Guam Notice of Violation of Fair Debt Act - Improper Document Appearance

Description

How to fill out Notice Of Violation Of Fair Debt Act - Improper Document Appearance?

You may invest several hours on-line attempting to find the legitimate record design which fits the state and federal specifications you want. US Legal Forms supplies thousands of legitimate types which are examined by specialists. It is simple to obtain or printing the Guam Notice of Violation of Fair Debt Act - Improper Document Appearance from our assistance.

If you have a US Legal Forms profile, you may log in and click on the Download button. Following that, you may complete, change, printing, or sign the Guam Notice of Violation of Fair Debt Act - Improper Document Appearance. Every single legitimate record design you buy is your own forever. To get another backup for any acquired develop, proceed to the My Forms tab and click on the related button.

If you are using the US Legal Forms site the first time, follow the easy recommendations beneath:

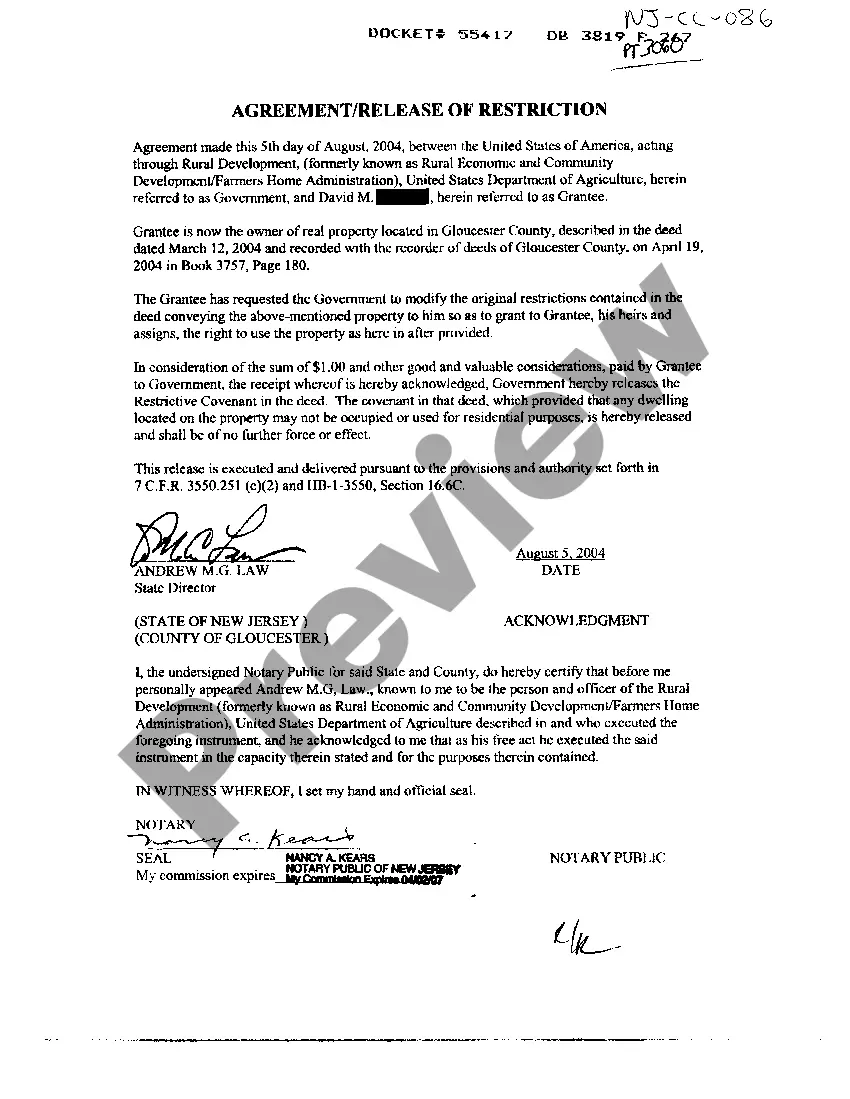

- Initially, be sure that you have selected the best record design for that region/city of your choice. See the develop explanation to ensure you have picked the right develop. If accessible, use the Review button to appear through the record design also.

- If you want to get another variation from the develop, use the Research field to get the design that suits you and specifications.

- After you have found the design you would like, simply click Buy now to carry on.

- Choose the pricing program you would like, type your credentials, and register for a merchant account on US Legal Forms.

- Complete the transaction. You should use your bank card or PayPal profile to purchase the legitimate develop.

- Choose the format from the record and obtain it for your gadget.

- Make changes for your record if possible. You may complete, change and sign and printing Guam Notice of Violation of Fair Debt Act - Improper Document Appearance.

Download and printing thousands of record themes making use of the US Legal Forms web site, which offers the biggest selection of legitimate types. Use expert and express-particular themes to tackle your organization or individual requires.

Form popularity

FAQ

The FDCPA prohibits debt collectors from publicizing your debts. That means they can't call your boss and say you're $11,000 upside down on your car and haven't made a payment in months. They can call you at work, but they can't identify themselves as a debt collector to the person answering the phone.

§ 807. (1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

Refusal-to-pay letters are simple to write. The consumer only needs to send a letter to the debt collector stating something like ?I refuse to pay this debt? with the debt amount and account number listed for reference to eliminate confusion.

I am responding to your contact about a debt you are attempting to collect. You contacted me by [phone/mail], on [date]. You identified the debt as [any information they gave you about the debt]. Please stop all communication with me and with this address about this debt.

Falsely represent the character, amount, or legal status of the debt, or of any services rendered, or compensation the collector may receive for collecting the debt. Falsely represent or imply that the collector is an attorney or that communications are from an attorney.

Ten Things Bill Collectors Don't Want You to Know The More You Pay, the More They Earn. Payment Deadlines Are Phony. The Don't Need a 'Financial Statement' The Threats Are Inflated. You Can Stop Their Calls. They Can Find Out How Much You Have in the Bank. If You're Out of State, They're Out of Luck. They Can't Take It All.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

You may bring a lawsuit against the debt collector in state court. In the lawsuit, you must prove that the debt collector violated the FDCPA. If successful, you might be able to collect $1,000 in statutory damages, and possibly more if you suffered harm from the violations.