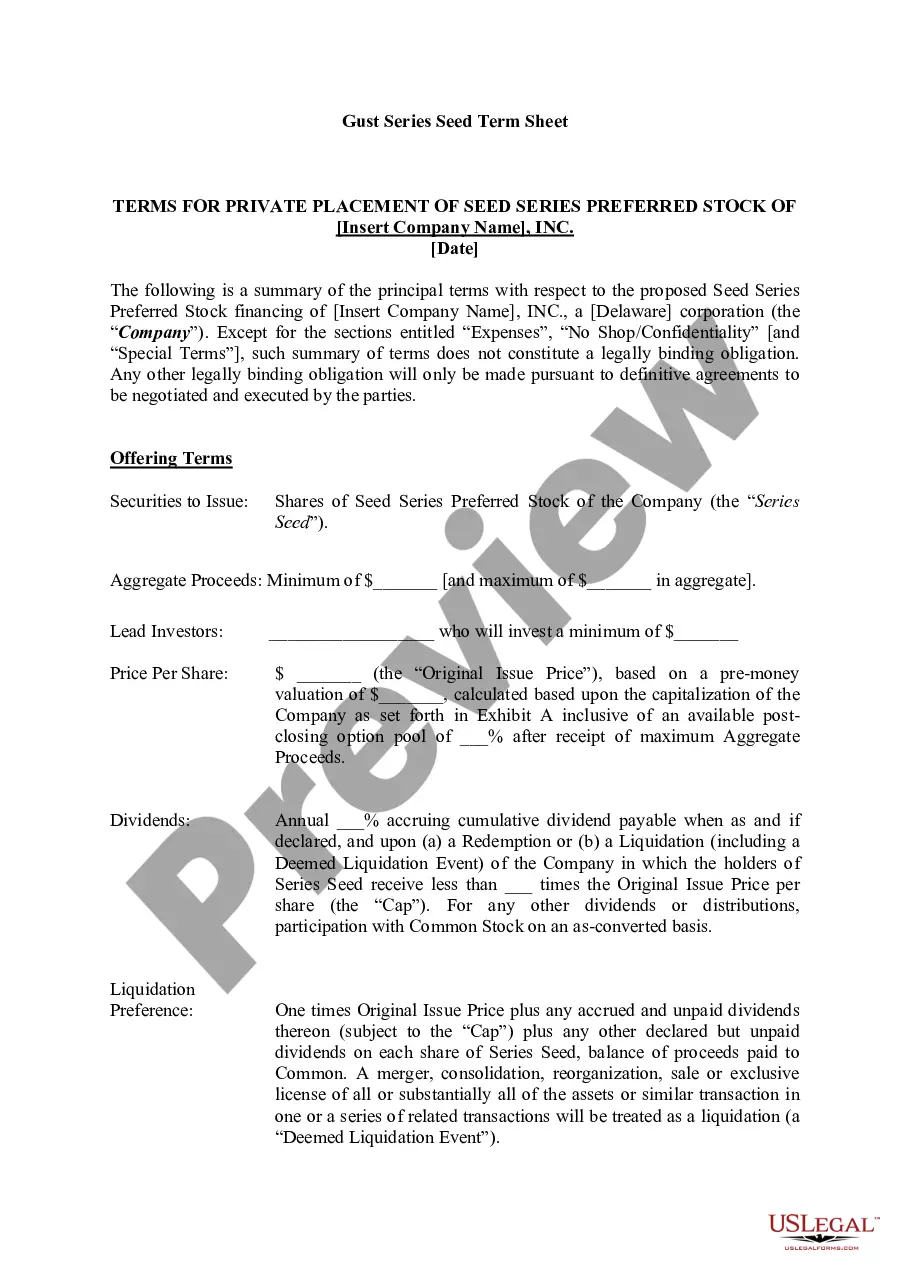

Guam Gust Series Seed Term Sheet

Description

developed by Gust, the platform powering over 90% of the organized angel investment groups in the United States.

The goal was to standardize on a single investment structure, eliminate confusion and significantly reduce the costs of negotiating, documenting and closing an early stage seed investment.

For those familiar with early stage angel transactions, this middle-of-the-road approach is founder-friendly and investor-rational, intended to strike a balance between the Series A Model Documents developed by the National

Venture Capital Association that have traditionally been used by most American angel groups (which include a 17 page term sheet and 120 pages of supporting documentation covering many low-probability edge cases), and the one page Series Seed 2.0 Term Sheet developed in 2010 by Ted Wang of Fenwick & West as a contribution to the early stage community (which deferred most investor protections and deal specifics until future financing rounds.)

The Gust Series Seed Term Sheet does meet Section 2.2 of the Founder Friendly Standard. The term sheet providesfor "reverse vesting"so the company can repurchase unvested stock if a Founder leaves before four years.

How to fill out Gust Series Seed Term Sheet?

US Legal Forms - one of several most significant libraries of legal types in the USA - offers an array of legal document layouts you can obtain or print out. Using the internet site, you will get a large number of types for enterprise and personal uses, sorted by types, states, or key phrases.You will find the newest variations of types like the Guam Gust Series Seed Term Sheet within minutes.

If you already have a registration, log in and obtain Guam Gust Series Seed Term Sheet through the US Legal Forms collection. The Down load switch can look on every kind you perspective. You have accessibility to all in the past downloaded types within the My Forms tab of your respective profile.

If you would like use US Legal Forms the very first time, allow me to share basic guidelines to help you started off:

- Make sure you have picked out the best kind for your area/state. Select the Review switch to review the form`s content. Browse the kind explanation to ensure that you have selected the correct kind.

- In the event the kind doesn`t satisfy your needs, utilize the Search industry towards the top of the monitor to find the one that does.

- When you are happy with the form, verify your option by simply clicking the Purchase now switch. Then, opt for the pricing plan you favor and give your references to sign up on an profile.

- Procedure the financial transaction. Utilize your credit card or PayPal profile to perform the financial transaction.

- Select the structure and obtain the form on your system.

- Make alterations. Fill out, revise and print out and signal the downloaded Guam Gust Series Seed Term Sheet.

Every design you included in your bank account lacks an expiry particular date and is the one you have permanently. So, if you want to obtain or print out another backup, just check out the My Forms section and click on the kind you need.

Gain access to the Guam Gust Series Seed Term Sheet with US Legal Forms, probably the most comprehensive collection of legal document layouts. Use a large number of skilled and express-specific layouts that meet your business or personal requirements and needs.

Form popularity

FAQ

What Is a Term Sheet? A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

A term sheet is a preliminary, non-binding document outlining the proposed investment amount and other important details of a deal. When you're raising funds for your startup, a lead investor will use a term sheet to outline the key points of their offer to invest in your company. Term Sheets for Startups: Uses & Examples - Carta carta.com ? blog ? term-sheets carta.com ? blog ? term-sheets

You need a strong pitch because you likely won't have an actual product at this point. This pitch will let investors know precisely what they're investing in and include details about your product, business, target market, and financial predictions for the future of your business.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

A typical term sheet has the following details: The proposed amount of funding and the duration of engagement. Rights of founders and other common shareholders. Rights of investors and restrictions. Proposed use of funds (how and where the money will be spent)