Guam Self-Employed Lecturer - Speaker - Services Contract

Description

How to fill out Self-Employed Lecturer - Speaker - Services Contract?

If you wish to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Take advantage of the site’s straightforward and convenient search to find the documents you require.

Various templates for commercial and specific purposes are categorized by categories and states, or keywords. Use US Legal Forms to locate the Guam Self-Employed Lecturer - Speaker - Services Contract in just a few clicks.

Every legal document template you purchase is yours forever. You have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Stay competitive and acquire, and print the Guam Self-Employed Lecturer - Speaker - Services Contract with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or specific needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Guam Self-Employed Lecturer - Speaker - Services Contract.

- You can also retrieve forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

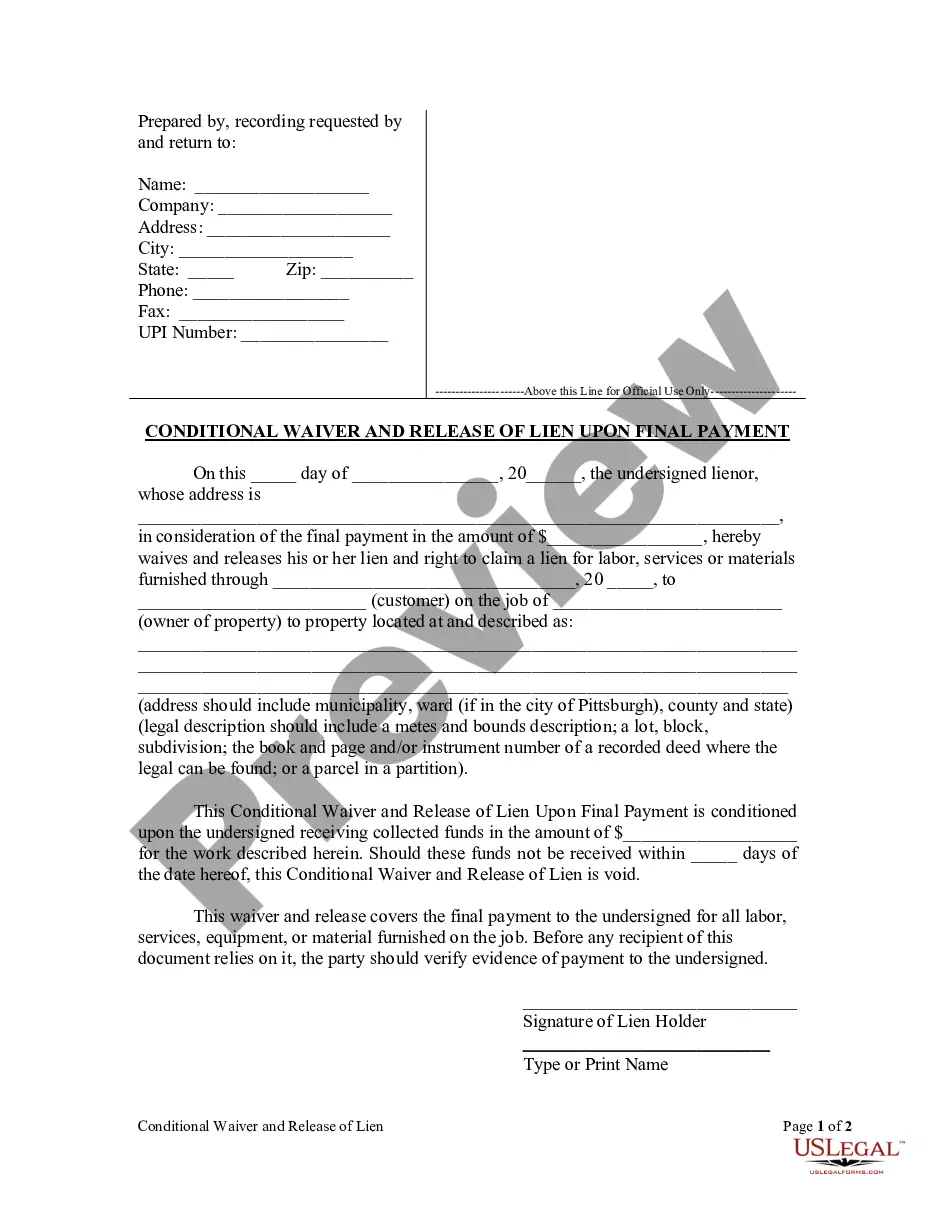

- Step 2. Utilize the Review feature to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose your preferred pricing plan and provide your details to register for the account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Guam Self-Employed Lecturer - Speaker - Services Contract.

Form popularity

FAQ

Completing a service agreement requires careful attention to detail. After drafting the agreement, review it for accuracy and ensure all parties agree on the terms. Once confirmed, both parties should sign and date the document. For Guam Self-Employed Lecturers, utilizing tools from platforms like USLegalForms can streamline this process and ensure all necessary components are included.

To write a simple service contract, start with a clear title and date. Include the names of both parties and a description of the services to be provided. Specify payment details, timelines, and any additional terms necessary. For Guam Self-Employed Lecturers, a straightforward structure helps prevent misunderstandings and fosters a professional relationship.

Yes, you can write your own service agreement, and many choose to do so for various reasons. However, it's important to include essential terms that protect your rights and outline your responsibilities clearly. For Guam Self-Employed Lecturers, using templates available on platforms like USLegalForms can simplify the process and ensure your contract meets legal standards.

The 5 C's of a contract are clarity, completeness, consistency, consideration, and compliance. These elements ensure that the contract is understandable, covers all necessary details, aligns with legal standards, and includes mutual benefits. For those drafting a Guam Self-Employed Lecturer - Speaker - Services Contract, incorporating the 5 C's will enhance the contract's effectiveness and enforceability.

Filling out a service contract involves several key steps. Begin by entering your personal information, including your name and contact details, followed by the client's information. Specify the services you will provide, along with payment terms and deadlines. For Guam Self-Employed Lecturers, this structured approach helps establish clear expectations and responsibilities.

A basic speaker contract outlines the terms between a speaker and an event organizer. This agreement typically includes details about the speaking engagement, such as the date, location, fees, and any special requirements. For Guam Self-Employed Lecturers, this contract serves as a vital tool to ensure clarity and protect both parties' interests.

What's the purpose of a speaker agreement? Speaker agreements are intended to help assure the quality of your event's content, to protect your event's reputation and potentially its legal and financial wellbeing.

A speaker's agreement should address the following: 1. Compensation of the speaker 2. The organization's rights to the presentation 3. The speaker's representations concerning the content of the presentation 4.

Dependent Personal Service ('DPS') Article which provides such an exemption can be descried as under: Businesses are no longer restricted to the local geographical boundaries.

Independent personal services are those performed as an independent contractor, or self-employed individual. Dependent personal services are those performed for a foreign employer. The majority of tax treaties will require that the U.S. citizen not reside in the foreign country for a period exceeding 183 days.