Title: Understanding the Guam Indemnity Escrow Agreement for Purchasing Issued and Outstanding Shares Keywords: Guam Indemnity Escrow Agreement, purchasing shares, issued shares, outstanding shares, indemnity, escrow account Introduction: The Guam Indemnity Escrow Agreement plays a crucial role in facilitating the purchase of issued and outstanding shares. This legal arrangement helps protect both the buyer and the seller by ensuring funds are securely held in an escrow account until certain indemnity obligations are fulfilled. In this article, we will explain the details of this agreement and highlight any variations that may exist within different types of Guam Indemnity Escrow Agreements. I. What is the Guam Indemnity Escrow Agreement? The Guam Indemnity Escrow Agreement, in relation to purchasing issued and outstanding shares, is a legally binding agreement typically used in business acquisitions or mergers. It establishes an escrow account where a predetermined amount of money is held by a neutral third-party escrow agent until specific indemnity obligations are met. II. Scope and Purpose of the Agreement: The agreement ensures that the seller is protected against any potential liabilities arising from the shares being sold, while the buyer can be confident that the funds will be available if they need to make a claim for indemnification. It provides a secure and efficient mechanism for addressing potential post-closing disputes or issues, allowing the parties to focus on the core aspects of the transaction. III. Indemnity Obligations: The Guam Indemnity Escrow Agreement specifies the terms and conditions under which indemnification claims may be made. It typically includes provisions outlining the identifiable actions, the required notice periods for claims, and the procedure for resolving disputes. IV. Different Types of Guam Indemnity Escrow Agreements: While there may not be concrete categorizations of Guam Indemnity Escrow Agreements based on purchasing issued and outstanding shares, certain variations may arise depending on the specific terms negotiated by the parties involved. Some common types include: 1. General Guam Indemnity Escrow Agreement: This encompasses a broad range of identifiable actions and covers all potential issues related to the purchased shares. 2. Limited Guam Indemnity Escrow Agreement: This agreement may narrow down the scope of identifiable actions expressly stated, usually based on prior negotiations or identified risks. 3. Time-Limited Guam Indemnity Escrow Agreement: This type provides a set duration during which indemnification claims can be made, ensuring disputes are resolved within a specified timeframe. V. Conclusion: In summary, the Guam Indemnity Escrow Agreement for purchasing issued and outstanding shares is a vital component of business transactions. It safeguards the interests of both the buyer and the seller by creating a secure framework for managing potential indemnity claims. Understanding the agreement's terms, obligations, and any potential variations is crucial when engaging in share purchase transactions in Guam.

Guam Indemnity Escrow Agreement regarding purchasing issued and outstanding shares

Description

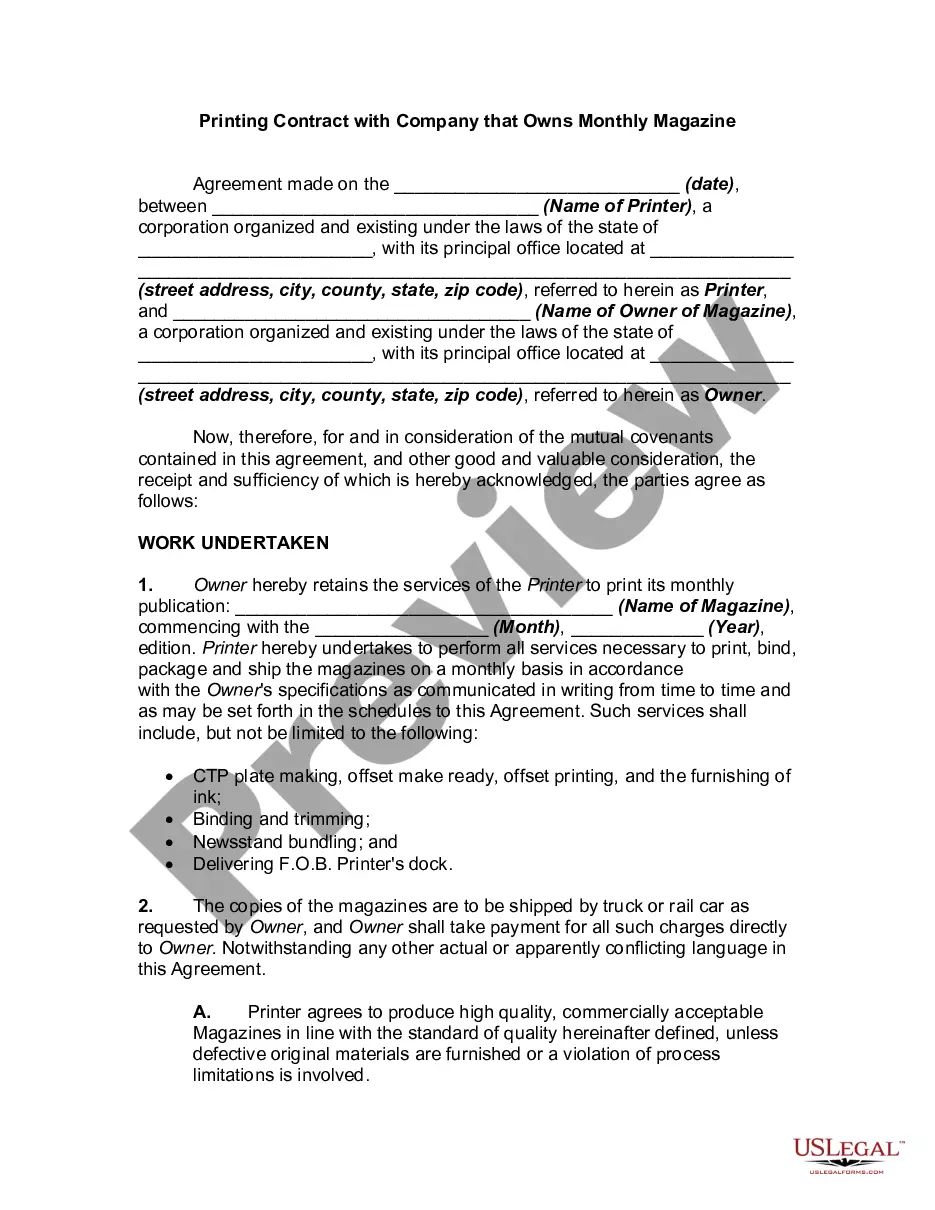

How to fill out Guam Indemnity Escrow Agreement Regarding Purchasing Issued And Outstanding Shares?

Are you presently in the placement in which you need to have paperwork for possibly company or specific uses almost every day? There are plenty of authorized document templates available on the Internet, but finding ones you can rely isn`t effortless. US Legal Forms delivers a huge number of develop templates, such as the Guam Indemnity Escrow Agreement regarding purchasing issued and outstanding shares, that happen to be created in order to meet federal and state needs.

If you are currently informed about US Legal Forms site and have your account, just log in. After that, you are able to acquire the Guam Indemnity Escrow Agreement regarding purchasing issued and outstanding shares design.

Unless you have an account and need to begin to use US Legal Forms, follow these steps:

- Get the develop you want and ensure it is for that right metropolis/region.

- Utilize the Preview switch to examine the shape.

- Look at the information to ensure that you have selected the right develop.

- If the develop isn`t what you are searching for, utilize the Lookup area to find the develop that fits your needs and needs.

- When you discover the right develop, click Acquire now.

- Choose the prices plan you want, fill in the desired information to make your bank account, and pay for your order utilizing your PayPal or charge card.

- Decide on a practical paper structure and acquire your copy.

Discover every one of the document templates you might have purchased in the My Forms food list. You may get a extra copy of Guam Indemnity Escrow Agreement regarding purchasing issued and outstanding shares at any time, if needed. Just click on the essential develop to acquire or produce the document design.

Use US Legal Forms, one of the most extensive collection of authorized varieties, to save lots of efforts and steer clear of mistakes. The services delivers professionally created authorized document templates which you can use for a selection of uses. Create your account on US Legal Forms and commence making your daily life a little easier.

Form popularity

FAQ

Indemnity clauses may provide for the opportunity to remedy the breach so that the seller shall not be liable for such claim to the extent that the fact, matter or circumstance giving rise to such claim is remediable, and is remedied by or at the expense of the seller within a determined time period.

Indemnity holdbacks are a temporary reduction in the amount of purchase price paid to the seller at closing, held in escrow to be drawn upon to cover seller's indemnity obligations to the buyer, thereby reducing the purchase price.

An escrow arrangement is set up by a neutral third party to hold funds or other assets that will be exchanged in a transaction involving a buyer and seller. In an M&A deal, an escrow account is typically used to ensure that the buyer and seller will fulfil their respective financial and other obligations.

An indemnification escrow is typically funded by setting aside and depositing a portion of the cash payable as purchase price with a third party (whether into an escrow account, a trust or a security deposit).

Structuring an Indemnification Hold-Back: a) Amount: The amount set aside as a hold-back is typically a percentage of the total purchase price, with common ranges falling between 5% to 15%. The specific amount is influenced by factors such as the nature of the business, industry norms, and perceived risks.

An indemnity claim arising from a clause in a contract creates a promise by a person to: compensate another person. for any loss or harm which comes to them, from an event or series of events. to put them in a position where they have not suffered loss.

Simply put, an indemnification clause lays out in legal language how one company (usually the buyer) will be compensated by another for losses they suffer after a merger or acquisition takes place.

Basically, this is a small portion of the purchase price held in escrow that can serve as a fund to satisfy indemnification claims against the seller. Escrow amounts are typically calculated as a percentage of the purchase price, and can range from less than 5% to greater than 15%.