Guam Form of Indemnity Agreement by Financial Corporation of Santa Barbara

Description

How to fill out Form Of Indemnity Agreement By Financial Corporation Of Santa Barbara?

Are you in the place that you need to have documents for both business or personal purposes just about every time? There are a variety of authorized record layouts available on the net, but finding ones you can rely on is not straightforward. US Legal Forms provides a large number of develop layouts, just like the Guam Form of Indemnity Agreement by Financial Corporation of Santa Barbara, that happen to be created to fulfill federal and state needs.

In case you are previously informed about US Legal Forms website and possess a merchant account, basically log in. Next, you can download the Guam Form of Indemnity Agreement by Financial Corporation of Santa Barbara design.

Should you not have an accounts and need to begin to use US Legal Forms, follow these steps:

- Find the develop you require and make sure it is for your right metropolis/state.

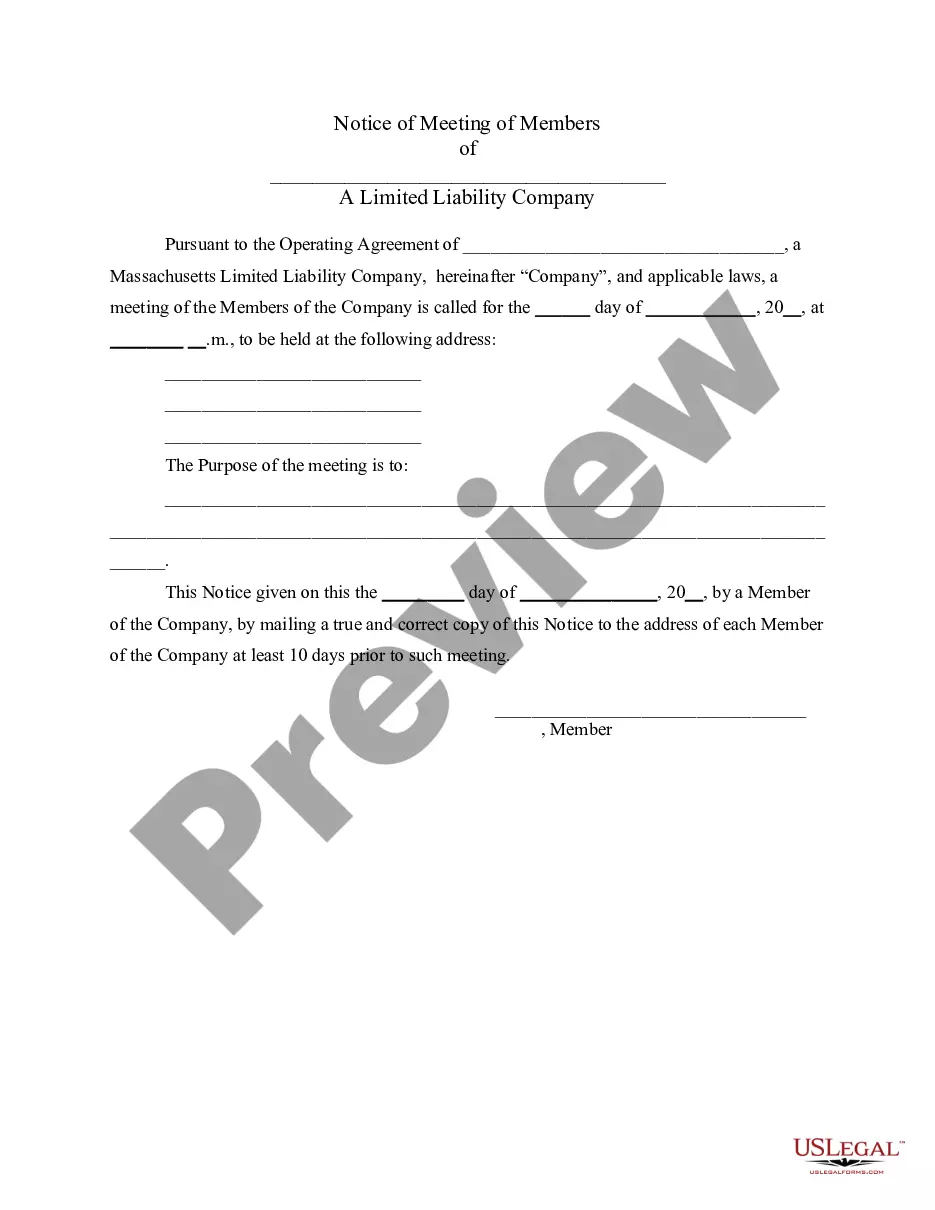

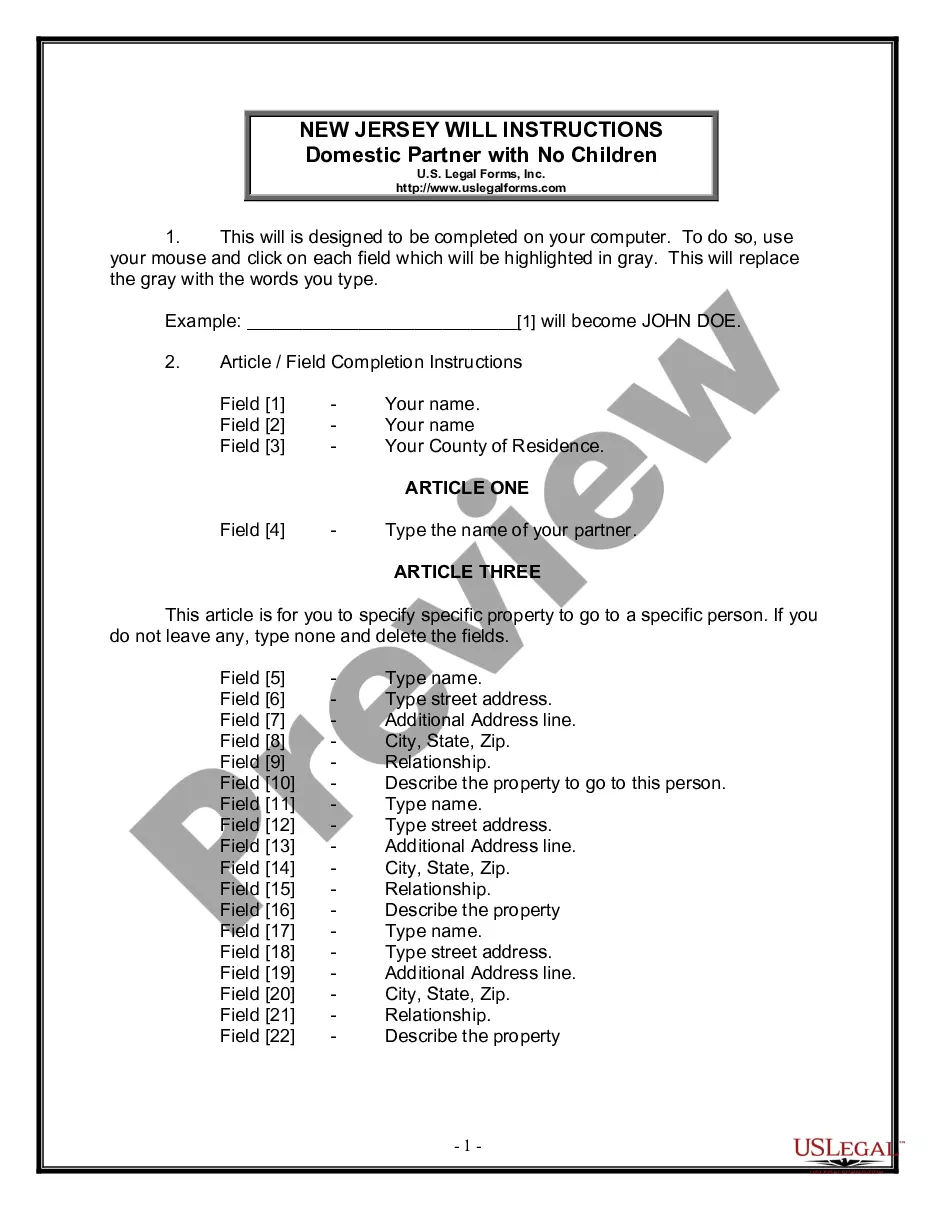

- Utilize the Review switch to review the form.

- Browse the outline to ensure that you have selected the correct develop.

- In case the develop is not what you`re looking for, take advantage of the Lookup field to find the develop that meets your needs and needs.

- When you discover the right develop, simply click Acquire now.

- Select the rates plan you would like, complete the desired details to create your account, and buy the transaction with your PayPal or charge card.

- Choose a practical paper format and download your copy.

Get all the record layouts you might have purchased in the My Forms menu. You can aquire a extra copy of Guam Form of Indemnity Agreement by Financial Corporation of Santa Barbara whenever, if needed. Just click the necessary develop to download or print the record design.

Use US Legal Forms, one of the most extensive collection of authorized varieties, to save some time and prevent mistakes. The services provides professionally made authorized record layouts which can be used for a variety of purposes. Produce a merchant account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

For example, A promises to deliver certain goods to B for Rs. 2,000 every month. C comes in and promises to indemnify B's losses if A fails to so deliver the goods. This is how B and C will enter into contractual obligations of indemnity.

Indemnity Agreement: Although similar to a hold harmless agreement, an indemnity agreement is an arrangement whereby one party agrees to pay the other party for any damages regardless of who is at fault.

A general agreement of indemnity, or GIA, is a contract between the surety company and the contractor and the other indemnitors. The GIA obligates the named indemnitors to protect the surety company from any loss or expense that the surety sustains as a result of having issued bonds on behalf of the bond principal.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

THIS INDEMNITY AGREEMENT (the ?Agreement? or this ?Indemnity Agreement?), is made and entered into as of this date, by and between party name 1 (the ?Indemnifying Party?), a state corporation, with a registered office located at address and party name 2, a state corporation, with a registered office located at address ...

Indemnity is a type of insurance compensation paid for damage or loss. When the term is used in the legal sense, it also may refer to an exemption from liability for damage. Indemnity is a contractual agreement between two parties in which one party agrees to pay for potential losses or damage caused by another party.

It is primarily intended to protect the person who is providing goods or services from being held legally liable for the consequences of actions taken or not taken in providing that service to the person who signs the form. Indemnity clauses vary widely.

A letter of indemnity (LOI) is a legal agreement that renders one or both parties to a contract harmless by some third party in the event of a delinquency or breach by the contracted parties. In other words, the party or parties are indemnified against a possible loss by some third party, such as an insurance company.