

Description

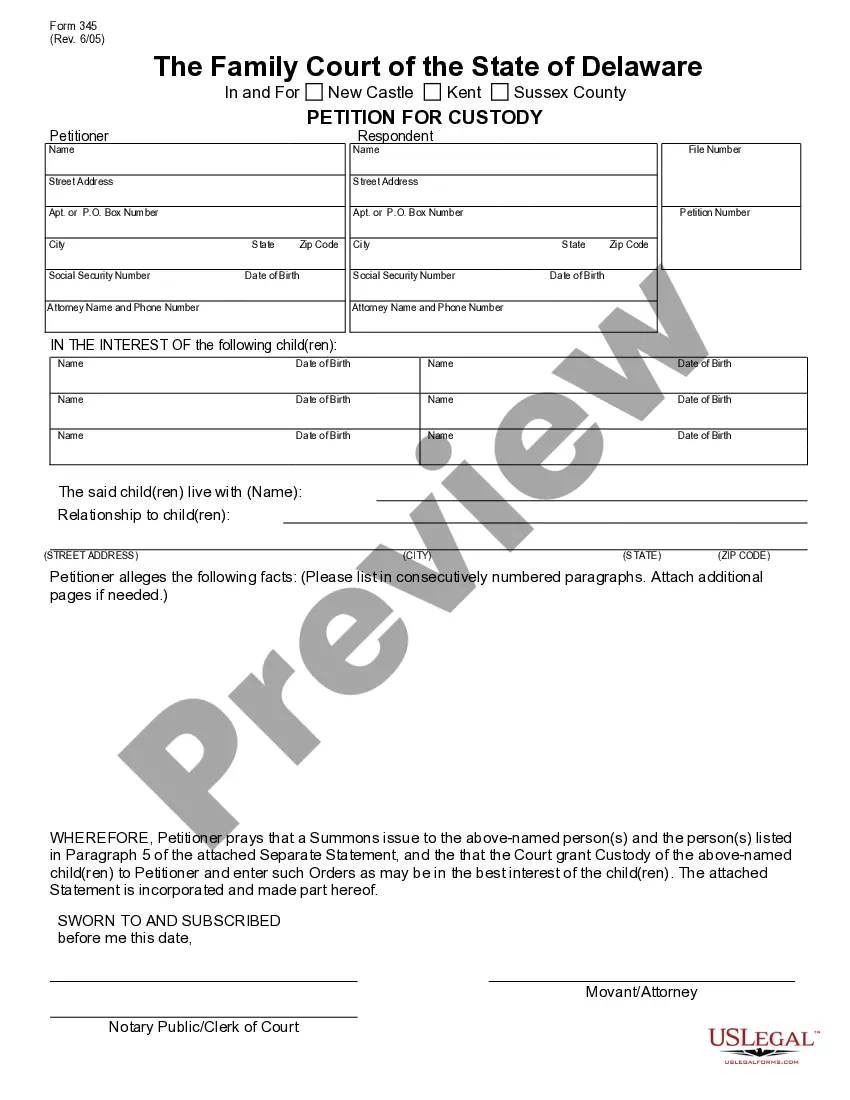

How to fill out Notice Of Claim Of Mineral Interest For Dormant Mineral Interest?

Are you in a position the place you will need papers for sometimes enterprise or personal functions almost every working day? There are tons of legitimate record themes available online, but finding kinds you can rely is not easy. US Legal Forms provides a large number of develop themes, much like the Guam Notice of Claim of Mineral Interest for Dormant Mineral Interest, which are written to satisfy federal and state requirements.

Should you be presently acquainted with US Legal Forms web site and get an account, simply log in. Afterward, it is possible to down load the Guam Notice of Claim of Mineral Interest for Dormant Mineral Interest web template.

Should you not offer an account and would like to start using US Legal Forms, abide by these steps:

- Get the develop you want and make sure it is for the appropriate area/region.

- Take advantage of the Review option to analyze the shape.

- Browse the description to ensure that you have selected the right develop.

- When the develop is not what you`re searching for, utilize the Search area to discover the develop that suits you and requirements.

- Whenever you obtain the appropriate develop, click Get now.

- Choose the costs strategy you want, submit the specified information to produce your money, and pay money for an order using your PayPal or Visa or Mastercard.

- Decide on a convenient data file format and down load your copy.

Discover all the record themes you may have bought in the My Forms menus. You can obtain a additional copy of Guam Notice of Claim of Mineral Interest for Dormant Mineral Interest whenever, if necessary. Just click on the essential develop to down load or produce the record web template.

Use US Legal Forms, one of the most substantial variety of legitimate forms, to save lots of some time and steer clear of faults. The services provides appropriately produced legitimate record themes that you can use for a range of functions. Produce an account on US Legal Forms and start producing your life easier.

Form popularity

FAQ

Mineral ownership, or mineral rights, are understood to be the property rights to exploit an area for the minerals, gas, or oil it harbors. The four types of mineral ownership are: Mineral Interest ? interest generated after the production of oil and gas after the sale of a deed or a lease.

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.

Rarity in minerals may be classed as due to the quality of the specimen being greatly superior to the average, or to the scarcity of the species, variety or form. In each instance rarity adds greatly to the value of a specimen. It is, indeed, one of the most important factors in the scientific valuation of minerals.

The IRS views the profits from the sale of mineral rights as a capital gain, not income. To figure out how much you might need to pay as a capital gains tax, you need to figure out your cost basis in the mineral rights. The cost basis is the original price or value of the asset ? in this case, mineral rights.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

The important properties are: Color and Intensity. Transparency. Formation of Crystals. Damage and Repairs. Locality. Size. Luster. Anomalies.

The cost basis for inherited mineral rights is ?fair value.? It's simply the book value of what you receive on the day you acquire it. If you sell your rights afterward, you'll have to pay capital gains tax on the difference between your cost basis and the sale price.

The term severed mineral rights refers to a state of title to a given parcel of land in which the mineral estate is owned by a party other than the party that is the owner of the surface estate ? in other words, the mineral estate has been severed from the surface estate.