Guam Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II

Description

How to fill out Class C Distribution Plan And Agreement Between Putnam Mutual Funds Corp And Putnam High Yield Trust II?

Are you currently in the placement where you need papers for both organization or personal uses almost every working day? There are a lot of legitimate record templates accessible on the Internet, but finding versions you can rely on is not simple. US Legal Forms offers thousands of type templates, like the Guam Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II, that happen to be written in order to meet federal and state requirements.

In case you are currently familiar with US Legal Forms site and possess an account, merely log in. Following that, you can obtain the Guam Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II format.

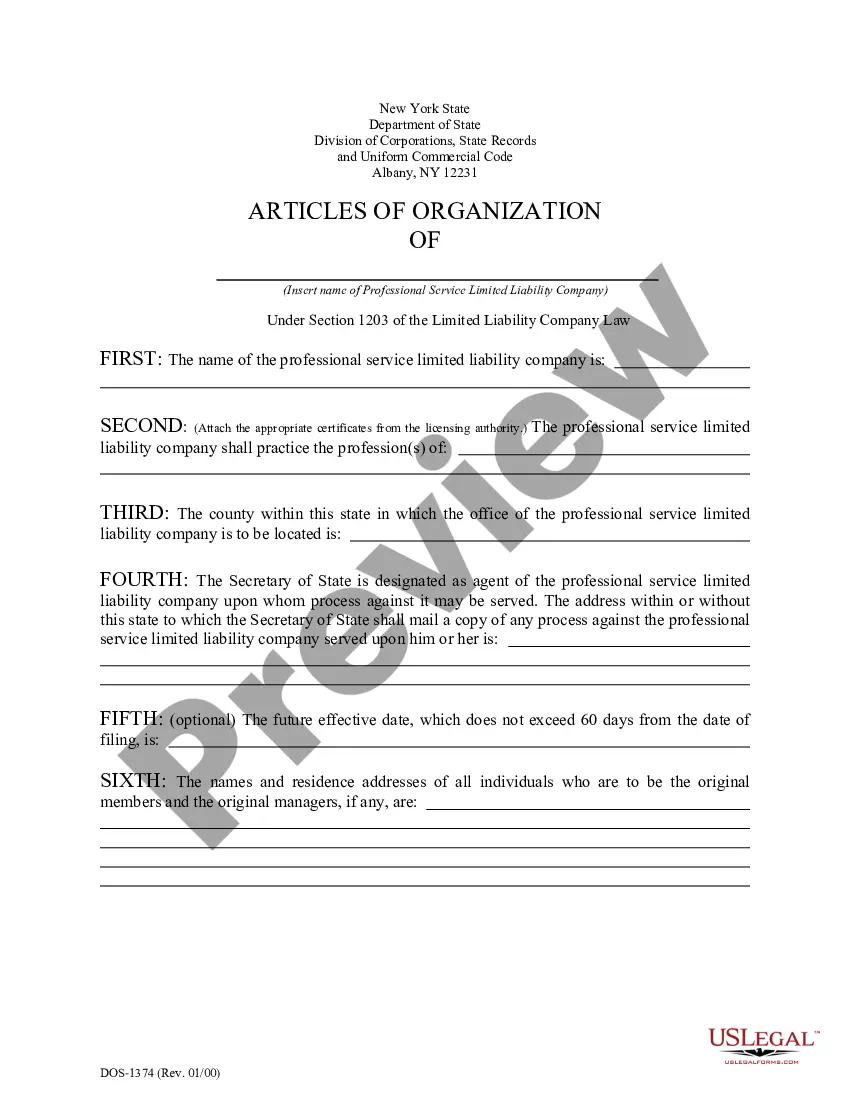

Should you not offer an accounts and want to begin using US Legal Forms, abide by these steps:

- Get the type you want and ensure it is for the right metropolis/county.

- Utilize the Preview switch to check the form.

- See the explanation to actually have chosen the appropriate type.

- When the type is not what you`re looking for, take advantage of the Research discipline to discover the type that suits you and requirements.

- Once you discover the right type, simply click Purchase now.

- Opt for the costs plan you would like, fill out the required information to make your bank account, and pay money for your order with your PayPal or charge card.

- Choose a practical data file format and obtain your duplicate.

Discover every one of the record templates you possess bought in the My Forms food list. You may get a more duplicate of Guam Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II any time, if required. Just click on the necessary type to obtain or printing the record format.

Use US Legal Forms, one of the most substantial selection of legitimate varieties, to save time as well as prevent errors. The support offers skillfully produced legitimate record templates which can be used for a variety of uses. Create an account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

Class C shares don't impose a front-end sales charge on the purchase, so the full dollar amount that you pay is invested. Often Class C shares impose a small charge (often 1 percent) if you sell your shares within a short time, usually one year.

Long-term investors (more than five years, at least, and preferably more than 10) will do best with class A share funds. Even though the front load may seem high, the ongoing, internal expenses of class A share funds tend to be lower than those of B and C shares.

Class C shares are often purchased by investors who have less than $1 million in assets to invest in a fund family and who have a shorter-term investment horizon, because during those first years Class C shares will generally be more economical to purchase, hold and sell than Class A shares.

WINNIPEG ? ? Great-West Lifeco Inc. (?Lifeco?) [TSX: GWO] today announced that Franklin Resources, Inc. [NYSE: BEN], operating as Franklin Templeton, one of the world's largest independent and diversified asset managers, has agreed to acquire Putnam Investments from Lifeco.

Putnam is headquartered in Boston, Massachusetts and has offices in London, Tokyo, Frankfurt, Sydney, and Singapore.

Class C shares are a class of mutual fund share characterized by a level load that includes annual charges for fund marketing, distribution, and servicing, set at a fixed percentage. These fees amount to a commission for the firm or individual helping the investor decide on which fund to own.

Class C shares are level-load shares that don't impose a sales charge unless you sell too soon after your purchase (usually a period of a year). Instead, mutual funds charge an ongoing annual fee. C shares are probably best for short term investors of beyond one year and no more than three years.