Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

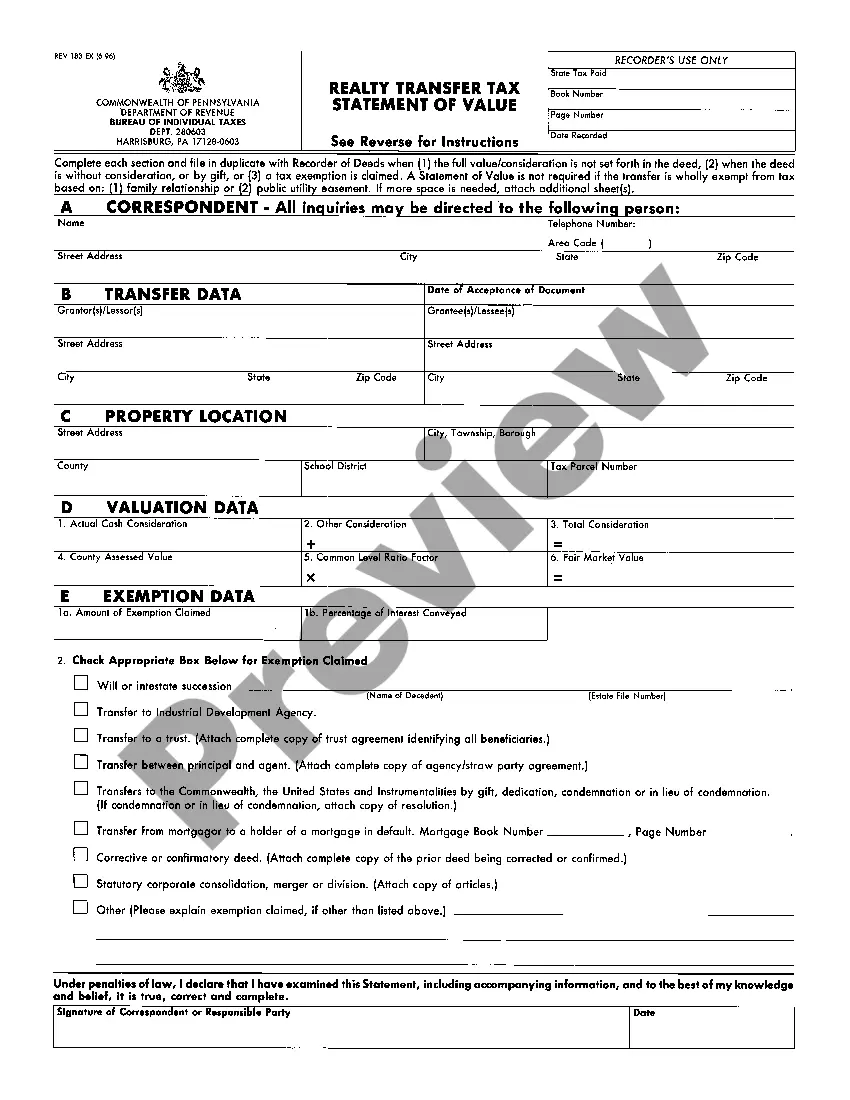

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

Should you desire to be thorough, obtain, or create legal document templates, utilize US Legal Forms, the most extensive variety of legal forms available online.

Employ the site's user-friendly and straightforward search feature to find the documents you need.

A variety of templates for business and personal purposes are categorized by type and state, or by keywords.

Step 4. Once you have located the form you need, click on the Acquire now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to acquire the Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Obtain button to retrieve the Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

- You can also access the forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your appropriate area/state.

- Step 2. Use the Review option to examine the form's details. Be sure to read through the information.

- Step 3. If you are not satisfied with the form, use the Search feature at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

The RMA mortgage form, or Request for Loan Modification and Affidavit RMA Form, is a document that homeowners in Guam use to formally request changes to their current mortgage terms. This form is crucial for those facing financial difficulties, as it allows them to seek modifications in their payment plans. By following Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form, homeowners can submit their requests effectively and increase their chances of approval. Understanding this process is essential for maintaining homeownership and achieving financial stability.

When applying for a loan modification, you typically need proof of income, a hardship letter, tax returns, and bank statements. These documents help demonstrate your financial situation to your lender. Following the Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form will guide you in compiling the necessary paperwork effectively.

The full form of RMA in mortgages is the Request for Mortgage Assistance. This document is essential for those seeking modifications to their mortgage terms. By utilizing the Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can effectively present your case to your lender.

RMA in the context of mortgages stands for Request for Mortgage Assistance. This request allows homeowners to seek help from their lenders in times of financial trouble. To ensure your request is well-formed, follow the Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form carefully.

In real estate, RMA refers to the Request for Mortgage Assistance. It is used by homeowners who are struggling with their mortgage payments. By understanding the Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can effectively navigate the loan modification process.

A hardship letter explains your financial difficulties to your lender. This letter should clearly state your current situation, such as job loss or medical expenses, and request assistance. When following the Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form, include this letter to strengthen your request.

RMA stands for Request for Mortgage Assistance. This form is crucial for homeowners seeking a loan modification. By filling out the Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can communicate your hardship and request assistance from your lender.