Guam Issuance of Common Stock in Connection with Acquisition

Description

How to fill out Issuance Of Common Stock In Connection With Acquisition?

If you want to full, acquire, or print out legal record web templates, use US Legal Forms, the greatest collection of legal forms, that can be found online. Make use of the site`s simple and easy practical search to get the papers you require. Numerous web templates for company and personal reasons are categorized by groups and says, or search phrases. Use US Legal Forms to get the Guam Issuance of Common Stock in Connection with Acquisition within a couple of mouse clicks.

In case you are already a US Legal Forms buyer, log in in your account and click the Down load option to get the Guam Issuance of Common Stock in Connection with Acquisition. You can even access forms you in the past downloaded within the My Forms tab of your respective account.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Make sure you have selected the shape to the appropriate town/country.

- Step 2. Make use of the Preview choice to examine the form`s content. Do not overlook to read through the outline.

- Step 3. In case you are unsatisfied with the kind, use the Research area at the top of the display screen to discover other models from the legal kind template.

- Step 4. When you have found the shape you require, go through the Get now option. Pick the pricing program you choose and add your references to register for the account.

- Step 5. Method the financial transaction. You can use your charge card or PayPal account to complete the financial transaction.

- Step 6. Select the format from the legal kind and acquire it on your system.

- Step 7. Total, modify and print out or sign the Guam Issuance of Common Stock in Connection with Acquisition.

Every single legal record template you acquire is your own forever. You might have acces to every single kind you downloaded in your acccount. Select the My Forms section and pick a kind to print out or acquire once more.

Remain competitive and acquire, and print out the Guam Issuance of Common Stock in Connection with Acquisition with US Legal Forms. There are many expert and express-distinct forms you may use to your company or personal needs.

Form popularity

FAQ

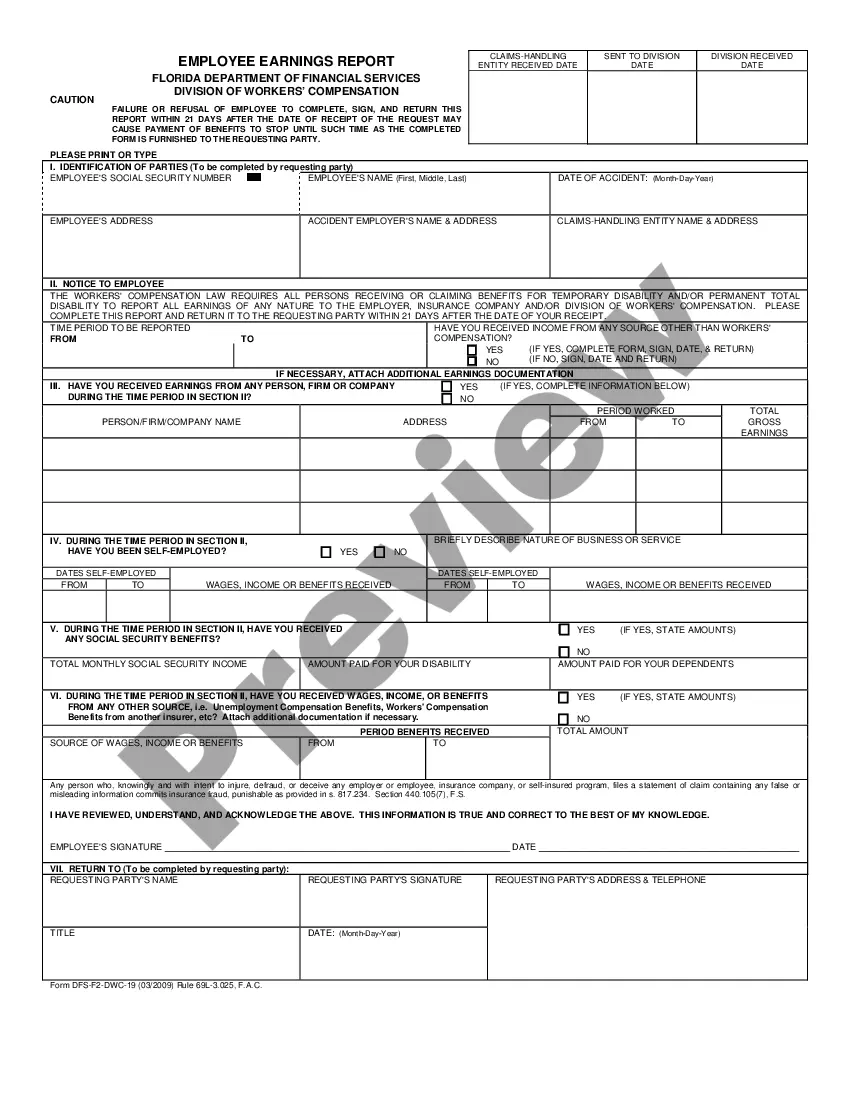

The journal entry for issuing preferred stock is very similar to the one for common stock. This time Preferred Stock and Paid-in Capital in Excess of Par - Preferred Stock are credited instead of the accounts for common stock.

Answer and Explanation: The entry to record the issuance of common stock at a price above par includes a debit to Cash.

Stock issuances DebitCash or other item received(shares issued x price paid per share) or market value of item receivedCreditCommon (or Preferred) Stock(shares issued x PAR value)CreditPaid in capital in excess of par value, common (or preferred) stock(difference between value received and par value of stock)

Upon issuance, common stock is generally recorded at its fair value, which is typically the amount of proceeds received. Those proceeds are allocated first to the par value of the shares (if any), with any excess over par value allocated to additional paid-in capital.

The common stock formula is Outstanding Shares = Number of Issued Shares ? Treasury Stocks. Outstanding shares are the number of shares available to the company owners; treasury shares are shares bought back by the company, and issued shares are the total number of shares issued by the company.

There two basic ways that issuance fees can be accounted for, namely: As a reduction to paid-in capital. Equity issuance fees may be listed as a reduction of paid-in capital. ... As part of organizational costs. The second way that equity issuance fees can be accounted for is as part of a company's organizational costs.

A company issues common stock to raise money, so the debit will always be to cash. There will always be a credit to common stock for the # of shares issued x the par value. Additional paid-in capital (APIC) is the plug.

The value of common stock issued is reported in the stockholder's equity section of a company's balance sheet.