Guam Accredited Investor Status Certificate Letter-Individual

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

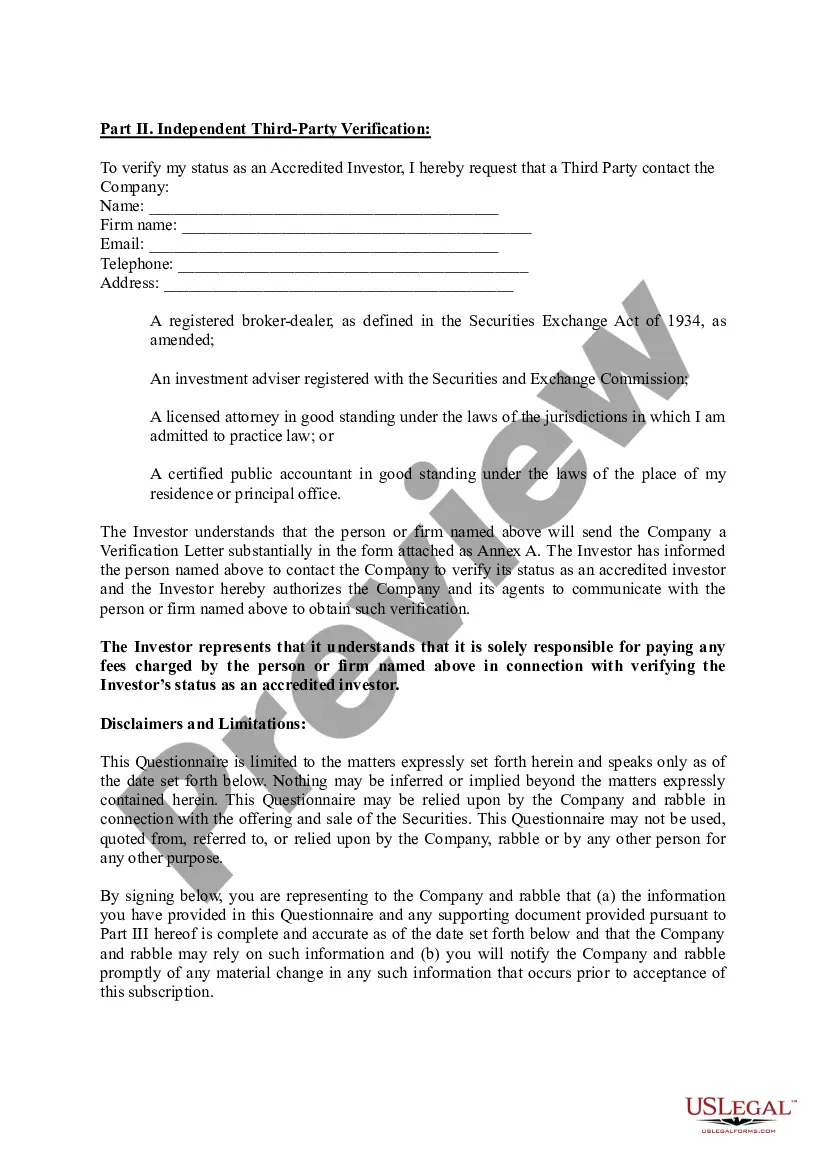

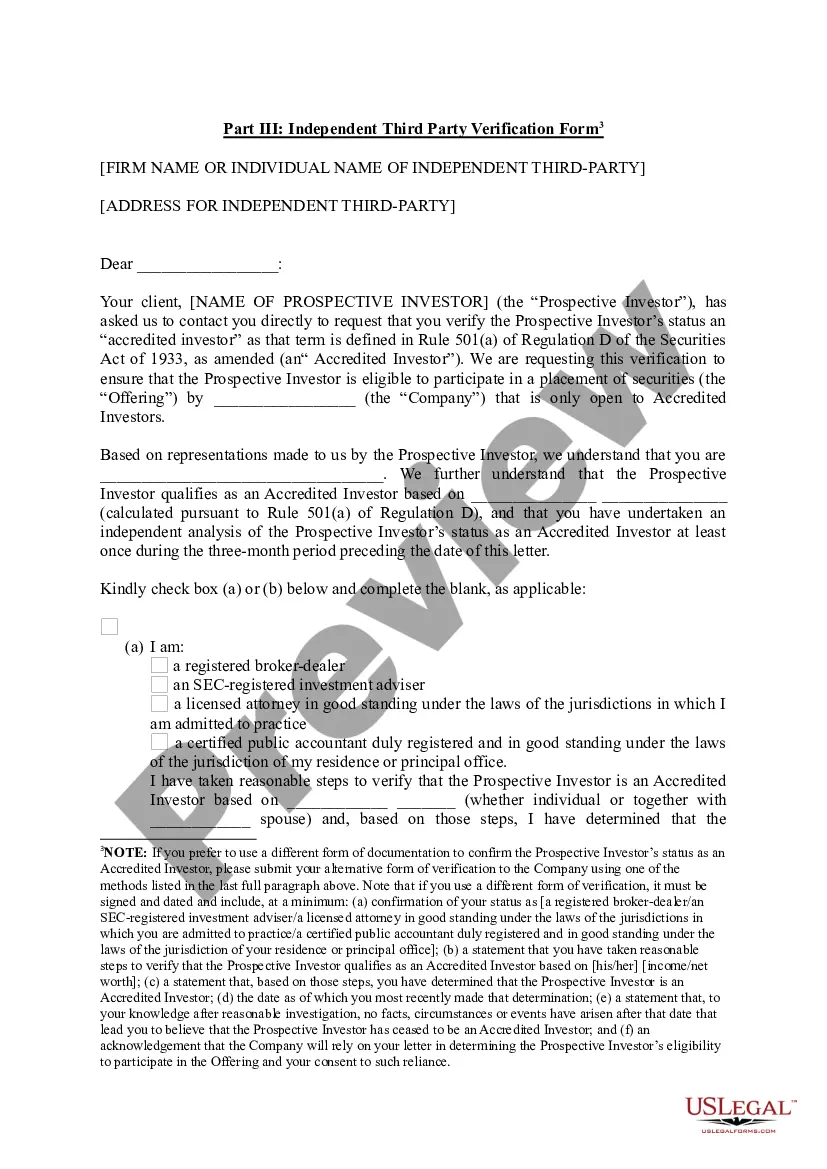

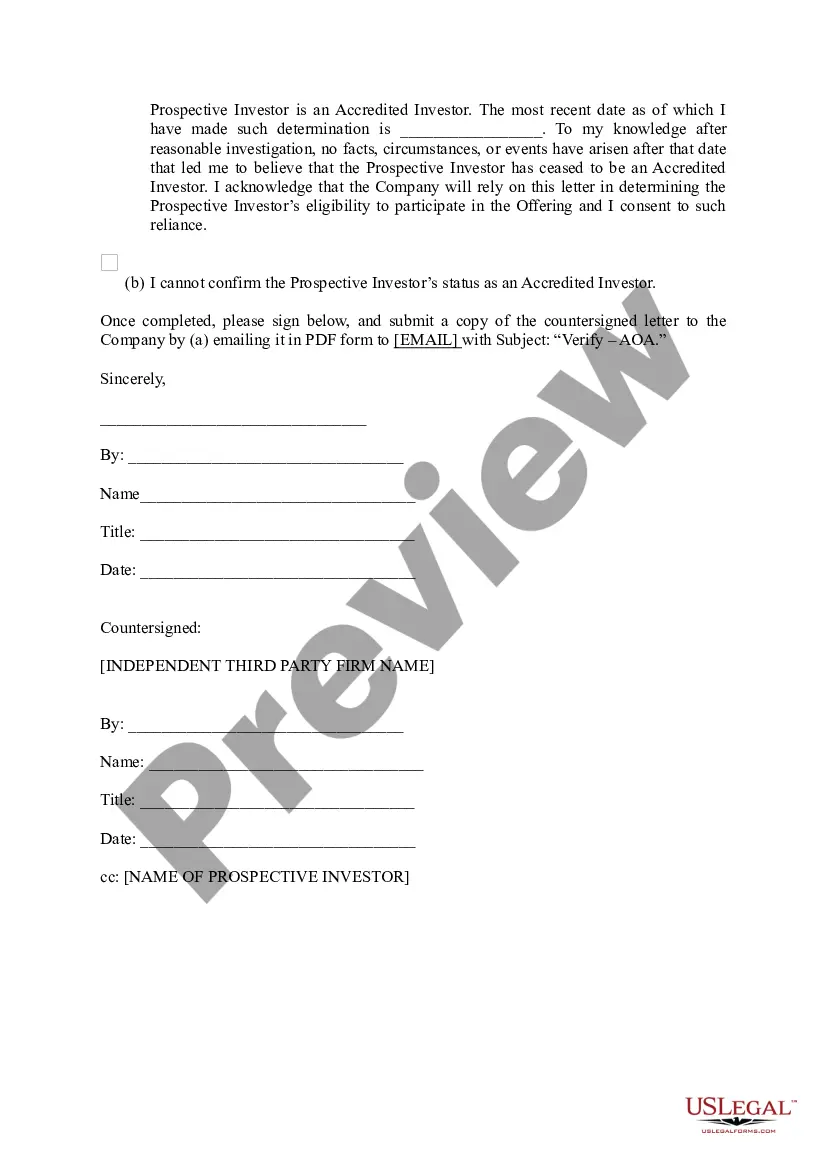

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Status Certificate Letter-Individual?

Have you been inside a situation in which you need to have paperwork for possibly enterprise or person reasons just about every day? There are a variety of legal record templates available on the Internet, but discovering types you can rely is not simple. US Legal Forms provides 1000s of develop templates, much like the Guam Accredited Investor Status Certificate Letter-Individual, which are composed in order to meet state and federal requirements.

Should you be presently familiar with US Legal Forms website and possess a merchant account, simply log in. Following that, you may acquire the Guam Accredited Investor Status Certificate Letter-Individual template.

Unless you offer an accounts and would like to begin using US Legal Forms, follow these steps:

- Obtain the develop you need and make sure it is for the proper metropolis/county.

- Make use of the Review button to check the shape.

- Read the outline to ensure that you have chosen the proper develop.

- When the develop is not what you are trying to find, take advantage of the Research area to find the develop that meets your requirements and requirements.

- If you discover the proper develop, just click Purchase now.

- Pick the rates plan you want, fill out the specified info to create your money, and purchase the order making use of your PayPal or credit card.

- Decide on a practical file format and acquire your version.

Get every one of the record templates you have bought in the My Forms menus. You can aquire a further version of Guam Accredited Investor Status Certificate Letter-Individual whenever, if required. Just select the needed develop to acquire or printing the record template.

Use US Legal Forms, by far the most substantial selection of legal forms, to save time as well as steer clear of mistakes. The service provides expertly created legal record templates that can be used for a range of reasons. Produce a merchant account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

In the U.S., an accredited investor is anyone who meets one of the below criteria: Individuals who have an income greater than $200,000 in each of the past two years or whose joint income with a spouse is greater than $300,000 for those years, and a reasonable expectation of the same income level in the current year.

Can an LLC become an accredited investor? Yes, a Limited Liability Company (LLC) could potentially qualify as an accredited investor if it has total assets of at least $5,000,000 and the LLC was not created for the specific purpose of acquiring the securities.

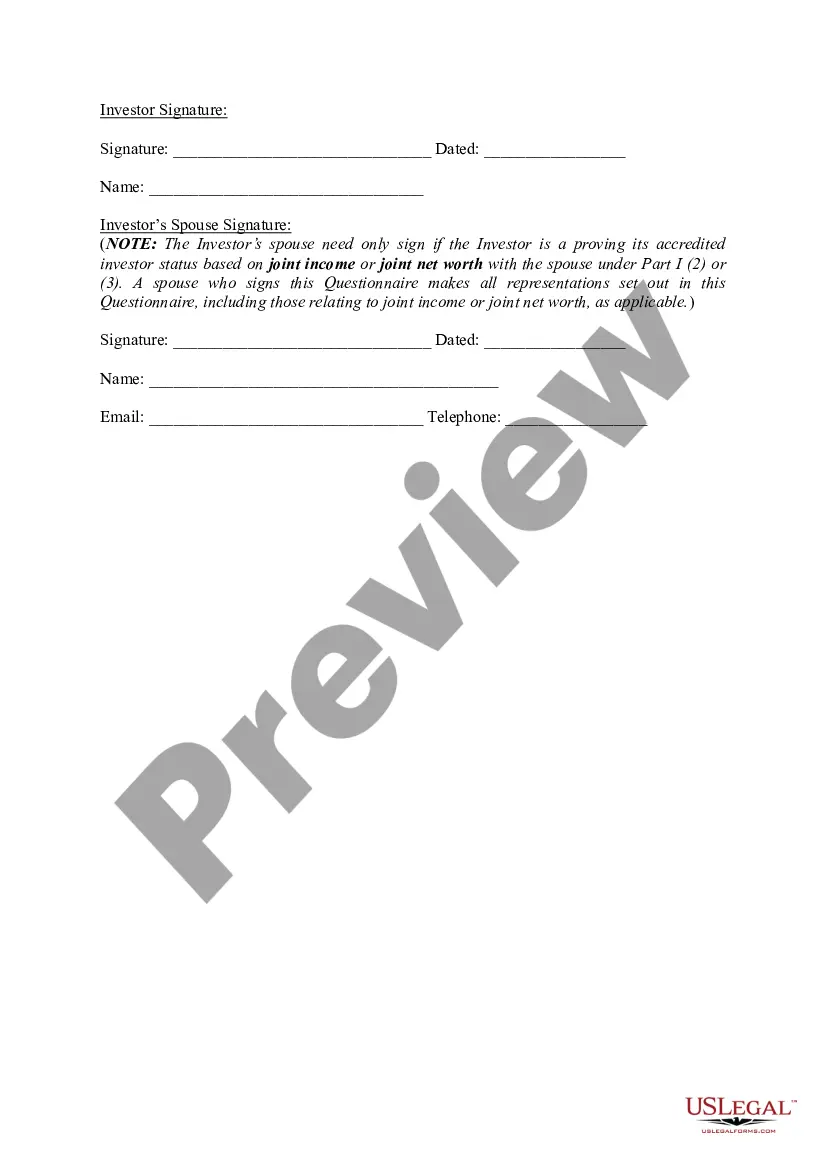

These documents are used to show your net or joint net worth as well as your financial knowledge to become accredited. Aside from third-party websites, you can also ask a CPA to write a letter verifying your accreditation.

The SEC in 2020 issued rules in Release No. 33-10824, Accredited Investor Definition, allowing investors holding certain professional licenses, such as a Series 7, to qualify as accredited, even if they fall short of meeting the income or asset tests.

How can individuals qualify as accredited? Individuals (i.e., natural persons) may qualify as accredited investors based on wealth and income thresholds, as well as other measures of financial sophistication.

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...