Guam Insurance Agent Agreement - Self-Employed Independent Contractor

Description

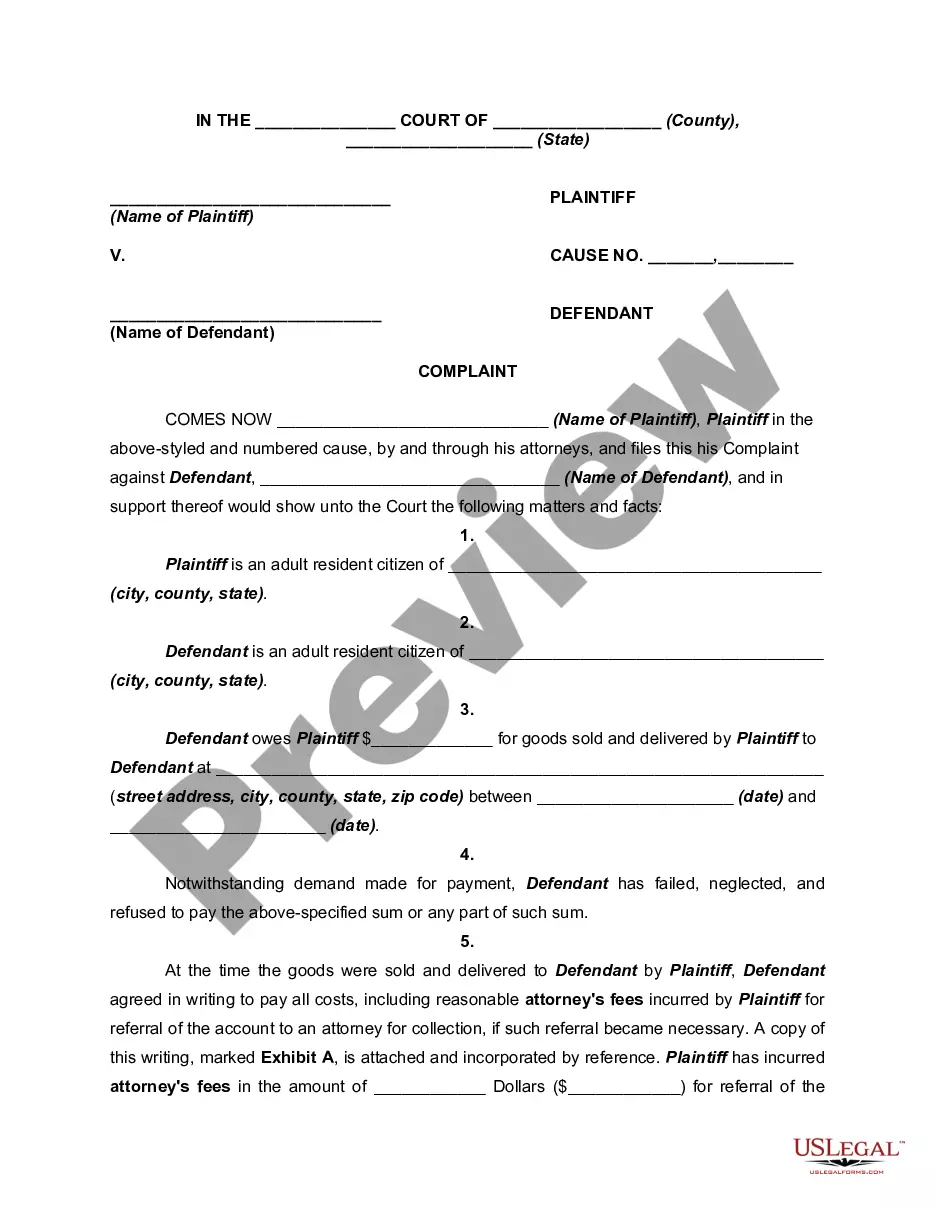

How to fill out Insurance Agent Agreement - Self-Employed Independent Contractor?

You can spend hours online trying to find the legal document template that meets the state and federal regulations you require.

US Legal Forms offers a multitude of legal forms that are reviewed by experts.

You can obtain or print the Guam Insurance Agent Agreement - Self-Employed Independent Contractor from our service.

If available, use the Preview button to review the document template as well. If you want to find another version of the form, use the Search field to locate the template that suits you and your needs. Once you have found the template you need, click Purchase now to proceed. Choose the pricing plan you want, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Select the format of the document and download it to your device. Make modifications to your document if possible. You can complete, edit, sign, and print the Guam Insurance Agent Agreement - Self-Employed Independent Contractor. Download and print numerous document templates using the US Legal Forms website, which offers the largest variety of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Guam Insurance Agent Agreement - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours indefinitely.

- To get another copy of the purchased form, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the right document template for the area/city of your choice.

- Check the form details to confirm you have selected the correct form.

Form popularity

FAQ

To form a legally binding contract, such as the Guam Insurance Agent Agreement - Self-Employed Independent Contractor, four essential elements must be present. First, there must be an offer and acceptance, meaning both parties agree on the terms. Second, consideration is necessary, which refers to something of value exchanged between the parties. Third, the parties involved must have the capacity to contract, meaning they are of legal age and sound mind. Finally, the contract must be for a legal purpose, ensuring that it complies with the law.

The Dave Santos exemption allows certain independent contractors in Guam to benefit from specific tax exemptions, helping to reduce their overall tax burden. This exemption may apply to those operating under a Guam Insurance Agent Agreement. Understanding this exemption can provide financial advantages, so it's wise to seek advice from a tax expert.

Public Law 34-87 establishes guidelines for independent contractors and their rights in Guam. This law ensures fair treatment and outlines obligations for both contractors and businesses that hire them, including those functioning under a Guam Insurance Agent Agreement. Being familiar with this law contributes to a respectful and professional working relationship.

Guam charges a business privilege tax on businesses operating within its jurisdiction, including self-employed independent contractors. This tax is calculated based on your gross receipts, impacting how you manage your income from your Guam Insurance Agent Agreement. Properly understanding this tax is essential for maintaining compliance and optimizing your profits.

Schedule SE is required for individuals who earn self-employment income over a certain threshold, which generally includes independent contractors and sole proprietors. If you have income from your Guam Insurance Agent Agreement, you must file this form to calculate your self-employment tax. Ensuring your taxes are filed correctly will help you avoid penalties and keep your business running smoothly.

Independent contractors and self-employed individuals typically file a Form 1040, along with a Schedule C to report their business income. This is crucial for accurately reporting earnings from your Guam Insurance Agent Agreement as a self-employed independent contractor. Consulting with a tax professional can provide further guidance tailored to your specific situation.

The Dave Santos Amendment in Guam relates to specific regulations governing the employment and classification of independent contractors. This legislation impacts how self-employed individuals, like Guam Insurance Agents, operate within the territory. It is essential to understand this amendment to ensure compliance with local laws while executing your Guam Insurance Agent Agreement.

Yes, notary fees are typically considered income for tax purposes, which means they are subject to self-employment tax. When you operate as a self-employed independent contractor, such as a Guam Insurance Agent, your income from notary fees must be reported. Therefore, it is important to keep accurate records of your earnings to comply with tax regulations.

Legal requirements for independent contractors vary by state, but they generally include obtaining the necessary licenses, filing taxes independently, and adhering to contract terms. For those engaging in the Guam Insurance Agent Agreement - Self-Employed Independent Contractor, understanding the specific regulations in Guam is crucial. Consulting resources like US Legal Forms can help you navigate these requirements to ensure compliance.

Writing an independent contractor agreement, especially in the context of the Guam Insurance Agent Agreement - Self-Employed Independent Contractor, involves outlining the scope of work, payment terms, and responsibilities. Include sections on confidentiality and termination for clarity. It’s advisable to use a legal template or a trusted platform like US Legal Forms, ensuring you cover all necessary legal requirements effectively.